What Are Todays Mortgage Rates

Even if you have a lower credit score, theres a good chance you can still get a low rate and payment in thecurrent interest rate market.

Check your eligibility for one of todayscredit-friendly mortgage programs.

Popular Articles

Step by Step Guide

Mortgage Rates For Poor Credit

The average credit score needed to buy a house can vary, but it could be more challenging to qualify for a loan if your credit needs work.

You may find that mortgage offers that are available to you come with high interest rates that can cost you a lot of money. Its important to consider the long-term financial impact of an expensive loan, and it may be worth taking some time to build your credit before applying.

But there are some types of mortgages to consider if you dont qualify for a conventional loan. These government-backed loans that are made by private lenders include

- FHA loans

- VA loans

- USDA loans

If you qualify for one of these loan types, you may be able to make a smaller down payment, too.

No matter what your credit is, its important to shop around to understand what competitive rates look like in your area. Compare current mortgage rates on Credit Karma to learn more.

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

Also Check: How To Remove Repossession From Credit Report

Usda Home Loan: Minimum Credit Score 640

USDAloans are popular for their zero down payment requirement and low rates.

Youll typically need a 640 FICO score to qualify fora USDA loan, though minimum credit score requirements vary by lender.

Thesemortgages are backed by the U.S. Department of Agriculture with the goal ofincreasing homeownership in rural areas. To qualify, you must buy a home in aqualified rural area though some suburbs make the cut.

A USDA loanalso wont work if you make too much money. Your household income cant be morethan 15 percent higher than the median household income in your area.

What Does A 500 Credit Score Mean And How It Affects Your Life

Scores below 500 are generally considered as low. No one wants to part away with their money especially when they have any reasons no matter how slight it is to doubt the person who wants to borrow from them.

In reality you may not be a bad debtor. You may actually be a credible person indeed but a low credit score will present you to a potential benefactor as a person that cannot be trusted to pay back.

You dont have to risk being denied the opportunity to get credit cards as well as loans. In the rare occasion when you even get loans, you will end up being subjected to having to pay a high interest not because you are a bad person but because your credit score is low.

What happens if you improve your 500 credit score by 50 or 100 points?

Well, an improvement in your credit score comes with a lot of unprecedented benefits. It opens up for you doors of opportunities that have once been slammed on you.

An improved credit score shows to a potential creditor that you have become more responsible with the way you go about handling money. An increase in your 500 credit score notifies your potential benefactor that you are now way more credible than you use to be.

It gives your potential lender a kind of guarantee that money given to you is not thrown away but has been handed over to someone who will manage it well and pay back as promised. Simply put, it rings a lot of positive bells around your personality.

and if you dont?

Recommended Reading: Does Opensky Report To Credit Bureaus

Who Calculates Your Credit Score

Your credit score is calculated by a credit reference agency . There are 3 CRAs in the UK: Equifax, Experian and TransUnion. At ClearScore, we show you your Equifax credit score, which ranges from 0 to 700.

Each CRA is sent information by lenders about the credit you have and how you manage it. Other information, such as public records like the electoral roll and court judgments, are also sent to the CRAs and form part of your credit report.

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

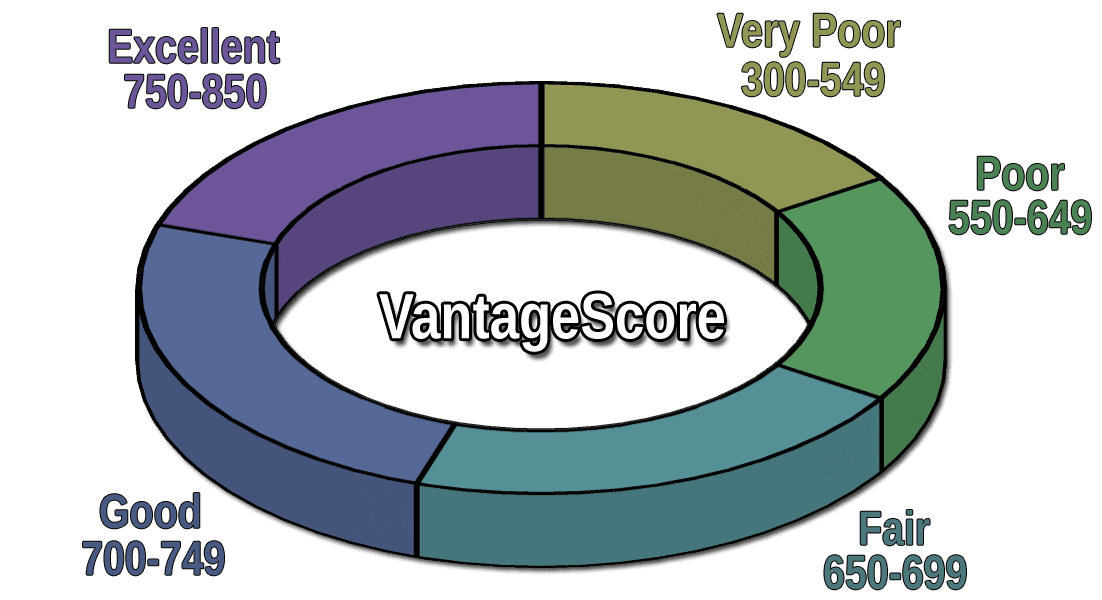

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Recommended Reading: How To Remove Repossession From Credit Report

Open A Secured Credit Card Account

Secured cards are designed for those with no credit history or those who are rebuilding credit.

You can open a secured card when you arent eligible for other cards because this type of credit card requires a deposit. The deposit acts as collateral for the issuer if you stop making payments, so its less risky for them to approve you. Secured card deposits are refundable. Many issuers will upgrade you to an unsecured card upon request after youve demonstrated you can wisely manage the card.

How To Improve Your 500 Credit Score

The bad news about your FICO® Score of 500 is that it’s well below the average credit score of 704. The good news is that there’s plenty of opportunity to increase your score.

99% of consumers have FICO® Scores higher than 500.

A smart way to begin building up a credit score is to obtain your FICO® Score. Along with the score itself, you’ll get a report that spells out the main events in your credit history that are lowering your score. Because that information is drawn directly from your credit history, it can pinpoint issues you can tackle to help raise your credit score.

Also Check: What Is Syncb Ntwk On Credit Report

How Do You Improve A Low Credit Score

The best way to increase a credit score of 500 or below will depend primarily on how you got a low score in the first place. For instance, if your low credit score is due to having a thin credit profile, then simply building up a positive credit history over time should see your credit score increase.

If, however, your low credit score is due to some financial mistakes, youll need to analyze your credit reports and build a plan. Make sure you check all three of your credit reports to get a complete picture of your credit health. You can do this for free once a year through AnnualCreditReport.com.

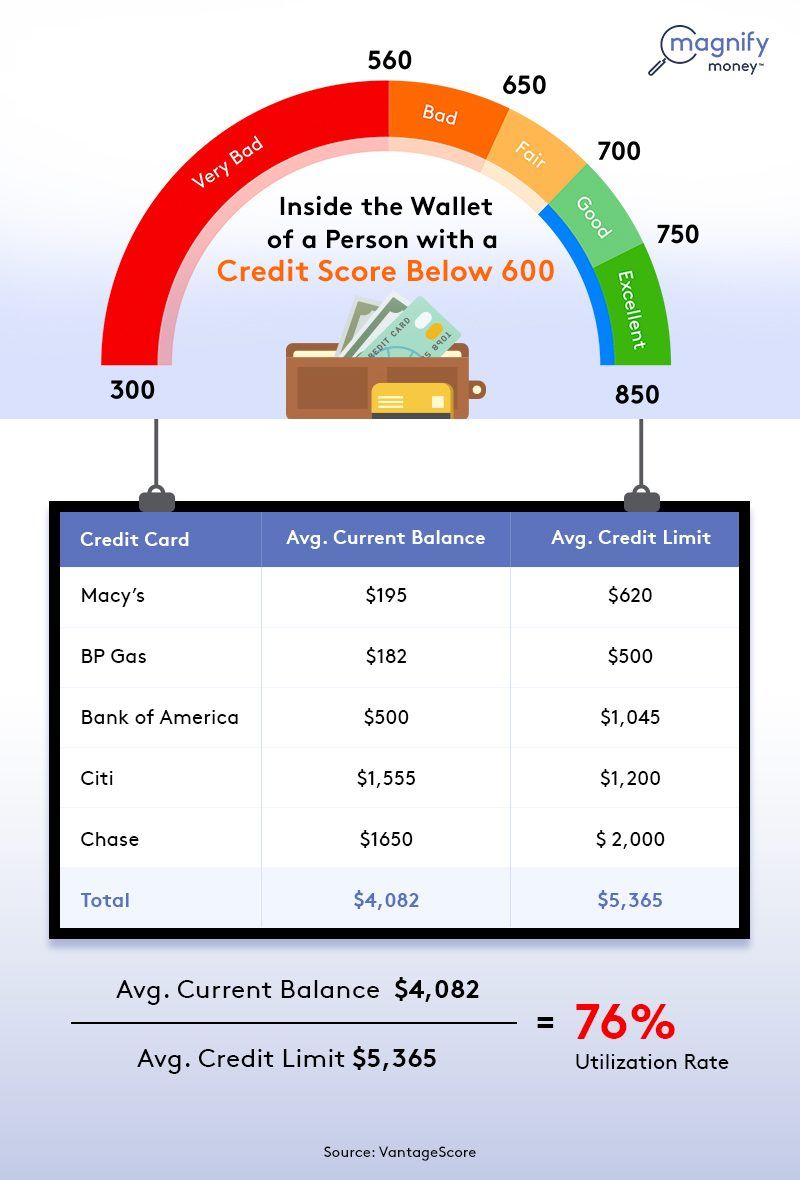

Having cards with high utilization rates the ratio of how much credit you are using over how much you have available will also drop your score, especially if you have credit cards that are maxed out. Paying down these balances can do a lot to boost your credit score.

Of course, your payment history is the largest factor in your score, meaning things like delinquent payments or defaulted accounts can really hurt your credit scores. While payments that are a day or two late wont cause your score to decrease, anything that is 60 days or more past due will be reported to the credit bureaus as delinquent.

How To Improve Your Cibil Score If Cibil Score Is Below 500

A CIBIL score below 500 puts you at the risk of being viewed negatively by lenders and hence, you can lose the opportunity to get a loan or credit. What is a CIBIL Score? CIBIL Score is a type of credit score, a three digit number indicating your credit worthiness. Various credit information companies operate in India which have developed their unique credit score algorithm. The most popular credit information company in India has been The Credit Information Bureau Limited, which is now known as TransUnion CIBIL Limited after TransUnion, an American company partnered with CIBIL. CIBIL is one of the few RBI approved credit information companies in India.

Lenders and banks check your in order to gauge your financial credibility and to mitigate potential risks caused by payment defaults on part of the borrower. CIBIL Score ranges between 300 and 900, with 900 being the best credit score and 300 the worst credit score. A CIBIL score below 500 is considered poor and it can lead to rejection of your loan application. So let us have a look at how you can improve your CIBIL score if it is below 500.

Don’t Miss: How To Report Death To Credit Bureaus

Dont Apply For Lots Of New Credit Cards

When you apply for a new credit card or loan, the issuing bank will check your credit, which is considered a hard inquiry. Hard inquiries will cause your credit score to dip temporarily. Itll bounce back as time passes and more positive behavior is reported. However, if you are already starting from scratch, even a slight dip of five to 10 points can be significant. Plus, credit bureaus keep tabs on how many times you apply for new lines of credit. Too many hard inquiries on your credit report can be a sign that you are desperately seeking credit and pose a risk to lenders.

What Credit Score Do You Start With

You don’t start with any credit score, and you won’t get a score until you open a credit account that reports to the credit bureaus. Once you open an account, you will receive a score based on that account. It probably won’t be the best score since you don’t have a long enough credit history, but it won’t be the worst score, either.

Recommended Reading: Credit Inquiries Fall Off

Credit Score: Reasons & Remedies

Regardless of what caused the damage, the best treatment for a credit score of 500 is a steady dose of positive information into your credit report. And the best way to get that going is to open a secured credit card account. Whether you lock the card in a drawer or use it to make purchases and pay the bill on time every month, positive info will stream into your report, offsetting previous mistakes.

That said, lets take a closer look at some of a 500 credit scores common causes and what to do about them.

Heres what can lead to a 500 credit score:

Remedy: If you have not yet defaulted on a delinquent account, making up the payments youve missed is your best option. Having your account default will cause your credit score to fall further, possibly leading to collections and even a lawsuit, both of which could add to the credit damage. Each missed payment you make up will reduce your delinquency level, so you dont have to pay the total amount due all at once. You can also explore debt management and debt settlement.

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

Also Check: Can You Remove Hard Inquiries Off Your Credit Report

The Basis For Your Credit Score

Here’s a more detailed breakdown of the specific factors that influence your FICO® Score:

Public Information: If bankruptcies or other public records appear on your credit report, they can have severe negative impacts on your credit score.

Among consumers with a FICO® Score of 590, the average credit card debt is $5,908.

Payment history. Delinquent accounts and late or missed payments can harm your credit score. A history of paying your bills on time will help your credit score. It’s pretty straightforward, and it’s the single biggest influence on your credit score, accounting for as much as 35% of your FICO® Score.

. To determine your , add up the balances on your revolving credit accounts and divide the result by your total credit limit. If you owe $4,000 on your credit cards and have a total credit limit of $10,000, for instance, your credit utilization rate is 40%. You probably know your credit score will suffer if you “max out” your credit limit by pushing utilization toward 100%, but you may not know that most experts recommend keeping your utilization ratio below 30% to avoid lowering your credit scores. Credit usage is responsible for about 30% of your FICO® Score.

Total debt and credit. Credit scores reflect your total amount of outstanding debt you have, and the types of credit you use. The FICO® Score tends to favor a variety of credit, including both installment loans and revolving credit . Credit mix can influence up to 10% of your FICO® Score.

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

Also Check: What Credit Score Do You Need For Affirm

Get A Secured Credit Card

One way to reshape your credit history is by using a secured credit card. Secured credit cards require a deposit as security, reducing the risk of missed payments because the deposit should, in most cases, cover them. The deposit also acts as the credit limit.

Secured credit cards allow you to have the flexibility of an unsecured card with the reassurance of a protective deposit. In time with good behavior, it’s possible to graduate to an unsecured card because you’ve regained trust with lenders.

Fha Mortgage: Minimum Credit Score 500

FHA loans backed by the Federal HousingAdministration have the lowest credit scorerequirements of any major home loan program.

Most lenders offer FHA loans starting at a 580 creditscore. If your score is 580 or higher, you only need to put 3.5% down.

For those with lower credit , it might still bepossible to qualify for an FHA loan. But youll need toput at least 10% down, and it can be harder to find lenders that allow a 500minimum credit score.

Another appealing quality of an FHA loan is that, unlike conventional loans, FHA-backed mortgages dont carry risk-based pricing. This is also known as loan-level pricing adjustments .

Risk-based pricing is a fee assessed to loan applicationswith lower credit scores or other less-than-ideal traits.

There may be some interest rate hits for lower-credit FHA borrowers, but they tend to besignificantly less than the rate increases on conventional loans.

For FHA-backedloans, this means poorcredit scores dont necessarily require higher interest rates.

You May Like: How To Report A Death To Credit Bureaus