What’s A Good Credit Score To Have How To Get It

Advertiser Disclosure

Advertiser Disclosure: ValuePenguin is an advertising-supported comparison service which receives compensation from some of the financial providers whose offers appear on our site. This compensation from our advertising partners may impact how and where products appear on our site . To provide more complete comparisons, the site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

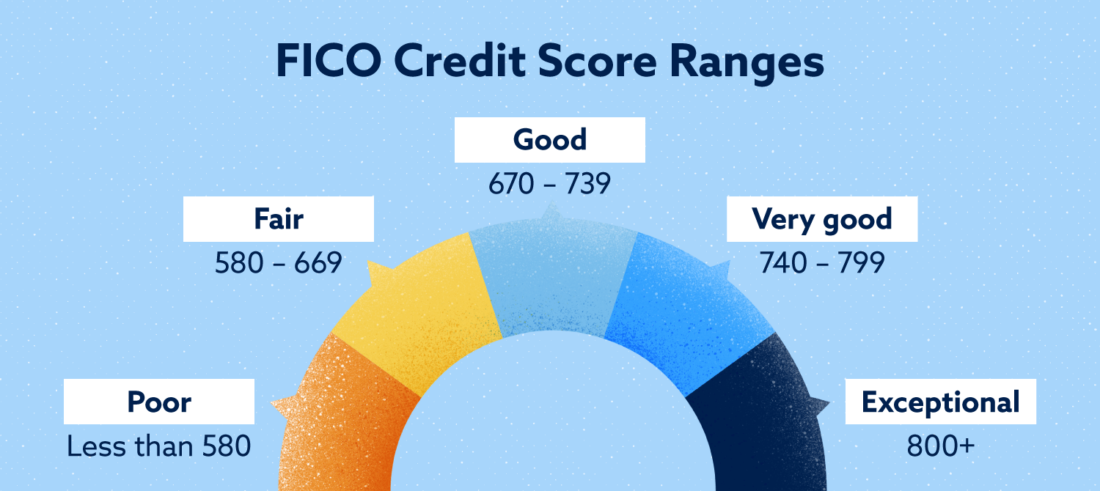

A good typically ranges between 680 and 750. Consumers who fall within this spectrum tend to qualify for excellent interest rates, and loans. However, what constitutes a good credit score is far more nuanced. In reality, the range of scores will depend on both the exact credit scoring model being used and its purpose.

How To Improve Your Credit Score If You Have No Credit History

Building good credit doesn’t happen overnight. Instead, you need to consistently practice responsible credit behavior, such as paying bills on time and limiting your credit utilization ratio.

Here are some credit building options that can help improve your credit score over time:

- Option 1: Become an authorized user

- Option 2: Get credit for paying monthly utility and cell phone bills on time

- Option 3: Open a college student card

How To Check Your Credit Score In Canada

With Borrowell, you can get your credit score in Canada for free! Signing up takes less than 3 minutes, and no credit card is required. Once you’ve signed up for Borrowell, you can download your Equifax credit report for free AND check your credit score at any time without hurting it. Plus, you’ll receive weekly updates on how your score has changed. Stay on top of your credit health with Borrowell.

Recommended Reading: Do Lending Club Loans Go On Your Credit Report

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans. Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of TransUnion Canada explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

How To Get Excellent Credit: 5 Expert Tips

1. Always pay on time. Always.

Payment history heavily influences your credit score. In fact, it is the most influential factor for FICO and VantageScore.1 To stay on top of your payments, set up a calendar reminder or enroll in automatic payments. The on-time payment goal applies to all your bills, including utilities, rent and cell phone service.

What if you were late on a payment a few years ago? While late or missed payments can stay on your credit report for seven years, the impact on your credit score decreases over time. Most negative items have little impact on your score after two years2 so be patient, keep making timely payments, and youll soon be on your way to an excellent credit score.

2. Optimize your credit utilization ratio.

is another key piece of your credit score puzzle. Credit utilization measures the balances you owe on your credit cards relative to your cards credit limits. Its calculated on an overall basis .

The general rule of thumb with credit utilization is to stay below 30%.3 This applies to each individual card and your total credit utilization ratio. Strategies for improving your credit utilization ratio focus on reducing the numerator and managing the denominator .

Try one of these techniques to improve your credit utilization ratio:

3. Regularly monitor your credit scores for inaccuracies.

4. Be strategic about taking on new debt and closing accounts.

5. Consider your credit mix.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

Different Scores At Each Credit Bureau

Because each credit bureau could have different information on file about you, your credit scores will most likely differ for each of the three credit bureaus: Equifax, TransUnion and Experian.

Sometimes the difference is just a few points. Other times, the difference in your credit scores from each bureau can be vast due to an error or mistake in your credit report. These differences can cost you thousands over the life of a loan. Be sure to check your reports regularly or sign up for alerts to be notified when your score changes.

What’s A Good Credit Score In Canada

A good credit score in Canada is any score between 713 and 900. Credit scores in Canada range between 300 and 900. There are five distinct categories that your credit score could fall into, ranging from poor to excellent. Having a good credit score can help you qualify for financial products at lower interest rates. Not sure where you stand? Check your credit score with Borrowell!

Read Also: Capital One Reporting Date

Experian 2020 Consumer Credit Review

As Americans entered 2020, the economyas measured by consumer confidence, spending and stock market performancewas thriving. Two months into the year, however, the nation was struck by the COVID-19 crisis, and the economy slid into territory not seen since the Great Recession.

The coronavirus pandemic and resulting stay-at-home orders and other restrictions led to record unemployment, a plunging stock market, economic uncertainty and thousands of business closures throughout the U.S.

Despite those challenges, and perhaps partly due to relief measures enacted to combat the economic impact of the crisis, some consumers have seen certain aspects of their finances improve since the onset of the pandemic. The national average FICO® Score increased by seven points this yearthe largest annual improvement in at least a decade.

Major credit score components, such as and payment history, have also changed for the better, with average utilization rates and late payments decreasing at a record pace. Improvements of this kind add to consumers’ overall credit health and can cause scores to rise in a short period of time.

Read on for our insights and analysis.

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These services, many of which are free, monitor for changes in your credit report, such as a paid-off account or a new account that youve opened. They typically also give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Don’t Miss: Capital One Authorized User Credit Score

Your Score Range: 800

Your score sits between 800 and 850 on the FICO scale, putting you in a category with only 18 percent of the population. Although you have little or no room for improvement, this score tells lenders and potential lenders that you are an excellent investment. Achieving a top score shows that you are a low risk and that lenders are very likely to receive payment on loans they grant to you.

Vantagescore 30 Credit Score Factors

Different credit scores can have a lot in common under the hood, but each individual scoring modeluses its own combination of factors to determine your score.

Here are the major factors that determine your VantageScore 3.0 credit scores.

Payment history The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Age and type of credit A longer credit history, particularly with the same accounts, shows lenders that youve been able to stick with your accounts over time. Lenders may also consider it a plus if you have a mix of credit accounts with positive use.

Your measures the amount of credit you use relative to the amount available to you. Most experts recommend shooting for a rate below 30%, meaning you use less than 30% of your available credit.

Balances Similar to credit utilization, this factor takes into account your total balances across your accounts but in terms of the dollar amount and not the percentage. If you already owe a fair amount elsewhere, lenders may be less inclined to extend more credit to you.

Read Also: Does Overdraft Affect Credit Rating

What Exactly Is A Credit Score

A credit score is a three-digit number used by lenders to determine whether you qualify for credit, such as a loan or credit card.

Your credit score is based on your credit report, which is a record of your credit history and how youâve managed your finances in the past. This allows lenders to assess your level of risk when you apply for credit.

The Ultimate Guide To Your Credit Score

9 minute read

Part of achieving financial wellness is understanding your credit score, what it means, how its calculated and learning practical strategies to improve it.

Understanding debt utilization ratio and the difference between hard checks and soft checks or between revolving credit and installment credit are just a small part of the story when it comes to seeing the full picture of your credit.

There are simple steps people can take to improve their credit score but before we explore some of those strategies, were going to look at what makes a good score, how its calculated, where you can check yours, and why it all matters.

Also Check: Is Chase Credit Journey Accurate

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

Good Credit Score For Mortgages

A good credit score for a home loan is one that will qualify you for the lowest interest rates possible. Different financial institutions will have varying credit score range cut-offs for different APRs. The Federal Deposit Insurance Corporation showed how credit score ranges can affect a sample $250k/30 year mortgage. A good score for a mortgage in this example would fall between 700 and 759.

|

FICO Score |

|

|---|---|

| $1,491 | $286,760 |

Mortgage companies use different credit score models to determine your rates FICO Score 2, FICO Score 4 and FICO score 5. For the most part, these models are powered by similar factors including payment history, length of credit history, and your current debt obligations.

Most lenders will not provide a mortgage to homebuyer whose credit score is below 620. The only exceptions are FHA loans which are insured by the Federal Housing Administration. If the borrower defaults on a loan of this type, the government protects the borrower against the damages. Note that people whose credit score ranges between 500 and 579 typically need to make a down payment of at least 10%.

Individuals with good credit scores can also qualify for FHA loans if they wish to lower their interest rates.

Recommended Reading: What Is Cbcinnovis On My Credit Report

Alternate Credit Scores Launched By Lexisnexis

On 9 February, LexisNexis Risk View Spectrum and Risk View Optics were unveiled by LexisNexis Risk Solutions. Risk View Spectrum and Risk View Optics are FCRA-compliant credit scores that offer a larger view on consumer credit worthiness. The new tools that are used can improve financial inclusion by finding out more credit-worthy consumers. Over 90% of individuals who do not have a regular credit score can get a score from Risk View Spectrum and Risk View Optics. Lenders can provide better offers to individuals whose credit scores are from Risk View Spectrum and Risk View Optics.

10 February 2021

Mortgage Debt Grew By 2% In 2020

- 44% of U.S. adults have a mortgage.

- The average FICO® Score for someone with a mortgage in 2020 was 753.

- The percentage of consumers’ mortgage accounts 30 or more DPD decreased by 46% in 2020.

Mortgage debt represents the largest outstanding debt in the U.S., and in 2020 consumer balances grew by 2%the same rate they grew from 2018 to 2019. Despite the pandemic, consumers across the country still bought homes, many fueled by the record drop in interest rates that accompanied the economic decline. Nearly half of all adults in the U.S. have a mortgage, and the average FICO® Score among these homeowners is more than 40 points higher than the national average.

Mortgage accounts saw the second largest decrease in accounts 30 or more DPD, dropping by 46% in 2020. Compared with 2019’s drop from the prior year of 6%, 2020’s improvement in 30 or more DPD accounts is significant.

This is likely due to the fact that the CARES Act and other government intervention provided relief for mortgage borrowers, giving those impacted by COVID-19 the right to request a forbearance. During forbearance, it was stipulated that mortgage accounts could not be reported negatively to the credit bureaus, a move that helped insulate consumer credit scores.

You May Like: Carmax Loans For Bad Credit

Over 1 Million Canadians Trust Borrowell

Courtney M.

Love this! I was a little skeptical at first but it tells you who you still owe and how much. Currently using this to view my credit and pay off what I owe.

Andrea B.

I have been using Borrowell for over a year now and I am a happy customer. I get the real deal on my credit and good advice also!

Ashvin G.

Excellent service. Recommend to understand your finance and banking accounts, debt control, loan utilization to build a good credit score for lending purpose.

Tip : Maintain A Low Credit Utilization Rate

“If your balances increase over time, your credit scores will suffer. Your is the second most important factor in scores, behind your payment history,” Griffin explains.

To calculate your utilization rate, add up the total balances on all your credit cards and divide by the total of your credit limit across all cards.

Let’s say you have two credit cards:

- Card A: $1,000 balance and $3,000 credit limit

- Card B: $3,000 balance and $5,000 credit limit

Your total balance would be $4,000 and total credit limit $8,000. That makes your utilization 50%, which is high. You should aim for a low utilization rate around 30% to improve your credit score.

If you find it hard to keep track of the percentage of credit you use, take advantage of various alerts card issuers set, such as when your balance exceeds a certain amount or when you’re approaching your credit limit. If you have no problem paying your balance in full each month, you can also call your card issuer and ask them to increase your credit limit.

Read Also: How To Remove Repossession From Credit Report

Small Business Loan Disbursals Increased 40% In Fy21

The latest edition of the Sidbi TransUnion Cibil MSME Pulse Report has been published and it shows that loans worth Rs.9.5 trillion have been disbursed by the lenders to micro, small, and medium enterprises for the current financial year.

This number is 40% more than the previous years disbursal of Rs.6.8 trillion. The report suggests that the interventions from the government such as Emergency Credit Line Guarantee Scheme have played a major role in the surge of the credit disbursement to the MSMEs.

11 August 2021

Some Defaults Or Missed Payments & Declined Applications

Defaults or missed payments will usually stay on your report for six years. If you close an account, the missed payments could stay on the account for six years after the closure, so keep that in mind. Bankruptcy is wiped six years from the date you’re declared bankrupt, provided it’s been discharged.

And when it comes to declined applications, lenders can only see whether you’ve applied for credit elsewhere, not whether you’ve been accepted or declined. However, they may be able to guess by examining the credit accounts you have open and when they were opened.

If you’ve attempted to, or have successfully reclaimed PPI or bank charges, it won’t appear on your credit files. If you’ve had bank charges, the penalties will show on your records.

Also Check: Bp Visa Syncb