Length Of Credit History

Lenders like to see that you can manage credit accounts responsibly over a long period of time. This is why its a bad idea to close old credit cards, even if youre no longer using them. Your credit report only tracks active credit accounts, and when you shut down your oldest credit accounts, you shorten your credit history. If you want to build good credit, keep your credit cards open.

Don’t ‘spend’ Your Applications Too Often

Every time you apply for a credit product , it adds a footprint to your file for a year.

Too many, especially in a short space of time, can trigger rejections as it makes it look like you’re desperate for credit. Therefore, space out applications if you can and don’t do them frivolously.

In fact it’s almost worth thinking about applications as ‘spending’. Is it really worth spending an application on what you’re doing, or could you save it for something else?

So if you fancy a cashback credit card and have no other credit you need to apply for in the next six months or so, great, spend your application. But if you’re just about to apply for a mortgage, wait until after you’ve done that. Prioritising is important.

For the same reason, if you apply for a cheap credit card and don’t get the credit limit you need, don’t automatically apply for another one. Read the Low Credit Limit guide for more information.

Understanding And Tracking Your Credit Score And Report

Its difficult to maintain something that you dont understand. Thats why its worth beginning with an analysis of which factors go into calculating your credit score in the first place.

If youre starting from scratch , the first thing you need to do is open a lending account. You may need a cosigner to do so, since you dont have a credit history yet. Once this is done, begin making payments. Usually, your score will appear within the next three to six months.

Once you have your score, the three major credit bureaus will begin tracking things like your payment history, the age of your credit, and your credit utilization ratio. The state of these will be reflected in both your credit score and your credit report, which lenders will want to review before they let you borrow money.

The importance of your credit score and credit report cannot be overstated. Therefore, its wise to get into the habit of reviewing both on a regular basis. This will help you catch any negative trends in your financial behavior and spot and dispute any errors with the credit bureaus.

You May Like: Does Checking Credit Karma Affect Your Credit Score

Become An Authorized User

If you are added as an authorized user to someone with good credit and a longer credit history, you can get an instant credit score boost. If you have a credit history of 10 years, and a friend has a credit history of 20 years and a higher overall credit score, being added to one of their cards will double your credit history length, instantly improving your credit score.

Approval Possibilities For Longer

A longer tenure often entails a higher level of risk for the lender. But with a good credit score, you may get a more extended payback period on your loan. When a loan repayment period is lengthy, the EMIs are less, the monthly credit load is reduced, and thus you can better manage your monthly costs.

Also Check: Coaf Credit Inquiry

Why Does A Good Credit Score Matter

A good or excellent credit score will save most people hundreds of thousands of dollars over the course of their lifetime. Someone with excellent credit gets better rates on mortgages, auto loans, and everything that involves financing. Individuals with better credit ratings are considered lower-risk borrowers, with more banks competing for their business and offering better rates, fees, and perks. Conversely, those with poor credit ratings are considered higher-risk borrowers, with fewer lenders competing for them and more businesses getting away with criminally high annual percentage rates because of it. Additionally, a poor credit score can affect your ability to find rental housing, rent a car, and even get life insurance because your credit score affects your insurance score.

Expert: Andrew Chen Hack Your Wealth

A few years back, I took my wife to London and Paris for two weeks. We stayed in fancy five-star hotels for zero dollars for the entire two weeks because we could redeem loyalty points that we had earned on premium credit cards our high credit scores had given us access to. We also redeemed those points for free round-trip flights. Our only expenses were food, drinks, and museum tickets.

Recommended Reading: What Score Do Mortgage Lenders Use

Income Age & Credit Scores

Income is another age-related factor that could indirectly affect credit decisions. Lenders use income to determine whether a person can afford a new debt obligation, but income isnt factored into credit scores. However, income does affect a persons ability to afford their financial obligations.

Having a history of on-time payments can give your credit score a huge lift since payment history is 35% of your credit score.

Average salary also tends to increase with age, which means consumers are better able to afford their bills as they get older and their salary increases.

What Fico Score Is Top Tier

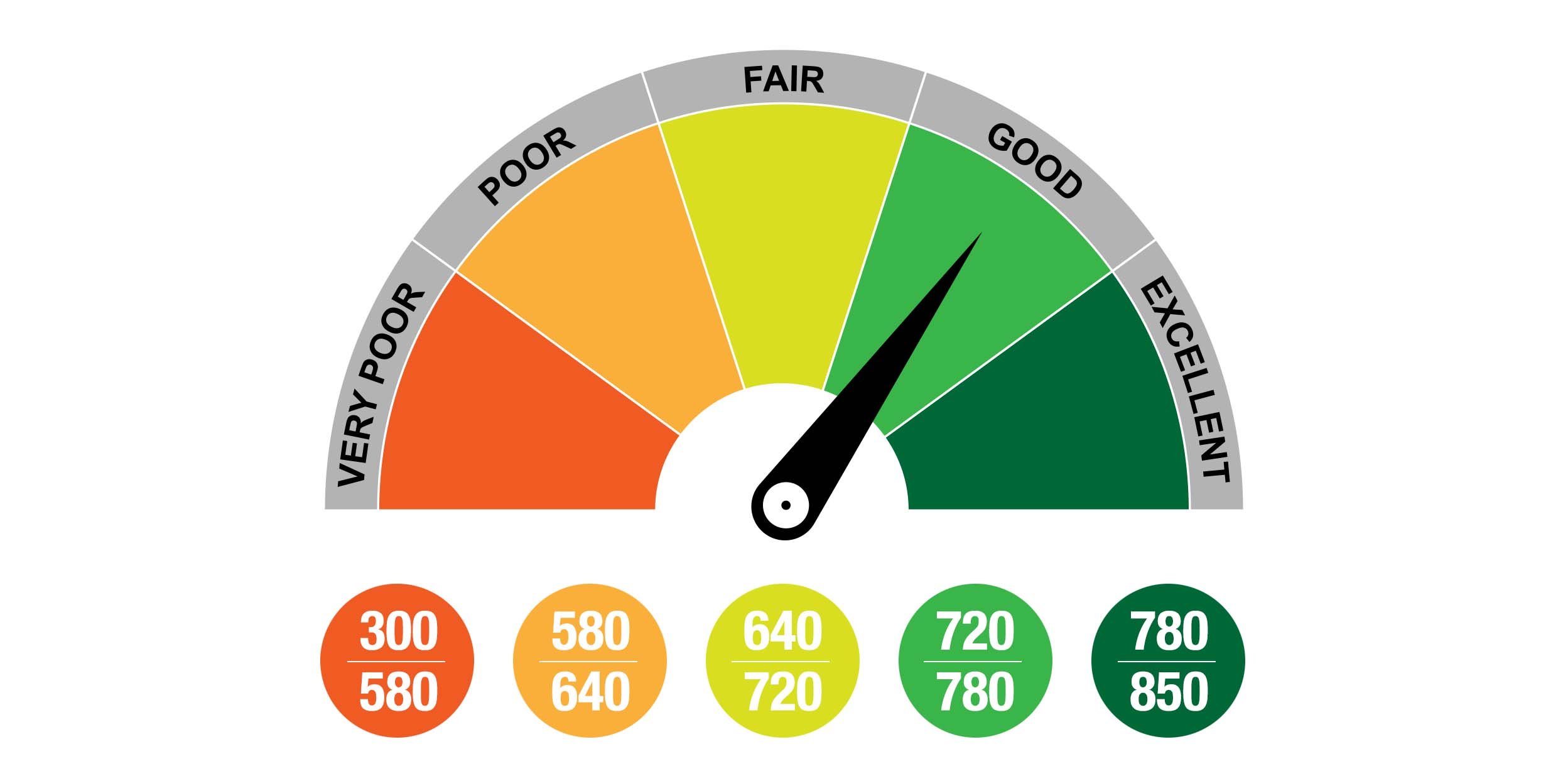

The maximum possible FICO score is 850, so a value between 750 and 850 is considered the highest level.

What’s the max credit scoreWhat is maximum credit rating? Different credit limits. One type of credit score is the FICO score. The maximum FICO score is 850 . Other credit ratings are available from Schufa and other third parties.What score is considered a good credit score?Good credit is generally defined as a score of 660 to 719 on a standard scale of 300 to 850. A score of 720+ is considered excellent and a

Recommended Reading: Navy Auto Loans

Use Credit Boosting Services

There are a couple of innovative ways of boosting your credit score, above and beyond the ordinary pay on time methods. One company is helping individuals take out a loan and pay it off each month. Whenever you make a payment, theyll report the good behavior to the credit bureaus and your credit score and profile will likely improve.

Another is Experian Boost, which allows you to include your positive payment history for utility bills and cell phone bill payments to your credit score payments which otherwise would not affect your score at all. Best of all the service is completely free.

Payday Loans Can Kill Mortgage Applications

Some payday lenders disingenuously suggest that taking them out and repaying on time can boost your credit score, as it starts to build a history of better repayment. This is true to a very minor extent for those with abysmal credit histories though using a correctly is generally both more effective and far cheaper.

If you’re getting a mortgage though, by definition you’ll need a far better than abysmal credit score. So you should avoid payday loans like the plague. Not just because they’re hideously expensive see the Payday Loans guide but because some mortgage underwriters have openly said they simply reject anyone who has had a payday loan, as it’s an example of poor money management.

To underscore the point, recent research has found that since the start of the coronavirus pandemic, a fifth of want-to-be first-time buyers who’ve had a mortgage application rejected were declined because of a payday loan.

Historically many people have been mis-sold payday loans they couldn’t afford to repay. If that happened to you, you can reclaim £100s or even £1,000s and request that any poor payment records on loans deemed to be ‘unaffordable’ are removed from your credit file. See our Reclaim Payday Loans for Free guide.

Don’t Miss: Does Wells Fargo Business Credit Card Report To Bureaus

What Is A Good Credit Score

What is considered a good credit score? :59

Reading time: 3 minutes

-

Theres no magic number to reach when it comes to receiving better loan rates and terms

Its an age-old question we get, and to answer it requires that we start with the basics: What is a, anyway?

A credit score is a number, generally between 300 and 900, that helps determine your creditworthiness. Credit scores are calculated using information in your , including your payment history the amount of debt you have and the length of your credit history.

Its also important to remember that everyones financial and credit situation is different, and theres no magic number to reach when it comes to receiving better loan rates and terms.

There are many different credit score models used today by lenders and other organizations. These scores all have the same goal: to predict a consumers likelihood to pay their bills. There are some differences around how the various data elements on a credit report factor into the score calculations.

Although credit scoring models vary, generally, credit scores from 660 to 724 are considered good 725 to 759 are considered very good and 760 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behaviour in the past, which may make potential lenders and creditors more confident about your ability to repay a debt when evaluating your request for credit.

How Do Your Actions Impact Credit Scores?

Keep Your Credit Card Balances Low

The higher your credit card balance in relation to your credit limit, the worse your credit score will be. Your combined should be within 30% of your combined credit limits to maintain a good credit scoreand the lower, the better.

Charging more than 30% of your credit limit is risky even if you plan to pay off the balance when your payment is due. Card issuers typically report the balance when your statement closes, so that’s the number that will be reflected on your credit report. It’s a good idea to keep tabs on your accounts online and pay enough to reduce your balances to as close to $0 as possible just before the billing month closes.

Don’t Miss: Does Ginny’s Report To Credit Bureau

How Can I Improve My Credit Score

Each lender decides which credit score range it considers a good or poor credit risk. Typically, the higher the score the better.If youre looking to improve your credit score, TransUnion recommends the following:

- Pay your bills on time: Late payments, collections, and bankruptcies have a negative effect on your credit score.

- Keep your account balances below 35% of your available credit. For example, if you have a credit card with a $1,000 limit, try to keep the outstanding balance below $350.

- Check your credit report on a regular basis to make sure the information is accurate. If youre registered for TransUnion Credit Services through Scotiabank, you can check your credit report by signing in to your account online or using the mobile banking app.

Make Payments In Full When Possible And Otherwise Pay At Least The Minimum

There are at least two reasons why you should never just pay the minimum on your cards, and one is because this is a terrible way to pay off debts! Paying just the minimum means even small debts could be stretched out over years, and this means exorbitant interest fees.

However, if the minimum is all you can manage, make sure you pay at least that every month, otherwise youll have late or missed payments on your report for seven years.

You May Like: Does Zebit Report To Credit Bureaus

Some Defaults Or Missed Payments & Declined Applications

Defaults or missed payments will usually stay on your report for six years. If you close an account, the missed payments could stay on the account for six years after the closure, so keep that in mind. Bankruptcy is wiped six years from the date you’re declared bankrupt, provided it’s been discharged.

And when it comes to declined applications, lenders can only see whether you’ve applied for credit elsewhere, not whether you’ve been accepted or declined. However, they may be able to guess by examining the credit accounts you have open and when they were opened.

If you’ve attempted to, or have successfully reclaimed PPI or bank charges, it won’t appear on your credit files. If you’ve had bank charges, the penalties will show on your records.

Stay Up To Date On Your Credit Score And Report

What you don’t know can hurt you when it comes to your credit. Regularly monitor your score for changes so you can swoop in quickly if it dropsmaybe because you’ve missed a bill, or maybe because there was suspicious activity that could be a result of fraud such as identity theft.

There are multiple ways to check your score for free, including through various personal finance websites, Experian, and credit card issuers or banks that provide customers with free scores.

Checking your is equally important, since your credit score is calculated using the information in your report. It’s also wise to ensure that your personal information is accurate and that all the credit accounts listed belong to you. Know that accessing your own credit report will never hurt your score. You can get a free credit report from each of the consumer credit bureaus at AnnualCreditReport.com.

You May Like: How To Remove A Repo From Your Credit

Limit Your Number Of Credit Applications Or Credit Checks

Its normal and expected that you’ll apply for credit from time to time. When lenders and others ask a credit bureau for your credit report, its recorded as an inquiry. Inquiries are also known as credit checks.

If there are too many credit checks in your credit report, lenders may think that youre:

- urgently seeking credit

- trying to live beyond your means

Ways To Keep Your Credit Score As High As Possible

Your credit score is one of the significant indicators of your financial health. It reveals to lenders how wisely you utilize credit at a glance. The greater your credit score, the faster it will be to get loans or lines of credit. While you borrow, a strong credit score might open the door to the cheapest accessible interest rates.

Knowing how the credit scoring system works and following the regulations as much as possible can help you keep a decent credit score. If your credit score isnt exactly where you like it to be, visit this site, to help you improve it. In this article, well discover a few tips to improve your credit score.

Read Also: Shopify Capital Eligibility Review Changed

Does Paying Off Collections Improve My Credit Score

Historically, paying off your collections does not improve your credit score because a collection stays on your report for seven years. Newer ways of calculating credit scores no longer count collections against you once they have a zero balance, but it is not possible for you to predict which method your lender will use to calculate your score.

Tips To Avoid Damaging Your Credit Score

A good credit score will not only facilitate your ability to get financing for a car, a home and many other things at favorable interest rates, but it can also help you get a job and obtain or keep your security clearance. Your credit score is a very important number. So, how do you build and maintain a good one — and, over time, even improve your score?

The first step is to understand how your score is calculated. The three primary credit reporting bureaus — Equifax, Experian and TransUnion — use formulas that take into account five key factors:

And the second step is to avoid common mistakes that could ultimately damage your score. These tips can help:

Recommended Reading: How To Remove Hard Inquiry From Transunion

What Is A Good Credit Score In Canada

Your credit score is used by lenders to determine what kind of borrower you are. It can affect your eligibility for certain loans or credit cards as well as the interest rate you get.

In Canada, your credit score ranges from 300 to 900, 900 being a perfect score. If you have a score between 780 and 900, thats excellent. If your score is between 700 and 780, thats considered a strong score and you shouldnt have too much trouble getting approved with a great rate. When you start hitting 625 and below, your score is getting low and youll start finding it more and more difficult to qualify for a loan.

Don’t Close Old Credit Cards

When you close a credit card, your credit card issuer no longer sends updates to the three major credit bureausExperian, Equifax, and TransUnionwhich hurts your score because the credit scoring formula places less weight on inactive accounts. After 10 years or so, the credit bureau will remove that closed account’s history from your credit report altogether, and losing that credit history will shorten your average credit age and cause your credit score to drop.

Closing a credit card also reduces your available credit. For example, if you have three cards with a combined credit limit of $10,000 and you close one with a $3,000 limit, your combined credit limit will be reduced to $7,000. Since your goal is to keep your credit card balances at less than 30% of your available credit, closing that card reduces your threshold by $900.

Recommended Reading: Does Wells Fargo Business Secured Credit Card Report To Bureaus