Cant I Just Pay Someone To Remove Information From My Credit File

The short answer? No.

While it may seem like a quick solution, dont be fooled by companies that promise they can do this for you.

Information contained within your credit report is only ever removed if its proven to be incorrect, or if its out of date. As weve explored above, disputing errors in your credit report is a good practice to follow, and shouldn’t cost you a cent.

Show You Can Handle Different Kinds Of Debt

Its probably not a good idea to run out and take on additional debt for the sake of it, but if youre in need of a type of loan you havent used before consider taking it on and make regular payments on it you may see a bump in your score.

Lenders want to see you can handle different types of debt, so adding another type of loan and paying it down could have a positive effect on your score.

Heres an example. If youve been paying down student loans but dont yet have a credit card , you could see a score increase just by opening that credit card account and paying off your balance regularly.

Unlock Lower Interest Rates And Higher Loan Approval With These 5 Tips

Your credit score may be with you for life, but a bad credit score doesnt have to be!

As weve covered in the past, your credit score could be the factor that decides how much interest youll pay when youre approved for a loan or line of credit, if youre given the tick of approval at all.

Heres why:

Among other things, a credit score weighs your positive credit history against the negative. If a lender finds that youre financially irresponsible, have large amounts of debt, or carry maxed out credit cards, youll have a tough time obtaining finance, and pay more interest than you might have otherwise.

However, you shouldnt throw in the towel just yet.

There is a silver lining.

With the right techniques and strategies, there are countless ways to boost your credit score, save money on interest, and improve your chances of being approved for your next loan.

Today were helping you to live your best financial life by sharing 5 of the easiest ways to improve your credit score, which will help you to:

- Quickly and easily boost your credit score.

- Supercharge your chances of landing a loan.

- Save $$$ and gain access to lower interest rates.

Up first? Lets take a look at why nows the time to give your credit score much-needed CPR:

- BEFORE YOU BEGIN:Learn everything you need to know about credit scores

Also Check: How Long Do Closed Accounts Stay On My Credit Report

What Is The Quickest Way To Improve My Credit Score

In short, there’s no super-quick fix for your credit score repairing a low credit takes time. But it’s not impossible.

Don’t rely on any credit repair companies that promise to have black marks removed from your report as quick-fix efforts are most likely to backfire. Advice that claims to instantly fix your credit history should not be trusted.

The best thing to do is follow the steps above and be consistent over time. You could be surprised at how quickly your score improves after a few tweaks to your financial behaviour. Be patient, disciplined, and keep checking your score to stay on track. The Finder app can help you stay on track: we’ll update your score regularly each month and let you know if anything changes.

How to start improving your credit score today

While improving your credit score won’t happen overnight, but there are a bunch of actions you can take right now to give your score a bit of a boost in the future. Start with:

Pay Off Credit Card Debt

Your credit utilization ratio is a major factor used to determine your FICO credit score. Simply put, this is how much of your available credit card balance youâre using. To calculate your credit utilization ratio, you can divide your credit card debt by your total credit limits. For example, letâs you have two credit cards, each with a $2,000 limit. That means your total credit limit is $4,000. If you owe $500 on one card and $750 on the other, your total debt is $1,250. In this case, your credit utilization ratio would be 62.5% , which is considered high.

The lower your credit utilization ratio, the higher your credit score. Aim to keep your ratio below 30%. A high credit utilization ratio, especially over 50%, will lower your credit score.

Why It Works

If you receive a bonus at work or a tax refund, use this one-time cash influx to pay off your credit card debt, if you can afford to do so. This will help reduce your credit utilization ratio and raise your FICO credit score. Also, you donât have to wait until your statement is issued to make your payment. If you can pay it earlier, thatâs often better. If you are able to pay off your balance before your monthly statement is issued, do it. That will help raise your FICO score quickly.

You May Like: How To Win A Dispute On Credit Report

Pay Off Cards With The Highest Balances First

In addition to limiting your future spending, work on paying off your credit cards. If you have several cards with a balance, focus on the highest card balance to reduce your credit utilization ratio.

Paying down your outstanding debt can also improve your debt-to-income ratio, which is not a factor in your credits core but is used by many lenders.

How Do You Build Or Establish Credit

As previously mentioned, payment history can significantly impact your credit score. If you have a thin credit file meaning you have few or no credit accounts and only a brief credit history then there may not be enough information in your credit report to calculate a credit score or it may be lower than you’d like.

If this is the case, you’ll need to take steps to establish a longer credit history before you can focus on improving your credit score.

Recommended Reading: What Number Is Considered A Good Credit Rating

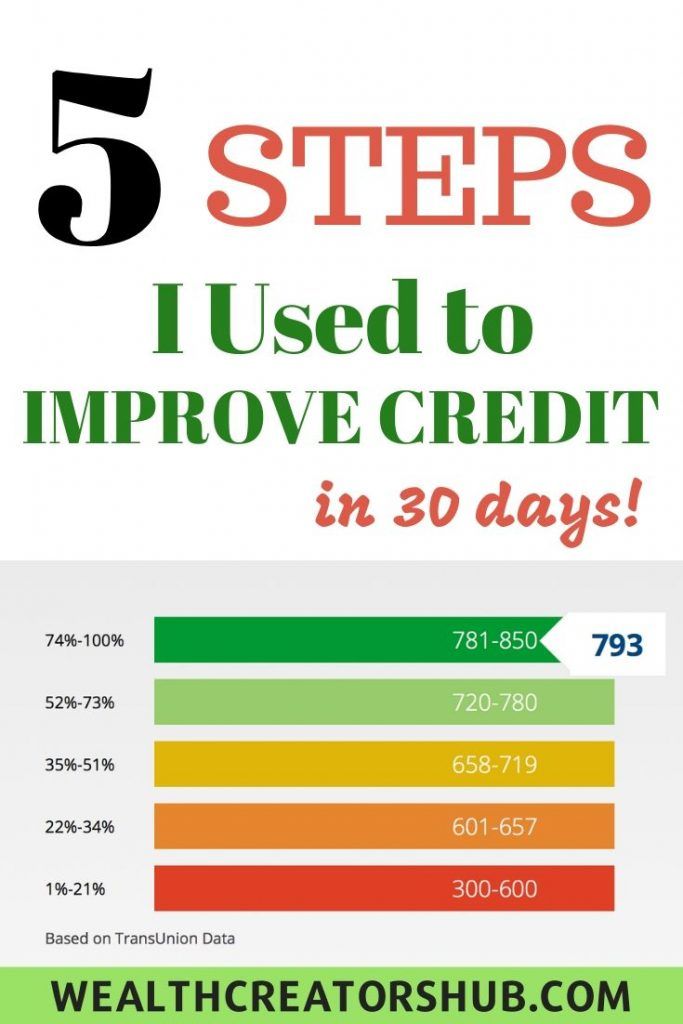

Can You Raise Your Credit Score By 100 Points In 30 Days

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

Your credit score affects everything from the interest rate youll pay on an auto loan to whether youll be hired for certain jobs, so its understandable if youre wondering how to raise your credit score quickly.

While there are no shortcuts for building up a solid credit history and score, there are some steps you can take that can provide you with a quick boost in a short amount of time. In fact, some consumers may even see their credit scores rise as much as 100 points in 30 days.

Learn more:

Also Check: How Long Does Payment History Stay On Credit Report

Long Term Actions That Could Improve Your Credit Score

I also spoke to members at Finder with a good credit score, it’s clear that in some cases, they haven’t tried to improve their credit scores specifically, but their strong scores may have also come down to a few longer term approaches to finances:

- Ordered their credit file and educated themselves. You can order your credit report and get your score for free through finder. Once you get your credit report, read up on what it means and what you can do with a good credit score.

- Focused on managing and improving their finances. In general, good credit scorers take responsible steps to manage their finances. For example one user was paying too high a rate on his personal loan, and refinanced it to cut his rate in half.

- Make sure their bills get paid. In addition to setting up automated payments, our respondents take proactive steps to ensure all their bills get paid. I’ve you have lived in a few rental properties, you could have your bills sent to a consistent address like your parent’s house so they don’t accidentally go unpaid.

Read Also: Will Being In My Overdraft Affect My Credit Rating

Tips To Boost Your Creditworthiness

The better your creditworthiness, the more ways youâll have to get ahead.

We have previoulsy looked at why creditworthiness matters. We learnt that law changes in March 2014 altered what information is collected for your credit fileâand how this âpositiveâ reporting can help you.

But your credit score isnât fixed. Here are our top 10 tips to improve it.

Tricks To Boost Your Credit Score Quickly

First things first: there is no magic solution to raising your credit score overnight.

If you have a low score due to, say, bankruptcy , boosting it requires a long-term plan of consistent on-time payments, and other responsible credit practices.

However, a low score due to a lack of credit can jump much more quickly. Check it out:1. Fix errors on your credit reports

According to the Federal Trade Commission, one in four credit reports contains small errors, which can affect your score. Errors might include false information attributed to you because of identity theft or just a simple mix up, accounts that dont belong to you, and more.

If the mistake negatively affected your score, you can expect it to improve in approximately 60 days after correction, reportedly.

2. Pay off credit cards every month

If you pay off your debts, youll see your score go up. That doesnt mean you should run out and buy things you dont need, however. Instead, charge expenses like bills and gas on your credit cards, and pay them off every month.

If youre struggling to cover your existing debt, create a debt management plan to free up extra cash.

3. Stay away from your credit limits

Paying down the debt will improve your creditworthiness, and help your credit utilization . When you get closer to your limits, you reduce your available credit, which is bad for your score.

BONUS*

A secured credit card can also be another way to help boost your credit score.

Recommended Reading: How To Get A Timeshare Off Your Credit Report

Opt For Different Types Of Credit

Credit, if obtained wisely, is helpful since a person who has never obtained any form of credit will generally have a lower CIBIL score which can make it difficult for them to obtain loans. Hence, it is advisable to include different types of credit in your portfolio that include a mix of personal and secured loans, long as well as short term loans to improve your credit history.

This step can help in improving your chances of availing a higher loan and a lower rate of interest when you decide to apply for a loan.

Here Are 10 Ways To Increase Your Credit Score By 100 Points

Also Check: Is 604 A Good Credit Score

Keep Your Credit Card Accounts Open

This step may seem counter-productive when weighed up with the need to keep your balances low, but that couldnt be further from the truth. In fact, closing down your credit cards wont help to improve your credit score, and may actually harm it.

Heres the deal:

Carrying maxed-out credit cards might be bad, but having credit card accounts open with little-to-zero balances will show a reliability and safety in handling money that has been lent to you. A low balance shows youre financially responsible and pay back your debts on time.

The best part? Should something go wrong that affects your credit score, cash flow, or your ability to gain finance, having credit cards on hand for a financial emergency could prove invaluable.

- WHILE YOURE HERE:Get out of credit card debt fast with these 5 tips

Why Are My Fico Score And Vantagescore Different

A score is a snapshot, and the number can vary each time you check it.

Your score can vary depending on which credit bureau supplied the credit report data used to generate it. Not every creditor sends account activity to all three bureaus, so your credit report from each one is unique.

Each company has several different versions of its scoring formula, too. The scoring models used most often are VantageScore 3.0 and FICO 8.

Also, FICO and VantageScore weight scoring factors slightly differently.

Read Also: How To Check Credit Score Wells Fargo

You May Like: Is 816 A Good Credit Score

Raise Your Credit Limits

If you tend to have problems with overspending, dont try this.

The goal is to raise your credit limit on one or more cards so that your utilization ratio goes down. But again, this works in your favor only if you dont use the newly available credit.

I dont recommend trying this if you have missed payments with the issuer or have a downward-trending score. The issuer could see your request for a credit limit increase as a sign that youre about to have a financial crisis and need the extra credit. Ive actually seen this result in a in credit limits. So be sure your situation looks stable before you ask for an increase.

That said, as long as youve been a great customer and your score is reasonably healthy, this is a good strategy to try.

All you have to do is call your credit card company and ask for an increase to your credit limit. Have an amount in mind before you call. Make that amount a little higher than what you want in case they feel the need to negotiate.

Remember the example in #1? Card A has a $6,000 limit and you have a $2,500 balance on it. Thats a 42% utilization ratio .

If your limit goes up to $8,500, then your new ratio is a more pleasing 29% . The higher the limit, the lower your ratio will be and this helps your score.

Boost Credit Score Fast

Financial Services

Do you need to boost your credit score fast? If you do, you are at the right place. I can show you how to add accounts to your credit report.

These accounts will boost your score ridiculously fast. I have seen score increases up to 171points with only 1 of these accounts. If you have a few minutes checkout to read more about it. I guarantee it will change your life.

- Avoid scams by acting locally or paying with PayPal

- Never pay with Western Union, Moneygram or other anonymous payment services

- Don’t buy or sell outside of your country. Don’t accept cashier cheques from outside your country

- This site is never involved in any transaction, and does not handle payments, shipping, guarantee transactions, provide escrow services, or offer “buyer protection” or “seller certification”

Recommended Reading: When Buying A Car What Credit Score Is Used

Dont Apply For Multiple New Credit Lines

Opening a new credit line increases your credit limit, but every application for a new credit line creates a hard inquiry on your credit report. Hard inquiry is a detailed analysis of your credit profile to assess how much risk you possess as a borrower.

As hard inquiry is reflected on your credit report for two years, multiple hard inquiries in a short span of time can negatively impact your credit score. Hard inquiry resulting in rejection of loan application is an extremely negative event.

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

Don’t Miss: What Can A Landlord See On My Credit Report