Can I Remove A Charge

If you have no money, you can still try to remove the charge-off from your credit report by using the steps outlined above. However, it will be more difficult to get the charge-off removed if you dont have the money to hire a credit repair professional.

Still, its worth trying to remove the charge-off on your own before hiring a professional. If youre successful, then you can avoid incurring any additional costs.

When A Collection Agency Steps In

Charge-offs don’t end your obligation to repay the debt.

Even if your original creditor no longer owns the account, you’ll still owe the debt to the collection agency that acquired it. Charge-offs and other negative account history, such as late or missed payments, can stay on your for up to seven years.

How Will A Charge

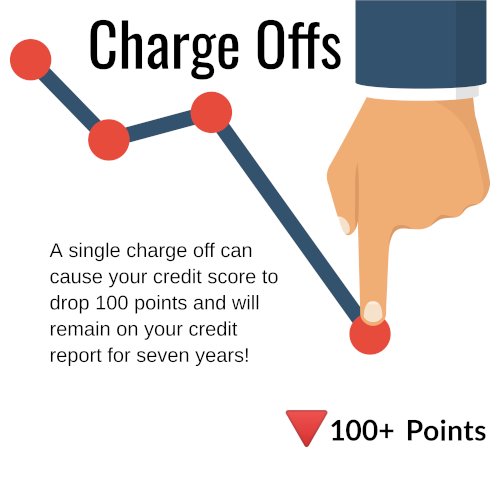

Your credit score is a direct reflection of your financial habits. Thats why people who pay their bills on time and dont carry a balance from month to month typically have good credit. Having a charge-off on your account is one of the biggest financial missteps, so it will have a major impact on your credit score.

A charge-off can cause lasting damage to your credit score, as it takes up to seven years for it to fall off of your credit report, according to Tayne. However, your score will likely start to dip the moment you miss a payment, and continue to go down with each passing month that you dont pay, she adds.

You May Like: How Long Does It Take To Improve Credit Score

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

How Can You Remove A Charge

In most cases, youll have to be patient where charge-offs and your credit reports are concerned. The FCRA states that credit reporting agencies must remove charge-offs from your credit reports after seven years. But nothing forces a credit bureau or creditor to remove a charge-off early.

Still, there are a few potential ways to get a charged-off account deleted from your credit reports before the seven-year clock runs out.

Read Also: How Many Points Does Your Credit Score Go Up

Get Help From A Credit Repair Company

If youre not comfortable disputing the charge-off yourself, or you dont have the time, you can hire a credit repair company to do it for you. A credit repair company can help you work with the creditor and the credit bureaus to get the charge-off removed from your credit report.

And while credit repair service will cost money, it might be the best investment youll ever make if it means securing that loan or new line of credit because they were able to remove a charge-off from your credit report.

One of the best things about hiring a professional is that they have the experience in resolving many issues in a shorter amount of time rather than doing it yourself. These companies are also skilled at communicating directly with creditors and collection agencies, which could speed up the process exponentially.

If youre considering hiring a credit repair professional, its important to do your research. Make sure that the company is reputable and has a good track record.

A few companies we recommend are and Sky Blue Credit Repair.

How Long Does A Charge Off Stay On Your Credit Report

A chargeoff is a big deal and can seriously affect your credit score. This happens for a couple of reasons:

Because a charge off can signal to a lender that you might have trouble paying back your loan, having this on your in the future. Negative information, such as charge offs, will generally stay on your .

Recommended Reading: Does Eviction Go On Credit Report

How To File A Dispute To Remove A Charge Off From Your Credit Report

If the information is correct and you pay off the outstanding debt, you can then ask the lender via phone or in writing to make a goodwill adjustment, removing the derogatory mark from your credit report. Although the lender is under no legal obligation to do so, goodwill requests are successful in many cases.

Note, the lender may also sell your debt to a collection agency, if it remains unpaid. The agency has the right to pursue further legal action against you.

You can check your credit report for free and also access personalized tips on how to improve your score here at WalletHub.

How do I remove charge off from my credit report?

You cannot remove a charge off from your credit report unless the information listed is incorrect. If the entry is an error, you can file a dispute with the three major credit bureaus to have it removed, but the information will remain on your report for seven years if it is accurate.read full answer

What If The Creditor Wont Budge

This situation is entirely possible and can certainly take the wind out of your sails. That said, you should still make an effort to repay the debt, as having a paid charge-off is much better than an unpaid one on your credit report. If the creditor wont settle or remove it, however, it will remain on your report for seven years.

Recommended Reading: How To Remove Inquiries From Credit Report Fast

The Original Creditor May Not Own Your Charged Off Debt

Once an account has been marked a charge off, the original creditor generally wants little to do with it. Of course, that doesnt mean it disappears. Instead, that debt may be transferred to an internal collections department to try and recover some of the loss.

If there is no internal collections department, the debt can be sold to an external debt collections agency. These agents usually obtain the debt for pennies on the dollar because of the projected time and energy required to collect on the debt.

To determine who currently owns your charged off debt, you should check your credit reports. When an account has been moved or sold to another entity, the account will generally be marked as transferred on your report and will indicate the new owner.

After a written off debt is sold to a collection agency, the original account will usually be considered closed on your credit report. In this case, there will be a new entry on your report representing the active, transferred debt account, attributed to the entity that now owns the debt.

Determine How Long A Charge

The charge-off account will be deleted 7 years from the date of the first missed payment that led to the delinquent status. Its also referred to as the original delinquency date. If a creditor transfers or sells the charge-off account to a collection agency, the original delinquency date that determines how long the charge-off remains on credit reports does not change.

Here is an example of the charge-off lifecycle:

- 1/1/18: You become 30-days late on a payment to your credit card issuer and never further payments.

- 7/1/18: At 180-days past-due, the credit card issuer closes your account and marks it as a charge-off.

- 1/1/25: The charged-off account must be deleted from your credit report by this date.

You May Like: When Does Capital One Report To Credit

Recommended Reading: How Do You Know Your Credit Score

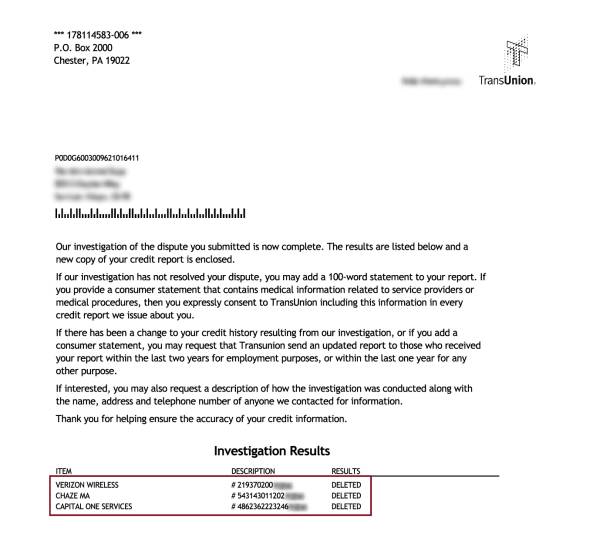

Initiating A Dispute Through Transunion

Wondering how to remove a charge-off without paying on your TransUnion credit report?

TransUnion offers an online dispute page where you can initiate your dispute with relative ease. Simply click the Start Dispute button near the top of the page and follow the on-screen instructions to complete the dispute.

This system will request that you open a new TransUnion account, which you can do at no cost. You can then log in to the system to get updates on your dispute. If TransUnion validates your dispute, the debt will be updated appropriately. If not, you will still have the opportunity to upload your own 100-word statement to explain the debt.

Pay Off Debt From Other Accounts First

Paying a charged-off account will help you, but it may not be your highest priority, especially if the account has already gone to collections. In this case the damage to your credit is already done and your main concern is avoiding legal action.

If you have other past-due accounts that have not yet been charged off, you may wanrt to prioritize payments on those. If you have limited funds to use for debt payments, you want to put them where theyll do the most good.

Its important to have a payment strategy. Review your debts and decide which ones to prioritize, based on the interest rates, their delinquency status, and any other factors that matter to you.

If youre having a hard time organizing and prioritizing your debts, credit counselling may help.

Also Check: How Do You Get An 800 Credit Score

If I Can’t Get It Removed Will A Charge

Lenders and collection agencies are required to report the original date of the delinquency. This is the time that the seven-year timeframe starts. If you enter into a payment plan later or pay it off entirely, the clock doesn’t restart from that original date. The status will be updated once it’s paid off and won’t look as bad, but it will remain on the report.

Consult With A Credit Repair Company Buyer Beware

People with charge-offs sometimes choose to speak with a credit repair company. These companies charge a fee.

However, some work on your behalf to challenge negative items creditors may have placed on your credit reports with the three credit bureaus.

Services like perform a full analysis of your credit history, challenges the damage you disagree with and sets you up with a plan to build credit.

The service comes highly-regarded by other users, showing 4.9 out of 5 stars with almost 170 reviews on ConsumerAffairs.com.

Consider this service if you need assistance with repairing your credit. Set up a consultation to learn more about and whether it can help with your charge-offs.

Don’t Miss: Is There A Free Credit Report

Collection Agency Issues With Reporting

Dont overlook that a collection agency may have a hand in the false information being reported to your credit reports. When they purchased the debt, they may have updated the account’s last payment date as the date they purchased it. This is not legal. An original charge-off date cannot be changed to accommodate a collection agency to use as a collection tool. The FCRA protects you from this.

Make A Plan To Pay Off Debt

The best option is to resolve the debt with the original investor. Ideally, you would somehow come into enough money to pay off the debt in full. If this happens, be sure your credit report reflects that the debt was paid in full.

Failing that, you should contact the creditor directly or hire an attorney to negotiate a resolution that both sides can live with.

Know how much a month you can afford before starting this process. Only agree to pay what you can reasonably afford each month. When you are finished negotiating and are satisfied with the agreement, ask to see it in writing and have the creditor/collection agency sign it. Never send money before seeing a signed agreement, especially when dealing with a collection agency.

Often a debt will be sold from company to company. Debt collection agencies can buy and sell debts without notifying you, so make sure you send the payment to the correct company. If you are unsure, you can always request verification that the debt indeed belongs to the company.

Also Check: How To Pay Off Debt On Credit Report

How Long Does It Take Until A Charge

Technically, a charged-off account can remain on your credit report for seven years, but it could hang around for much longer than that.

When you stop making payments to your original lender, the financial institution could report your negative payment history as a charged off-account to each credit reporting agency. At that point, the seven-year statute of limitations clock starts ticking.

At some point, the original lender may choose to sell the debt to a debt buyer or debt collection agency. If that happens, the clock restarts on your statute of limitations.

At any point during that time frame, the collection agency could sell the debt to someone else. This can again restart the clock.

You may also unknowingly do certain things that reset the clock to zero, including:

- Acknowledging that you owe the money when talking to the debt collector

- Making a payment toward the debt

- Create a debt repayment plan to eliminate the debt

A debt collector may approach you over the phone and seem sympathetic to your situation. In many cases, this is done to urge you to acknowledge that you owe the debt which restarts the statute of limitations clock.

You Arent Sure You Owe The Amount Listed On The Charge

Sometimes a collection agency will attempt to tack on bogus fees and interest. Unless the agreement you signed with the original creditor stipulates that a third-party debt collector can add their own fees and interest, they cannot do this.

It is also possible that you paid off the balance, but your account was flagged as a charge-off due to an error in the system. If you have any proof that the balance was paid, you absolutely should not pay it.

However, even if you dont have proof, having the debt verified may still work in your favor. A professional credit repair specialist will be able to advise you on the best course of action if you arent sure how to proceed.

Don’t Miss: Can Late Payment Removed Credit Report

Hire A Credit Repair Company If You Need Help

Although even the best credit repair companies will pretty much do the same thing you can, they may get things done quicker and potentially get better results. These professionals may also have insight into other personal finance strategies that may boost your credit score even more.

The key to working with a credit repair company is proper vetting. Ensure that youre dealing with a reputable service that uses effective, non-fraudulent ways to remove charge-offs from your credit report.

Check sites like the Better Business Bureau, Trustpilot, the Consumer Financial Protection Bureau or Google Reviews to ensure the company doesnt engage in unethical, shady practices around .

A charged-off account is one that your original creditor deems as uncollectible and is written off from their books. Say you’ve fallen behind on your credit card payments and have accumulated a substantial amount of credit card debt. If your credit card issuer determined you’re delinquent, , they can then write it off as bad debt.

Once an account is charged-off, the creditor reports it to the CRAs, which update your credit files. Then, usually, the original creditor will sell this account to a third-party debt collector, which will then contact you to pursue the charged-off debt.

When You Cant Remove A Charge

Even if you eventually pay off your debt to a credit issuer or collection agency, charge-offs typically stay on your account.

As charge-offs age, their overall impact lessens. Charge-offs remain on credit reports for seven years before falling off entirely.

Suppose your charge-off occurred at a young age, and you arent looking to get a mortgage, car loan, credit card, or another loan soon.

In that case, you might be able to deal with a lower credit score until the charge-off removes itself from your credit history.

However, having a good credit score carries several advantages. When you cant eliminate a charge off from your credit report, you can take other steps to fix your bad credit.

Related: How to Build Credit as a College Student

Also Check: What Is Lexisnexis On My Credit Report

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners.Heres an explanation forhow we make money.

Should I Pay Off A Charged Off Account

If you want to improve your credit score after a charge off has been added to your credit report, you should know that paying a charge off will not improve it. Paying a charge off will not remove it from your credit report, instead the charge off will go from charged off to charged off paid. Although your credit score will not improve, having a paid charge off on your credit report is better than an unpaid charge off because lenders view paid charge offs more favorable than unpaid charge offs.

Read Also: Is Annual Credit Report Safe