Can I Rebuild My Credit After Bankruptcy

You can rebuild your credit after bankruptcy, but its a long process. Your options will be limited at the start, but it is key to not get discouraged. As time goes on, if you consistently pursue a credit rebuilding strategy, your reports and scores can improve.

Here are some recommendations to start with:

- Understand the cause: Identify, accept, and learn from the root causes of your bankruptcy so you wont find yourself in the same position down the road.

- Stick to a budget: Re-evaluate your finances and see where you can cut expenses and save more money if you can.

- Start establishing a new credit history: No, this does not mean using an alias . It means starting fresh with whatever credit you can obtain.

This may mean settling for an extremely high-interest rate, taking on a co-signer, depositing cash into a secured credit card, or other options that have been designed specifically to help you re-establish a positive credit record.

Use these credit options sparingly and never put more on a card than you can pay off by the end of the month so your credit improves over time.

The Difference Between Chapter 7 And Chapter 13

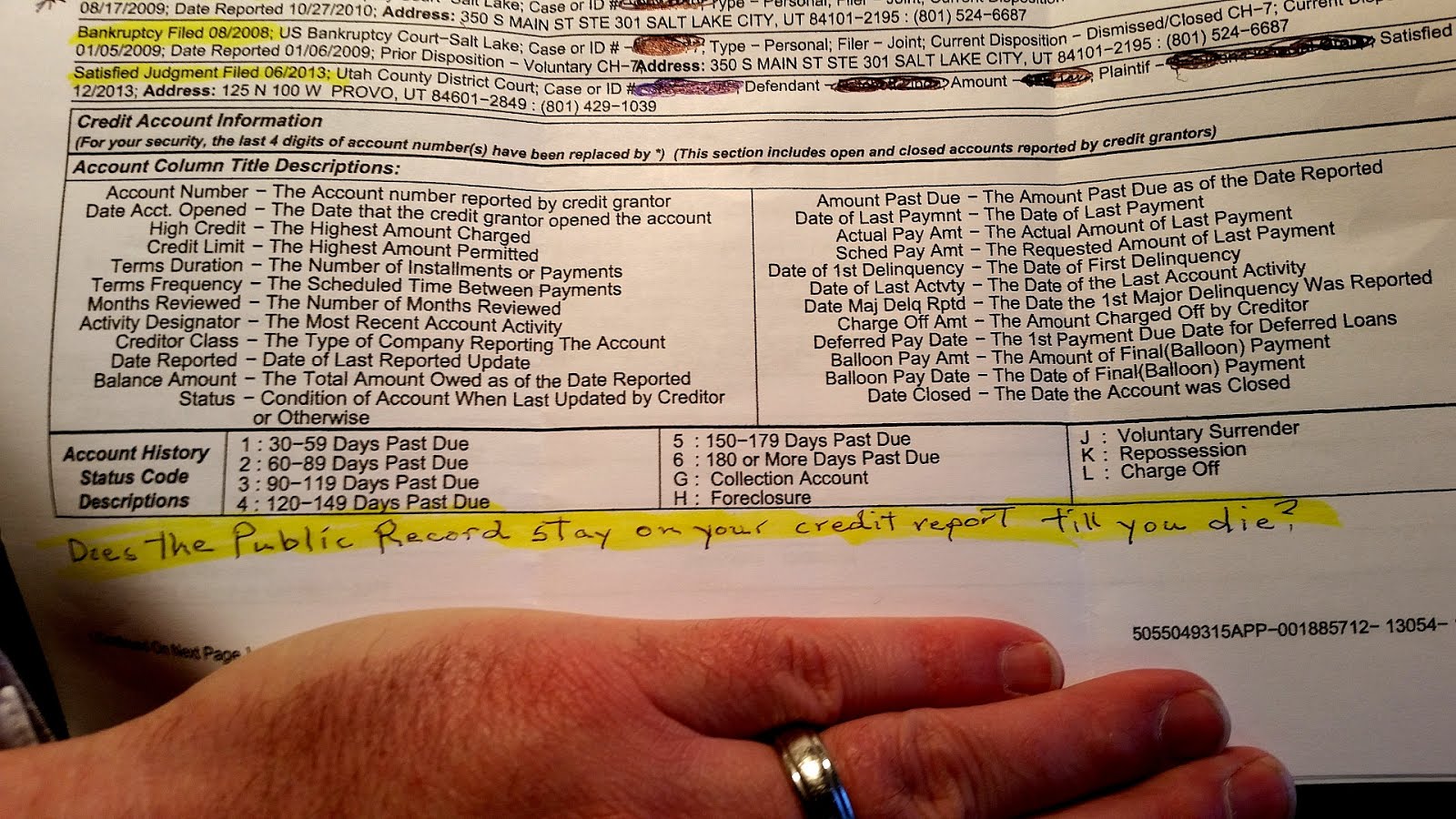

How long does a bankruptcy stay on your credit report depends which kind of bankruptcy you file. Chapter 7 bankruptcy is the liquidation chapter of bankruptcy, and no payments are made to creditors. It is generally a quick process and debts like credit cards and personal loans are discharged in Chapter 7 after about 6 months from filing bankruptcy. Chapter 13 bankruptcy is a payment plan in which all or part of the debt is paid back over the course of 3-5 years, and the discharge is entered once the payment plan is complete.

Chapter 7 generally appears on your credit report for 10 years after filing. This is because in Chapter 7, no payments are made to creditors. However, credit bureaus typically only report Chapter 13 on your credit report for 7 years after filing bankruptcy. This means that if you file a 5-year Chapter 13 payment plan, you only have to wait 2 years after the bankruptcy for it to drop off of your credit report.

At Steiner Law Group we are often asked how long does bankruptcy stay on your credit report? If you are asking yourself this question, please call Steiner Law Group at to learn more about how a bankruptcy can give you a fresh start.

- Does Chapter 13 Take All Disposable Income?

- Make a New Years Resolution to Deal with Debt

- Can You Get Your Chapter 13 Payments Lowered?

- Can I Keep My House if I File for Chapter 13?

- How are Chapter 13 Payment Plans Calculated?

How Long Does Chapter 13 Bankruptcy Stay On Your Credit Report

Chapter 13 bankruptcy, also known as wage earners bankruptcy, is for people who earn too much money to qualify for Chapter 7 but not enough to actually satisfy their creditors’ demands.

As with Chapter 7 bankruptcy, filing for Chapter 13 bankruptcy will torpedo your credit score, but the filing will only remain on your credit report for seven years.

If you need to apply for another loan during that time, youll need to file a motion and obtain the courts permission first.

Under Chapter 13 bankruptcy, the court creates a payment plan for you to repay as much of your debt as possible over the span of three to five years.

After that span of time, any remaining debts are wiped clean, meaning that your creditors may not get the full amount you owe them. Chapter 13 bankruptcy allows you to repay some of your debt while still holding on to your assets, including cars, jewelry and property.

Read Also: How Long Does A Dismissed Bankruptcy Stay On Credit

Consider Applying For A Secured Credit Card

After filing for bankruptcy, its unlikely that you will qualify for a traditional credit card. However, you may qualify for a secured credit card. A secured credit card is a credit card that requires a security depositthis deposit establishes your credit limit.

As you repay your balance, the credit card issuer usually reports your payments to the three credit bureaus. Repaying your balance on time can help you build credit. Once you cancel the card, a credit card provider typically issues you a refund for your deposit.

When shopping for secured credit cards, compare annual fees, minimum deposit amounts and interest rates to secure the best deal.

Consumers Can Seek Chapter 7 Or Chapter 13 Bankruptcy

There are two types of bankruptcy that consumers can choose if their financial situation warrants it: Chapter 7 or Chapter 13 bankruptcy. The type of bankruptcy you choose will ultimately determine how long it remains on your credit report.

Chapter 7 bankruptcy essentially means any unsecured debt will be wiped out with certain limits and restrictions. The other type is Chapter 13 Bankruptcy, which calls for people to continue paying their debt for several years and afterward, a portion of that debt is discharged.

Don’t Miss: Increase Credit Score By 50 Points

How Long Does Chapter 11 Bankruptcy Stay On Your Credit Report

Chapter 11 is the most complex form of bankruptcy. It is a form of reorganization bankruptcy, often employed by individuals and corporations that need to get a handle on significant debt so that day-to-day business operations can continue. During Chapter 11 proceedings, the court helps a person or company restructure their debts and obligations while keeping the businesss doors open. Because it is the most complex, Chapter 11 is also the most expensive form of bankruptcy. Therefore, its often important to explore other forms of bankruptcy before deciding to pursue Chapter 11. A skilled and affordable Indianapolis bankruptcy lawyer can help you do this. Chapter 11 can be used to do a personal or business reorganization.

Typically, a Chapter 11 bankruptcy will stay on your credit record for up to 10 years.

What Is Chapter 11 Bankruptcy

Chapter 11 is often called the reorganization bankruptcy. Its for businesses that want to keep operating but need time to restructure their finances in order to pay the bills.

Filing can be done voluntarily, or it can be forced on a business if three or more creditors file a petition with the bankruptcy court.

Once filed, creditors are temporarily prohibited from taking any action. The business or individual has four months to come up with a reorganization plan, though that can be extended to 18 months. After that, creditors can propose reorganization plans.

The plan is basically a contract between the debtor and creditor that defines how the business will operate and pay its financial obligations. Most plans include some downsizing to reduce expenses and free up assets.

Once a business or individual files the plan, creditors vote whether to accept it. They are usually cooperative since the next option is usually filing for a Chapter 7 bankruptcy. In Chapter 7, assets are liquidated and creditors could get little or nothing.

There are three classes of creditors priority, secured and unsecured. They must vote in favor for it to be approved by bankruptcy court.

If the plan is rejected, the business or individual can ask for a cram down, in which they ask a judge to force creditors to accept it. In other words, they want to cram it down their throats.

There is no time limit on completing the repayment plan. Most take between six months and two years.

Recommended Reading: How To Unlock My Experian Account

Can I Buy A House 1 Year After Chapter 7 Discharge

In most cases, theres at least a twoyear waiting period from your Chapter 7 discharge date until you can be approved for a home loan.

There are some limited circumstances in which you can obtain a loan after one year from the discharge, explains Andrea Puricelli, production resources engagement manager for Inlanta Mortgage.

But thats only if the bankruptcy was caused by extenuating circumstances beyond your control and youve since exhibited an ability to manage your financial affairs responsibly.

Such extenuating circumstances could apply if you were forced into bankruptcy due to a serious illness or major job loss or income reduction.

But in most cases, it takes more than a year to recover after declaring bankruptcy. So most home buyers will have to wait two years or more before applying anyway.

Read Also: How Many Times Has Donald Trump Filed Bankruptcy

Sign Up For A Secured Credit Card

Getting approved for a traditional credit card can be difficult after bankruptcy, but almost anyone can get approved for a secured credit card. This type of card requires a cash deposit as collateral and tends to come with low credit limits, but you can use a secured card to improve your credit score since your monthly payments will be reported to the three credit bureaus Experian, Equifax and TransUnion.

Also Check: Bby Cbna Credit Card

Report Credit Repair Fraud

State Attorneys General

Many states also have laws regulating credit repair companies. If you have a problem with a credit repair company, report it to your local consumer affairs office or to your state attorney general .

Federal Trade Commission

You also can file a complaint with the Federal Trade Commission. Although the FTC cant resolve individual credit disputes, it can take action against a company if theres a pattern of possible law violations. File your complaint online at ftc.gov/complaint or call 1-877-FTC-HELP.

So How Can A Bankruptcy Filing Possibly Help My Credit Rating

Think of your credit report like a timeline that dips down when negative information is reported and steadily goes up with every on-time payment you make. After a while, the bankruptcy filing will be nothing more than a blip in your timeline.

Remember, your credit history is ⦠well ⦠history. What you do to improve your personal finances today matters more than what you did last year! Letâs take a look at some of the things you can do to build good credit after a bankruptcy filing.

Don’t Miss: Syncb Ntwk Card

How Chapter 11 Works

A chapter 11 case begins with the filing of a petition with the bankruptcy court serving the area where the debtor has a domicile, residence, or principal place of business. A petition may be a voluntary petition, which is filed by the debtor, or it may be an involuntary petition, which is filed by creditors that meet certain requirements. 11 U.S.C. §§ 301, 303. A voluntary petition must adhere to the format of Form B 101 of the Official Forms prescribed by the Judicial Conference of the United States. Unless the court orders otherwise, the debtor also must file with the court:

If the debtor is an individual , there are additional document filing requirements. Such debtors must file: a certificate of credit counseling and a copy of any debt repayment plan developed through credit counseling evidence of payment from employers, if any, received 60 days before filing a statement of monthly net income and any anticipated increase in income or expenses after filing and a record of any interest the debtor has in federal or state qualified education or tuition accounts. 11 U.S.C. § 521. A married couple may file a joint petition or individual petitions. 11 U.S.C. § 302.

When Is Bankruptcy Removed From Your Credit Report

A Chapter 7 bankruptcy can stay on your credit report for up to 10 years from the date the bankruptcy was filed, while a Chapter 13 bankruptcy will fall off your report seven years after the filing date.

After the allotted seven or 10 years, the bankruptcy will automatically fall off your credit report.

Read Also: Opensky Payment Due Date

Be Mindful Of Your Credit Habits

A good rule of thumb when rebuilding your credit is that whatever you did to ding your credit, you must do the reserve to rebuild your credit. For instance, if you hurt your credit score by having too high a debt-to-income ratio, then make a point to keep your DTI low. Youll want to keep your credit usage to 30 percent or under.

If you fell into the habit of missing payments, then do whatever it takes to stay on top of your credit card payments. Remember: your payment history makes up 35 of your credit score. If you tend to rack up a huge credit card bill over the holidays, and experience holiday debt hangover, avoid it at all costs this holiday season.

Why this matters: Your credit habits play a big part of keeping your credit score in tip-top shape. And when youre rebuilding your credit after bankruptcy, it is particularly important to show to lenders that youre financially responsible.

How to get started: Start by making on-time payments, monitoring your financial habits around using credit. It might also help you to sign up for a free credit monitoring service, which can show you how much progress youve made on building your credit back up.

Learn more:

Ways To Rebuild Credit After Bankruptcy

To many, bankruptcy may seem like a hole you cannot climb out of, but this isnât true. There are steps you can take to start rebuilding your credit after filing for bankruptcy.

Tip #1: Review your credit reports. If you donât know where you stand, you canât take measures to repair your credit. Frequently monitoring your reports is a simple and smart way to stay abreast of your expenses. Plus, if any errors show up in your credit report, youâll be able to dispute them sooner rather than later.

Youâre entitled to free weekly reports from AnnualCreditReport.com as well as a free credit report from the three major credit bureaus â Experian, Equifax, and TransUnion â once a year. It is best to take advantage of this.

Tip #2: Make on-time payments. Payment history accounts for 35 percent of your overall score. It is the single most significant factor in calculating your score, according to two of the most popular credit score models, FICO and VantageScore. Making payments on time consistently will boost your score and improve your credit history.

If youâre worried about late payments or missing due dates, you can set up automatic payment transfers or notifications.

Not using a credit card can help you avoid this entirely. One fantastic tool for you to consider is Point Card.

Also Check: Does Paypal Credit Help Your Credit

Business Use Of Chapter 11 And Chapter 7

Businesses frequently use both types of these bankruptcies. Choosing between these two chapters comes down to what business owners hope to achieve with their business in the long run. If the business is not profitable or worth keeping, Chapter 7 bankruptcy is a reasonable choice. If the business is profitable, Chapter 11 may be a good option. It is worth noting, however, that few small businesses survive the costs of Chapter 11 bankruptcy.

How Will Bankruptcy Affect Your Credit Score

The better your credit score was, the more it will beaffected by your bankruptcy. Someone with bad credit, to begin with, isnt going to see as much of a dip in their credit as a result of going bankrupt.

Regardless of what your credit looks like now, keep in mind that you can still use the time after the bankruptcy tobuild up your credit score, to prepare for the day when it is removed from your credit.Good credit habits will help your credit score recover faster.

Read Also: Ginny’s Catalog Request

First Meeting Of Creditors And Bankruptcy Court

Barring when creditors dispute a discharge, few must attend a hearing in a bankruptcy court for a personal bankruptcy filing. Instead, there is a “First Meeting of Creditors,” which is a meeting that takes place around 30 to 40 days into the filing process. As the name suggests, creditors may attend this meeting, but they rarely do instead, they tend to have their attorneys work with the debtor’s attorney another reason it is wise to hire an attorney for the bankruptcy process.

This meeting is not overseen by a bankruptcy judge, but by a bankruptcy trustee, a person who is in charge of managing an individual’s bankruptcy. Trustees are usually appointed by the U.S. Department of Justice. In some Chapter 11 filings, a chief restructuring officer is used in place of a trustee.

In either type of filing, the person seeking liquidation or reorganization swears an oath to truthfully answer a trustee’s questions. Most of the time, this meeting is very short unless the trustee or chief restructuring officer is confused or suspicious about certain information the debtor has provided.

Avoid Bankruptcy At All Costs

While it’s technically possible to rebuild your credit after filing for bankruptcy, you should still avoid it at all costs. Your bankruptcy credit score will almost always be significantly lower than your pre-bankruptcy score, making it difficult to get loans or credit without exorbitant interest and fees.

Don’t Miss: Is Carmax Pre Approval A Hard Inquiry

What Are The Steps In Filing Chapter 11 Bankruptcy

There are multiple steps to filing Chapter 11 Bankruptcy depending on the case and fact pattern. Below is a very basic example:

Let Nature Take Its Course

Make sure your credit report is accurate. Once youve corrected any errors, sit back and start working on improving your financial situation. Your bankruptcy will come off your report in due course. In the meantime, do what you can to make sure it doesnt impact your life and ability to get new credit.

Its far more important that worrying about the impact of your bankruptcy on your credit report or score.

You May Like: How To Fix Serious Delinquency On Credit Report