What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

;Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

Reducing Risk Weight On Consumer Loans Will Be Credit Negative For The Rbi

The decision made by the Reserve Bank of India to reduce the risk weight on consumer loans will be credit negative according to Moodys Corporation. Due to this decision, banks might increase their exposure to this loan segment at a time in the economy where credit risks have been increasing.

On 12 September 2019, the Reserve Bank of India had reduced the risk weightage on consumer loans such as personal loans from 125% to 100% excluding credit card receivables.

Moodys Corporation which is a global credit rating company, mentioned that amongst all the banks, HDFC Bank Limited had the highest exposure to personal loans. This will make them more vulnerable to a rise in risk for their assets due to this decision by the RBI.

According to the company, reducing the risk weights would lower the capital requirements which would serve as a loss-absorbing buffer on the loans. This decision by the RBI will also encourage banks to further increase their exposure at a time where the marco-economy is slowing down.

20 September 2019

Important Benefits Of Credit Rating To A Company

Benefits of Credit Rating to Company as summarised below:

Lower cost of borrowing:

A company with highly rated instrumet has the opportunity to reduce the cost of borrowing from the public by quoting lesser interest on fixed deposits or debentures or bonds as the investors with low risk preference would come forward to invest in safe securities though yielding marginally lower rate of return.

Image Courtesy : cloudfront-6.publicintegrity.org/files/styles/18col/public/img/Wall%20Street%20traders.JPG?itok=gEho9_De

Wider audience for borrowing:

A company with a highly rated instrument can approach the investors extensively for the resource mobilisation using the press media. Investors in different strata of the society could be attracted by higher rated instrument as the investors understands the degree of certainty about timely payment of interest and principal on a debt instrument with better rating.

Rating as marketing tool:

Companies with rated instrument improve their own image and avail of the rating as a marketing tool to create better image in dealing with its customers feel confident in the utility products manufactured by the companies carrying higher rating for their credit instruments.

Reduction of cost in public issues:

Motivation for growth:

Rating provides motivation to the company for growth as the promotors feel confident in their own efforts and are encouraged to undertake expansion of their operations or new projects.

Unknown issuer:

Also Check: When Does Wells Fargo Report To Credit Bureaus

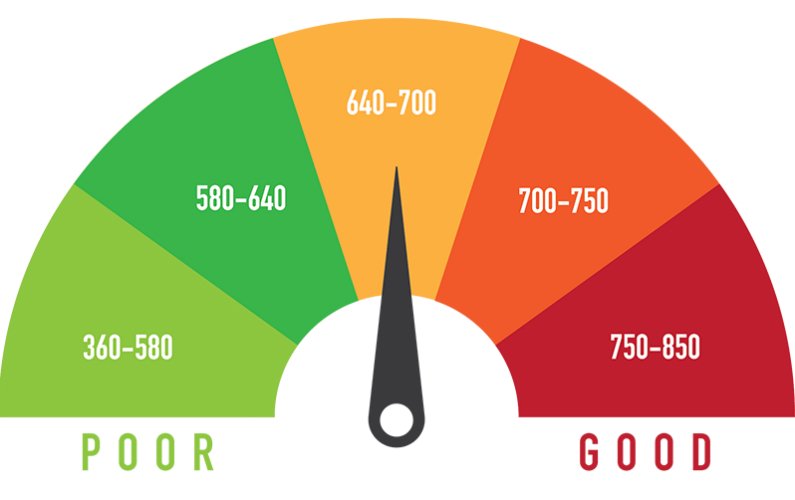

Factors Affecting Your Credit Score

Your credit score is determined by many different factors:

- The type of credit you have. For example, student loans, car loans, and your mortgage as well as store credit cards.

- Late payment history. Late payments negatively impact your score the most in the first two years, but they will stay on your report for seven.

- A study by the FTC found that one in five consumers had an error on their credit report that could be corrected by a credit reporting agency. Twenty percent of the consumers who found errors experienced an increase in their credit score once the error was removed.

Make sure your report is up to date before you go to a lender for an auto or home loan; you dont want to be denied for a mortgage over an error that could have been prevented. If you do find a mistake, file a dispute with the creditor and the credit bureau to get it fixed immediately.

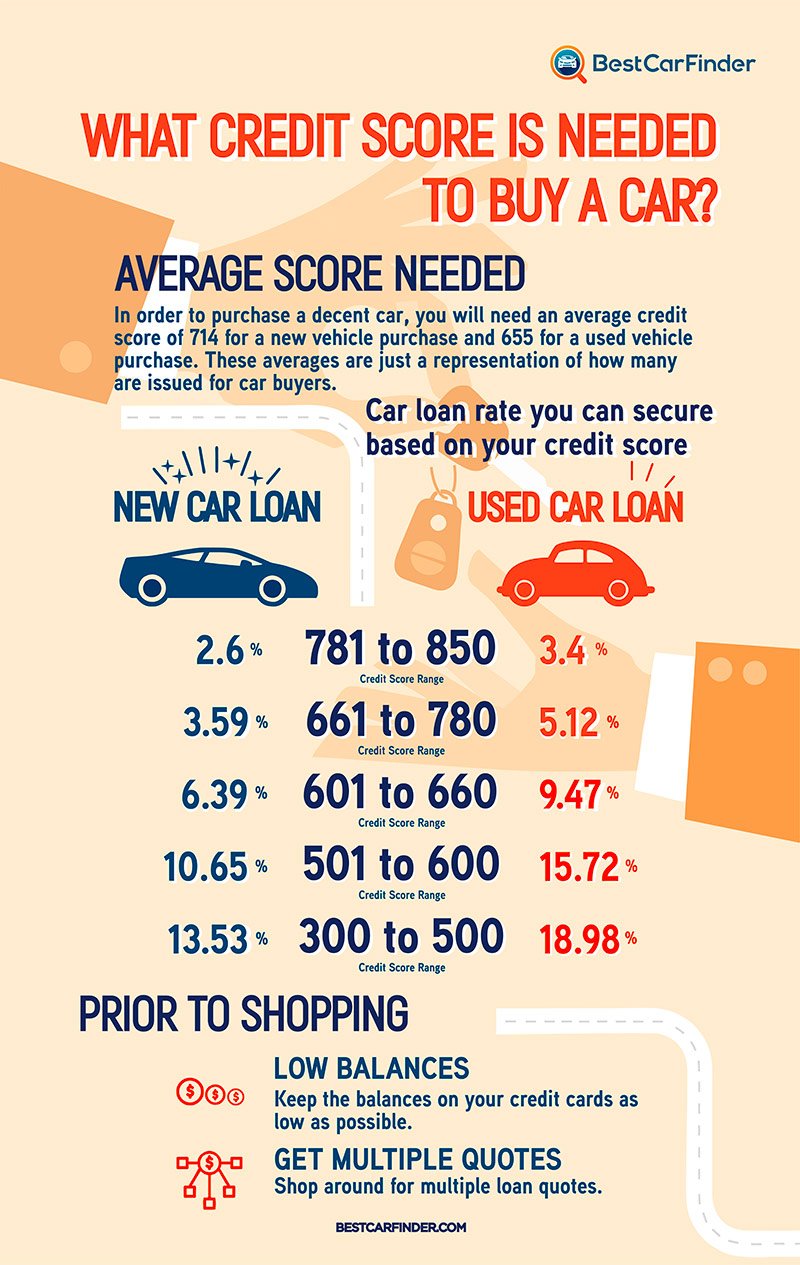

What Is A Good Credit Score To Buy A Car Best Cars

What Credit Score Do I Need to Get a Good Deal on a Car? To get an auto loan without a high interest rate, our research shows youll want a credit;

Sep 26, 2020 When it comes to buying a car, there is no minimum score needed to be approved. Having a higher score may improve your chances of getting;

You May Like: Which Is A Credit Rating Agency In India

What Is A Good Credit Score Forbes Advisor

Jun 28, 2021 For example, someone with a FICO score of 620 who is looking to buy a new car is told by the car dealer they could qualify for a 60-month;

May 9, 2020 Are you interested in buying a car? While there is no set credit score you need to qualify for an auto loan, the higher your score,;780 661: 4.75%600 501: 11.51%660 601: 7.55%500 300: 14.25%

Mar 22, 2021 If you want to buy a new car with a car loan, your credit score is traditionally a big piece of the puzzle. Dealerships, for instance, will need;

For instance, Equifaxs scoring system allows for a score between 0-700 with the UK average being around 380. On the other hand, TransUnion

In 2018, the average new car buyer had a credit score of 722, while the average for buyers of used cars was 655. Keep in mind that those are averages,;

Jul 7, 2020 Theres no official industry standard minimum credit score that you need to secure a car loan. Like other loans though, the higher your score;

In general, the higher your credit score, the lower your payments will be. An average new car buyer has a credit score of around 722, while used car buyers;

Mar 1, 2021 According to FICO, consumers with scores in the 700-850 range are considered the most reliable borrowers. They get the lowest interest rates and;

Jun 11, 2021 Generally speaking, lenders prefer when applicants have a credit score in the mid-600s for car loans in Canada. Lenders are especially happy;

What Is Creditworthiness

Creditworthiness, simply put, is how worthy or deserving one is of credit. If a lender is confident that the borrower will honor her debt obligation in a timely fashion, the borrower is deemed creditworthy. If a borrower were to evaluate their creditworthiness on her own, it would result in a conflict of interest. Therefore, sophisticated financial intermediariesFinancial IntermediaryA financial intermediary refers to an institution that acts as a middleman between two parties in order to facilitate a financial transaction. The institutions that are commonly referred to as financial intermediaries include commercial banks, investment banks, mutual funds, and pension funds. perform assessments on individuals, corporates, and sovereign governments to determine the associated risk and probability of repayment.

You May Like: How To Get My Free Credit Score

Role In Capital Markets

Credit rating agencies assess the relative of specific debt securities or structured finance instruments and borrowing entities , and in some cases the of governments and their securities. By serving as information intermediaries, CRAs theoretically reduce information costs, increase the pool of potential borrowers, and promote liquid markets. These functions may increase the supply of available risk capital in the market and promote economic growth.

What Do Ratings Really Mean

How much should ratings influence decisions? While they provide a general guide, they shouldn’t be relied upon too closely. The ratings fall somewhere between an accurate financial and operational analysis of a company and an investor speculation.

In plain English, there is no way to know how a bond will perform based on its rating because the ratings use past data from company reports. If you’ve ever heard the saying “past performance is not indicative of future performance or returns” applied to stocks, you can use it for bond ratings as well. All the ratings can tell you is the amount of risk certain people see in an investment.

Read Also: Which Information Can Be Found On A Person’s Credit Report

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

How Do Credit Ratings Work

As we know, credit rating companies offer various ratings which are benchmark parameters used by investors who seek valuable information regarding various investment or debt instruments available in India. Higher the credit rating, higher are the chances of attracting investors for investments. The calculation of credit rating or process of rating an instrument varies from one agency to another. Each credit rating agency has its own unique way of rating various entities, but the basic parameters that every credit rating agency considers are financial statements of the entity, type of lending, borrowing and lending history, repayment history and debt history of the entity. Thus, every credit rating agency analysis entity on these parameters and offers credit rating for them.

Also Check: Do Lending Club Loans Go On Your Credit Report

The Big Three Agencies

Credit rating is a highly concentrated industry, with the “Big Three” credit rating agencies controlling approximately 95% of the ratings business.Moody’s Investors Service and Standard & Poor’s together control 80% of the global market, and Fitch Ratings controls a further 15%.

As of December 2012, S&P is the largest of the three, with 1.2 million outstanding ratings and 1,416 analysts and supervisors; Moody’s has 1 million outstanding ratings and 1,252 analysts and supervisors; and Fitch is the smallest, with approximately 350,000 outstanding ratings, and is sometimes used as an alternative to S&P and Moodys.

The three largest agencies are not the only sources of credit information. Many smaller rating agencies also exist, mostly serving non-US markets. All of the large securities firms have internal fixed income analysts who offer information about the risk and volatility of securities to their clients. And specialized risk consultants working in a variety of fields offer credit models and default estimates.

Market share concentration is not a new development in the credit rating industry. Since the establishment of the first agency in 1909, there have never been more than four credit rating agencies with significant market share. Even the Financial crisis of 200708where the performance of the three rating agencies was dubbed “horrendous” by The Economist magazineled to a drop in the share of the three by just one percentfrom 98 to 97%.

What Is A Rating Agency

A rating;agency is a company that assesses the financial strength of companies and government entities, especially their ability to meet principal and interest payments on their debts. The rating assigned to a given debt shows an agencys level of confidence that the borrower will honor its debt obligations as agreed.

Each agency uses unique letter-based scores to indicate if a debt has a low or high default riskSystemic RiskSystemic risk can be defined as the risk associated with the collapse or failure of a company, industry, financial institution or an entire economy. It is the risk of a major failure of a financial system, whereby a crisis occurs when providers of capital lose trust in the users of capital and the financial stability of its issuer. The debt issuers may be sovereign nations, local and state governments, special purpose institutions, companies, or non-profit organizations.

Following the Global Financial Crisis of 2008, credit agencies drew criticisms for giving a high credit rating to debts that later turned out to be high-risk investments. They failed to identify risks that would have warned investors against investing in certain types of debts such as mortgage-backed securitiesMortgage-Backed Security A Mortgage-backed Security is a debt security that is collateralized by a mortgage or a collection of mortgages. An MBS is an asset-backed security that is traded on the secondary market, and that enables investors to profit from the mortgage business.

You May Like: How Long Does Debt Settlement Stay On Your Credit Report

Minimum Credit Score Required For Mortgage Approval In 2021

Categories

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.;

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.;

Conflicts Of Interest And Other Potential Problems

As discussed at the outset, fundamental to any credit rating agency’s credibility and the market’s use of its credit ratings are both the reality of, and the public’s belief in, the independence, objectivity and credibility of its credit ratings and rating process. Standard & Poor’s is committed to protecting the value of its ratings franchise built over its 86-year history through uncompromising dedication to these principles. These principles are reflected both in the policies governing the conduct of Standard & Poor’s credit ratings personnel, and the structure and operation of its credit ratings business.

Codes of Conduct. All Standard & Poor’s credit ratings personnel are subject to both Standard & Poor’s Credit Market Services Guidelines and Procedures and Code of Ethics and McGraw-Hill’s Code of Business Ethics.

These codes of conduct and guidelines include standards designed to promote:

McGraw-Hill’s Code of Business Ethics require the reporting of violations and Standard & Poor’s Guidelines and Procedures require annual affirmation of compliance.

Recommended Reading: Does Zzounds Report To Credit Bureau

Finding The Right Mortgage

As we said, if your credit score is below your lenders standards, its possible that your first mortgage application wont be approved but, dont give up right away. If everyone with a score under 680 got rejected for mortgages, the population of homeowners in most cities would be sparse, to say the least. That being said, before applying for a mortgage with any lender, its best to improve your credit score as much as you can, since doing so will help you gain access to better interest rates.;

Remember, applying for a mortgage is the same as for any other credit product, in the sense that the lender will have to make a hard inquiry on your credit report, causing your score to drop a few points. So, when youre starting to get serious about buying a house, make sure to do some research in advance to find the best lender for your specific financial needs. Loans Canada can help match you with a third-party licenced mortgage specialist that meets your needs, regardless of your credit.

Note: Loans Canada does not arrange, underwrite or broker mortgages. We are a simple referral service.

Rating of 5/5 based on 87 votes.

Frequently Asked Question’s On Credit Rating

Is Credit Rating Important for Bank Loans?

Yes, Credit Rating represents the credit worthiness of an individual, which is an important aspect while availing Bank Loans. Therefore, higher the credit rating of an individual, higher is his / her chance of getting a loan approval quickly. Similarly, higher credit rating implies good credit repayment history. Thus, having a higher credit history implies that you are a no risk customer with good credit history in the eyes of the banks.

Is there any Relation Between Tax & Credit Rating?

Yes, there is co-relation between tax and credit rating. Filing of your tax reports does not affect the credit rating. However, failing to pay tax can hurt the credit ratings.

What are the types of credit rating?

- Bond or Debentures Rating

You May Like: Does American Express Report To Credit Bureaus

What Credit Score Do You Need To Buy A Car The Atlanta

Jun 11, 2021 MyFICO.com recognizes 720 as the preferred credit score when buying a car. MyAutoloan.com also identifies a credit score of 720 or higher as the;

Aug 26, 2021 So whats a good credit score? Anything above 700 will at least allow borrowers to be in a good position to obtain auto loans. Once you build;

Your credit score can be an important factor when youre purchasing a car. Heres why its best to have a score of at least 700.

May 22, 2021 You dont need some magic credit score to get a car loan. Most people and most credit scores good or poor can get one.

Aug 2, 2019 A good credit score to buy a car is usually above 660, which is the minimum score to be considered a prime borrower by Experian.