Importance Of A Credit Analysis Report

The credit report is the sole source of information when calculating credit scores, a numerical value that lenders use when evaluating the creditworthiness of a borrower. If the credit report shows consistent on-time payments for all the past credit accounts, a borrower will be assigned a high credit score, which can help them get favorable credit terms on loans.

However, if the borrower has a history of late payments and defaults, he/she will have a low credit score, which will make it difficult for them to access credit facilities. If a bank approves a loan application for a borrower with a low credit score, they will have to contend with higher interest rates to compensate the lender for the high risk of default.

Request A Copy Of Your Credit Report

To verify that the information is correct, you should first request a copy of your credit report. By law, you can request a copy of your from both Equifax and TransUnion at least once a year for free, either online, by mail, fax or telephone. The report is called something different with each agency. With TransUnion, you must request a consumer disclosure, and with Equifax, you must request a credit file disclosure. You will have to provide personal information when making your request. To get a copy of your , you will normally have to pay a fee.

To order your credit report, contact Equifax or TransUnion.

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

Read Also: Which Credit Score Is More Important

What’s Not In Your Credit Report Information

There are a lot of misconceptions about the information your credit report contains and which factors affect your credit score. Here are a few things that don’t appear in your credit report or impact your score in any way:

- Your race

- Your age

- Your salary

- Your occupation or employment history

- Your level of education

- Your bank account balance

- Your shopping habits

The information in your credit report is strictly related to your history of credit management and does not contain any information unrelated to credit, apart from the basic identifying information outlined above.

Top Credit Card Wipes Out Interest Until 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, you’ll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read our full review for free and apply in just 2 minutes.

Also Check: Is 781 A Good Credit Score

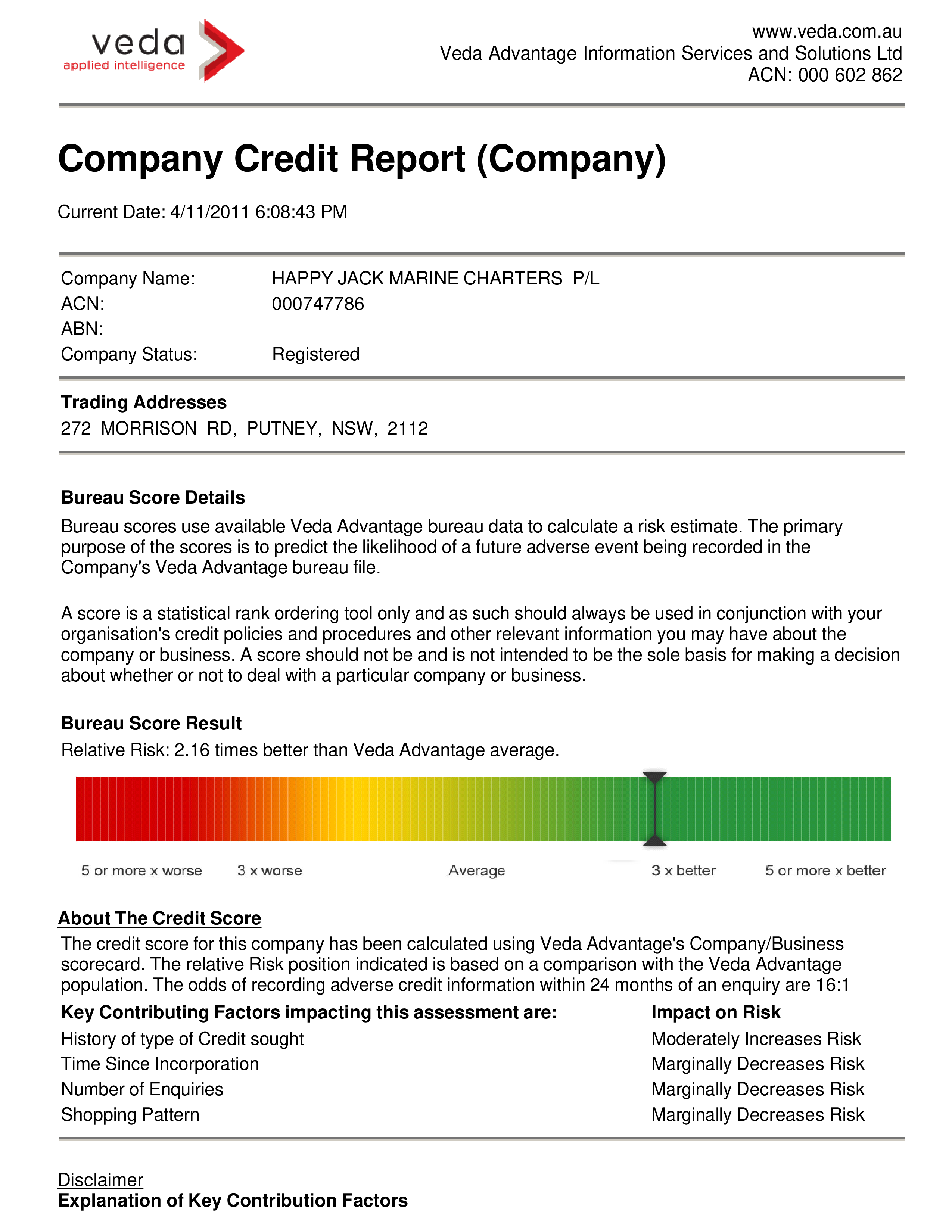

How To Build Business Credit

Major business credit bureaus maintain business credit reports. The key to building good business credit scores is to do business with companies that report payment history, and then to pay on time and keep debt levels manageable.

It really can be that simple.

However, there are some nuances that make the process of establishing business credit a little tricky for some entrepreneurs, so well break it down here into step-by-step instructions.

Compare your financing options with confidence

Finding funding doesnt have to feel like an uphill climb. Use Nav to instantly compare your best options based on your unique business data. Create an account to find opportunities youre most likely to qualify for fast.

What Is A Credit Report And How Do I Access Mine

Institutions that have issued you credit cards and loans send regular updates about your accounts to , also known as credit reporting agencies. Credit bureaus collect all the data and combine it into a single file, known as your credit report. When you apply for new credit, the financial institution pulls your to determine whether you meet the qualifications.

To quickly figure out the likelihood that you’ll repay a loan on time, creditors may instead use your , a three-digit numerical summary of your credit report information at a given point in time.

It’s important to check your credit report periodically to make sure the information it contains is accurate, complete, and within the allowed reporting time limit. You can access your credit report online from any of the credit bureaus, but there may be a fee. You’re also entitled to a free credit report each year from the major credit bureaus.

Through December 2022, the three major credit bureaus are offering weekly free credit reports through AnnualCreditReport.com.

As you read through your credit report, reference this guide to better understand some of the abbreviations you see. Different credit bureaus and credit report providers may use slightly different codes, and some codes may only appear on the reports issued to lenders. Well clarify as much as possible.

Recommended Reading: What Does Cls Mean On Experian Credit Report

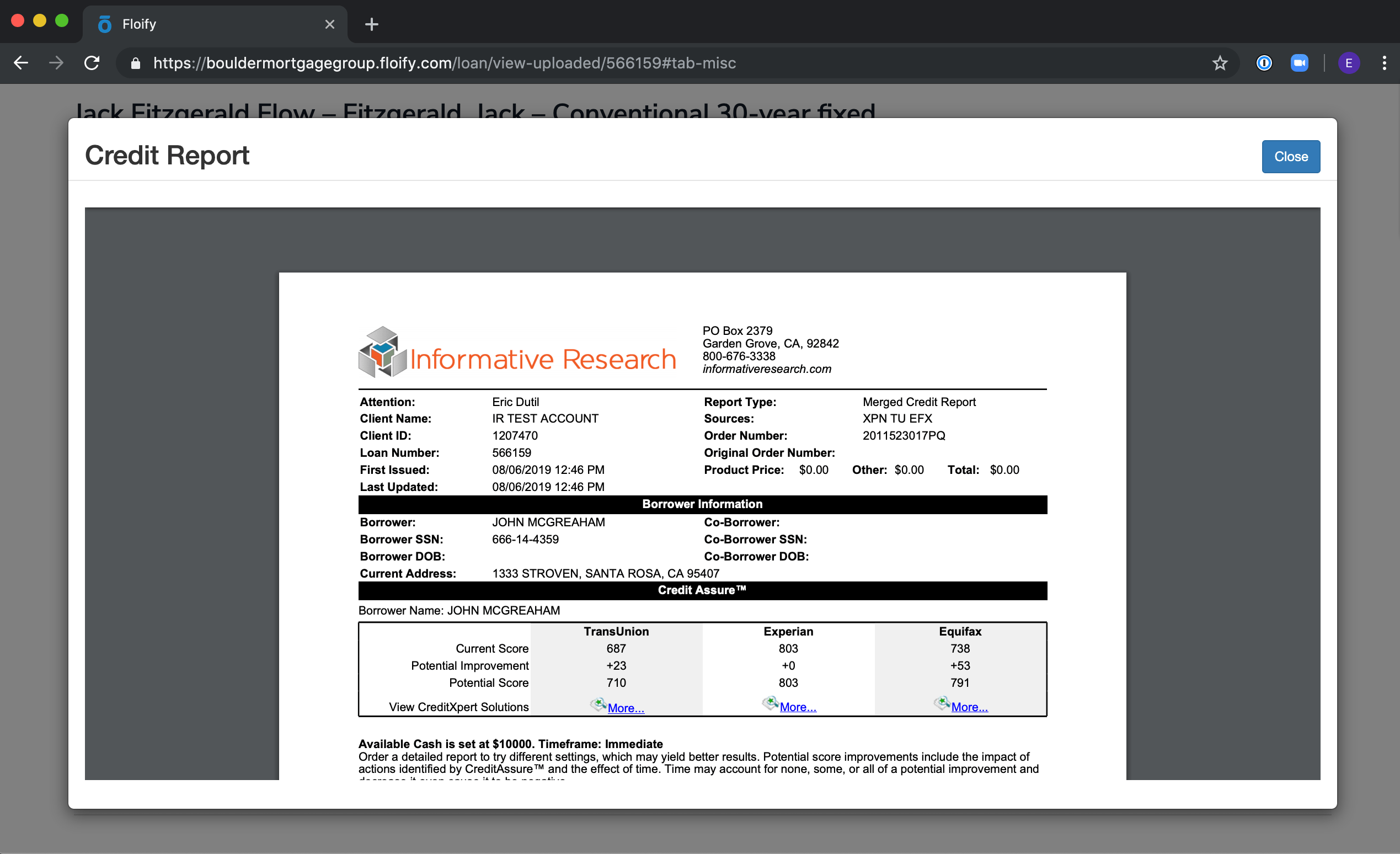

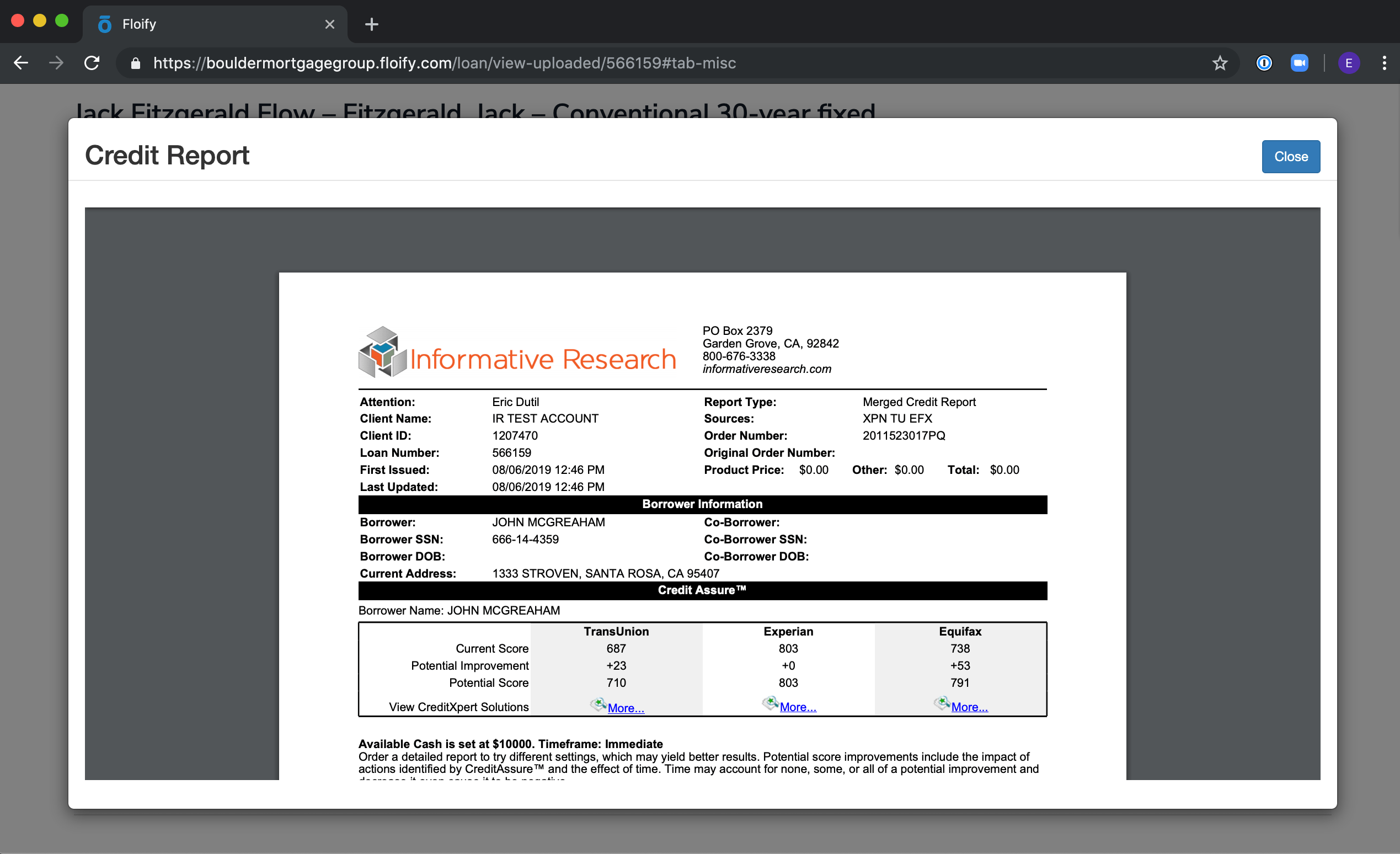

Stewart Title Acquires Informative Research For $192m

M& A deal brings title firm closer to creating an “end-to-end” experience for customers

Big Four title firm Stewart Title has struck yet another acquisitions deal. And this ones a big one.

Stewart has acquired Informative Research, a mortgage-focused data and analytics tech company based in Houston, the companies announced on Thursday.

Informative Research said the deal, which is subject to regulatory approvals, values IR at about $192 million.

Stewart has been on an acquisition tear in the past 18 months, closing deals to acquire over a dozen companies including Cloudvirga, NotaryCam, Pro Tek Valuation Intelligence, United States Appraisals, and A.S.K. Services, just in March. In late 2020, Stewart acquired a significant number of Western U.S. operations from ET Investments, and even expanded into Alaska with the acquisition of Yukon Title.

In late July, Stewart acquired Title First Agency, one of the countrys largest independent title agencies.

In acquiring Informative Research, Stewart is buying a company that uses proprietary tech to create workflow automation tools and lead generation insights. It claims to have more than 3,000 customers in lending and real estate.

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Recommended Reading: How Much Does A New Credit Card Affect Credit Score

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

How Many Credit Scores Must Be Disclosed

When a creditor uses multiple credit scores in setting the terms of credit, the creditor must disclose any one of those scores. Alternatively, the creditor, at its option, may disclose multiple scores used in setting the material terms of credit. If a creditor obtained multiple credit scores, but used only one score, only that score must be disclosed. For example, if the creditor regularly requests scores from several consumer reporting agencies and uses only the lowest score, then the lowest score must be disclosed.

Don’t Miss: How Accurate Is Free Credit Report

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Why Is My Credit Score Different When Lenders Check My Credit

The credit score you see and the one your lender uses may be different for several reasons.

To start, it’s important to understand that credit scores are based on the information found in credit reports maintained by the three major credit bureaus. If those reports differ, a credit score based on one report may not be identical to a score based on another.

Another reason the scores differ might be because there’s more than one credit scoring model, and there’s no guarantee the one you’re using to check your own credit is the same one your lender relies on. Plus, each model regularly releases updated versions of the scores it producesand there are score versions that are specific to certain industries. For example, when you check your for free, you might receive a score calculated using the VantageScore® 3.0 model, but your mortgage lender might use the FICO® Score 2 to assess your credit.

We’ll explain more about the differences between credit scoring models below, as well as other reasons your score may differ. What’s important to remember, though, is that the same positive behaviorpaying bills on time, limiting credit card debt, maintaining a long credit historywill typically lead to a good or excellent credit score across the different models and versions and credit bureaus.

Here’s what you need to know about the various credit scores you have, and which are most important to keep an eye on when you’re seeking new credit.

Also Check: How To Get A Free Credit Bureau Report

What Types Of Small Business Loans Report To Business Credit

Any lender may choose to report accounts to business credit reporting agencies. Many traditional lenders such as banks, report lines of credit and loans to the Small Business Financial Exchange which is not a credit reporting agency, but collects information that may be included in business credit reports that are sold by SBFE Certified Vendors like the major business credit bureaus.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

You May Like: How To Get A Dispute Removed From Credit Report

Second Stop: My Banker

We just completed the building of our dream home earlier this year and refinanced when rates dropped a few months back, so I knew that my bank would have our most recent credit scores. I contacted my banker to see what scores they had on me.

This is what I got from them:

776 / 765 / 773 These are from all three credit bureaus. Also, these are mortgage report credit scores which will be lower than credit scores that you would pull.

Did you catch that? Look again:

.these are mortgage report credit scores..

Mortgage report credit scores.what the heck is that? Now thoroughly perplexed, I emailed my banker to see exactly what that meant. His second response:

I found out about a year ago, that Freddie & Fannie had been working with the three credit bureaus to set up a scoring model for the purpose of mortgage loan requests. The mortgage scoring is tougher then the normal consumer scoring. Both are FICO scores utilizing the same system, but as one example, consumer models dont give a lot of weight to collection items, whereas the mortgage scoring system does. People who have collection items on their credit will score lower with the mortgage scoring system then the traditional consumer scoring system. Thats one of the examples, but since FICO is a proprietary system, the public knows very little about the full details that go into your score.

After I read the email, this was my response: Huh?

I knew at this time I was in way over my head.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Read Also: How To Remove Bad Items From Credit Report

What Types Of Loans Is Credco Associated With

CoreLogic Credcos website states that 19 of the top 20 mortgage lenders use its Instant Merge three-bureau merged credit report, so a CREDCO inquiry is probably more common than you might imagine. If you recently applied for a mortgage with a company like Wells Fargo, thats probably why youre seeing it.

Its important to note that, while mortgage is a significant part of CoreLogic Credcos business, the companys data and consumer information services touch a number of other industries as well.

One notable industry when it comes to CoreLogic Credcos credit-reporting services is the automotive industry. According to the companys website, CoreLogic Credco is integrated with more than 50 dealer sales and finance platforms. Auto dealers and lenders may partner with the company to order credit reports from all three bureaus from a single source so if youve recently applied for an auto loan and see CREDCO on your reports, we may have just cracked the case.

Still unsure about a CREDCO mention on your reports and want some additional information? Just call them. You can reach the companys consumer assistance telephone number at 866-873-3651 on weekdays from 6 a.m. to 5 p.m. Pacific time.

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Recommended Reading: Does Chase Report Authorized Users To Credit Bureaus

How To Get Your Credit Report

You have the right to get a free copy of your credit report every year from the three nationwide credit bureaus: TransUnion, Equifax, and Experian. Some financial advisors suggest staggering your requests over a 12-month period to help keep an eye on your reports and make sure they have accurate information. The best way to get your free credit report is to

- go to AnnualCreditReport.com or

Through December 2022, everyone in the U.S. can get a free credit report each week from all three nationwide credit bureaus at AnnualCreditReport.com.

And everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

When Must A Credit Score And Information Relating To A Credit Score Be Disclosed On A Risk

A creditor must disclose a consumer’s credit score and information relating to a credit score on a risk-based pricing notice when the score of the consumer to whom the creditor extends credit or whose extension of credit is under review is used in setting the material terms of credit.5 The use of the credit score does not have to be the sole or primary factor in setting the terms of credit to be subject to the disclosure requirement it need only be a factor. If the creditor did not use a credit score at all in setting the material credit terms, the creditor is not required to disclose the consumer’s credit score or information relating to a credit score.6

You May Like: Does Argos Card Affect Credit Rating