Can I Get A Mortgage & Home Loan W/ A 749 Credit Score

Getting a mortgage and home loan with a 749 credit score should be easy. Your current score is in the second highest credit rating category that exists. You shouldn’t have any issues getting a mortgage or a home loan.

The #1 way to get a home loan with a 749 score is to complete minimal credit repair, and simply apply and wait for approval.

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

Your Fico Score: Just One Piece Of The Puzzle

Id like to conclude this post by offering a little perspective. You may want a perfect credit score, and if you do I suggest you go for it.

But theres more to your personal finance life than perfect credit. Different lenders consider criteria other than your credit history when you apply for a loan or a credit card.

Your debt-to-income ratio, for example, could disqualify you for some of the best credit cards and loan options. This ratio measures how well youre able to pay your current bills with the income youre bringing in.

Your employment history could matter to some lenders, too. Just like with the length of credit history, a longer employment history works in your favor.

If you work to create the most stable personal finance life possible, your FICO score will fall into place, and youll stay at the top of the credit score range.

Shopping For Credit Cards With A 746 Credit Score

When shopping for credit cards, make sure you explore all of your options. In other words, dont just sit down with one potential creditor and decide to accept their deal or not. Sit down with multiple potential creditors and compare and contrast them to find out what works best for you.

If you already have a credit card, but have been shopping for one that is cheaper, you can then go to your existing creditor and request them to either match or beat an offer from another credit card company. Tell them that you believe you are paying too much money in fees and interest, and ask them if they are willing to lower their rates and fees down to the other credit card company that you are thinking about switching to.

If they refuse, then you can switch accounts, but dont close your existing account immediately. You still want to make the minimum payment on. it while you are waiting for your balance to transfer to your new account. You only want to close a credit account when your balance is at zero.

Don’t Miss: How To Check Itin Credit Score

What Interest Rate Can I Get With My Credit Score

While a specific credit score doesnt guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, lets assume that you meet the highest standards for all other criteria in your loan application. Youre putting down at least 20% of the home value, you have additional savings in case of an emergency and your income is at least three times your total payment. If all of that is true, heres how your interest rate might affect your credit score.

- Excellent Your credit score will have no impact on your interest rate. You will likely be offered the lowest rate available.

- Very good Your credit score may have a minimal impact on your interest rate. You could be offered interest rates 0.25% higher than the lowest available.

- Good Your credit score may have a small impact on your interest rate. This means rates up to .5% higher than the lowest available are possible.

- Moderate Your credit score will affect your interest rate. Be prepared for rates up to 1.5% higher than the lowest available.

- Poor Your credit score is going to seriously affect your interest rates. You may be hit with rates 2-4% higher than the lowest available.

- Very Poor This is trouble. If you are offered a mortgage, youll be paying some very high rates.

More from SmartAsset

What Credit Score Should You Have

A is a number that helps lenders evaluate a person’s credit report and estimate their credit risk. The most common credit score is the FICO score, named after software developer Fair, Isaac, and Company.

A person’s FICO scores are provided to lenders by the three major credit reporting agenciesExperian, TransUnion, and Equifaxto help lenders evaluate the risks of extending credit or loaning money to people.

Don’t Miss: Afni Subrogation Department Bloomington Il

Credit Score: Is It Good Or Bad

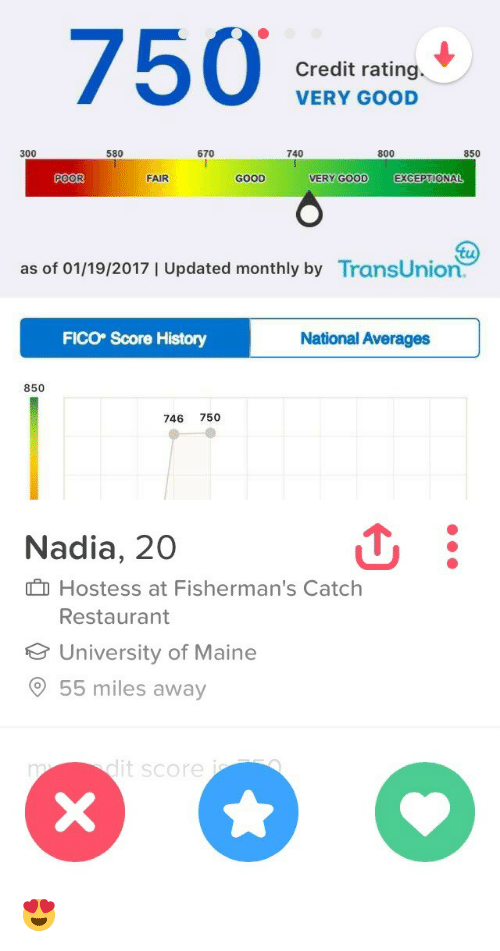

Your FICO® Score falls within a range, from 740 to 799, that may be considered Very Good. A 746 FICO® Score is above the average credit score. Borrowers with scores in the Very Good range typically qualify for lenders’ better interest rates and product offers.

25% of all consumers have FICO® Scores in the Very Good range.

In statistical terms, just 1% of consumers with Very Good FICO® Scores are likely to become seriously delinquent in the future.

Here’s What Americans’ Fico Scores Look Like

by The Ascent Staff | Updated Sept. 7, 2021 – First published on July 29, 2020

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

The average American has a FICO credit score of 706. But unless your credit score is exactly 706, this doesn’t tell you much about where you stand. Wondering how you compare with other American consumers? Here’s a look at the current distribution of FICO scores, and some guidelines that can help you interpret what your score means.

Recommended Reading: How To Fix Serious Delinquency On Credit Report

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

Charge No More Than You Can Easily Repay When The Bill Comes In

This really gets to the mechanics of paying off your balance each month. If you have room in your budget to pay $500 per month toward your credit card bill, then thats as much as you should charge on it. It makes it less likely youll need to carry a balance.

Remember, using a credit card responsibly does not mean maxing out your available credit every month!

Don’t Miss: Shopping Cart Trick Comenity

Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.

S To Improve Your 746 Credit Score

Improving your 746 credit score can take a lot of work, but following these steps can make all the difference. It will take time, but you can see your credit score go up within a year, which could save you countless amounts on interest rates. Dedicating the effort to improving your credit is worth the investment.

You May Like: When Does Care Credit Report To Credit Bureaus

Breakdown Of A Credit Score Rating

So far, this article has only discussed two of the credit score groups which you could move into Good credit score group and Excellent credit score group but there are a range of others that you could fall into if you do not manage your debts very well. These are fair, poor and bad.

A fair credit score would fall into the 650 699 range, if you fall into this bracket it means that you have likely missed a small number of payments on a debt. In general, around 15% of people fall into this category. A poor score means that you have missed several payments over an extended period or have missed a payment on multiple occasions. In can also mean you have a lot of debt at present and would be unlikely to be able to repay any further loans, about 20% of people have this rating.

At the bottom of the scale is a bad score, here you are likely to have had a legal judgment registered against you or in a worst-case scenario been declared bankrupt at some point. The main factor driving you credit score is how well you have managed to make repayments and as shown above these drive your credit rating which is especially true in this case. If you are in this bracket you are in the 8% of the borrowing population.

Why A Very Good Credit Score Is Pretty Great

A credit score in the Very Good range signifies a proven track record of timely bill payment and good credit management. Late payments and other negative entries on your credit file are rare or nonexistent, and if any appear, they are likely to be at least a few years in the past.

People with credit scores of 746 typically pay their bills on time in fact, late payments appear on just 23% of their credit reports.

People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms. These may include opportunities to refinance older loans at better rates than you were able to get in years past, and chances to sign up for credit cards with enticing rewards as well as relatively low interest rates.

Recommended Reading: Serious Delinquency On Credit Report

What Is The Average Credit Score In Canada

While credit scores in Canada range from 300 – 900, the average is around 650, according to TransUnion, though it varies from province to province. Once you’ve reached a credit score of 650 or higher, you’ll be able to qualify for more financial products. A credit score below 650 is going to make it hard to qualify for new credit, and anything you are approved for will likely come with very high-interest rates.

Do you know your credit score? You can use Borrowell to get your credit score in Canada for free. With Borrowell, you’ll get weekly credit score updates, see exactly what’s impacting your credit score, and get personalized tips on how to improve your score. You can also find your free credit score here.

Check out this infographic that shows the average credit scores in Canada:

Can I Get A Personal Loan Or Credit Card W/ A 746 Credit Score

Like home and car loans, a personal loan and credit card is easy to get with a 746 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 746 score means you likely have few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

Read Also: Aargon Agency Debt Collector

What Affects Your Credit Score

On the list of what affects your credit score, two factors have the biggest influence: Payment history, which is whether you pay on time, and credit utilization, which is how much of your credit limits you have in use.

Other factors matter but carry a little less weight: how long you’ve had credit, whether you have a mix of credit types and how frequently and recently you’ve applied for credit.

What Does Your Credit Score Mean

Your credit score measures how often you pay bills on-time , how close you are to your credit limits , and how much experience you have with managing debt .

A higher credit score can give you more options for borrowing money. It also qualify you for low-interest loans, which can save you tens of thousands of dollars in interest.

Don’t Miss: Check Credit Score Without Ssn

Learn More About Your Credit Score

A 746 credit score is Very Good, but it can be even better. If you can elevate your score into the Exceptional range , you could become eligible for the very best lending terms, including the lowest interest rates and fees, and the most enticing credit-card rewards programs. A great place to begin is getting your free credit report from Experian and checking your to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

What Is A Good Fico Score

A good FICO score lies between 670 and 739, according to the company’s website. FICO says scores between 580 and 669 are considered “fair” and those between 740 and 799 are considered “very good.” Anything above 800 is considered “exceptional.”

According to FICO, the average credit score in 2021 was 716, which falls in the good range.

FICO comes from Fair Isaac Corp., the company that first developed a credit scoring system. It uses data about consumers from the three major credit reporting bureaus: TransUnion, Equifax and Experian.

FICO scores typically express a consumer’s creditworthiness as a number between 300 and 850.

Also Check: How To Get A Repo Removed From Your Credit

Why Should I Care Anyway

Is all of this making your head spin? Youre definitely not alone! At this point, maybe youre wondering why you should even care.

Well, for one thing, having a good credit score can seriously affect your ability to get credit. And a higher score will also result in lower rates. This means you can save tons of money just by improving your credit score.

Dont believe me? Heres one way to see how the differences play out.

Looking at current mortgage rates, lets see how the varying FICO credit scores stack up when applying for a 30-year fixed mortgage of $300,000.

| FICO Credit Score | |

|---|---|

| 5.142% | $1,637 |

But your credit score doesnt just affect how big your mortgage payment will be. It also impacts things like:

- How much you pay for auto and homeowners insurance.

- What you pay in credit card interest.

- Whether you qualify for the best rewards credit cards.

- How employable you are, in certain states.

- Whether or not you qualify for a lease agreement or utilities.

Bottom line: You credit score is central to everything you do in your financial life. So having a good one is really important.

A 746 Credit Score Is Considered A Good Credit Score By Many Lenders

| Percentage of generation with 700749 credit scores |

|---|

| Generation |

| 14.7% |

Good score range identified based on 2021 Credit Karma data.

With good credit scores, you might be more likely to qualify for mortgages and auto loans with lower interest rates and better terms. You might also be approved for credit cards with valuable sign-up bonuses and attractive rewards programs.

Why do these three-digit numbers matter so much to your financial well-being? Well, lenders use your as a gauge of how likely you are to pay back any money they lend to you. So, a good credit score can give a lender the confidence to lend you money at terms favorable to you. It might not be enough to unlock the absolute best financial products or terms, but its a milestone indicating youre on the cusp of excellence.

People often talk about their credit score as if they have only one, so you might be surprised to learn that there are many different credit scores out there. A credit score is based on a credit-scoring model, which differs depending on the company that created it, like VantageScore or FICO. To generate your credit scores, these models can use data from different sources: Equifax, Experian or TransUnion .

Each model has its own standard for what qualifies as good. And to make matters even more confusing, its often not clear which credit score, model or bureaus data a particular lender is using and what other factors the lender may look at beyond scores.

Also Check: What Credit Score Is Needed To Buy A Car At Carmax