Important: Your Credit History Impacts Your Creditworthiness But You Don’t Have A Uniform Credit Score Or Credit Rating

Don’t fall for the misconceptions, as in the UK, there’s no one credit rating or score that is a market-wide judge of your creditworthiness, and there’s no blacklist of banned people.

While individual credit reference agencies may give you a score, that is simply their view of your history, sometimes as a means to sell you that verdict as part of a subscription service.

Yet the agencies just collect data that they share with lenders. It’s lenders that make decisions whether to give you credit and each lender scores you differently and secretly, and their scores are far more important.

Here are our nine other credit rating need-to-knows:

Get Credit For Rent And Utility Payments

Rent reporting services can add your on-time rent payments to your credit reports. Rent payments are not considered by every scoring model VantageScores include them but FICO 8 does not, for example. Even so, if a would-be creditor looks at your reports, rent records will be there, and a long record of consistent payments can only help.

Experian Boost also can help, but in a more limited way. You link bank accounts to the free Boost service, which then scans for payments to streaming services and phone and utility bills. You choose which payments you want added to your Experian credit report. If a creditor pulls your FICO 8 using Experian data, you get the benefit of that additional payment history.

Impact: Varies.

Time commitment: Low. After initial setup, no additional time is needed.

How fast it could work: Boost works instantly rent reporting varies, with some services offering an instant “lookback” of the past two years of payments. Without that, it could take some months to build a record of on-time payments.

Aim For 30% Credit Utilization Or Less

refers to the portion of your credit limit that youre using at any given time. After payment history, its the second most important factor in FICO credit score calculations.

The simplest way to keep your credit utilization in check is to pay your credit card balances in full each month. If you cant always do that, then a good rule of thumb is to keep your total outstanding balance at 30% or less of your total credit limit. From there, you can work on whittling that down to 10% or less, which is considered ideal for improving your credit score.

Use your credit cards high balance alert feature so you can stop adding new charges if your credit utilization ratio is getting too high.

Another way to improve your credit utilization ratio: Ask for a credit limit increase. Raising your credit limit can help your credit utilization, as long as your balance doesnt increase in tandem.

Most credit card companies allow you to request a credit limit increase online youll just need to update your annual household income. Its possible to be approved for a higher limit in less than a minute. You can also request a credit limit increase over the phone.

Don’t Miss: Syncb/ppc Credit Card

Establishing Or Building Your Credit Scores

Depending on your experience with credit, you might not have a credit report at all. Or, your credit report might not have enough information that credit scoring models are able to assign you a credit score.

With FICO® Scores, you need to have at least one account that’s six months old or older, and credit activity during the past six months. With VantageScore, a score may be calculated as soon as an account appears on your report.

When you don’t meet the criteria, the scoring model can’t score your credit reportin other words, you’re “credit invisible.” As a result, creditors won’t be able to check your credit scores, which could make it difficult to open new credit accounts.

Some people may be in a situation where they’ve only opened accounts with creditors that report to only one bureau. When this happens, they may only be scorable if a creditor requests a credit report and score from that bureau.

If you’re brand new to credit, or reestablishing your credit, revisit step one above.

Is My Free Credit Score On Credit Karma Accurate

The free credit scores you see on Credit Karma come directly from Equifax or TransUnion. Its possible that more-recent activity will affect your credit scores, but theyre accurate in terms of the available data.

If you see errors on your credit reports that may be affecting your credit scores, you have options to dispute those errors.

Recommended Reading: Does Rent A Center Run Your Credit

How Long Does It Take To Improve Your Credit Score

How long it takes to improve your credit score depends on your individual credit history and situation. Many people can see improvement in as little as a month.

Research from FICO shows that it can take 3 months for credit to return to its previous level after closing a credit card account, maxing out a credit card, or applying for a new credit card. Late mortgage payments can affect credit scores for 9 months, while missed or defaulted payments can decrease credit scores for 18 months.

If youve had any of these situations, you can expect your credit score to gradually increase over 3 to 18 months.

The time it takes to change your credit score is heavily affected by the amount of information in your credit file. If you have a thin credit file with a small number of accounts, any change, even a small one, will have a noticeable impact. If you have many accounts and a long credit history it will take more time and effort to change your score.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Don’t Miss: When Do Companies Report To Credit Bureau

Not Eligible To Vote In The Uk Add Proof Of Residency

If you aren’t eligible to vote in the UK so can’t be on the electoral roll , send all three credit reference agencies proof of residency and ask them to add a note to verify this. This should help you get credit.

Some foreign nationals are allowed to vote in local elections, and therefore can be registered on the electoral roll in the normal way.

Update: Despite the UK having left the EU, and the so-called transition period having ended, the rules described above about EU citizens and their right to vote in UK local elections remain the same.

The Easy Way To Get An 800 Credit Score

Whats easier and safer than taking out a credit card and using that to build a positive credit history? Using Grow Credit to do it for you.

The virtual Grow Credit Mastercard lets you pay off your monthly subscriptions in a single place without the temptation to go on a spending spree and pay it all back later.

This means that you can keep your credit utilization low, build your credit history, and make sure that everything gets paid off on time, every time.

Been turned down by traditional credit cards but youre looking to turn over a new leaf and get back on the credit horse?

No worries – were offering our card without any prior credit checks.

Strapped for cash? No problem. Grow Credits new products only required a secured card with a small security deposit. You can get started on improving your prospects and reaching that 800 credit score without already having stacks in the bank.

Thats just one of the many reasons NerdWallet named us as one of the best cards you can get without the need for a credit check.

All you need to do is to add your subscriptions to your card and watch as your score starts climbing.

Read Also: Report Death To Experian

What Do I Need To Sign Up For A Credit Karma Account

In addition to creating a username and password, Credit Karma may ask you for your Social Security number. This information allows us to confirm your identity with the consumer credit bureaus to ensure that we show you accurate data.

You must be at least 18 years old to sign up for a Credit Karma account.

Sign Up To Mse’s Credit Club Which Includes Your Experian Credit Report

Our totally free MoneySavingExpert.com Credit Club helps you keep a track of your credit record. You can here’s what it does:

You can get your full Experian Credit Report for FREE through Credit Club. See our full details on how this will work.

You’ll get a free Experian Credit Score. This will give you an indicator of how lenders see you when assessing you for credit applications.

Our unique affordability score. This clever tool will help you work out how much you can afford to borrow, using calculations based on your income and estimated spending.

Our unique Credit Hit Rate this will show you your chances of success, expressed as a percentage, of grabbing our top cards and loans.

Eligibility tool to show your best credit deals. It reveals the likelihood of you getting top credit cards or loans.

Wallet workout tool to check if youre on the best credit products for YOU.

Your credit profile explained. It shows the key factors affecting your score and how to improve them.

You May Like: Does Opensky Increase Your Credit Score

Use Experian Boost And Ecredable Lift

Experian Boost and TransUnions eCredable Lift can help you improve your credit score by giving you credit for paying utilities and other bills on time. Anyone who regularly pays for utilities or streaming services can use Experian Boost and eCredable Lift to boost their credit score, even if it is already good. Both services are free!

Experian Boost can help you build your credit record with phone and utility payments and its absolutely free!.

Does Checking Your Credit Score Lower It

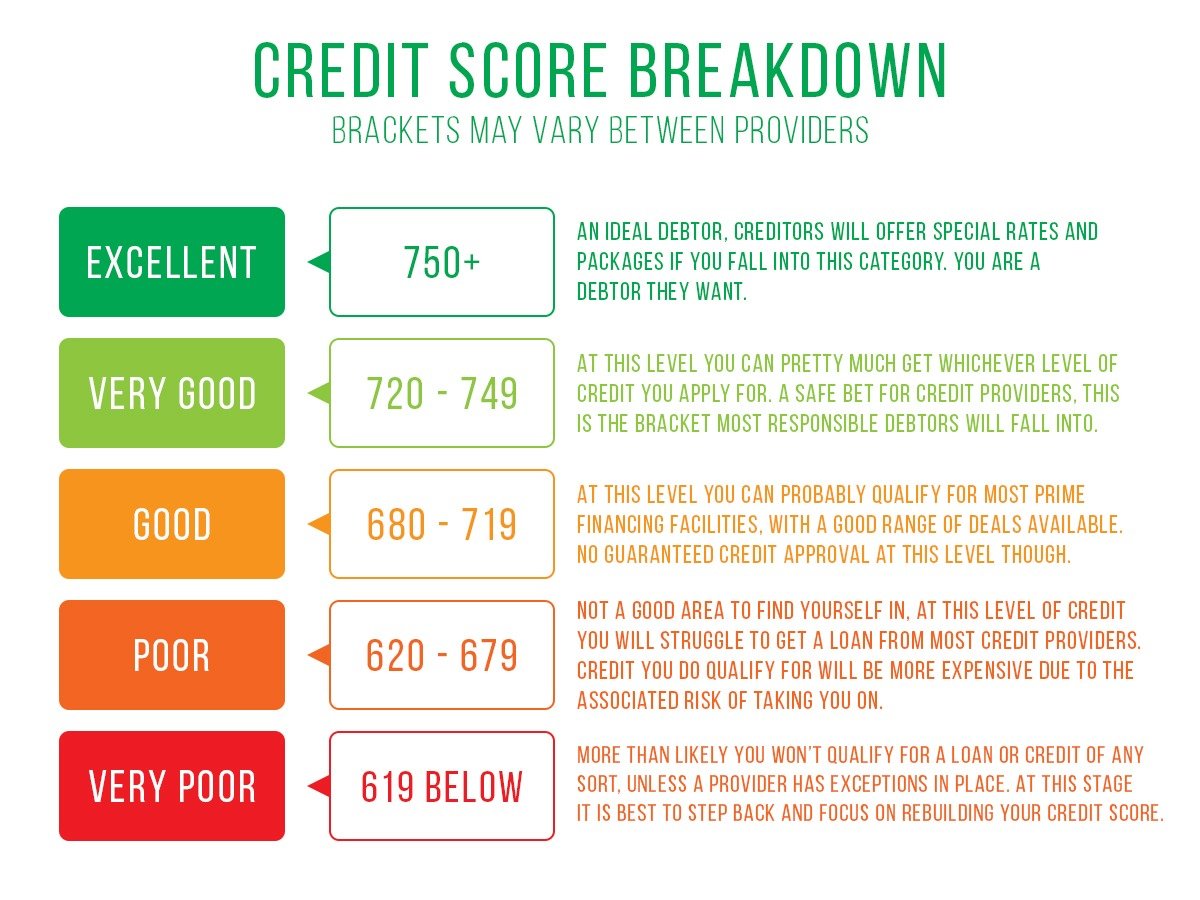

When a consumer checks their own credit score, it is treated as a soft credit inquiry that is not reflected on their credit report. For that reason, checking your credit score does not lower it. Instead, are based on five major factors: payment history , amount of debt , length of credit history , amount of new credit and credit mix . We recommend you check your credit score at least once a month.

Read Also: Paypal Credit Credit Score

How To Improve Your Credit Score If You Have No Credit History

Building good credit doesn’t happen overnight. Instead, you need to consistently practice responsible credit behavior, such as paying bills on time and limiting your credit utilization ratio.

Here are some credit building options that can help improve your credit score over time:

- Option 1: Become an authorized user

- Option 2: Get credit for paying monthly utility and cell phone bills on time

- Option 3: Open a college student card

How Often Should You Check Your Credit Score

You should check your credit score regularly to check for errors, but make sure that you are doing so through soft inquiries so that your score isnt dinged. Many banks offer free credit monitoring to their customers check with yours to see if you can enroll in their service and get alerts whenever your score changes.

Also Check: Fico Score 820

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Register To Vote Or It’s Much Harder To Get Credit

If you’re not on the electoral roll, it’s much harder to get accepted for credit, so sign up immediately. Don’t wait for the annual reminder or for the elections to roll around, apply at any time on Gov.uk.

Simply follow the instructions online it’ll ask you a series of questions aimed at identifying you, and the local electoral borough you need to register with. Note that you’ll need your national insurance number to hand.

Many worry some councils sell on the data. But you can opt out of the open electoral register which can be used for marketing.

Credit reference agencies are allowed to use the full register which you can’t opt out of and that you should, by law, be on. The electoral roll can be a factor in scoring, but even where it isn’t, not being on it can lead to delays as lenders also use it to check your address and ID.

It’s worth noting the credit scores sold to you by credit reference agencies may show you’ve a perfect score without being on the electoral roll. Don’t let that fool you into thinking not being registered won’t affect your ability to get credit. It will, because lenders also need to be sure you are who you say you are.

Read Also: Report Death To Credit Bureau

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Tip : Pay Bills On Time And In Full

Payment history is the most important factor making up your credit score. If you miss a payment, it will show up on your credit report, and multiple missed payments can make it impossible to achieve an excellent score. For this reason, you should always pay at least your minimum payment.

It’s also a good idea to pay off your bill in full each month to avoid potential late payment fees, penalty and interest charges that often result from carrying a balance.

As a rule of thumb, set up autopay for at least the minimum payment, so you can avoid forgetting a payment. You can also schedule email, text or push notifications through your card issuer.

If you struggle to remember to pay your bills each month , there’s an easy fix: autopay. If you’re not sure you’ll be able to pay your bill in full, you can set it so you just pay the minimum as a safeguard to avoid missed payments.

Here are some tips:

The sooner you start paying on time, the sooner your score will begin to improve. And just as a bit of motivation, older credit penalties, such as late payments, matter less as time passes. So start now and stay consistent.

Some credit building credit cards reward cardmembers with an automatic credit limit increase after they make six on-time payments. An example is the Capital One® Platinum Credit Card.

See our methodology, terms apply.

You May Like: Can You Use Klarna At Walmart

Ask A Real Estate Pro: I Have No Debt But A Low Credit Score How Can I Get Association Approval To Purchase Condo

Q: I am having trouble getting approved to buy a condo due to my lack of credit. I do not use a credit card and have more than enough money saved up to purchase my new home without a mortgage. Because I have no debt, my credit score is low, and I am being denied approval by the association. What can I do? Rose

A: Many community associations have the right to screen prospective buyers. While an association may not discriminate, it can look at income, credit score, and other objective factors.

While it is commendable to have no debt and avoid the temptations that come with credit cards, a solid credit score is helpful.

For example, your credit history can be used to determine the price you pay for insurance and, as you have found out, whether you can purchase a new home.

There are reasons why a credit score can indicate whether someone will timely pay their association dues.

Even so, the system is far from perfect, as you know.

ASK A REAL ESTATE PRO: Lawyer Gary Singer answers questions about real estate »

Your first step is to speak with the association and explain why your credit score is low. Ask them to look beyond the score at the details.

Another option is offering to prepay a year of association dues to alleviate any concerns. Because you are not a member of the association, it does not have to deal with you, so you should get the seller involved to lobby for your approval.