Apple Card Monthly Installments

You can buy a new Mac, iPhone, iPad, Apple Watch, and more with interest-free monthly payments on purchases at Apple. Just choose Apple Card Monthly Installments and then check out. Your installment automatically appears on your Apple Card statement alongside your everyday Apple Card purchases in the Wallet app. If you have an eligible device to trade in, youll pay even less per month. And youll get 3% Daily Cash back on the purchase price of each product, all up front. If you have Apple Card already, theres no additional application. If you dont, you can apply in as little as a minute during checkout, from the privacy of your iPhone.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Apple Card Credit Score: How To Make Sure You Get Approved

Worried about your chances of getting the Apple Card? Fear not! Here are a few tips on how to make sure Apple approves your application.

The Apple Card is one of the most unique and interesting credit cards on the market, but as with any card, being approved ultimately comes down to someone’s credit score. Since its debut in 2019, the Apple Card has stood out as one of Apple’s most peculiar products. From Apple’s perspective, it’s the first financial-based product the company’s ever created. As a credit card, the Apple Card is the first iPhone-exclusive credit card on the planet and one of the first credit cards from a consumer tech brand.

While the Apple Card may not be for everyone, it is a pretty compelling option for most iPhone users. It’s integrated seamlessly into the Apple Wallet app, offers instant access to customer service via iMessage, and its Daily Cash system rewards cardholders with easy-to-understand cashback earnings that are paid out every single day. For the person who owns an iPhone and wants a credit card that’s as easy to use as possible, the Apple Card makes a solid argument for itself.

Related: How To Transfer Apple Cash To Your Bank

Read Also: Is 672 A Good Credit Score

Re: Did Anyone See If Apple Card Reported To Credit Bureaus

Goldman Sachs reports the new account to TransUnion with an HP a few hours after acceptance. Considering that the Apple Card is new nobody has had the luxury of it properly being reported as an account yet since they are not Synchrony Bank. I recommend waiting for a statement to be issued first before looking on if it will show up. The only guarantee is that if you fail to pay on time the the late and collection will definitely show up since Goldman Sach’s wants to be repaid.

How Apple Card And Apple Card Family Is Credit Reported

Learn how Apple Card reports your credit based on your particular role on the account.

Your credit report contains a detailed record of your credit history that is maintained by the credit bureaus. Information within your credit report can be used by lenders for evaluating your credit applications. If an account is reported to the credit bureaus, a lender must provide accurate information about your performance on the account. This includes whether you are paying your bills on time, how much of your available credit on the account is being utilized, and age of the account.

If you have an Apple Card account, this information is reported by Goldman Sachs Bank to each of the three major credit bureaus Equifax, Experian, and TransUnion1 on at least a monthly basis. Your Apple Card will appear as a separate trade line on your credit report labeled APPLE CARD – GS BANK USA or GS BANK USA. It may take up to 45 days from the time of activity for that information to appear on your credit report. Some personal credit monitoring services may take longer to refresh your information after the credit bureaus have published it.

If you choose to , it’s important for everyone to understand how they are uniquely reported based on their role on the account.

Also Check: Zzounds Credit Approval

What To Do If Your Credit Card Is Still Not Showing Up

Don’t panic if the credit card you opened is not appearing on your Experian credit report. It may be on the other two or just one, so pull your credit reports from the other credit reporting bureaus and read them over. Hopefully it will be on at least one of them. You can get your credit reports from all three credit bureaus through AnnualCreditReport.com or through Experian.

Not there? Your credit card issuer may not send your account activity to any of the bureaus. In the future, select an issuer carefully to be sure it will appear on all three of your credit reports. If necessary, call the company to find out before you apply.

In the event you do spot issues, such as identification errors, take action to rectify the problem. Call the credit card company and update your identification information. To make sure lenders get the full picture of your payment history, you’ll want all your accounts to show up on your credit report and factor into your credit scores.

Having a long history of on-time payments in your credit file will help your credit rating rise. So if your credit card isn’t showing up, consider adding other types of information to your credit report. By signing up for Experian Boost, you can have your utility and cellphone bills added to your credit report at no extra cost to youwith the likely benefit of a credit score increase. It makes sense to have those timely payments work in your favor!

The Details On The New Apple Card

Apple offered the card to a select group of users on Aug. 6, 2019, with a wider release later in the month. The Apple Card will live on your Wallet App and be available across all of your Apple devices. It will track your spending with details like vendor names, payment due dates, and monthly spending. There are no late fees, annual fees, international fees, over-balance fees, or higher interest fees if you are late with payments. There was no mention of the at the press conference, but if you followed the fine print, you’d see that it is somewhere between 13.24% and 24.24%, based on creditworthiness. While the low end is low, customers with that kind of credit may be hard to find. The high end is standard and in line with other rewards cards.

According to Apple, the rewards for using the Apple Card are very competitive: “Every time customers use Apple Card with Apple Pay, they will receive 2 percent Daily Cash. Customers will also get 3 percent Daily Cash on all purchases made directly with Apple, including at Apple Stores, on the App Store and for Apple services.” Get it? 2% on all purchases, but 3% for buying more Apple services. That’s sticky. If you can roll your Daily Cash into more games on Apple Arcade or to pay off your Apple TV+ charges, why wouldn’t you? The cash rewards are delivered daily, and made available to you very quickly on your Apple Cash card balance.

Jennifer Bailey, vice president of Apple Pay, put it much nicer at the event:

Read Also: Ccb Mprcc On Credit Report

Simply Put Interest Rates Are The Cost You Pay For Taking Out A Line Of Credit From An Issuer Your Annual Percentage Rate Or Apr Is Assigned To Your Account When Youre Approved To Find Your Daily Interest Rate Your Apr Is Divided By The Number Of Days In The Year This Daily Interest Rate Is Applied To Your Balance At The End Of Each Day These Amounts Are Added Up For The Month Rounded To The Nearest Cent And Thats Your Interest Charge

Ideally, you pay off your entire monthly balance on time each month and dont have to pay any interest. But we know thats not always possible. So we designed Apple Card to help you pay less interest over time. When you enter the amount you want to pay, the payment tools in the Wallet app estimate how much interest youll be charged, so you can make an informed decision. And if you share your card with a CoOwner, you can each pay off a portion of the balance each month.

Well never charge you a late fee if you miss a payment deadline, but youre still responsible for the interest applied to your balance on the date that the payment was due, and you may accrue more interest.

Earn The Highest Cash

Odds are you’re a fan of Apple’s products if you apply for the Apple Card, and with this card you can earn 3% cash back on goods or services purchased directly from Apple. There is no other card on the market that offers more unlimited cash back on Apple purchases.

Apple products cost a pretty penny, so earning a generous amount of cash back is a great way to offset the cost of purchasing AirPods or an iPhone. I’m looking to purchase a new Macbook Air later this year, which starts at $1,099, and I would earn at least $33 cash back if I buy through the Apple store, which is more than I’d earn from any other rewards card.

Update: Since launch, Apple continues to add new merchants that offer 3% cash back when you use your Apple Card via Apple Pay. New additions include: Uber and UberEats, Walgreens and Duane Reade stores, on the Walgreens app and on walgreens.com and at T-Mobile stores.

Also Check: Creditwise Is Not Accurate

Apple Card Reporting To Experian Equifax And Transunion

The Apple Card has been a resounding success for the tech giant since its launch last year. The card, which Apple issues through Goldman Sachs, works through an iPhones digital wallet and its proprietary Apple Pay system. The card works wherever Apply Pay is accepted and for those merchants that dont accept Apple Pay, the physical titanium card comes in handy.

The digital payment focus of the Apple Card is a notable quirk of the product, but not its only peculiarity. Another curiosity of the Apple Card is that up to now it only reported one credit bureau: TransUnion. It seems that has now changed. The addition of regular reporting to all three credit bureaus is good news for cardholders who are looking to improve their credit score.

Monthly reporting to all the credit bureaus can help establish a record of on-time payments and low credit utilization for those willing to put the work in. This, in turn, will boost their credit score and approval odds on future credit card applications, regardless of the credit report the bank pulls. In addition, the update makes it more accessible when it comes to lenders that prefer using Equifax or Experian.

Does The Apple Card Help You Build Credit

If you use your Apple Card responsibly, it can help you build your credit over time. To improve your credit score with the Apple Card, focus on making regular, on-time payments and try to keep your credit card balance as low as possible. As of this writing, the Apple Card reports credit activity to TransUnion and Equifax two of the three major credit bureaus and Apple may expand reporting to Experian in the future.

You May Like: 676 Credit Score Good Or Bad

How The Apple Card Colors Differ From Apple Card Skins

The Apple Card color categories apply only to the digital Apple Card that appears when you open your Wallet app. Your physical Apple Card is white, and it does not change color as you make purchases.

Since the physical Apple Card is a titanium credit card, some people decide to protect and/or customize the metal card with an Apple Card skin. Apple does not sell Apple Card skins but various third-party retailers offer customizable skins. If you want a black Apple Card, a textured Apple Card or an Apple Card skin with an eye-catching image, you have plenty of options and when you use your Apple Card to buy an Apple Card skin online, watch for a percentage of your digital Apple Card to turn yellow.

Want to know more about the Apple Card? Start with our complete guide to the Apple Card, followed by three reasons why the Apple Card isnt right for everybody. If you already applied and were denied, find out why your Apple Card may have been denied and next steps to get another chance.

*The information about the Apple Credit Card has been collected independently by CreditCards.com. The card details have not been reviewed or approved by the card issuer.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Apple Card Now Appearing On Experian Credit Reports

Apple Card users are reporting the credit card is now showing up on Experian credit file reports. Reporting of Apple Card information was previously limited to credit bureau TransUnion .

Though not officially confirmed by Apple or Goldman Sachs, several Reddit users have noticed the creditor addition to their Experian credit reports. Some users, however, have not seen any credit report changes, so the reporting may still be rolling out.

Like any credit card, Apple Card credit reporting can either positively or negatively impact users’ credit scores based on how the card is used.

When the Apple Card card first launched last August, credit data was reported to neither of the three United States credit bureaus, and it wasn’t until December that Goldman Sachs began reporting Apple Card information to TransUnion.

Although it appears Apple Card information is now being reported to both TransUnion and Experian, it remains to be seen as to when credit reporting may begin to Equifax.

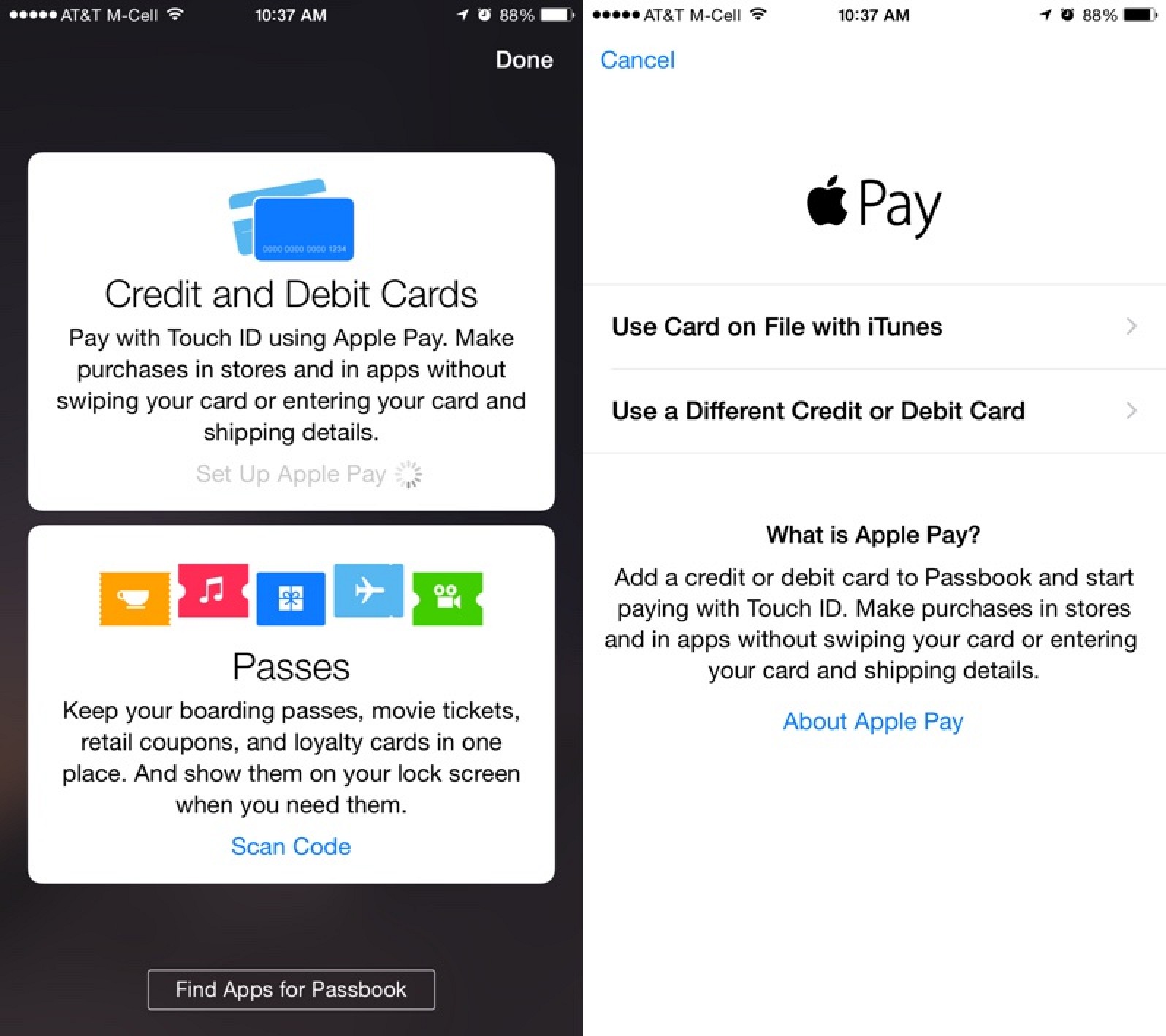

To apply for an Apple Card, simply open the Wallet app on an iPhone running iOS 12.4 or later, tap the plus button in the top-right corner, and follow the on-screen steps. The process takes just a few minutes, and if approved, a digital Apple Card will be ready for purchases immediately. A physical titanium-based Apple Card is also available for use at retail stores that do not accept contactless payments.

Recommended Reading: How To Remove Repossession From Credit Report

If Your Application Is Declined Because Your Identification Information Couldn’t Be Verified

Make sure your name, address and other information provided on your Apple Card application is correct. If you find inaccurate information, re-enter the information as needed.

If you are asked to verify with an ID, follow these steps:

After you complete these steps, submit your application again. If your application is declined again for the same reason, contact Apple Support.

Your credit score won’t be impacted if you’re declined, or don’t accept your offer. Your credit score might be impacted if your application is approved and you accept your offer.

You can apply for Apple Card again, but you might receive the same decision.

If you want to receive a different decision on your application when you apply again, you should review your credit report to see if you have conditions that might result in a declined application and then check for these common errors in your credit report.

*If the information on your ID doesn’t match the information you entered for your Apple Card application, try to apply again after you update your ID.

Apple Card Beginning To Show Up On Credit Reports Apr Range Lowered

Nearly four months after rolling out in the United States, the Apple Card is now beginning to appear on credit reports.

Goldman Sachs has confirmed that it is working with credit bureau TransUnion to begin reporting Apple Card information, informing cardholders that they will see full details on their credit report within the next five days. This includes the date the Apple Card account is opened, credit balance, payment status, and more.

In other words, like any other credit card, the way you use your Apple Card can now have an impact on your credit score.

Last month, Apple CEO Tim Cook opined that the Apple Card has been the “most successful launch of a credit card in the United states ever,” although that was before allegations surfaced of gender bias during the approval process. Goldman Sachs has since offered to reevaluate credit limits.

To apply for an Apple Card, simply open the Wallet app on an iPhone running iOS 12.4 or later, tap the plus button in the top-right corner, and follow the on-screen steps. The process takes just a few minutes, and if approved, your digital Apple Card will be ready for purchases immediately.

We have been working with TransUnion to begin reporting your Apple Card information. Within the next 5 days, you will see the full details on your credit report. GS Bank Support

#AppleCard showed up on my credit report today. Dongjun

i already wanna cancel this card

i already wanna cancel this card

usable

You May Like: Syncbppc