Follow Up After The Investigation

Heres what to expect when the investigation is complete:

- The results of the investigation, in writing, from the credit reporting bureau.

- A free copy of your credit report, if the report has changed.

What about parties who have seen your incorrect information? You can ask the credit bureaus to notify them of the corrections, the FTC says. This includes:

- Notifying anyone who received your report in the past six months.

- Sending a corrected copy of your report to anyone who received it in the past two years.

But what if the investigation doesnt resolve your dispute? If the furnisher continues to report the error, you can ask the credit bureaus to include a statement in your credit file that describes your side of the dispute and it will be included in future credit reports. For a fee, you can usually ask the credit bureau to send a copy of the statement to anyone who has recently received a copy of your report.

Also, if you believe you were treated unfairly or a valid error remains on your credit report, you can file a complaint with the Consumer Financial Protection Bureau. The CFPB is required to forward the complaint to the company with which you have an issue. The CFPB usually will provide you with a response within 15 days.

How long can it take for an error to be corrected on your credit report after the dispute is resolved? Credit bureaus have five business days after finishing their investigation to notify you of the results.

Submit A Dispute To The Credit Bureau

The Fair Credit Reporting Act is a Federal law that defines the type of information that can be listed on your credit report and for how long . The FCRA says that you have the right to an accurate credit report and because of that provision, you can dispute errors with the credit bureau.

are easiest when made online or via mail. To make a dispute online, you must have recently ordered a copy of your credit report. You can submit a dispute with the credit bureau who provided the credit report.

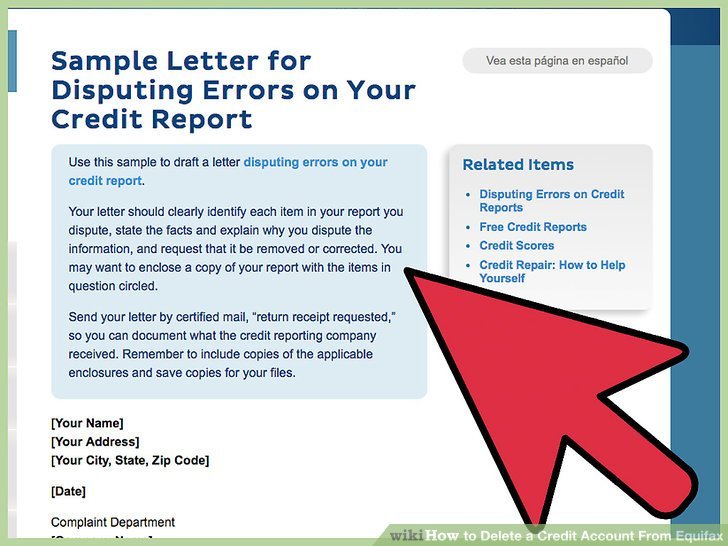

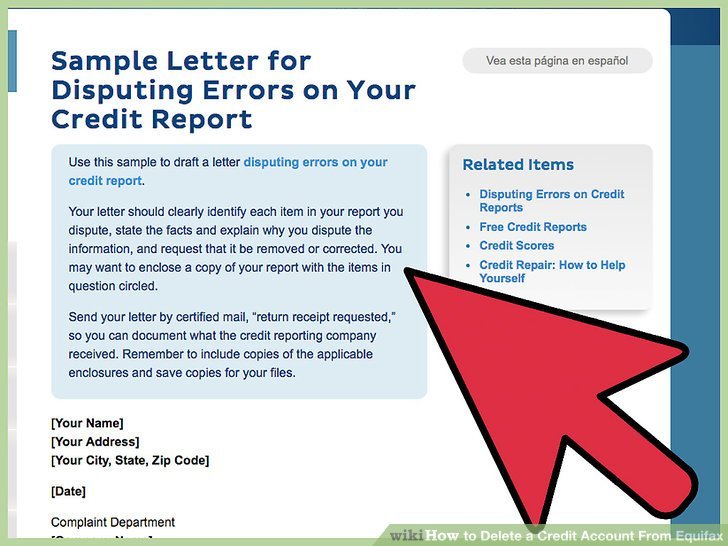

To dispute via mail, write a letter describing the credit report and submit copies of any proof you have. The credit bureau investigates your dispute with the business that provided the information and removes the entry if they find that is indeed an error.

Can I Have Closed Accounts Removed From My Credit Report

If you have closed accounts on your credit report that are not delinquent or hurting your credit, then there is no need to remove them. They may actually be helping your credit, even though they are closed.

Accounts that were closed in good standing should automatically fall off your after 10 years, while delinquent closed accounts will fall off your credit report after 7 years.

You May Like: How To Remove Repo From Credit

Should I Pay Off Closed Accounts On My Credit Report

If your account was closed with a balance but remains in good standing, maintain its good standing by continuing to make payments until the account is paid off.

If your account was closed due to delinquency, the first thing to do is call your credit card issuer to check the status of the account. If the debt hasnt been sold to a collections agency yet, youll want to start paying off the account immediately to prevent it from going to collections. You could end up with bad credit if you have a collection account on your file.

If the account is already in collections, however, whether or not you should pay it off is an entirely different question that depends on your individual situation.

See our article on collection accounts on your credit report for more information on how to handle collections.

Your Credit Utilization May Increase

Your credit utilization rate is the portion of revolving credit youre using compared to how much you have available generally expressed as a percentage. If you close a revolving account, such as a credit card, the total amount available decreases.

When that happens, your credit utilization could increase, which may lower your credit scores. In general, most experts recommend keeping your rate below 30%.

Read Also: Does Opensky Report To Credit Bureaus

Are Closed Accounts On Your Credit Report Bad

Closed accounts on your credit report are not inherently a bad thing. In fact, they can often be a good thing, as we will elaborate on below.

Closed accounts on your credit report, unless they are derogatory, are not bad for your credit. In fact, they are probably giving your credit a boost.

However, derogatory closed accounts can definitely have a negative impact on ones credit.

For example, if you had a credit card closed due to delinquency, meaning the creditor closed the account because you had stopped paying it, the account likely still has a balance owed.

Having a closed credit account with a balance on your credit report could really hurt your credit. According to some sources, closing a credit account removes its credit limit, so a credit card account closed with a balance would be considered maxed out or over-limit.

However, other sources say that a closed account with a balance will be treated as an open account until the balance is paid off, at which point you can expect some damage to your score, especially if you have balances on your other credit cards.

The specific way that closed accounts are treated may depend on which is used to calculate your score as well as other variables in your credit profile.

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your credit report. The NFCC can provide debt counseling services, help review your credit reports, work with lenders, and help create a debt management plan free of charge.

As always, be wary of predatory credit organizations or companies. Make sure to find a reputable counseling agency and keep a lookout for any red flags, like hidden fees or lack of transparency.

When looking for a credit counselor, the Federal Trade Commission advises consumers to check out each potential agency with:

- The Attorney General of your state

- Local consumer protection agencies

- The United States Trustee program

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

Will My Credit Score Increase If A Collection Account Is Removed

Since payment history accounts for 35% of your FICO score, your score might build if a collection account is removed. However, how much it increases will depend on other items listed in your credit report. For example, if this negative account is the only one listed on your credit report, removing it could boost your score more than if you had several other collection accounts on your report.

You May Be Able To Remove Or Update Information About Student Loans If Its Inaccurate

May 27, 2021 |9 min read

If youâre wondering how to get student loans off your credit report, itâs important to know when thatâs possible and when itâs not. Generally, if the loan belongs to you, it will remain on your credit report.

You canât remove accurate information from your credit report. But if you notice an error on your credit report, you have the right to dispute it. Here are some things to know about removing student loans from your credit report, how long student loans stay on your credit report and ways to improve your credit score.

You May Like: When Do Hard Inquiries Fall Off Credit Report

Identify Any Credit Report Errors

Review your credit reports periodically for inaccurate or incomplete information. You can get one free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion once a year at annualcreditreport.com. You can also subscribe, usually at a cost, to a credit monitoring service and review your report monthly.

Some common credit report errors you might spot include:

- Identity mistakes such as an incorrect name, phone number or address.

- A so-called mixed file that contains account information belonging to another consumer. This may occur when you and another consumer have the same or similar names.

- An account incorrectly attributed to you due to identity theft.

- A closed account thats still being reported as open.

- An incorrect reporting of you as an account owner, when you are just an authorized user on an account.

- A remedied delinquency such as a collections account that you paid off yet still shows as unpaid.

- An account thats incorrectly labelled as late or delinquent, which could include outdated information such as a late payment thats over 7 years old or an incorrect date regarding your last payment.

- The same debt listed more than once.

- An account listed more than once with different creditors.

- Incorrect account balances.

- Inaccurate credit limits.

Asking Equifax To Remove The Account

Recommended Reading: Credit Score 672

How To Remove Negative Items From Your Credit Report

Its smart to know how to remove negative items from your credit report, especially if you are soon to be applying for a mortgage or car loan.

In fact, you can remove something from your credit history before seven years pass.

Whatever youre dealing with, late payments, collections, charge offs, or foreclosures, the following techniques can clean up your credit quickly.

Dispute Any Inconsistencies To A Credit Bureau

The first step to closing a settled account on your credit report is todispute it.

You must study the loan or account closely and see if there is any inaccurate information.

If there is, then you can dispute inaccurate information.

This information can include personal details like your name and address to inconsistencies in repayments.

For example, you have kept track of making payments and when comparing your data to the records on the account it appears that they didnt receive or track a payment.

This is something you should dispute.

To dispute, you must contact one of the three credit bureaus.

Equifax, Experian, and TransUnion allow anyone to file a dispute online or by mail.

When filing your dispute you must provide your name, number of the account you are disputing, why youre disputing it, and supporting information and documents to prove that the dispute is valid and accurate.

After providing the credit bureau with your dispute and supporting information they must look into it.

They have a timeline of 30 days to begin the investigation process.

If the credit bureau finds anything, they will inform you in writing through the mail.

If the settled account was faulty, it will then be removed from your account.

The only way it will appear again is if the creditor proves it was accurate.

This is a great way to not have the account affect your score negatively but in most cases, it will still remain on your report.

You May Like: How Long Foreclosure On Credit Report

More Accounts Are Better When Handled Responsibly

In general, a larger number of accounts is better for your credit.

I have more than ten credit cards and a mortgage, and my credit score is well over 800 and the best score Ive ever had. Having a lot of accounts is good for my credit only because I handle them responsibly.

Using credit cards is a great way to earn valuable cash back and travel rewards. The key to doing so successfully is following the most important rule of credit cards:

Pay your balance every month in full by the due date.

I was lucky to learn that tidbit from my history teacher, Mrs. Waples, during an off-topic class discussion in high school. But most people dont learn anything about credit in school.

So Im sharing three key credit tips with you now:

For many people, thats easier said than done. Thats why its important to understand your own credit habits and use tools like automatic payments.

Another option is just to leave your credit cards in the back of a drawer for emergencies. Just make sure you use them a few times a year to keep them active.

If you can manage them responsibly and hold onto them, however, more accounts could be better for your credit. Closing an account, even one you dont regularly use, is rarely in your best interest.

Ive Disputed But The Creditor States The Information Is Correct Now What

So, the original creditor pulls their files and verifies that the information is correct, and the collection remains on your report. This shouldnt be the end of your collection-deleting quest.

Your next tactic should be to contact the original creditor and participate in some negotiation.

Pay-for-Delete

One option is to pay for a deletion. This entails the creditor agreeing to delete the collection contingent upon your payment, either in full or a lesser agreed-to amount.

Pay for deletions, or PFDs are a way to take care of debt with possibly a resolution for both parties.

A key point in this method is that you must have the creditors agreement in writing stating that they will delete the derogatory item once you pay X amount of dollars. This may take some time and some skill if you are dealing with a call center. However, trying several times with various agents may prove to be rewarding if you stick to your guns.

Do not agree to pay without an agreement in writing if you want the collection removed. Although it is wise to pay off your debts old and new, without a deletion your old debt will be updated on your credit report as a paid collection.

Paid collections are better than unpaid collections, but they do not have as much of a positive impact on your score as a removed collections from your credit report .

Wait 7 Years

Another dont is not to agree to a payment plan in paying off debt. You must be able to pay the debt in full or a smaller agreed-to amount.

Don’t Miss: How To Unlock My Experian Credit Report

How To Request Pay For Delete

To ask for pay for delete, youll need to send a written letter to the creditor or debt collection agency. A pay for delete letter should include:

- Your name and address

- The creditors or collection agencys name and address

- The name and account number youre referencing

- A written statement saying how much you agree to pay and what you expect in return with regard to the creditor removing negative information

Youre essentially asking the creditor to take back any negative remarks that it may have added to your credit file in connection with late or missed payments or a collection account. By paying some or all of the outstanding balance, youre hoping that the creditor will show goodwill and remove negative information from your credit report for that account.

How To Get A Closed Account Off Your Credit Report

Many people close credit accounts they no longer want, thinking that doing so removes the account from their credit report. The Fair Credit Report Actthe law that guides credit reportingallows credit bureaus to include all accurate and timely information on your credit report. Information can only be removed from your credit report if it’s inaccurate or outdated, or the creditor agrees to remove it.

Read Also: How To Report A Death To Credit Bureaus

Re: Remove Old Closed Accounts And Transferred Student Loans

Every year or so I would use the sample from this forum. I never use the electronic submission and stated the payments relected were incorrect and listed the late payments dates. Alot of times the credit cards will not verify and they have to be removed if not verified within 30 days. I did just use the online submission and chase removed an old providian late payment.

Only good thing with the banking crisis is they may not have the records handy to verify your late payments. If they come back verified, then next step is Good Will letter to the company asking them to remove the mark.

Ways To Get Something Removed From Your Credit Report

Before you get started, note that if your negative information wasnt the result of an inaccuracy or crime, neither Equifax or TransUnion will remove it from your credit report prior to the designated date. Otherwise, there are 6 different ways to get an error or other negative incident removed from your credit report:

Wait For It To Go Away Naturally

Normally, timely payments and other positive incidents will stay on your credit report indefinitely and will improve your credit score over time. On the other hand, negative information will remain in your credit history for several years, the length of which depends on the incident. Common examples of negative information include:

- Late/missed payments = 6 years

- Consumer proposals = 3 years

- Bankruptcies = 6 7 years

In these cases, the simplest way to deal with the negative information is to wait until Equifax and/or TransUnion clears it from your report. As mentioned, whether the incident was intentional or accidental, neither bureau will remove it immediately, because it was technically your responsibility to pay your debts on time.

File a Dispute

Although waiting for the negative information to be removed is the most convenient option, remember that it can damage your credit score while its on your credit report. You may not want to wait for years, during which you could get denied for new credit.

- For the dispute to have grounding, be sure to provide any proof you have that shows that the incident was not your fault

You May Like: How To Remove Repossession From Credit Report