Use Experian Boost To Report Council Tax Netflix Subscriptions And Savings

In November 2020, Experian launched a new tool to help people quickly improve their credit scores.

Experian Boost uses open banking, by which you grant Experian access to your current account information.

The tool allows them to unlock previously hidden information on your salary, council tax payments, savings habits and even your subscription payment information.

Experian says that 17m people could boost their credit scores by up to 66 points by using the tool.

Find out more:Experian Boost explained

What Are The Penalties For Bad Credit

Having bad credit can make it harder to get approved for new credit cards, a mortgage, or other loans. You may be offered a high interest rate or other unfavorable terms if you are approved.

Bad credit can impact other areas of your life, as well. Landlords may not accept you as a tenant, or they may only agree if you have a cosigner. Bad credit can even make it harder for you to get a job if your potential employer checks your credit score as part of your job application.

A good credit score shows that youre a dependable borrower, which makes lenders more willing to have a relationship with you and give you funds. Consumers with very good or exceptional credit scores have better odds of loan, rental, and mortgage approvals. They can choose from a wider selection of credit card and loan products with more favorable interest rates.

Ways To Help Improve Bad Credit Scores

With time, credit scores can improve. In general, you can help yourself by committing to responsible credit use and good financial habits. Here are some strategies that might help:

Also Check: Do Mortgage Pre Approvals Affect Credit Score

What Does Written Off Mean On Your Credit Report

Asked by: Brennan Jakubowski

Your question touches three important terms to understand in the context of a credit report. They are fairly self explanatory. Charged off

an entry on your credit report that indicates a creditor, after trying and failing to get you to make good on a debt, has given up hope of getting payment and closed your accounta debt that has become seriously delinquent, and the lender has given up on being paid

Also Check: Where Can You Get Your Free Credit Report

What To Do When You Have Bad Credit And Need Money Fast

It can be hard to fix bad credit. It can be even harder to get the quick cash you need when your is less than stellar.

There are millions of people in the United States who feel constantly pressured to fix bad credit. Roughly 43.4 million people in the country have a credit score of 599 or less.

Everyone knows that it is important to fix bad credit, but not everyone knows exactly how bad credit can affect their life.

You May Like: How To Dispute A Hospital Bill On Credit Report

Go Through A Private Mortgage Lender

If your credit is so bad that no A or B lender is willing to approve your mortgage application, talk to your mortgage broker about going through a private lender. Private lenders arent just bad credit mortgage lenders. While they do a lot of bad credit mortgages, they also lend to borrowers who may have decent credit but whose application falls outside the box of a bank or credit union.

Your broker will bring up the private lender alternative before you do. Understand that private lenders charge much higher interest rates than A lenders, but the idea is to deal with them for a year or two and then move the mortgage to a prime lender.

Use A Secured Credit Card

A secured credit card is one of the easiest ways to build credit if you dont have a credit score. Secured credit cards require a deposit that will serve as collateral for the card company. The deposit will often equal the credit limit of the card. For example, a card with a $200 deposit will have a $200 credit limit.

You can use a secured credit card at the same retailers where you would use a traditional credit card, such as online or brick-and-mortar retailers. After several months of on-time payments, some providers will graduate you to a traditional, unsecured credit card.

There are two things to keep in mind when using a secured card. First, on-time payments make up the biggest portion of your credit score, so aim to always pay by the due date. A late payment can cause pitfalls in your credit score.

Second, keep your 30%. Your credit utilization is a percentage that represents how much credit youre using compared to your overall credit limit. For example, if your secured card has a $500 limit, you should never have a balance greater than $150. Be careful, though, its very easy to stack up a high balance because secured cards have low limits.

Recommended Reading: How To Add Rent To Credit Score

Can Applying For A Loan Online Improve Your Credit Score

The act of applying for a loan online in itself cannot improve your credit score. The hard checks the lenders run mean youre always likely to see a slight dip in your score initially.

However, over time, a personal loan can help you establish a positive repayment history, as long as you make all your repayments on time and in full. Positive repayment history makes up a large part of your credit score, so as counterintuitive as it may seem, someone who has had personal loans that they have repaid on time will usually have a higher credit score than someone who has never taken out a loan.

This guide from Wonga explains in more detail how applying for a quick loan online can, in some circumstances, boost your credit score. However, they are quick to advise that there are much better ways to go about doing this than taking out a loan. The guide also includes many other useful facts and tips about your credit score relative to accessing loans. The guide is about a ten-minute read but well worth the time.

Why Do Your Credit History And Score Matter

Banks stay in business by issuing credit to people who are responsible enough to pay it back. Without an intimate knowledge of how you spend your money, a credit score and credit history are the next best thing. They give the lender an idea of the risk they are taking when they lend to you. Then, they can approve or deny your application based on that risk.

Also Check: What Credit Score Is Needed For An Amazon Credit Card

Who Checks Your Credit Score

A lender, business or potential employer might ask for a credit check to get a sense of how reliable you are with money. You might be asked for a credit check when applying for loans, credit cards, mortgages, bank accounts, phone contracts, car finance, insurance and rental accomodation.

If the lender or business thinks your credit history makes you seem risky, they might reject your application.

In most cases, the person or business wanting a credit check must get your consent first. Consent is not needed for some organisations and businesses, eg certain public sector agencies, debt collectors.

Examples Of Bad Credit

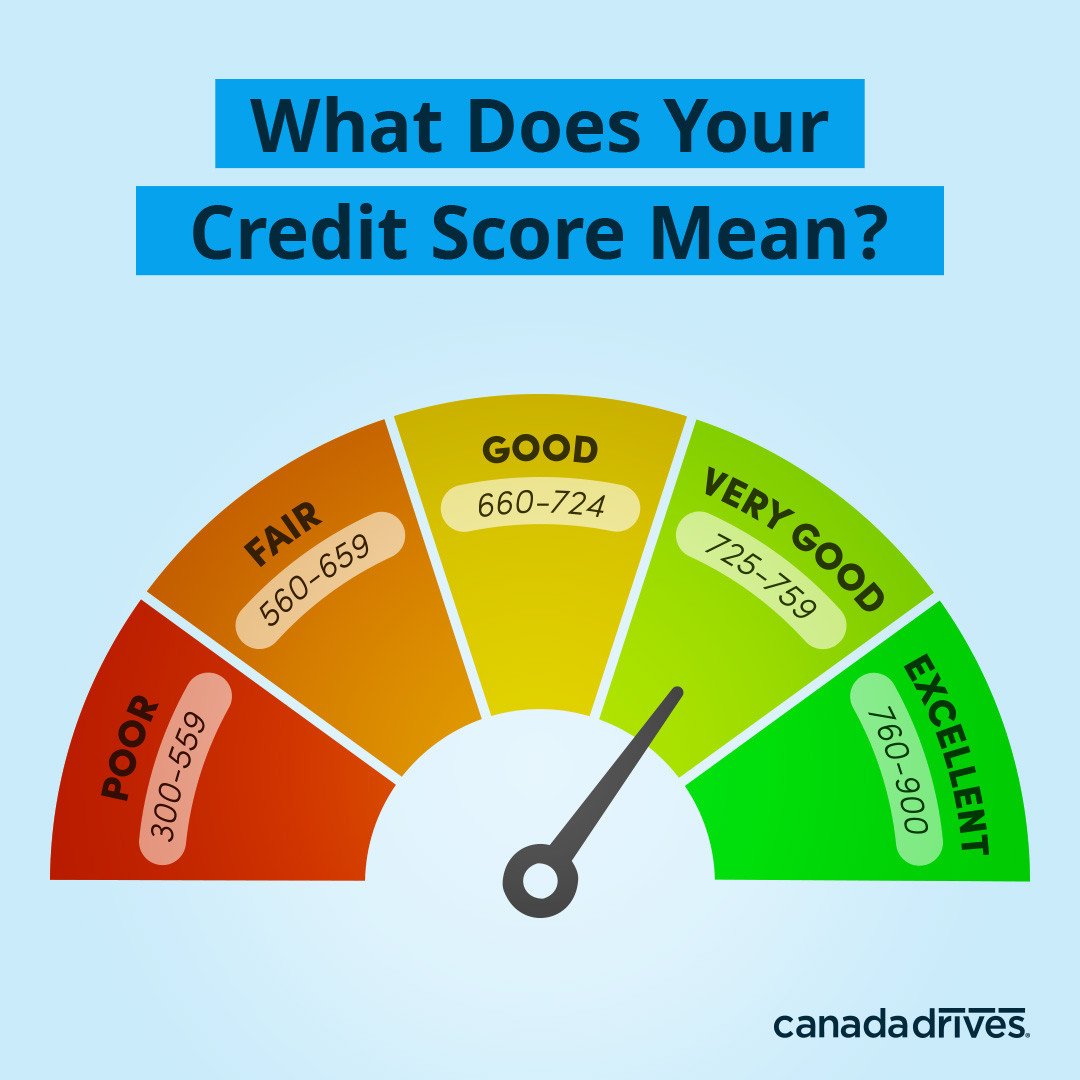

FICO scores range from 300 to 850, and traditionally, borrowers with scores of 579 or lower are considered to have bad credit. According to Experian, about 62% of borrowers with scores at or below 579 are likely to become seriously delinquent on their loans in the future.

Scores between 580 and 669 are labeled as fair. These borrowers are substantially less likely to become seriously delinquent on loans, making them much less risky to lend to than those with bad credit scores. However, even borrowers within this range may face higher interest rates or have trouble securing loans, compared with borrowers who are closer to that top 850 mark.

Also Check: Does Experian Affect Your Credit Rating

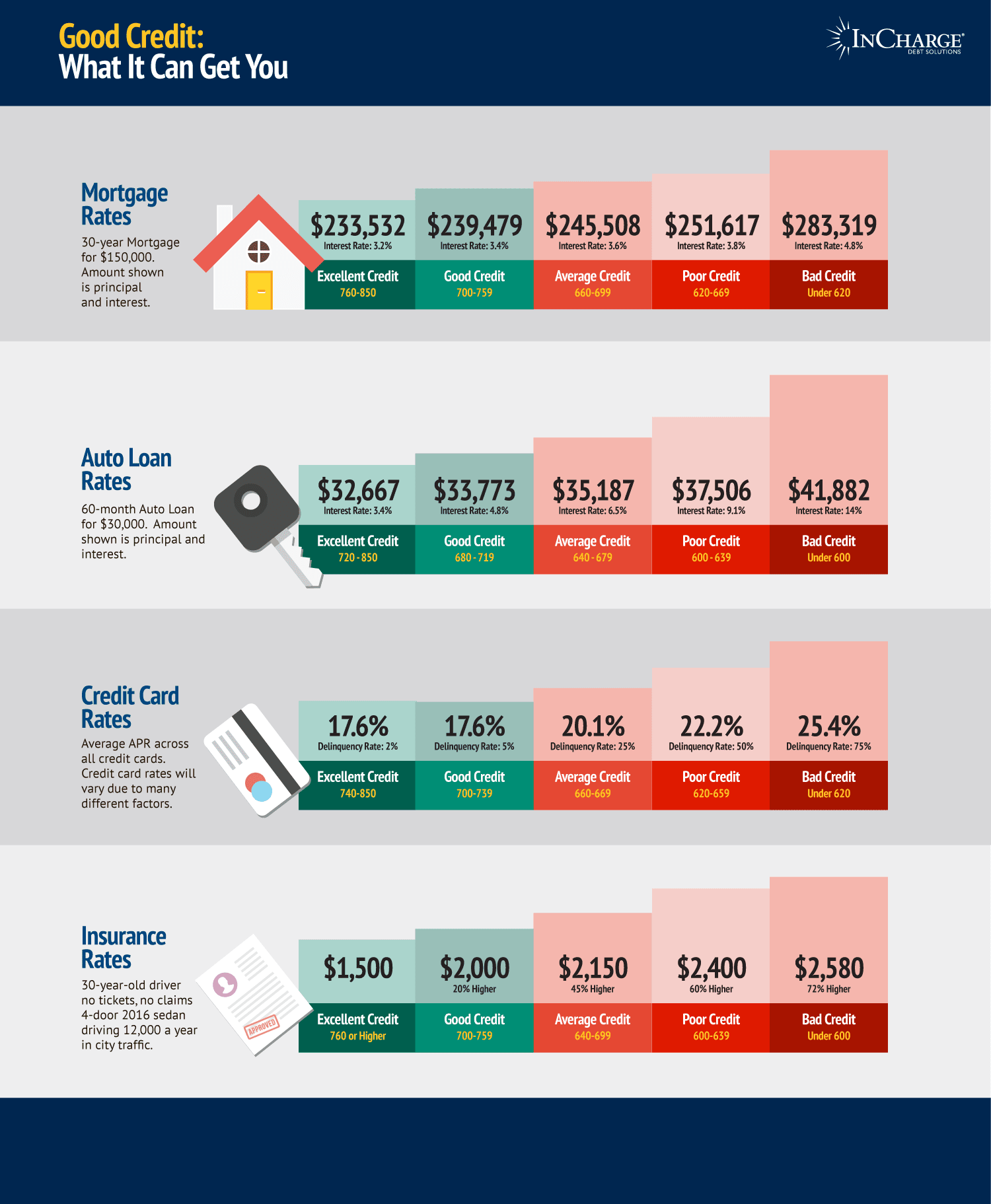

How Bad Credit Can Affect You

Everyoneâs situation is different, but you can see how bad credit scores might affect you when you look at some of the places in life where credit can come into play and where higher scores might help:

- With some improvement of your credit score, you might increase your chance of qualifying for cards with no fees and higher credit limits.

- Loans and mortgages: A higher credit score could help you get approved for auto loans, mortgages and other types of loans.

- Interest rates: Interest is the price you pay for borrowing money. In many cases, a higher credit score could help with getting better interest terms.

- Rental applications: When you apply for a lease, your potential landlord could look at your credit to decide about leasing to you.

- Employment applications: Potential employers sometimes pull credit reports during a background check. But they have to get permission from you first.

- Insurance premiums: In some states, your credit history could influence the cost of things like car insurance.

- Deposits: A stronger credit score might allow you to skip security deposits to set up service with utility companies and cellphone providers.

Thatâs just a quick look at the importance of credit. If youâre not satisfied with your credit scores, there are steps you can take to improve them.

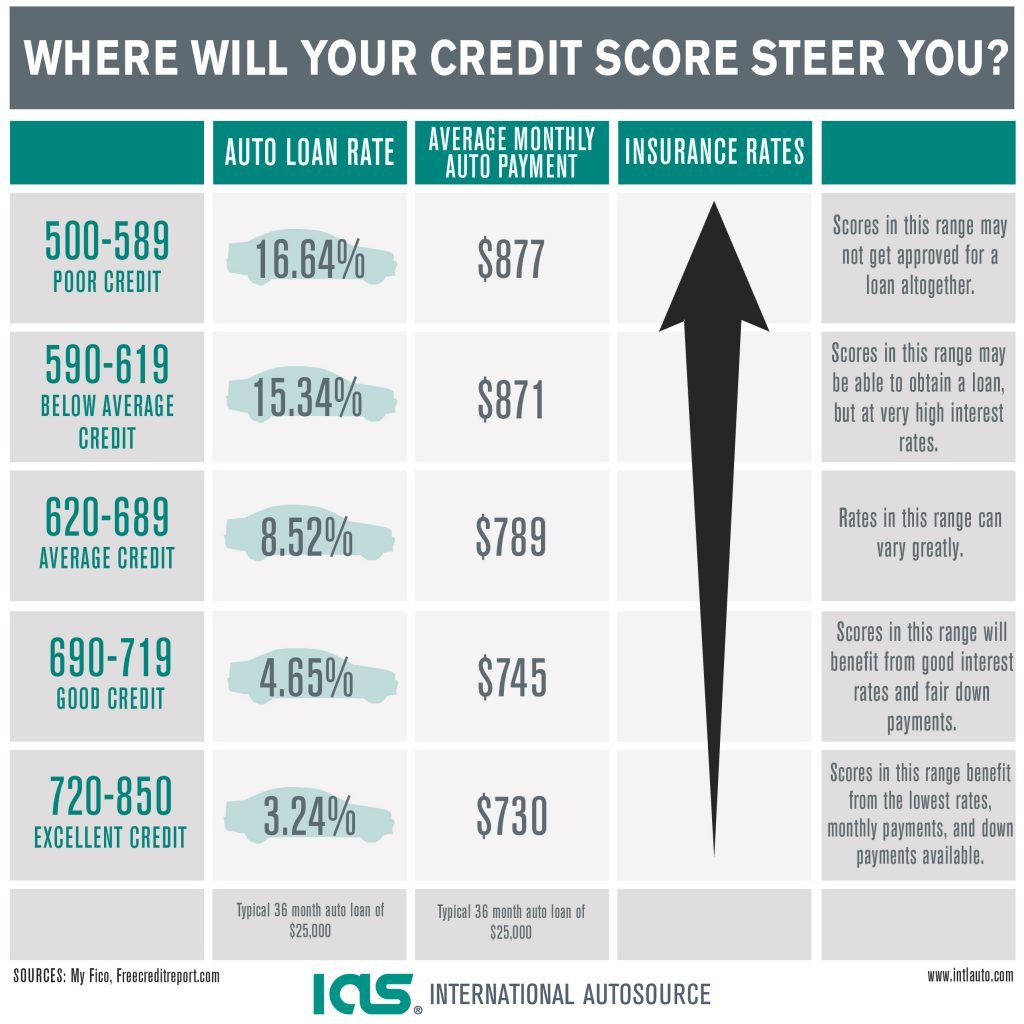

Bad Credit Means Trouble Getting A Loan

It probably doesn’t come as a surprise that before handing you a new loan, banks want to know how likely you are to pay them back. One of the primary ways they make that assessment is by ordering your credit score through providers such as FICO and VantageScore. These credit-scoring models use information in your credit reportsfrom loan balances to payment historiesto assess your creditworthiness.

A low score can make it harder to borrow, whether it’s a car loan, mortgage, or credit card account. And if you do qualify, you’ll likely have to pay higher interest rates to make up for your great level of default risk. A lot of credit card issuers, for instance, require a credit score that’s somewhere between good and excellentthat means a FICO score of at least 670 and a VantageScore of 700 or above.

If youre looking to buy a home with a conventional loan, you’ll need a FICO of at least 620. Borrowers can sometimes get an FHA mortgage with scores as low as 500, although you would put down at least 10% and have to pay mortgage insurance, which will increase your overall borrowing costs.

If your credit is less than stellar and you face a financial emergency, you may need to borrow money in a hurry to help you weather the situation. While credit problems complicate the process of securing an emergency loan, you may still be able to access a variety of emergency loan options.

Read Also: How To Get My Credit Score Up Fast

Two Types Of Cards To Avoid

While you’re on the hunt for a new credit card, watch out for subprime credit cards. These cards prey on people with bad credit. They often have high interest rates and extremely high fees that make credit unaffordable. You could easily find yourself right back in debt with damaged credit after trying to rebuild with one of these credit cards.

Prepaid cards also aren’t a great tool to rebuild bad credit. While you can get a prepaid card regardless of your credit history, they don’t report to credit bureaus because they’re not credit cards. No matter how responsible you are, using a prepaid card won’t help your credit.

Being The Subject Of A County Court Judgement

As long as you repay money you owe on time, you should never have to worry about County Court Judgements. If you are issued one, pay the full amount within one month and get a certificate from the court to say youve paid off the debt, otherwise the CCJ could affect your credit rating for six years.

If youre worried theres been a mix-up and a CCJ has been added to your credit history in error, you can request to see a copy of your statutory credit report for free by visiting the Experian, Equifax or Callcredit sites.

For more on keeping track of your credit history, read our article How to check your credit score.

Also Check: What Is The Maximum Credit Score

Pay Off Debts In Collection

If youre focused on your credit scores, such as those produced by FICO, know that paying off a collection account wont raise those numbers much . Thats because evidence that an account went unpaid will remain on your report for a total of seven years.

However, if you satisfy that collections debt, lenders, landlords, and employers will see that you did the right thing. The perception will likely be that youre on a better financial track after going off the rails.

How To Rent With A Poor Credit History

Landlords and agents must ask your permission to carry out a credit check.

They can ask credit referencing agencies for information about your credit history, including unpaid debts, missed loan payments and money judgments against you.

Be honest if you’re asked about your credit history. You could lose your holding deposit if you do not declare issues you know about.

You May Like: How Long Does Chapter 7 Stay On Credit Report

Avoid Ccjs And Bankruptcy

Being declared bankrupt, entering into an individual voluntary arrangement or having a county court judgement made against you will badly affect your creditworthiness.

According to Experian, receiving a CCJ will knock 250 points off your score, and defaulting on an account will mean a 350-point reduction.

So it’s worth checking if there are any alternatives to these routes if you are in financial difficulty.

Usually, it takes six years for IVAs or CCJs to disappear from your credit report. At that point, you should see an immediate change in your score.

Find out more: how to pay off your debts

Avoid New Hard Inquiries

If you’re focused on increasing your score, you may want to delay applying for new credit in the meantime. A hard inquiry happens when a lender checks your credit to evaluate you for a financial product. It will appear on your credit report and may affect your credit score. That’s because lenders could consider you a greater credit risk if you’re attempting to borrow money from many different sources. Applications for new credit account for 10% of your FICO® Score.

Soft inquiries don’t affect your credit they occur when you check your own credit score or when a lender or credit card issuer checks your credit to preapprove you for a product. It’s also likely you won’t see a major effect on your score if you’re shopping for a single auto loan or mortgage and apply with multiple lenders in a brief time period. Scoring models distinguish this process from, say, opening lots of credit cards at one time, and typically won’t penalize your score the same way.

Also Check: How To Fix Your Credit Score Fast

Use A Credit Builder Credit Card

If you’ve never borrowed money before, you might assume this means you have a good credit score. In fact, this is unlikely to be true.

That’s because when assessing your application, lenders look for evidence that you’ll be able to pay back what you borrow, so having no record of successful repayments can count against you.

Experian estimates 5.8m people have a thin’ or non-existent credit file in the UK. This means that CRAs hold little or even no information on you, which makes you invisible to the financial system. This can lead to not being able to access products such as a mortgage, loan or credit card, or facing higher costs than others.

Consequently, you may find that you’re turned down for a credit card or loan especially one at the cheapest rate even if you could comfortably afford to pay them back.

One solution is to take out a credit card specifically designed to help you build or rebuild your credit history.

Because these ‘credit builder’ cards are aimed at higher-risk customers, APRs tend to be very high, so you should never use them to borrow.

How long will this take to boost my score?

It takes six to 12 months of paying on time for someone whos never officially borrowed before to improve their credit score.

How Many Credit Cards Should I Have To Build My Credit

Again, this is a personal decision based on what you think you can handle financially. A primary card for everyday purchases is a great way to steadily and consistently build credit over time.

If youre someone who has goals for major investments or purchases in the near future and know you would like to build your credit quickly, it may help to add several cards to the mixespecially those with specific loyalty programs so you can keep track of them in a more organized and categorized fashion, and for those with annual fees you have yet another opportunity to regularly pay off debt in a timely manner.

You really only need one credit card to start accumulating credit, but the more you have and the more responsibly you use them, the more opportunities you have to earn points and gradually increase your credit line.

You May Like: How To Bring Up Credit Score Fast