Does A Debit Card Affect Your Credit Score

In the case of alternative credit reports, using your debit card will likely affect your “balance.” However, the effect is most likely indirect. However, most alternative credit scores focus on the overall financial responsibility they want to see so you can avoid overspending on your checking account and live within your means.

What’s an average credit scoreWhat is a good credit score range? According to Experian, one of the three major credit bureaus, credit scores are as follows: Excellent: 750 to 850 Good: 700 to 749 Fair: 650 to 699 Poor: 550 to 649 Very Bad: 300 to 549.What is a good FICO 8 score?FICO 8 is the most widely used FICO scoring model. A FICO credit score of 670-739 is considered “good.” A FICO credit score of 740-799 is considered

Above 760 The Benefits Of A Higher Score Are Diminishing

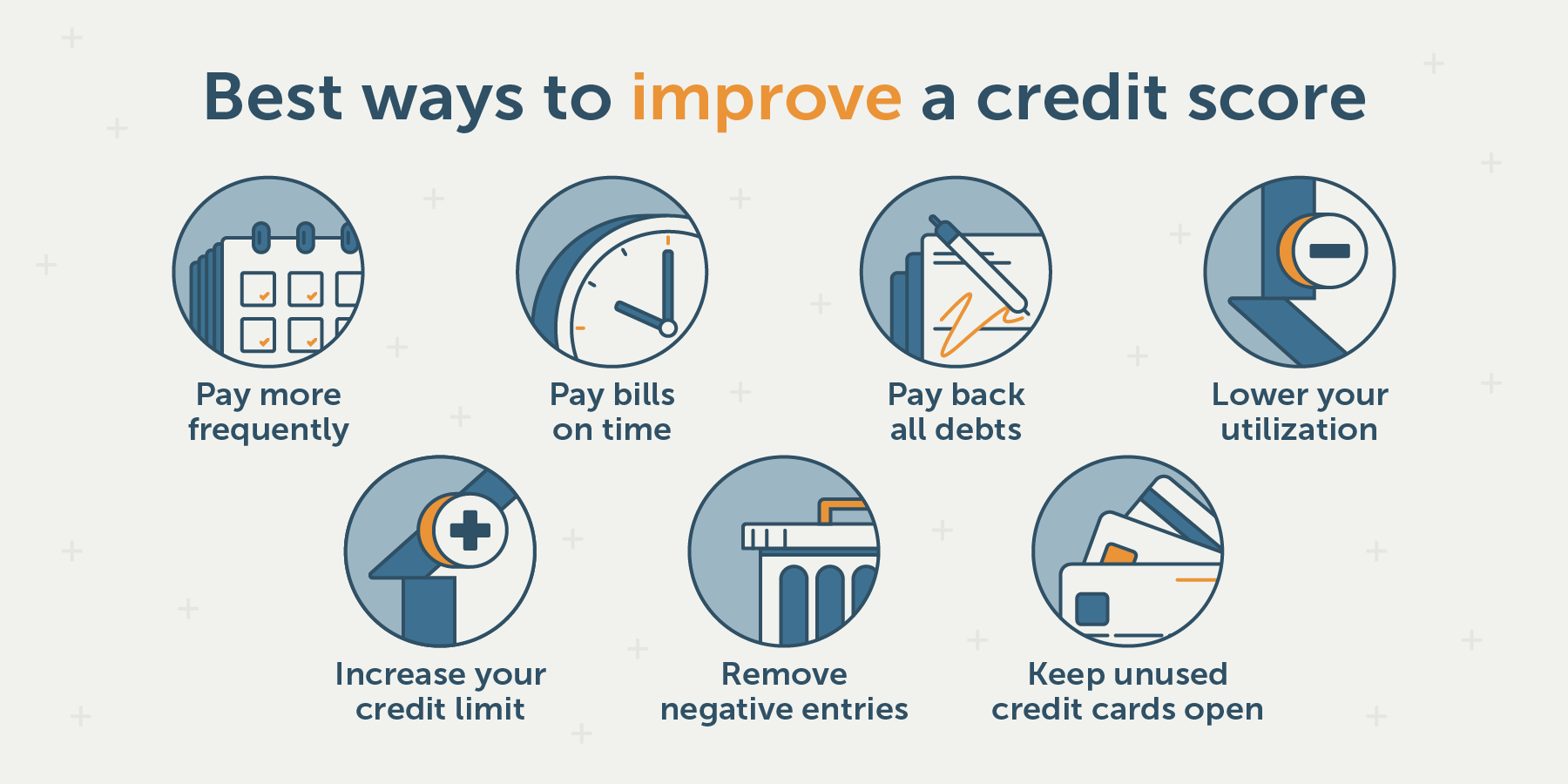

As you read this guide and begin to think about the changes you want to make to improve your credit, its important to remember that it can take time.

Lowering your utilization drastically can quickly improve your credit, but dont get discouraged if you dont see a change overnight. Its also important to remember that you dont need to have a perfect credit score of 850 in order to receive the perks of a high score. Many lenders consider a score of 760 to be perfect enoughmeaning having a perfect 850 wont get you a better rate.

Finally, if you dont have credit and have been rejected for new cards, it can seem impossible to start building credit. If thats the case for you, youll want to look into applying for a secured card. This is an entry level card that requires a deposit as collateral.

How Often Should You Check Your Credit Score

You should check your credit score regularly to check for errors, but make sure that you are doing so through soft inquiries so that your score isnt dinged. Many banks offer free credit monitoring to their customers check with yours to see if you can enroll in their service and get alerts whenever your score changes.

Don’t Miss: Navy Federal Auto Loan Rates By Credit Score

Checking Your Credit Report For Errors

Everyone is entitled to a free annual credit report from each of the three major bureaus, which areExperian,Equifax, andTransUnion. Once you have brought up your report, the first thing you need to do is check for errors. This is the most important step because incorrect information can make it nearly impossible to improve your credit score.

There are two types of mistakes to look out for: incorrect information and unanswered disputes.

- Incorrect Information: This typically shows up as a different name, address, or social security number than what you have on file. If you spot any such irregularities, dispute them immediately. Don’t delay! The longer that same incorrect info stays on your report, the lower your score will fall as that information makes its way into lenders’ computer systems.

- Unanswered Disputes: If you look at a different section of your report and see a line for “This account has an unresolved problem,” this means that you never submitted a dispute. Disputes automatically expire after 30 days, so if you can’t remember submitting one, there’s your problem!

If You’ve Split Up Ensure You Financially De

If you split up with someone you’ve had joint finances with , once your finances are no longer linked, write to the credit reference agencies and ask for a notice of disassociation. You can also call up or find the forms online.

This will stop their credit history affecting yours in the future. However, the agencies say they can’t do this if you still have a joint account open with the ex. The account’ll need to be closed or transferred to an individual account before you can do it. For example, a joint loan would have to be paid off before a notice be given.

Tip Email

Read Also: Does Verizon Report To Credit Bureau

What Is A Credit Report

A credit report is a detailed breakdown of an individual’s credit history prepared by a . Credit bureaus collect financial information about individuals and create credit reports based on that information, and lenders use the reports along with other details to determine loan applicants’ .

In the United States, there are three major credit reporting bureaus: Equifax, Experian, and TransUnion. Each of these reporting companies collects information about consumers’ personal financial details and their bill-paying habits to create a unique credit report although most of the information is similar, there are often small differences between the three reports.

How To Improve Your Credit Score: No

If you already have a good credit score, or youre close to getting a good credit score, youll be eager to step up from good to very good or even to excellent. One step up in your credit score can unlock lower interest rates, better mortgage terms, and larger credit lines with better features and rewards.

Your credit score is a reflection of your financial health, and having a good credit score can make it easier to get a loan or secure financing. With the strategies outlined here and a little patience, you could increase your credit score by 100 points or more. Heres how.

In this post:

You May Like: Carmax Financing With Bad Credit

Building Credit Without Credit Cards

The need for good credit history is inevitable for most of us. When the time comes to buy a car or a home, rent an apartment, set up new utility accounts, obtain a cell phone, or handle other financial transactions, a healthy is crucial. For many, the first step in establishing a credit history is through the use of credit cards.

Luckily, only a small portion of your is based on having and using revolving credit products . However, consumers who can’tor don’t want toobtain a credit card can build a credit history in other ways.

Does Paying Off A Loan Help Or Hurt Credit

Paying off a loan frequently hurts credit because it impacts your credit history and your credit mix. If the loan that you have paid off is your oldest credit line, then the average age of your credit will become newer and your score will drop. If the loan that you pay off is your only loan, then your credit mix suffers.

Also Check: Syncb Qvc

Establishing A Credit Score

If you dont have any credit history, get started! A positive credit history helps out nearly every aspect of your financial future, whether its purchasing a car, renting or buying a home, or even applying for a job.

The easiest way to start is to apply for a line of credit. Credit cards for gas stations or department stores are generally easy to obtain and are good ways to build solid credit. Use them responsibly, being careful not to overcharge. The key is to pay your bill on time each month.

If you cant get approved for a traditional credit card, . These cards require a deposit, often equal to the credit limit you will be extended with the card. For example, a $500 deposit will get you a secured credit card with a $500 spending limit.

These cards act the same as unsecured cards in that you receive a monthly bill and payment is expected each month. Be sure that the spending on the secured card is reported to the credit reporting bureaus.

In most cases, as long as you pay each month, your deposit will be refunded when you are finished with the card. Your deposit cant be used to make the monthly payments.

Becoming an authorized user is another way to establish a credit score.

Being an authorized credit card user is the best position possible in the credit world: you get all the benefits and none of the responsibility. You spend, someone else pays, and everybodys credit improves.

That is the sole responsibility of the cardholder.

12 Minute Read

Find Out When Your Issuer Reports Payment History

Theres something called a credit utilization ratio. Its the amount of credit youve used compared to the amount of credit you have available. You have a ratio for your overall credit card use as well as for each credit card.

Its best to have a ratio overall and on individual cards of less than 30%. But heres an insider tip: To boost your score more quickly, keep your credit utilization ratio under 10%.

Heres an example of how the utilization ratio is calculated:

Lets say you have two credit cards. Card A has a $6,000 credit limit and a $2,500 balance. Card B has a $10,000 limit and you have a $1,000 balance on it.

This is your utilization ratio per card:

Card A = 42% , which is too high.

Card B = 10% , which is awesome.

This is your overall credit utilization ratio: 22% , which is very good.

But heres the problem: Even if you pay your balance off every month , if your payment is received after the reporting date, your reported balance could be high. And that negatively impacts your score because your ratio appears inflated.

So pay your bill just before the closing date. That way, your reported balance will be low or even zero. This lowers your utilization ratio and boosts your score.

Also Check: Usaa Check Credit Score

Apply For A Secured Credit Card

Rebuilding your credit can take time, but you can improve a bad credit score with a secured credit card. A secured credit card works just like a regular credit card, but your credit limit is based on either a security deposit you pay or how much you put into an attached account, like a savings account. For instance, if you put down a $500 security deposit, your secured credit card limit will likely be $500.

With good payment history and credit usage, your credit limit may increase and you can get your deposit back. You may even have the opportunity to upgrade your card to a traditional credit card.

Get A Loan With The Help Of A Cosigner

Making on-time payments toward an installment loan, similar to making timely payments on a credit card, helps build credit history. Besides using a credit-builder loan, getting a traditional one such as a car loan can add positive information to your credit report and improve your credit mix.

If you can’t qualify for a loan on your own, a cosigner can helpbut make sure the cosigner knows what they are getting into. If you can’t afford to repay the loan, it becomes their responsibility. Also, as always, only seek out a loan if you really need it, not simply to improve credit. Potentially boosting your score should be an added bonus or motivation, not the central reason.

Also Check: Affirm Credit Score Required

Improving Your Credit Score

Your credit score is important. The higher your credit rating, the better your chances of being accepted for credit at the best rates. It can influence your ability to get things like credit cards, loans, mortgages, mobile contracts and more.

Looking for tips on how to improve your credit score? Try following the steps below.

Never Miss A Repayment

Showing that you can repay on time and stay within the credit limit you’ve been given will help convince lenders you’re a responsible borrower.

Inform your lenders as soon as possible if your debts are proving too difficult to handle. Its better to seek their help than to repeatedly miss loan or credit card repayments with no explanation.

If you are late with a payment or miss one, it will show up on your report within a month. One late payment on a credit card or loan can dent your score by as much as 130 points, according to Experian.

To help people struggling financially during the coronavirus pandemic, lenders have been offering payment holidays of up to three months which shouldn’t impact your score.

A missed payment will show on your report for six years, although its effect will lessen. If youve missed only one payment, your score could start to recover after around six months and should be fully recovered after a year.

Recommended Reading: Eviction Credit Report

Are Credit Repair Companies Scams

There are some legitimate credit repair companies that can help you dispute errors on your credit report. However, there’s nothing these companies can do that you can’t handle on your own through the credit bureau dispute process. If you do choose to use a credit repair service, be cautious of any company that doesn’t explain your rights as a consumer. Also, if a company asks you to pay upfront or promises to remove negative marks on your credit report that are accurate, it may be a .

Pay Down High Credit Card Balances

Opening more credit accounts is a great way to improve your credit score over a couple of months because it doesnt require a large chunk of money upfront. Paying down your credit card balances, on the other hand, can have a longer-term project.

If your credit cards are maxed out, then paying them down will improve your financial situation and your credit score rapidly. is an important credit scoring factor, so using more than 30% of your available credit hurts your credit score.

There are two common approaches people use to pay off their debts over the long term:

- The debt snowball method: Pay off your accounts in order of lowest to highest outstanding balance.

- The debt avalanche method: Pay off your accounts in order of highest to lowest interest rate.

The debt snowball is widely considered a more satisfying approach. It helps some people feel like theyre making progress by paying off accounts in full.

However, the debt avalanche method will save you more money. If you have an account thats accruing interest at a much higher rate than the rest, it would make sense to tackle that one first, regardless of the account balance.

Heres a quick example. Imagine that you have three credit cards with balances of $500, $2,000, and $5,000. Their interest rates are 18%, 20%, and 25%, respectively.

If you took the debt snowball approach, youd target the credit card with the $500 balance first and pay it off quickly.

Under 30% is good.

Below 10% is even better!

You May Like: Carmax Interest Rates

Check Your File For Mistakes

To improve your credit rating, first check your score isnt being affected by errors or fraud. If you spot something, get in touch with the company who have made the error. Theyll let the credit reference agencies know and your file will be corrected. You can also add up to 200 words to your credit file to explain the situation to future enquirers.

How Does Checking My Credit Affect My Credit Score

Not all questions or credit ratings appear in a credit report, but not all questions affect creditworthiness. Some credit checks are only visible when you request a copy of your own credit report. Requests for personal credit reports, job reviews, and pre-approved quotes are some of the requests that do not affect creditworthiness.

You May Like: How Long Is A Repo On Your Credit

How Does Applying For A Credit Card Impact Your Credit Score

Approving or rejecting your application will not affect your creditworthiness, at least not directly. If approved, opening a new credit card can roughly cost you your credit scores as it lowers the average age of your credit score. On the other hand, the rejection will not affect your creditworthiness.

How Do You Get A Good Credit Score

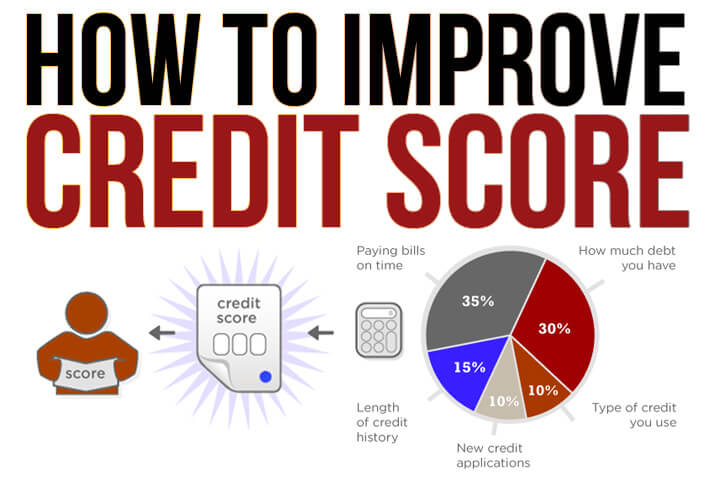

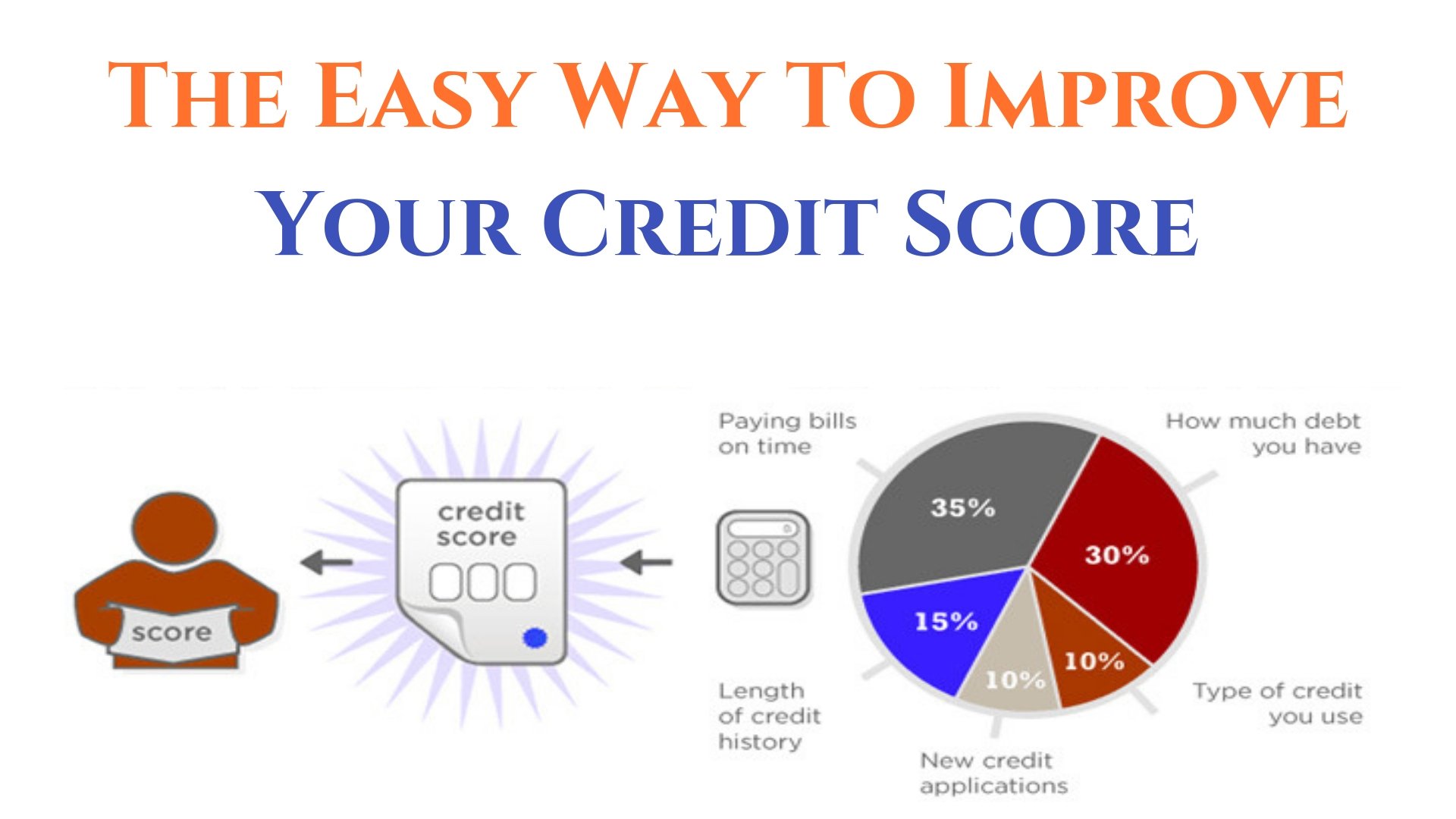

- Always pay on time. Its always. Your payment history has a major impact on your creditworthiness. In fact, it is the most influential factor in FICO and VantageScore.

- Optimize the use of credit. Using credit is another important piece of the solvency puzzle.

- Regularly check your creditworthiness for inaccuracies. Identity theft and error messages can quickly ruin your path to a good reputation.

- Be strategic when taking on new debt and closing accounts. Credit scoring models take into account your total credit card balances and outstanding loans.

- Look at your credit.

You May Like: How To Get Rid Of A Repo On Your Credit

Lower Your Credit Utilization Rate

The fastest way to get a credit score boost is to lower the amount of revolving debt youre carrying.

The typical guidance from personal finance experts is to use no more than 30% of your credit limit, which applies both to individual cards and across all cards. For example:

- On a card with a $500 credit limit, spend no more than $150.

- On a card with a $700 credit limit, spend no more than $210.

- On both cards , spend no more than $360.

How much will this action impact your credit score?

Reducing your balances is the single most effective way to boost your credit score. Provided you have no derogatory marks on your credit reports, such as late payments or delinquencies, you are guaranteed to see a big jump in your scores quickly if you knock down your balances to $0 or close to zero.

Still, if your utilization is currently over 30%, and simply paying the debt off immediately isnt a viable option, there are a few other ways to lower your credit utilization rate.

Pay On Time Every Time

The most vital thing you can do to build and maintain good credit is pay on time. This means every bill, every debt — every month. This is called your payment history, and it’s more than a third of your credit score. Even one payment more than 30 days late can hurt your score for years. If you think you can’t make a credit card payment, call your card company before you’re late to arrange a payment plan.

No matter what, be sure to make at least the minimum required payment on your accounts every month. Ideally, pay in full.

If you’re struggling with remembering due dates, you can set up automatic payments. The autopay feature will make your payments for you, in the amount you decide when you set it up.

This suggestion isn’t necessarily for how to build credit fast — it’s how to build credit for life.

Read Also: Credit Report Inquiries Removal