Best Ways To Improve Your Credit Score

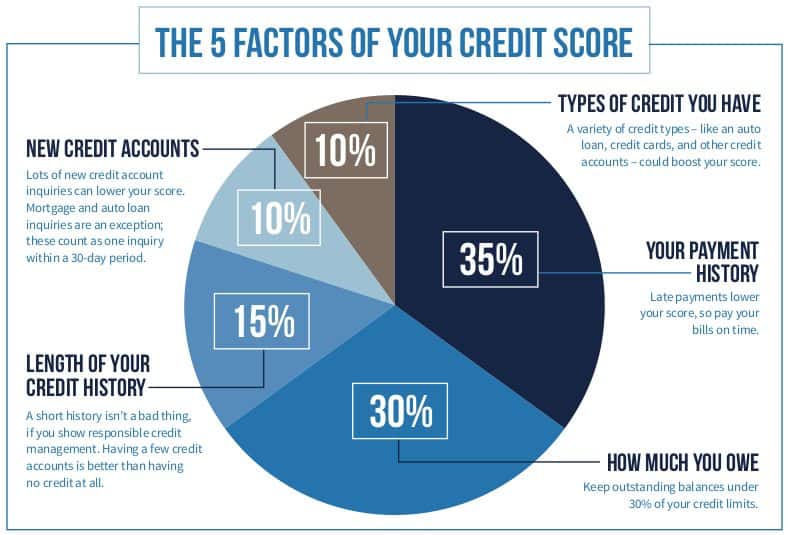

The most important thing you can do to improve your credit score is to make all of your payments on time. Maintaining low balances relative to your total limitsespecially for credit cardsis another crucial thing you can do to improve your credit score. Together, these two factorspayment history and credit usageaccount for 65% of your score.

An easy way to avoid late payments is to on all of your bills. It can be tough to keep track of multiple bills due at varying times manually pay every month. Autopay can remove that friction and youll never have to worry about a late payment. Just be sure that you have enough in your bank account to cover the automatic payment each otherwise, it will count as a negative mark, which is what youre trying to avoid in the first place.

How Long After Buying A House Does Your Credit Score Go Up

This decrease probably won’t show up immediately, but you’ll see it reported within 1 or 2 months of your closing, when your lender reports your first payment. On average it takes about 5 months for your score to climb back up as you make on-time payments, provided the rest of your credit habits stay strong.

Deal With Delinquent Accounts

If you have bad credit, bringing delinquent accounts current and settling accounts that are in collections can also boost your score fairly quickly. Once the creditor or collection agency reports your account update, you should see a positive bump in your score.

Keep in mind, though, that your late payment history will remain on your credit report for seven years. If you have bad accounts that have been on your report for six years or more, you may not want to worry about settling them or bringing them up to date. This can re-age the account, and if you fall behind again, it will stay on your credit report for another seven years.

Make sure you dont re-age these accounts, because theyre going to drop off soon, says Nathan Danus, CDMP and director of housing and community development at DebtHelper in West Palm Beach, FL. Negative information typically falls off your credit report after seven years, so if youre close, its best to just wait it out.

You May Like: What Credit Score For Care Credit

Deal With Collections Accounts

Paying off a collections account removes the threat that you will be sued over the debt, and you may be able to persuade the collection agency to stop reporting the debt once you pay it. You can also remove collections accounts from your credit reports if they aren’t accurate or are too old to be listed.

Impact: Varies. An account in collections is a serious negative mark on your credit report, so if the collector agrees to stop reporting the account it could help a great deal.

If the collector keeps reporting the account, the effect depends on the scoring model used to create your score. The FICO 8 model, which is most widely used for credit decisions, still takes paid collections into account. However, more recent FICO models and VantageScores ignore paid-off collections.

Time commitment: Medium. You’ll need to request and read your credit reports, then make a plan to handle collections accounts that are listed.

How fast it could work: Moderately quickly. On credit scores that ignore paid collections, such as VantageScore and newer FICOs, as soon as the paid-off status is reported to credit bureaus it can benefit your scores. In other cases, such as disputing a collection account or asking for a goodwill deletion, the process could take a few months.

What Is My Credit Utilization Rate

When companies are deciding your credit score, they compare how much you’ve borrowed compared to how much credit you have available. The comparison of how much you could spend on credit vs. how much you do spend on credit is your . It factors into the “Amounts Owed” category of credit scoring.

Here’s an example:

| 25% | Good |

FICO looks at your utilization across all of your credit cards, but they also consider the individual utilization of each card. For a good credit score, try to keep your credit utilization at about 30% or less.

Since lower utilization is better, reducing your utilization typically increases your credit score. This is the main part of your score affected when you pay off credit card debt.

Don’t Miss: Is 593 A Good Credit Score

If I Pay Off A Credit Card Will My Credit Score Change

For most people, are a mystery even credit experts don’t know every last thing about how credit scores are calculated — and what makes them change. If you pay off credit card debt, for instance, will your credit score go up — or down? Here’s what you need to know.

Rapid Rescoring For Fast Credit Score Updates

Theres one more service that can give you earlier access to credit score changes, but only in a narrow set of circumstances. If you’re applying for a mortgage loan, the lender may offer rapid rescoring, a service that will update your credit score within 48 to 72 hours.

Rapid rescoring doesnt work for every situation. You need to have proof that theres inaccurate information on your credit report, like a payment inaccurately reported as late.

Rapid rescoring is only available with certain mortgage lenders when you’re trying to qualify for a mortgage or get better terms its not a service available directly to consumers or with other types of businesses.

FICO’s new credit score systemthe UltraFICOmay help some borrowers boost their credit score right away by allowing access to bank information. Lenders who use UltraFICO may offer the score to you if you have an application turned down. UltraFICO can improve your credit score if you have a history of managing your bank account well.

The UltraFICO score was initially rolled out to a small group of lenders at the beginning of 2019 in a test pilot. Once the pilot phase is complete, and all is working in good order, the UltraFICO score will become available nationwide.

Don’t Miss: How To Dispute Something On My Credit Report

The Passage Of Time Affects Your Credit Scores

Even if there are no changes to your credit reports, the passage of time could cause fluctuations in your credit scores. If you have a late credit card payment, for example, its effect on your credit scores may diminish over time. That doesn’t mean that it’s okay to make a late payment. One of the best habits you can get into is paying your bills on time every time.

Check Your Credit Reportson A Regular Basis To Track Your Progress

No matter where you turn for your credit check-in your bank, or one of the major consumer credit bureaus its important to keep an eye on your credit. And if you find any mistakes or inaccuracies, we can help you file a dispute. If your dispute is approved by the credit bureaus, you may see the error corrected as soon as within 30 days, which can help raise your credit scores.

Don’t Miss: Can Private Landlord Report To Credit Bureau

How Long Does Improving Your Credit Score Take

There is no set minimum, maximum, or average number of points by which your credit score improves every month, and there is no set number of points that each action will gain. How long it takes to boost your credit depends on the specifics for why your credit score is low. If the major negatives on your credit score are credit utilization, and then you pay off your balances, your score can improve drastically in a single month. If your credit is low because of multiple collections and poor payment history, then it will take several months of on-time payments to see any positive movement in your score.

How Long Do Derogatory Marks Stay On Your Credit Report

Your score is determined by the three credit bureaus , but its up to your lenders to contact them to report information about you. It can be as simple as your credit card company reporting that you made a monthly payment on time, increased your debt or decreased your balances. These are all positive influences on your score, but there may be a slight lag in timing due to the reporting process.

In addition to a potential delay in the telephone game between your credit issuer and the credit bureaus, certain financial events can linger on your credit history for years. Unfortunately, the more harmful events are often the ones that stick around the longest, so its best to know what actions will be the biggest burdens:

| Event | |

|---|---|

| Chapter 7 bankruptcy | 10 years |

This may seem ominous, but heres the good news: recency bias is alive and well in the credit scoring world. Even if theyre still present, the old items that appear on your report have less weight than your newer ones.

Also Check: How To Get Free Annual Credit Report

Open A Secured Credit Card

If you dont qualify for unsecured credit cards, then a secured card could be the way to go. Secured credit cards are backed by a cash deposit, so even borrowers with poor credit scores can get one. Through this card, youll be able to improve your credit score by proving your creditworthiness with on-time payments.

What I Learned From Being Denied Credit Cards

When I was finally prepared to get a credit card on my own, none of the banks I applied to would give me a chance.

It went like this:

| I am unemployed, have no credit history, and have a couple of thousand dollars in college debt that I will have to start paying on in the next year or two. |

Not exactly a winning pitch to convince someone to give you a line of credit! Two banks denied me, but one banker was kind and shared some info that has helped me raise my credit score over 100 points in the past five months.

First, I should stop trying to apply for credit cards that would get denied. His reasoning was simple: when you apply, they do a hard credit check which, in turn, can lower your credit score even more.

His second piece of advice was to get a secured credit card.

Also Check: How To Increase Your Credit Rating Uk

What Affects Credit Score Update Timing

The timing of credit score updates is based on the timing of changes to your credit report. Since your credit score is calculated instantly using the information on your credit report at a given point in time, all it takes to raise your credit score is a positive change to your credit report information.

At the same time, having negative information added to your credit report can offset positive changes you might have seen to your credit score. For example, if you receive a credit limit increase but a late payment is also added to your credit report, you may not see your credit score improve. In fact, your credit score could fall.

Seriously negative information can weigh your credit score down, making it take longer to improve your credit score. For example, it can take longer to improve your credit score if you have a bankruptcy, debt collections, repossession, or foreclosure on your credit report.

The more recent negative information is, the more it will impact your credit score.

Keep The Accounts That You Already Have

One mistake that people often make is to close their credit accounts after paying off their balances. Its common for those with a secured credit card or one with an annual fee.

Unfortunately, doing so can come back to bite you. When you close a credit account, you have less open accounts on your credit report. Many lenders will turn down your credit application if you dont have enough open accounts in your name.

Also, closed accounts dont contribute to the length of your credit history. So your average credit history length could go down if you close your oldest accounts.

Since length of credit history is a credit score factor, it could decrease your credit score immediately.

If you have a secured credit card, its sometimes possible to get your deposit back without closing the account. Your credit card company might allow you to roll over into an unsecured card after six months to a year of good behavior.

If they dont offer the upgrade after a year or so, you can reach out and request one. If youre successful, theyll refund the deposit without closing the account. They may also increase your available credit, which will help your credit utilization. Double win!

As for cards with an annual fee, its up to you to decide whether theyre worth the cost. If you still use it and can accrue enough in rewards to cover the fee, its probably worth keeping.

Also Check: Does Afterpay Affect Your Credit Rating

Make The Most Of A Thin Credit File

Having a thin credit file means that you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isnt normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO Score. Its free to use and designed for people with limited or no credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO Score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, several services allow you to get credit for those on-time payments. For example, Rental Kharma and RentTrack will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO Score. Some rent-reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

How Fast Can You Raise Your Credit

Theres no one answer to this question as it depends on a few factors, including the items on your credit report, your current credit score, and your credit history. In general, it takes time to raise your credit score. But if youre patient and follow the steps outlined in this article, you can raise your credit score significantly over time.

You May Like: How Do You Get A Copy Of Your Credit Report

If I Pay Off My Credit Card In Full Will My Credit Go Up

Yes.

Here’s a short chart showing different methods of paying off credit card debt and how they usually impact your credit score.

| Method used to pay off credit cards | Usual impact on credit score |

|---|---|

| Cash or check | |

| Personal loan, debt consolidation loan | Boost in score |

| Balance transfer credit card | No change |

Note: Depending on your circumstances, you may not see these effects on your credit score. We’ll explain more about how your credit score is calculated below so you can take all factors into account.

Dont Waste Your Money

Many debt relief companies make big promises. But you should be wary. The CFPB issued a consumer advisory warning people about paid . The fees these companies charge are often high, and you can accomplish the same results on your own. If someone promises a quick fix, go somewhere else because theres no such thing as a quick fix, advises Griffin.

Despite what some companies might claim, accurate negative information cant be removed from your credit reports, says Griffin. So you could end up paying your hard-earned money for nothing. Instead, focus on keeping up with your payments, keeping your credit card balances low, and avoiding new credit lines to improve your credit.

Also Check: How To Remove Old Closed Accounts From Credit Report

Negotiate A Lower Interest Rate

A lower rate can help you pay off your balance faster, because more of your payment can be applied to your principal balance than interest. Lower balances can mean a lower credit utilization ratio . Learn more about how to negotiate a lower interest rate.

Check Your Credit Report For Errors

Carefully review your credit report from all three credit reporting agencies for any incorrect information. Dispute inaccurate or missing information by contacting the credit reporting agency and your lender. Read more about disputing errors on your credit report.

Remember: checking your own credit report or FICO Score has no impact on your credit score.

Read Also: How To Remove Credit Report Freeze

Fewer Hurdles For Getting A Job

This is a newer trend that is arising, but its affecting more and more people. Some employers are choosing to check candidates credit scores before offering them a job.

Their theory is that a persons credit score gives them insight into how responsible the person is. While there havent been studies that show a concrete connection between job performance and credit, employers want all the information they can get about a person.

In this way, a poor credit score can even affect your ability to get the job you need in order to pay down your debt and improve your credit. Its a harsh cycle but its true.