Changing Your Name On Your Credit Report

You dont have to notify the of your name change. When your creditors update your credit report information, your new name will be sent to the credit bureaus along with the rest of your account information. Your name will appear in the personal information section of your credit report along with any other variations of your name.

What Should I Do If My Name Has Changed

There can be multiple reasons you might want to change your name. Your name might change after a marriage or a divorce or there might be a spelling mistake in your documents that you wish to get corrected or there might be some other personal reason. Whatever the reason, it is very important to inform your banking partners about the change in your name.

While in most cases, once the name is updated in the records of your lenders, the same is also reflected in your CIBIL report automatically, it is always a good idea to also inform CIBIL about the name change.

Changing Your Name On Your Credit Cards

Now youve officially changed your name. You can contact the to change your name on your credit card. Once youve completed the process, your credit card issuer will mail a new credit card to you with your new name embossed on the front.

For example, American Express allows you to change your name online. You fill out a name change authorization form and upload a copy of your new identification, such as your new drivers license, to complete your request. If you have a Bank of America card and live near a Bank of America location, you should take your government-issued photo identification plus any additional documentation there to complete a name change. You can also call customer service to complete your request.

For other credit card issuers, calling the number on the back of your credit card is the best way to initiate the process. Be prepared to email, fax, or mail copies of your documentation to complete your name change request.

Changing the name on your credit card doesnt change anything else related to your credit card account. Youll maintain the same account number, credit limit, balance, and other credit card details.

Details about your personal information dont affect your credit score, so your credit wont be affected when you change your name on your credit card. If youre recently married, you and your spouse will continue to maintain separate credit files unless one of you is made an authorized user on your accounts.

Recommended Reading: How To Get Free Credit History Report

Is There Anything Else I Need To Know

Even though a name change doesnt factor into how your credit score is calculated, youll still want to make sure your personal information is correct on your credit report. If not, you can face issues, especially if you want to apply for a loan, new credit or even to move into a new apartment.

That means monitoring your credit using tools like Rocket HomesSM to see when your name has been updated with lenders. Then, review your credit report with all three major credit bureaus and dispute any inaccurate information so you can get it resolved as soon as possible. For more articles like this one, check out our

Rocket HQSM has partnered with CardRatings for our coverage of credit card products. Rocket HQ and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the authors alone, and have not been reviewed, endorsed or approved by any of these entities.

If Youve Been Told You Might Have 12 Months Or Less To Live

Report the change online through your Universal Credit account. Youll be contacted about what to do next.

You can also get someone else to report the change for you. They should ask a doctor or medical professional to fill in:

- form DS1500 if youve been told you might have 6 months or less to live

- form SR1 if youve been told you might have 12 months or less to live

The doctor will have the form already. Either the doctor or your representative can send it to:

Freepost Department for Work and Pensions Universal Credit Full Service

If youve already sent either form SR1 or DS1500 for another benefit, for example Employment and Support Allowance, you do not need to send it again.

You will not need to have a Work Capability Assessment.

Also Check: Does Afterpay Show On Credit Report

How Does The Delay Impact You

In case there have been significant changes made to your name, it can be misleading for the lender. There can also be a case of identity mistake. In extreme situations, there might be liabilities relating to a different individual linked to your credit report due to this confusion in the name. So, any alteration in your name or surname must be communicated to the bank immediately to avoid such confusions. The change of name must not be communicated until the entire process of changing your name is completed. Once the name change process is complete and you have informed your lender, you need to follow up regularly with the credit bureau, to ensure that your revised name is incorporated. Once you find that your new name or surname has been incorporated in the records of CIBIL, you will no longer face any problem while applying for a fresh loan or credit card.

S For Changing Your Name On A Credit Card

If you need to change your name on a credit card account, follow these steps:

Recommended Reading: How To Add Utility Bills To Your Credit Report

How To Report A Name Change To A Credit Bureau

When you change your name, you’ll want to make sure all the businesses you work with have your new information. When it comes to your finances, notify all your creditors you’ve changed your name so your credit reports will also reflect the change. Also ask them if there are any forms or documentation you need to complete to ensure their records are updated.

Though changing your name won’t impact your credit, you should know what to look out for and take all the proper steps to ensure you’re able to use your new name without issue.

Does Changing Your Name Affect Credit

Legally changing your name won’t affect your credit report at all. Additionally, neither does marriage. If you’re getting married, your financial accounts aren’t added to your spouse’s credit report and theirs aren’t added to yours. Your existing individual accounts stay on each of your respective credit reports, and you each maintain your own credit report. They don’t merge into one.

The only way a marriage will impact your credit score is if you open a new joint account with your spouse. If you take out a mortgage or car loan together, or open a joint credit card account together, it will appear on both of your accounts and will impact both of your scores. But simply getting married and changing your last name will not result in any changes to your credit score, good or bad.

You also don’t have to do anything to change your name on your credit report. Once you have updated your name with the Social Security Administration and with your creditors, the credit bureaus will receive this new information and update your report automatically. It can take a few months for it to take effect, since reporting schedules vary, but it will eventually happen without any effort required on your part. Your old name will still show up on your report as a former name, but your new name should update automatically.

Recommended Reading: Why Credit Rating Is Required

When Is It Necessary To Dispute A Name

If your credit reports list accounts that belong or belonged to you and are under names you no longer use, it’s probably not necessary to file a dispute to correct them. One exception, though, is if you’ve informed a current creditor about a name change, and it’s reflected in their communications with you but your credit reports aren’t updated after several months. If this were to happen, you may want to submit a dispute with the credit bureaus to bring the reports current.

But sometimes names you’ve used could be connected with account information that isn’t yoursand that’s when it becomes important to dispute the information. This isn’t a common occurrence, but it can happen accidentally or under suspicious circumstances, such as identity theft.

You’re particularly at risk if:

- You share a name with a parent or childparticularly if neither of you uses a suffix with your name.

- Your name is fairly common, and someone who shares your name also shares your date of birtha situation that’s atypical, but also not as rare as you might think.

Accidental mixture of your credit data with those of another person who shares your name creates what’s known in the industry as a “mixed credit file,” or mixed credit report. A mixed credit file distorts your credit history and can lead to erroneous credit score calculations.

How Transgender People Can Change Their Name On Their Equifax Credit Report

Reading time: 3 minutes

Highlights:

- Certain steps must be followed in order to update vital records to reflect a legal name change.

- Every state has its own set of laws and procedures, so you’ll need to know your specific state’s legal requirements.

- The easiest way to change your name on your Equifax credit report is through the myEquifax Dispute Center.

- The name change court order is the most important document you’ll need to change your full legal name on your Equifax credit report.

Last name changes are a common process for credit reporting agencies when people change their last name after marriage. For transgender individuals, a full name change requires additional steps and documentation. The process not only involves your legal name, but may also include updating vital records such as your Social Security card and driver’s license with the federal and state government.

The legal process for full name changes varies by state, and each state may require different documentation. Additionally, states may put requirements on where you must be in your transition before certain documentation may be updated.

Generally, the process for trans individuals to change their name is:

Read Also: How To Clear Defaults On Your Credit Report

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

How To Update Information On Your Credit Report

In a Nutshell

The offers that appear on our platform are from third party advertisers from which Credit Karma receives compensation. This compensation may impact how and where products appear on this site . It is this compensation that enables Credit Karma to provide you with services like free access to your credit score and report. Credit Karma strives to provide a wide array of offers for our members, but our offers do not represent all financial services companies or products.

You May Like: How To Remove Closed Accounts From Credit Report

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Check Your Credit Report For Fraud

Look for accounts that don’t belong to you on your credit report. Accounts that you don’t recognize could mean that someone has applied for a credit card, line of credit, mortgage or other loan under your name. It could also just be an administrative error. Make sure it’s not fraud or identity theft by taking the steps to have it corrected.

If you find an error on your credit report, contact lenders and any other organizations that could be affected. Tell them about the potential fraud.

If it’s fraud, you should:

- report it to the Canadian Anti-fraud Centre

The Canadian Anti-Fraud Centre is the central agency in Canada that collects information and criminal intelligence on fraud and identity theft.

You May Like: Is 702 A Good Credit Score

How To File A Dispute

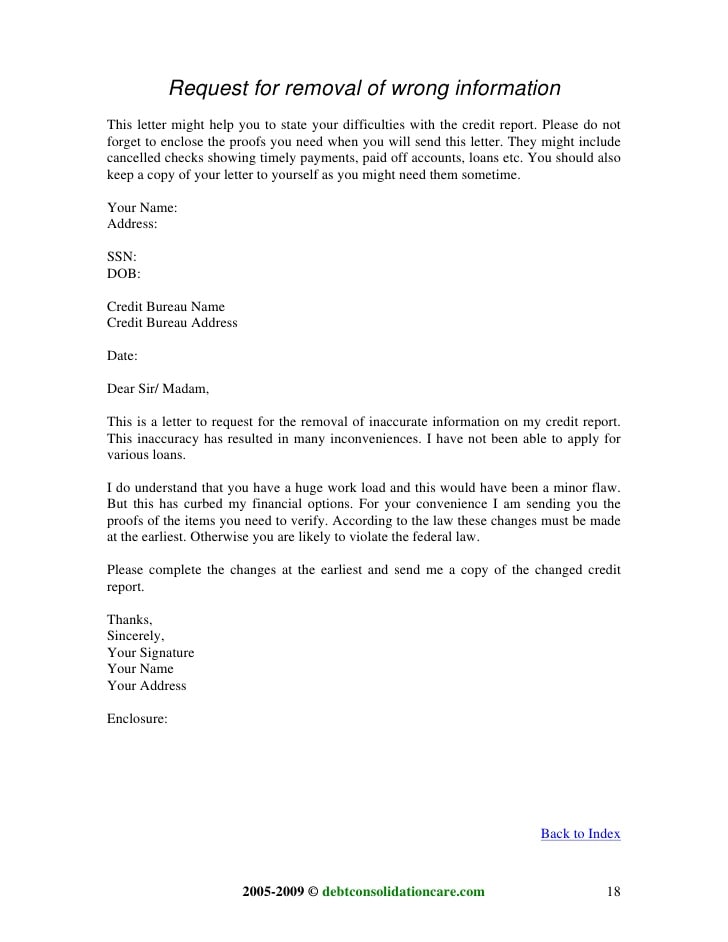

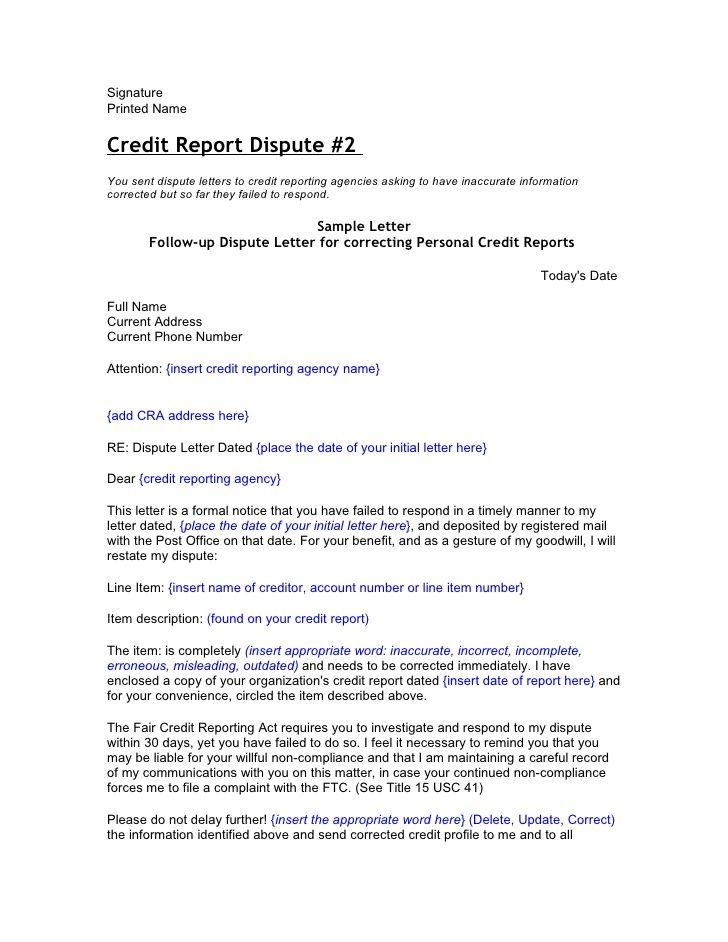

If you need to correct your name on your credit reports, you must file a dispute with each credit bureau that lists the name incorrectly. The process differs somewhat for each of the national credit bureaus. The Experian Dispute Center webpage explains procedures for submitting disputes online, by phone or by mail.

How To Change A Name On A Credit Card

At Experian, one of our priorities is consumer credit and finance education. This post may contain links and references to one or more of our partners, but we provide an objective view to help you make the best decisions. For more information, see our .

In this article:

Changing your legal name can be a complicated process, especially when it comes to updating all of your financial accounts. If you want to update your credit card accounts, you may find the process is not uniform.

Each financial institution and credit card company has its own process for approving name changes, so you should start by reaching out to your issuer or examining their website to find out their policy, then gathering and submitting the required documentation. Read on to learn more.

Don’t Miss: How Long Derogatory Information On Credit Report

Social Security Number Change

It is difficult and unusual to change a Social Security number, but it is sometimes necessary. For example, someone facing continuing damage due to fraud perpetrated using their stolen Social Security number may be able to obtain a new one. As with other identifying information, new numbers should be provided to creditors, who will pass that information along to credit agencies.

The credit agencies have differing policies about Social Security number changes:

- Experian: Update your number with your creditors. It is not necessary to change it directly with Experian.

- Equifax: If you would like to change your number directly with the agency, submit a request to update it with Equifax at the address on your credit report. One of the following types of documentation is required:

- Copy of the new Social Security card

- Pay stub with the number

- W-2 form or 1099 form

- Medicaid or Medicare documentation