Is Older Than Your Average Age Of Accounts

If you have a very thin credit profile meaning that you dont have a lot of accounts and they are very young then you want to find an account that has been around for a long time.

And remember, you also want to make sure that that bank will report and backdate the authorized user account. Otherwise, your average age of accounts will not benefit.

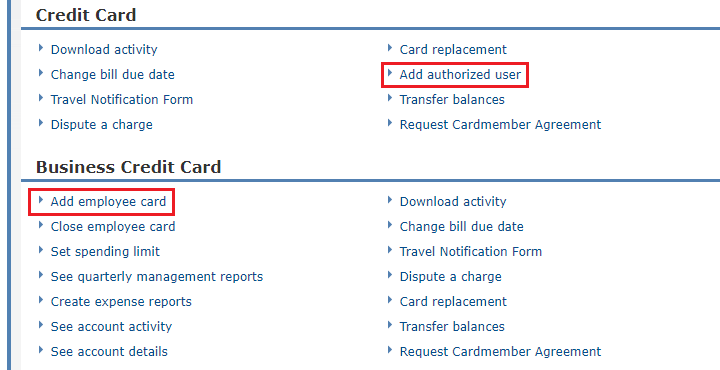

How To Remove An Authorized User With Chase

You need to contact Chase to remove an authorized user account. The fastest option is to call the card issuer, but you can also send a secured message. Once you’ve removed an authorized user, their card won’t work anymore.

Note that for Chase personal credit cards, the card number is the same for the primary cardholder and each authorized user. Even if you remove a Chase authorized user, they’ll still have your card number. You may want to request a replacement credit card if you’re worried about someone using your card number when they’re no longer an authorized user.

You won’t have this problem with Chase business credit cards because employee cards have different card numbers.

Adding an authorized user with Chase is a useful option in certain situations. Just make sure the person you add is someone you trust completely. You’re the primary account holder, so ultimately it’s your credit on the line.

What Issuers Are Saying

All of the issuers we contacted are pretty clear on a couple of things: If you stop paying your credit card bill, you will be held personally responsible for whats owed, even if the account doesnt appear on your personal credit report. Some issuers American Express and Chase included require both joint and several liability, meaning that both you and your business are liable for repayment. They all also will report your card activity to one or more business credit bureaus.

Business credit bureaus including Dun & Bradstreet, Equifax and Experian all look for similar trends in business credit card activity as consumer bureaus do for consumer cards. Experian, for instance, says payment history is the top factor to pay attention to when looking to improve your business score. It also looks at how much you owe, how long youve been in business and whether you have collections, liens or bankruptcies in your past.

Also Check: How To Get Credit Report Without Ssn

Choosing A Credit Card

Don’t you wish you could take a peek inside a credit card expert’s wallet sometimes? Just to see the cards they carry? Well, you can’t look in anybody’s wallet, but you can check out our experts’ favorite credit cards. Get started here:

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Does Removing An Authorized User Hurt Their Credit Score

It is possible that removing an authorized user can hurt their credit score, especially if they haven’t built up much credit history. Credit score calculations are made up of several different factors, the length of credit history. Removing an authorized user from an account that has been open for a long time can decrease their average age of accounts, decreasing their credit score. If the account has a good payment history, they may also lose that record of timely payments on their credit report another major factor in credit scoring.

For rates and fees of The Platinum Card® from American Express, please click here.

The information related to The Amex EveryDay® Preferred Credit Card from American Express has been independently collected by ValuePenguin and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply to American Express credit card offers. See americanexpress.com for more information.

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Also Check: How To Remove Hard Inquiries From My Credit Report

What It Means To Report

If your business card activity not just the hard inquiry for opening the account, but your actual account activity on an ongoing basis appears on your personal credit report, it will have the same impact as the rest of your credit cards. For issuers that report business card activity to personal reports, theres one major exception to this rule: If you have employees and they have access to your business credit card as authorized users, it should appear on your credit report only, not theirs.

About two-thirds of your credit score is determined by just two factors: Your payment history and what you owe. You can control the first by always paying your bill on time. You can somewhat control the second by paying your bill in full. But even if you pay your bill in full and on time, the issuer may report your account status to the credit bureaus before your monthly payment clears, meaning your may be reported to be higher than you might think it is. The ratio basically the amounts you owe versus the total credit available to you could impact your credit score and your creditworthiness.

Building Your Credit The Smart Way

Being added as an authorized user on another person’s card may help you establish a credit history or build your credit. Yet cardholders and authorized users’ on-time, late or missed payments will be added to both parties’ credit reports, so it’s important that cardholders and authorized users see eye to eye. Be mindful of the following as you consider whether to get added as an authorized user:

- Confirm with the account holder that the card’s full payment history will get reported. They may need to check with the credit issuer or credit reporting agencies to confirm.

- Work together to maintain the card account in good standing. Don’t spend more than you are able to reimburse the main account holder.

- Agree to a spending limit and plan to ensure that the main account holder is able to make consistent on-time payments. This payment history is one of the factors that can contribute to an increased credit score for the authorized user.

- Manage the card’s total utilization by keeping your credit card debts low.

As you begin to build your credit history, your experience as an authorized user can help you improve your credit score, but it can also help you understand how credit is maintained. By proactively engaging with your credit, you can grow your credit score as much as you grow your credit knowledge.

Don’t Miss: Capital One Rapid Rescore

What To Know About Authorized Users

Did you realize adding an authorized user to your credit card can impact your credit report? While there can be practical advantages, such as consolidating purchases with your spouse or providing an emergency credit card for your out-of-town college student, there are some important considerations to keep in mind to ensure that your credit isnt negatively impacted and that your authorized user remains in good credit standing as well.

Did you realize adding an authorized user to your credit card can impact your credit report? While there can be practical advantages, such as consolidating purchases with your spouse or providing an emergency credit card for your out-of-town college student, there are some important considerations to keep in mind to ensure that your credit isnt negatively impacted and that your authorized user remains in good credit standing as well.

Find out what you need to know to enjoy the benefits of this feature without a hit to anyones FICO score.

What is an Authorized User?

An authorized user is someone who holds a credit card in their name but they are not the primary cardholder. They can make purchases with the card on their own, just as the primary cardholder can, but the credit line issuer may treat the authorized user differently when it comes to credit reporting.

The Truth About Piggybacking Credit

When an Authorized Users Credit Report is Affected

Who Makes the Payments?

How the Primary Cardholder is Affected

Why An Authorized Users Activity May Not Be Reported

There are some cases when the primary cardholders activity wont be reported to the authorized users credit report. Here are a few reasons why that might happen:

- Card issuer doesnt report authorized users. Some card issuers wont report your credit activity to credit bureaus, so make sure you avoid them if youre looking to build your credit.

- Age restriction. If the authorized user is younger than the minimum requirement, card activity isnt reported.

- Not the same address. Some authorized users report that their activity wasnt reported because they had a different address than the primary cardholder. This isnt the case with every credit card issuer, so ask about its policies.

- Social Security number missing. The authorized user needs to provide their SSN. Otherwise, your card activity may not reach the credit bureaus.

- Not all credit card issuers report your card activity to all credit bureaus sometimes only one or two.

Read Also: Afni Subrogation Department Bloomington Il

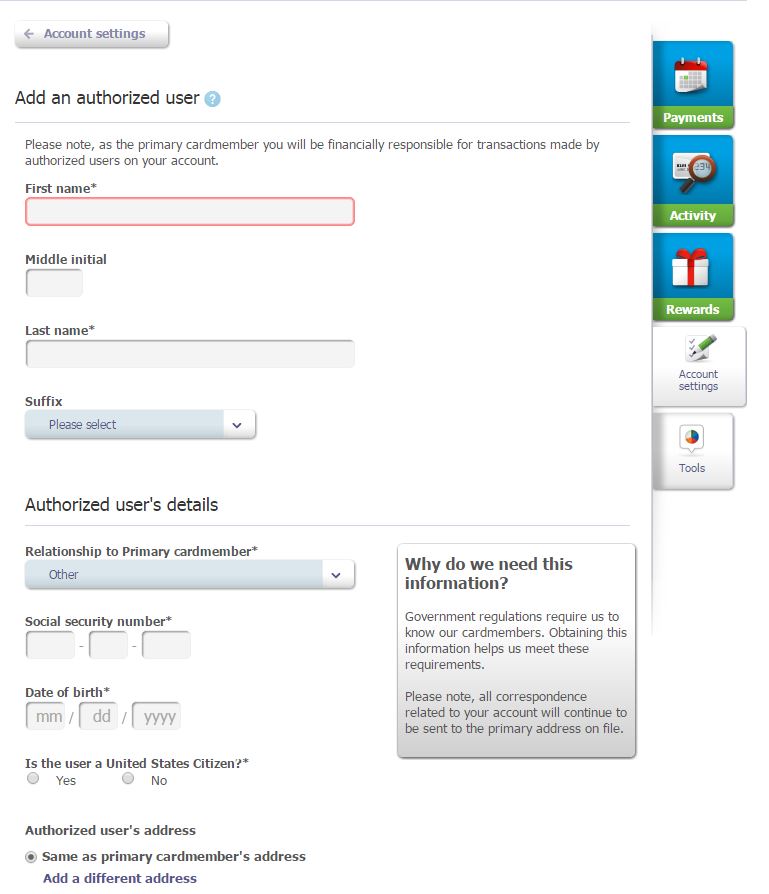

How To Become An Authorized User

The process of becoming an authorized user on someone elses account is relatively easy. It starts with your family member or friend reaching out to their credit card company over the phone or online to make the request. From there, your loved one gives the card issuer your name and some personal information like your date of birth and Social Security number.

Once the card issuer approves the request, it will mail a credit card in your name to the primary account holder. At that point, its up to your loved one to decide whether to give you the credit card to use or hang onto it for safekeeping. Parents, for example, might want to hold on to the card and only give it to their son or daughter to use at specific times.

With most credit cards, adding an authorized user is free. Yet some card issuers may charge fees to include authorized users on your account. Adding an authorized user to The Platinum Card® from American Express will cost you $175 per year . With the Chase Sapphire Reserve®, youll pay $75 per year for each authorized user you add to your account.

Are Authorized Users Responsible For Debt Payments

No, as an authorized user you generally do not have to pay a debt. If the collection agency insists that you co-sign the account, but you think you are not, you can ask them for proof, for example: B. A copy of the contract you have signed. Credit card issuers generally report the status of authorized users to the credit bureau.

Also Check: Ic Systems Inc Credit Report

Does An Authorized User Build Credit

Yes. But only if the primary cardholder keeps the credit utilization rate low and always pays the full balance on time. This is a common credit-building strategy, especially if youre looking to help your kids or family members build credit.

However, if the primary cardholder misses payments or only pays the minimum balance, you wont see your credit improve. It could actually hurt your credit.

How much and how fast will the authorized user credit score improve?

If the authorized user has no prior credit history, it may take up to six months for the credit score to appear. But again, for this to work, the card provider must report authorized users to credit bureaus and the main cardholder should always pay their balance on time.

For example, heres what one Reddit user experienced when they added their sibling as an authorized user to their credit card.

If Your Credit Takes A Hit Theirs Might Too

Your right now, but sometimes life goes sideways for instance, a job loss or an unexpected major expense could affect your ability to make payments or cause you to max out your credit limit. If your credit score drops due to late payments or increased utilization, your authorized user’s credit file may be affected, too.

If you’re faced with this situation, you may want to remove your children as authorized users to prevent any damage to their credit file.

Jasmin Baron is an associate editor at Personal Finance Insider, where she helps readers maximize rewards and find the best credit cards to fit their lifestyles.

Recommended Reading: Les Schwab Credit Score Requirement

If Youve Seen Jpmcb On Your Credit Reports And Wondered What Its Doing There You May Want To Take A Look In Your Wallet

Chase, which also does business as JPMorgan Chase Bank, provides financial products such as credit cards, auto loans, mortgages and more.

If you have credit cards, theres a chance one of them is a Chase card and that it appears on your credit reports as JPMCB Card Services.

Charges They Make Are Your Responsibility

Kids don’t always make good choices, especially if they’re tempted by a shiny new gadget or want to keep up with their friends. Even if you’ve set clear rules about spending on an authorized user card, it’s possible your child could slip up and rack up charges neither of you can afford.

You can’t go back and claim a fraudulent or unauthorized charge with the credit card issuer, either authorized user spending is still your responsibility. So be sure to keep a close eye on your child’s spending and reinforce the limits you’ve set .

Read Also: How To Remove Child Support Arrears From Credit Report

Does Being An Authorized User Build Credit

Being an authorized user can potentially build credit, especially for teenagers or young adults who may not have had many opportunities to show responsible credit usage.

Without any history to go off, many lenders will not approve credit applications. An authorized user account gives lenders a credit history to go off of. This can open up additional opportunities for accessing credit and lower interest rates.

Note, your credit card issuer must report the account to the credit bureaus, and lenders must use a credit scoring system that incorporates authorized user accounts. There are a multitude of credit scores employed by different lenders, and some scores may not include authorized-user activity in determining your creditworthiness.

Furthermore, an authorized user will most benefit from an account with a long history of timely payments. On the other hand, an account with a lot of missed payments could actually negatively impact your score. If that happens, you can contact the credit bureaus. Some credit bureaus, like Experian, will remove delinquent authorized user accounts from your credit report, since you are not legally responsible for the debt. Experian also reports that they generally do not include negative payment history on an authorized user’s account, but other credit bureaus may include this information.

Should You Add An Authorized User To Your Credit Card

As a primary cardholder, you will benefit very little from adding an authorized user to your account. But adding someone as an authorized user can definitely benefit that person and potentially improve their credit profile.

Best way to build credit fastWhat’s the fastest way to boost my credit?Eliminate your running balance. If you need to pay more in cash than the minimum monthly amount, you can do the following.Increase your credit limit. You can increase your credit limit in two ways: request an increase on your current credit card or open a new one.Check your credit report for errors.What is the quickest way to es

Also Check: Credit Check Usaa

Chip Lupo Credit Card Writer

Yes, Chase reports authorized users to credit bureaus. Chase will report authorized users to all three of the major credit bureaus TransUnion, Equifax, and Experian soon after theyre added to a primary cardholders account. Once it begins reporting an authorized user to the credit bureaus, Chase will provide all account activity, both positive and negative, to the credit bureaus once a month.

Its important to remember that the primary cardholder is responsible for all purchases on the account. Also, both the authorized user and the primary cardholder can request to have the user removed from the account at any time. Authorized users cannot dispute negative information related to the account unless theyve been removed, either on their own or at the primary cardholders request.

How good can an authorized users credit score get?

An authorized users credit score can get to the good- or excellent-credit range. Adding someone as an authorized user is a great, low-risk way to give your child a head-start on financial success or to help a family member rebuild damaged credit.

In any case, it’s important to consider both the benefits as well as the potential barriers to adding an authorized user on an account before doing so.

Next Steps:

Do authorized users build credit?

Can An Authorized User Redeem Rewards

Some issuers allow authorized users to both earn and redeem credit card rewards. The specifics will differ from issuer to issuer. For example, American Express allows you to set up an authorized user as a Rewards Manager, which lets them redeem Membership Rewards points on the account. This adds to the list of liabilities that come with adding a person to your account. You should be comfortable with your authorized user having access to it at all times.

Some card issuers, such as American Express, allow you to set specific permissions for your authorized user. If your issuer supports that, make sure those permissions are set in a way that you are comfortable with.

You May Like: Minimum Credit Score For Amazon Prime Rewards Visa