Top Overall Cards For 600 To 650 Credit Scores

Although consumers with credit scores in the 600 range are hardly the lowest cardholders on the credit card food chain, theyre not exactly writing their own tickets, either. To easily qualify for the rewards-rich prime credit cards so popular these days, youll likely need a credit score north of the 670 mark.

What you can get with a 600 to 650 credit score is a solid unsecured credit card or a low-fee secured card that will allow you to build credit and, maybe, earn some rewards. Use your new card responsibly for six to 12 months, and your score should increase enough to get your hands on even better cards.

| Yes | 9.0/10 |

A PREMIER Bankcard® Mastercard® Credit Card can be obtained by consumers with a wide range of credit types. The card can be used to make purchases both online and in stores, and can help you build credit with responsible use.

Is A 604 Fico Score Good

Asked by: Zelma Hessel

A FICO® Score of 604 places you within a population of consumers whose credit may be seen as Fair. Your 604 FICO® Score is lower than the average U.S. credit score. … Consumers with FICO® Scores in the good range or higher are generally offered significantly better borrowing terms.

How We Came Up With This List

We started by isolating the cards known to be available to those in the 600 to 649 credit score range. From there, we considered the features that would make it most valuable to people in that credit score range, based on different credit factors.

Those factors include:

- The issuer reports to all three major credit bureaus TransUnion, Experian and Equifax giving you an opportunity raise your credit score with all three

- Secured or unsecured credit cards secured may be necessary for those at the lower end of the fair credit score range

- Low or no annual fee

- Offering the ability to increase your credit line as your payment history warrants.

- Card features, like rewards and other benefits, if offered

You May Like: How Do I Unlock My Credit

How 604 Credit Score Appears On The Personal Loan Application

Seeing a 604 credit score on a personal loan application is viewed differently depending on the lender. Some lenders may trash your application right away. Others may be skeptical but still open to still giving you a chance. A 604 FICO score is basically a glass half empty, glass half full debate some lenders might see that youre half way to bad credit or half way to fair credit.

Ultimately, it depends on the lender. Always do your research on a company before diving into the application process, especially because some lenders will only specify that they lend to those with good or excellent credit. Dont waste your time applying for a loan through these lenders only to get your application denied.

What Is A Good Vantagescore

FICO’s competitor, VantageScore produces a similar score using the same credit report data from the three bureaus.

A good VantageScore lies between 661 and 780, which the company calls a “prime” credit tier. VantageScores above 780 are considered “superprime” while those between 601 and 660 are “near prime.” VantageScores below 600 are considered “subprime.”

The average VantageScore 3.0 in July 2021 was 693.

Recommended Reading: Klarna Approval Odds

What About Transunions Credit Score

TransUnion uses the VantageScore® 3.0 model, but the above way of looking at it still applies: two different lenders may have completely different opinions on what a good-enough TransUnion score is. And since lenders may use several different sources of information to evaluate an applicants creditworthiness, one lender may view two separate applicants differently, even if those applicants have the exact same TransUnion score under consideration.

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

Read Also: Ccb Mprcc

What Is Average Credit

Average credit actually floats somewhere in the unspecified zone between the upper reaches of fair and the lower end of good credit. In other words, between 650 and 699. When it comes to credit cards, average credit is very subjective. One credit card company might consider it 675 to 724, while another may decide its 640 to 679. But its safe to say if you fall somewhere between 650 and 699, youll be considered to have average credit with most banks.

How Can I Raise My Credit Score 20 Points Fast

4 tips to boost your credit score fast

Don’t Miss: Syncb Ppc Closed

Different Types Of Credit Scores

The three main credit bureaus are Equifax, Experian, and TransUnion. Each bureau gives you a score, and these three scores combine to create both your 604 FICO Credit Score and your VantageScore. Your score will differ slightly among each bureau for a variety of reasons, including their specific scoring models and how often they access your financial data. Keeping track of all five of these scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Qualifying For A Mortgage With Nocredit Score

Its possible to qualifyfor a mortgage even with no credit history.

Many individuals havepurchased everything with cash, which is a sign of fiscalresponsibility. Thats why most lenders can help you build a non-traditionalcredit report if you have no credit score or history.

The lender will take historyfrom accounts like rent, utilities, and even cell phone bills tobuild a score for you.

As long as youve managed thesetypes of accounts well in the past, theres a good chance you can get amortgage even with no credit score.

Also Check: Does Drivetime Pre Approval Affect Credit Score

What Does A 604 Credit Score Mean

A credit score of 604 is higher than the lowest credit score of 300, but its still a long way off from the highest credit score of 850. In the main scoring models , 604 is in the fair range.

A credit score of 604 is still low enough that it can make it hard to open new lines of credit and can damage your quality of life.

Heres how your score compares with the average credit score for different generations.

Understanding Your Credit Score

Your credit report is an essential part of getting your credit score, as it details your credit history. Any mistake on this document could lower your score. Its easy to check your credit score, and youre entitled to a free credit report from all three major credit reporting agencies once a year.

Its good practice to stay on top of your credit score and check it often for any errors to ensure youre in the best possible position. From there, you can assess your options for a conventional or government-backed loan and, when youre ready, apply for a mortgage.

Don’t Miss: Affirm Credit Reporting

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Discover It Student Cash Back

The Discover it® Student Cash Back is good starter card for college students, providing high-rate bonus rewards in the form of 5% cash back on up to $1,500 in eligible bonus category purchases each activated quarter.

- Earn 5% cash back rewards for purchases on up to $1,500 in qualifying category purchases each activated quarter

- Earn unlimited 1% cash back on all other purchases

- Pay $0 annual fee

In addition to purchase rewards, the card also offers Discovers signature Cash Back Match signup bonus that doubles the cash back cardholders earn in their first year. Students who maintain a GPA of 3.0 or higher can also earn a Good Grades Rewards statement credit.

The Citi Clear Card is tailored to the unique wants and needs of students everywhere. This card no minimum income requirement, no annual fee, and pays out point rewards for every dollar spent.

- Earn 1 reward point for $1 spent

- Get local deals and discounts plus ongoing promotions

- Pay $0 annual fee

You can use the Citi mobile app to redeem your rewards, review transactions, and schedule payments, among other features. Applicants below the age of 21 must get their parent or legal guardians consent to submit the application.

Read Also: When Does Wells Fargo Report To Credit Bureaus

Rebuilding Your 604 Credit Score

A Credit Repair company like Credit Glory can:

An industry leader like Credit Glory can guide you through this process. Give them a call @ , or chat with them, today â

How Long Does It Take To Get A 604 Credit Score

It depends where you started out.

If you have poor credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Also Check: Remove Serious Delinquency Credit Report

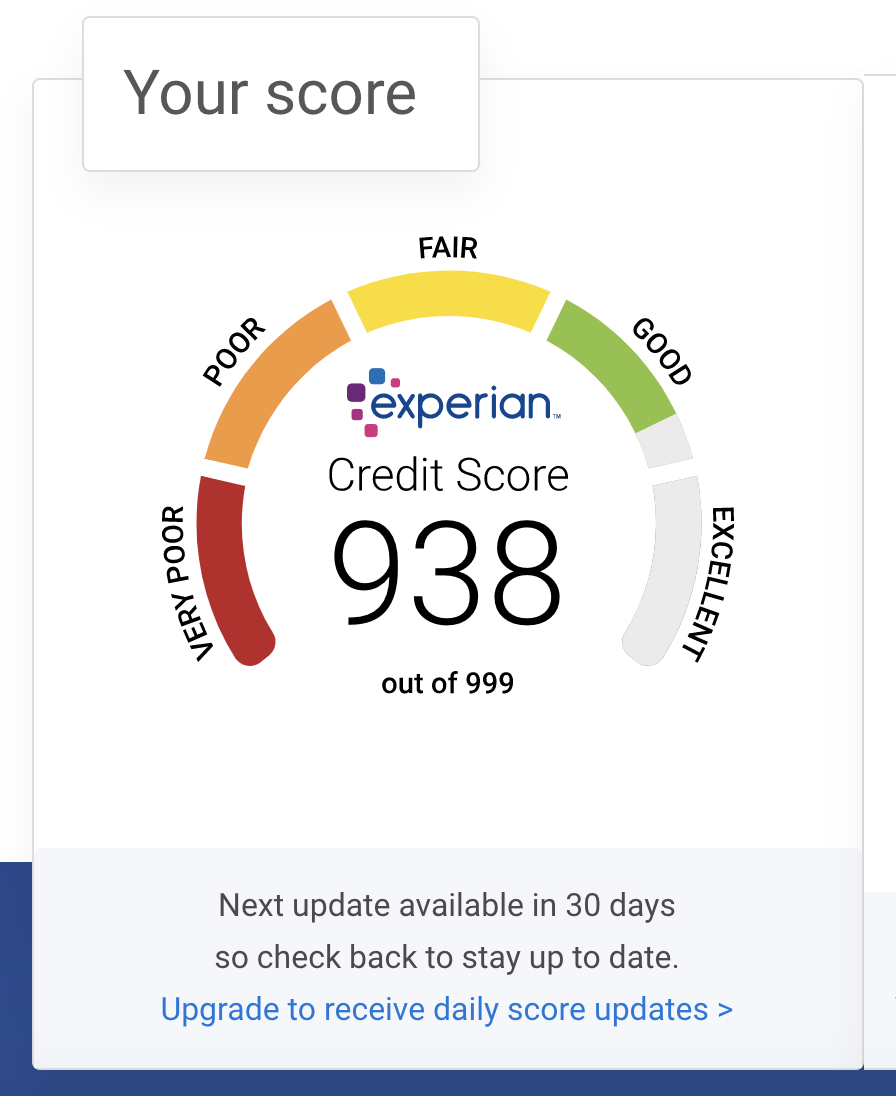

Why Does Your Credit Score Matter

Your credit score is important when it comes to applying for credit as it is viewed by prospective lenders, alongside your credit report and other information you supply during the application process. It will impact whether you are likely to be approved for a credit product, including mortgages, credit cards, personal loans or mobile phone contracts.

If you have a good credit rating, you are likely to be approved for most mainstream credit, while if you are lucky enough to have an excellent credit rating, you will likely secure the most competitive deals, with the lowest interest rates and highest credit limits.

Can You Buy A House With Credit Score Of 604

The most common type of loan available to borrowers with a 604 credit score is an FHA loan. FHA loans only require that you have a 500 credit score, so with a 604 FICO, you will definitely meet the credit score requirements. … We can help match you with a mortgage lender that offers FHA loans in your location.

You May Like: Does Les Schwab Report To Credit

What Is A Good Credit Score For A Mortgage

While it is true to say that the higher your credit score, the more likely it is you will be approved for a mortgage, there isn’t a score that guarantees you will secure a loan. Instead, a lender will look at your credit score and rating from one or more of the credit reference agencies alongside other factors, such as your income, day-to-day spending and the size of the available deposit. That said, if you have a credit score that equates to a “good” credit rating across all three agencies, you are more likely to be able to get a better deal with a more attractive rate than those with a lower score.

For those with a poorer credit rating overall, it should still be possible to get a mortgage, although it may require getting a deal with a specialist lender and this will typically involve paying a higher interest rate and, possibly, also having to contribute a larger deposit. In this situation, using a good whole-of-market mortgage broker, such as online broker Habito*, can make a huge difference as they will be familiar with the lending criteria for a wide range of lenders, giving you guidance on the best option for your circumstances. You may also find it helpful to read our article “How to get the best mortgage deal“.

Tips To Get A Personal Loan With 604 Credit Score

As mentioned, it can be harder to get approved for a personal loan when your credit score is around 604. On the bright side, there are some ways to increase your chances of being approved for a loan quicker without having to apply for dozens of loans through the process:

Personal Loan Requirements

Apart from ones credit score, there are several requirements that determine if one is eligible for a personal loan, such as the following :

- Age: 21 to 60 must show proof of birthday.

- Employment: Must show proof of employment must be with current employer for at least one year or have been self-employed for at least two years.

- Proof of Income: Provided by W-2 forms, tax returns, bank statements, or pay stubs.

- Identification: Proof can be provided by a drivers license or state ID, Social Security, and/or a passport.

- Verification of home address: Can be provided by utility bills or copy of lease.

Depending on the lender, there may be additional requirements or specific details asked apart from the above, such as certain information about your employer, your contact details, your previous address, your college/university name and major, and the like.

Alternative Option to a Personal Loan: A Credit Card

Improving Your Credit May Save You Money

Read Also: What Is A Good Leasingdesk Score

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Understanding Auto Loan Credit Scores

Your credit score is how lenders measure your financial stability and determine how well you can pay back debt. Credit scores are broken into tiers. Experian gives the following tiers and score ranges for auto loans.

Your FICO Auto Score, which most lenders use to evaluate car loan applications, may be lower or higher than your regular credit score depending on your previous auto loans – how much you borrowed and how well you made the payments.

Your exact FICO Auto Score can even vary from lender to lender. Each lender reviews your credit report information and weighs it according to what they think is the most important.

Also Check: Fico Score 820

Credit Score Credit Card & Loan Options

Some lenders choose not to lend to borrowers with credit scores in the Fair range. As a result, your financing options are going to be somewhat limited. With a score of 604, your focus should be on building your credit history and raising your credit scores before applying for any loans.

One of the best ways to build credit is by being added as an authorized user by someone who already has great credit. Having someone in your life with good credit that can cosign for you is also an option, but it can hurt their credit score if you miss payments or default on the loan.

What Does A Fico Score Of 8 Mean

FICO 8 scores range between 300 and 850. A FICO score of at least 700 is considered a good score. There are also industry-specific versions of credit scores that businesses use. For example, the FICO Bankcard Score 8 is the most widely used score when you apply for a new credit card or a credit-limit increase. 1.

Also Check: Remove Payday Loans From Credit Report

Improving Your Credit Score

Fair credit scores can’t be turned into exceptional ones overnight, and only the passage of time can repair some negative issues that contribute to Fair credit scores, such as bankruptcy and foreclosure. No matter the reason for your Fair score, you can start immediately to improve the ways you handle credit, which can lead in turn to credit-score improvements.

Look into obtaining a secured credit card. A secured credit card requires you to put down a deposit in the full amount of your spending limittypically a few hundred dollars. Confirm that the As you use the card and make regular payments, the lender reports your activity to the national credit bureaus, where they are recorded in your credit files. (Making timely payments and avoiding “maxing out” the card will favor credit-score improvements.

Consider a credit-builder loan. Available from many credit unions, these loans take can several forms, but all are designed to help improve personal credit histories. In one popular version, the credit union places the money you borrow in a savings account, where it earns interest but is inaccessible to you until the loan is paid off. Once you’ve paid the loan in full, you get access to the funds and the accumulated interest. It’s a clever savings tool, but the credit union also reports your payments to national credit bureaus, so regular, on-time payments can lead to credit-score improvements.