Are You Doing The 11 Worst Things For Your Credit Score

Most of us know roughly what a credit score or credit rating is its a number that goes up or down depending to what weve done in the past and present with money, especially when it comes to loans and credit cards. Typically, a high number is good – as in it will get you better deals/more credit. And a low number is bad – it might give you less choice. But theres always uncertainty with credit scores about what affect certain actions have on your score. Thats why weve pulled together the worst things you can do for your credit rating.;

East St Louis Illinois: 581

The U.S. city whose residents suffer from the lowest average credit score is described as America’s most violent city by Bloomberg News. Like other cities on this list, it has been hurt by depopulation, losing about two-thirds of its population since 1950.

East St. Louis’ roughly 27,000 residents have a median household income of $19,161, or less than half the state’s median of $57,000. About 47 percent of its residents live below the poverty line, which adds to the city’s challenges.

First published on January 28, 2016 / 6:00 AM

Quotes delayed at least 15 minutes.

How To Improve Your Credit Score

It’s difficult to pin down the exact reasons for the low credit scores in the five states above — and it’s possible that it’s a combination of many factors. Interestingly enough, credit card debt doesn’t appear to be one of them.;

None of the states listed above had abnormally high amounts of credit card debt in The Ascent’s study on , and actually, Mississippi has the sixth-lowest average credit card debt in the nation. While there doesn’t seem to be an easy explanation for why these five states are struggling with poor credit more than the rest of the nation, the solution is the same.

The single-most important thing you can do for your credit score is to always pay your bills on time. Payment history makes up 35% of your FICO® Score and about 40% of your VantageScore because it’s been found to be such an accurate predictor of future financial behavior. Late payments can drop an excellent FICO® Score by 100 points or more and they remain on your credit report for seven years, though their effect diminishes with time. Consistent on-time payments will raise your credit score, but it might be a little while before you see the results, especially if you have some late ones on your record.

Read Also: How To Get Credit Report With Itin Number

States With The Best And Worst Credit Scores

View Gallery

23 photos

Not only is a good credit score a sign of healthy money management â it’s also necessary if you want to afford many of life’s necessities. For example, if you want to buy a home this spring, a higher credit score will get you a lower mortgage rate, which saves you money. The same is true for car loans; a higher credit score can get you a lower APR on your auto loan.

While a credit score can determine which financial products you have access to, the score itself can be heavily influenced by where you live, finds a new study from GOBankingRates.com. Using Experian data on local credit scores, GOBankingRates calculated the average credit score by state to find the 10 states where people have the best credit scores â and the 10 with the worst credit.

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Read Also: Why Is There Aargon Agency On My Credit Report

Nevada Among States With Worst Credit Scores Study Says

LAS VEGAS A recent study found that most Americans have decent credit scores but certain states rank a little lower overall when it comes to those numbers.

According to a study shared with 13 Action News, the average credit score in the United States is around 680 – and that figure is considered good, as stated by Experian.

However, 22 states have residents that rank below that 680 number on average, including Nevada.

Good with Money | 13 Action News

Mississippi leads the way on the bottom portion of the study with residents holding an average credit score of 647, followed by Louisiana with 650, Alabama with 654 Georgia with 654, and Nevada with 655.

Residents in these states have an average credit card balance of more than $6,100, with the Silver State averaging $6,401.

The study says its findings were based on a VantageScore from Experian and that Texas was excluded from the list.

Nevada is 3rd among worst states for coronavirus-related fraud

Six Southern states were found to have some of the worst credit scores in the nation, while Minnesota led the way on the positive side with residents averaging a credit score of 709.

Vermont, New Hampshire, and South Dakota followed Minnesota on the top portion of the list, all with residents reporting an average credit score of 700 or above.

Here is a link to the full study provided by Zippia, a site that says it is a resource for job seekers with shareable data.

New Mexico And Arkansas: 6537

Missed payments and delinquent debts are big contributors to the low credit scores in New Mexico and Arkansas. The Urban Institute reports that nearly half of New Mexico residents have debts that are past due or in collections. In fact, borrowers with personal loans in this state have a delinquency rate of 6.41 percent for this type of credit, which is much higher than the national average of 3.87 percent.

In Arkansas, 45.8 percent of residents have debts that are past due or in collections. And, the average personal loan balance in the state is a staggering $20,117 while the national average is just $13,649, according to TransUnion.

Recommended Reading: What Does Bankruptcy Petition Mean On Credit Report

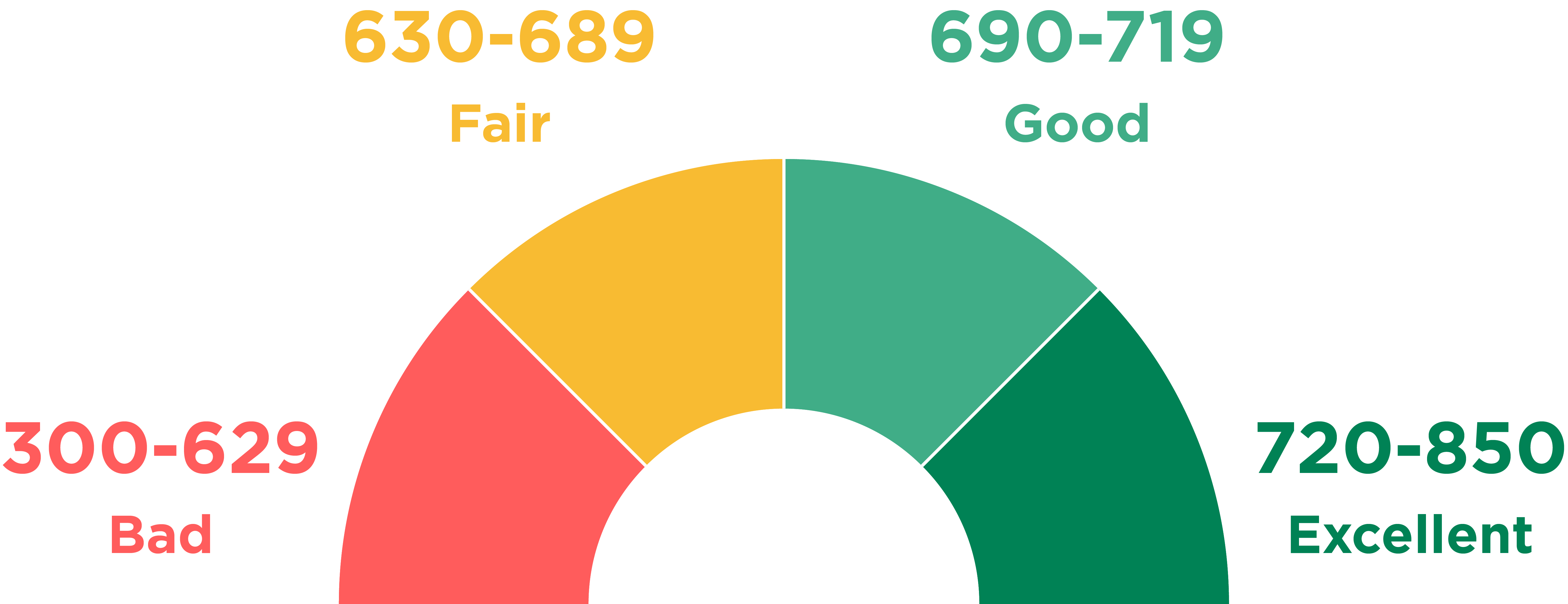

What Is The Lowest Credit Score

Credit scores help lenders evaluate whether they want to do business with you. The FICO® Score, which is the most widely used scoring model, falls in a range that goes up to 850. The lowest credit score in this range is 300. But the reality is that almost nobody has a score that low. For the most part, a score below 580 is considered “bad credit.” The average FICO® Score in the U.S. is 704.

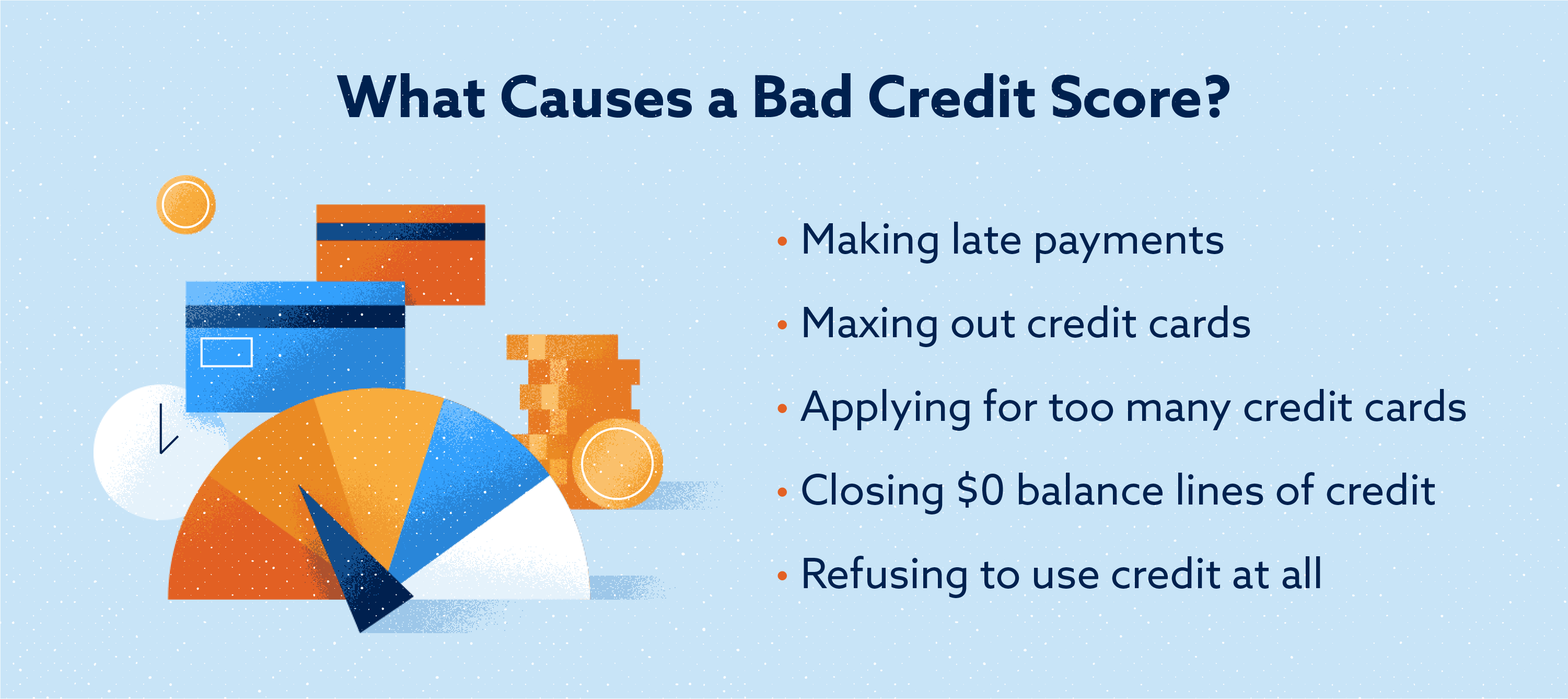

Things That Can Hurt Your Score

Borrowers with bad credit usually have one or more of the following negative items on their credit reports:;

- Delinquent payments

- A bankruptcy

Your payment history counts for 35%;of your score, so missing your payment due dates seriously hurts your score. Being 31 days late is not as bad as being 120 days late, however, and being late is not as bad as failing to pay for so long that your creditor sends your account to collections, charges off your debt, or agrees to settle the debt for less than you owe.;

How much you owe relative to how much credit you have available is another major factor, accounting for 30%;of your score. Say you have three credit cards, each with a $5,000 , and youve maxed them all out. Your is 100%. The scoring formula looks most favorably on borrowers whose ratio is 20%;or lower.

To keep their credit utilization ratio at a favorable 20%, someone with $15,000 in available credit should aim to keep their debt under $3,000.

The length of your credit history counts for 15%;of your score. You dont have much control over this component. Either your credit history stretches back several years or it doesnt.

The number of new credit accounts you have counts for 10%;of your score, which means that applying for new loans to move your debt around might hurt your score. On the other hand, if moving your debt lands you a lower interest rate and helps you get out of debt more easily, new credit could ultimately boost your score.

Don’t Miss: Is 643 A Good Credit Score

Do You Have A Good Or Bad Credit Score

, which may range from 300 to 850, take into account a number of factors in five areas to determine your : your payment history, current level of indebtedness, types of credit used, length of credit history, and new credit accounts.

A bad credit score is a FICO score in the range of 300 to 579. Some score charts subdivide that range, calling bad credit a score of 300 to 550 and subprime credit a score of 550 to 620. Regardless of labeling, youll have trouble obtaining a good interest rate or getting a loan at all with a credit score of 620 or lower. In contrast, an excellent credit score falls in the 740 to 850 range.

What Is The Worst Credit Score

You want a great credit score? First you need to know what youre working with.

Even if you know the number of your score, you wont know if its good or bad until you know the range used by the scoring model. If you have poor credit, you may be dealing with a score in the 500s or 600s, but how close are you to the bottom?

FICO scores are commonly used in lending decisions, and the worst FICO score you can get is a 300. The same goes for VantageScore 3.0, and both scoring models have a high of 850.

Note: You may want a really high credit score, but aiming for perfection isnt worth your time. Scores fluctuate constantly, because your creditors are reporting new information about your to credit reporting agencies on a regular basis. Even the same model will spit out a different score, because all credit bureaus dont have the same data on you. Still, you should have a general idea of whats good and whats bad in terms of credit scores.

There are hundreds of scoring models out there, so I wont be able to go over the ranges of all of them, but here are a few scores you may interact with as a consumer:

-

FICO score: 300 to 850

-

VantageScore : 501 to 990

-

VantageScore 3.0: 300 to 850

-

PLUS score: 330 to 830

-

TransRisk score: 100 to 900

-

Equifax credit score: 280 to 850

With these and all other scores, you want to be closer to the top. Generally, those with poor credit fall below the 620 mark, so youll want to do what you can to get on the better side of scoring.

More from Credit.com

Don’t Miss: Does Cancelling Finance Affect Credit Rating

What Does It Mean If Your Credit Score Is High

Lenders tend to look at your credit score when you apply for credit, such as a credit card. Theyâre looking for someone who will be able to meet the repayments – someone who is low risk.

A higher credit score means your credit report contains information that shows youâre low risk, so youâre more likely to appeal to lenders. For example, if your report shows that you always pay your bills on time, youâll be considered a reliable borrower.

If you have a high credit score, your application is more likely to be accepted. Youâre also more likely to be offered the best interest rates and higher credit limits.

Check your eligibility: See what offers you’re eligible for with your credit score.

What Factors Impact My Credit Scores

Reading time: 2 minutes

Highlights:

- One of the key behaviours lenders and creditors like to see is on-time bill payments

- Lenders and creditors prefer to see a lower ratio of how much debt you’re carrying compared to how much available credit you have

Regardless of the financial milestones youre reaching, when it comes to financial progress and credit, its important to understand the factors that may impact your credit scores. Consider the following:

Have you generally made payments on time?One of the key behaviours that lenders and creditors typically like to see is on-time payment of bills. Since this is one of the strongest predictors that you are likely to meet your financial obligations, it is generally an important factor in credit scoring models .

Do you have different types of credit accounts?While there are many different , they generally factor in the mix of different types of credit you have, such as credit cards, installment loans, mortgages, and store accounts. If you have too many different credit accounts or dont have a mix of different types — it could negatively impact credit scores.

How old are your credit accounts?In general, creditors and lenders like to see that youve been able to properly handle credit accounts over a period of time. Credit accounts with a longer history showing responsible credit behaviour will reflect positively on credit scores. Newer accounts will lower your average account age, which may negatively impact credit scores.

Also Check: How Accurate Is Credit Karma Score

What Exactly Is A Credit Score

A credit score is a three-digit number used by lenders to determine whether you qualify for credit, such as a loan or credit card.

Your credit score is based on your credit report, which is a record of your credit history and how youâve managed your finances in the past. This allows lenders to assess your level of risk when you apply for credit.

Why Are My Fico Score And Vantagescore Different

A score is a snapshot, and the number can vary each time you check it.

Your score can vary depending on which credit bureau supplied the credit report data used to generate;it. Not every creditor sends account activity to all three bureaus, so your credit report from each one is unique.

Each company has several different versions of its scoring formula, too. The scoring models used most often are VantageScore 3.0 and FICO 8.

Also, FICO and VantageScore weight scoring factors slightly differently.

Don’t Miss: Is 611 A Good Credit Score

Q What Happens If You Default On Your Payday Loan Repayment

A delay on payment loans can result in bank overdraft costs, collection calls, credit penalties, a day in court, and paycheck confiscation. So if you feel like you can never refund an online payday loan because your bills are excessive, its high time you should consider expert financial assistance.

Why Having Good Credit Is Important

Having good credit can help you in many ways. The most obvious is by helping you qualify for better interest rates on loans.

According to May 2020 data from myFICO, increasing your credit score from a range of 620639 to 760850 could lower your monthly payment by nearly $200. Thats a big deal!

But even if you arent planning to apply for a mortgage or another form of financing, your credit scores can still affect your life. Your credit report information could affect your home and car insurance rates, your eligibility for rental housing, and depending on where you live, it may potentially affect your job applications.

With so many ways that your credit report and scores can influence your life, its important to keep close tabs on both and take quick action when you notice credit file mistakes.

Also Check: Is Settled Good On A Credit Report

How Can I Improve My Credit Scores

You are never stuck with a bad credit score. Work on your financial habits and you can improve your credit scores over time.

Paying your bills on time, even if you pay just the minimum amount due, accounts for 35% of your FICO® Score. Set up automated bill pay to avoid late payments.

Your is another important credit-scoring factor to be aware of. This takes into account how much of your total available credit you are using on a monthly basis. Your credit utilization ratio accounts for 30% of your FICO® Score. Focus on paying down your balances will help to lower your utilization rate.

You might also want to consider a to help improve your credit.

What About The Average Credit Score By Province

The average Canadian credit score does fluctuate by province. The province or territory with the highest number of people with credit scores above 750 is Quebec. The province or territory with the highest number of people with credit scores below 520 is Nunavut.

Since the health of your credit is tied to the overall health of your finances, it makes sense that there is at the very least a small correlation between the province you live in and your credit score. Certain provinces or territories offer Canadians more financial opportunities or more financial hurdles, all of which can have an effect on your credit score. Some of these opportunities or hurdles could be:

- Job opportunities

- Cost of housing

- Insolvency

Based on a study by Borrowell , weve compiled the average credit score of some of the major cities by province.

| Ontario; | |

| Yukon; | Whitehorse 619 |

Moreover, of the eight cities, two belonged to Quebec, two belonged to British Columbia, three belonged to Ontario and one belonged to Newfoundland and Labrador. The other 12 cities all fell within the fair credit score range. Overall, the city credit scores averaged around the average Canadian score of 650 which reinforces the fact that the provinces average credit score has a small correlation to your credit score and can be an indicator of the financial hurdles you face in one province over another.

Debt Levels Could Also Affect Credit Scores

| Province |

Also Check: What Does Frozen Credit Report Mean