Down Payment And Closing Costs

It should come as no surprise that to buy a home, you need to have enough funds available to cover the down payment and closing costs However, you can’t just get these funds from any old source. Your lender will need to confirm that the down payment isn’t from borrowed funds and that you’ve had the money in your possession for at least 30 days.

Exceptions can be made, but don’t plan to use the income tax refund you expect to arrive in a couple of weeks to qualify for a mortgage you’re applying for tomorrow. Here is a list of acceptable sources of down payment.

Acceptable down payment sources

- Other investments

Pay More If Possible When Paying Off Debt

As you make your monthly debt payments on time, consider paying more than just the minimum amount due. With most forms of debt, lenders will charge an interest rate based on the amount a borrower owes. The less your balance is, the less you may pay in interest rates. So, by paying more towards your debt each month, you can end up saving money and paying off your debt faster!

How A Good Credit Score Positively Affects Your Finances

A good credit score opens your world up to getting the best financial products on the market. Its easier to get loans you want so you can own your own home or invest in a business. If your credit score is really good, lenders will give you the best possible interest rates. Youll save money in the long run. They also offer you special offers and incentives, especially with . You can get cash back credit cards and travel rewards.

Your good credit gives lenders the confidence to loan money to you. Youll be qualified for the many top-tier products out there. Things like unsecured credit loans and low interest loans will be available to you. Here are some of the benefits youll get from having a good credit score:

Also Check: What Is My Mortgage Credit Score

What Should I Do If I Dont Have What Is Considered An Excellent Credit Score Of 760+

First, take a deep breath because thankfully, this wont make or break your life.

Yes, having an excellent credit score will save you money and give you access to better deals, but its not even the most important financial thing you should worry about.

For example, knowing your monthly savings rate is more important, since that will actually impact your long-term quality of life. Dont have and use a monthly budget or spending plan? You need one before you start to worry about your credit score.

Ultimately, 35% of your credit score is determined by your payment history, and having a budget is your first line of defense to ensure that youll always have enough to make on-time payments.

However, this also doesnt mean that your credit doesnt matter and that you should ignore it.

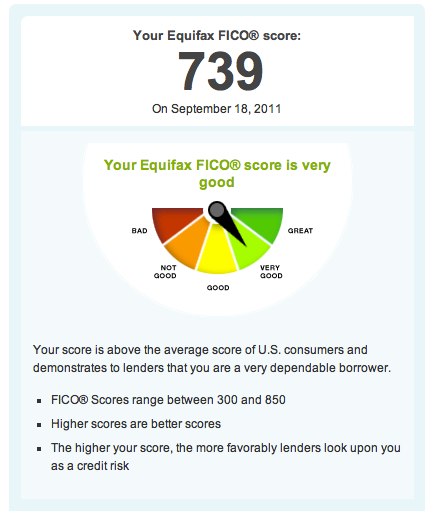

What Does A Credit Score Of 760 Mean

A credit score is a number that lenders use to determine your riskiness as a borrower. The higher your score, the lower the risk you pose to lenders and the better interest rates youll be offered. A score of 760 or above is considered excellent and will get you the best interest rates possible on loans.

There are a few things that go into your credit score, including your payment history, the amount of debt you have, the length of your credit history, and more. You can improve your score by paying your bills on time, maintaining a low level of debt, and using a mix of different types of credit.

READ OUR POSTS

Read Also: How To Get Late Payments Off Your Credit Report

Where Do You Stand

Image source: Getty Images

Recent research suggests that 60% of Americans don’t know their credit scores, according to LendingTree.

This is astounding knowing that your credit score is one of the most important numbers in your financial life. Short of the eventual size of your nest egg, there may be no more important financial number. Excellent credit is the gateway to the lowest loan and mortgage rates and some of the best credit card offers, including our picks of the best credit cards for excellent credit.

In the video segment below, The Motley Fool analysts Hamilton Hamilton and Michael Douglass talk more about credit scores and highlight what score will land you in excellent territory.

Michael Douglass: Hamilton, let’s talk about credit scores. We talk a lot on fool.com about how to boost your credit score, how to think about your credit, but let’s just ask you the basic question. What is an excellent credit score, like what does that mean? What number is that? Give us a grade.

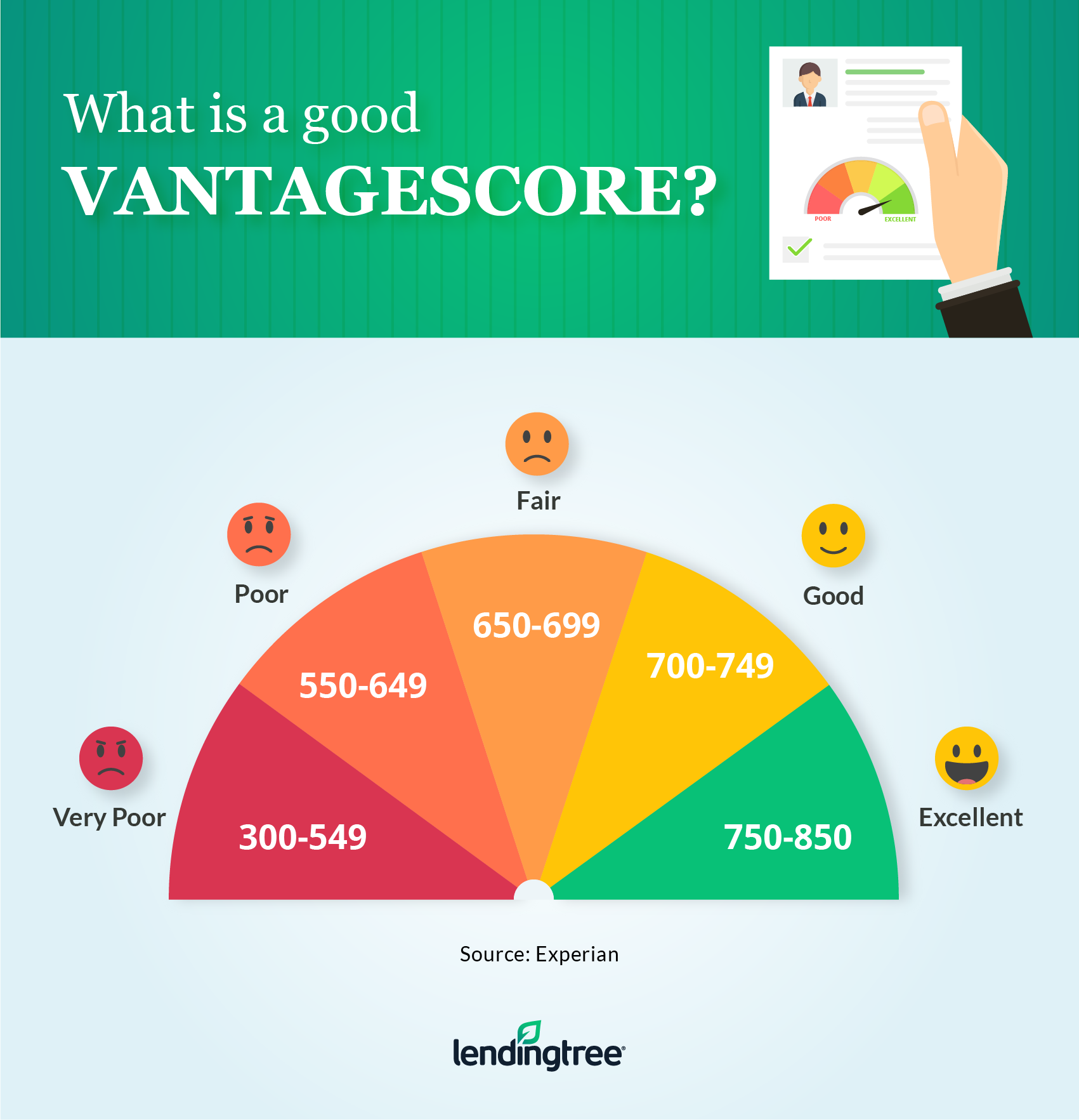

There are proprietary free scores that have different ranges, so it’s really important to look at it and say, “Okay, what’s my FICO score?” The other ones may have a different range, and 750 may mean something different. It could be prime, prime credit or it could be average, could be good, so just pay attention to the details there.

Hamilton: Sure.

Hamilton: Into the very excellent category.

Douglass: Yeah, which is, I mean, again, 750 is excellent. 800 is like way up there, so.

Whats Considered A Good Credit Score

If youre trying to build or maintain healthy credit, knowing whats considered a good score can be helpful. A good credit score can help you get approved and lock in better rates for loans and other credit.

Higher is generally better, but its hard to say specifically what a good score is. Whats considered a good score can differ by lender and the type of credit youre applying for. The score you see when you obtain credit monitoring or buy a credit score along with your credit report may not be the score that the lender is using. There are also different scoring models. That said, read on to learn what a good credit score range is when you check your score with TransUnion. Plus, youll find tips on how to maintain healthy credit.

You May Like: What Does Age Your Credit Report Mean

How To Build A Good Credit Score

Building a good credit score comes down to using credit responsibly over time. The same is true when it comes to maintaining a good credit score. Here are five things the CFPB says you can do:

When it comes to monitoring your credit, makes it easy. Itâs free for everyoneânot just Capital One customers. And checking wonât hurt your scoreâa major plus if youâre working to improve a bad credit scoreâso you can check it as often as you like.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Improve Your Credit Score With Borrowell And Credit Karma

Instead of going directly through the credit bureau, you can open an account with Borrowell or Credit Karma. Both companies will email your credit score and credit report to you for free every week. It’s free to sign up, and you can access your credit report within minutes of becoming a member. In my opinion, this is the easiest and cheapest way to stay on top of your credit. Borrowell will send you a copy of your Equifax Canada credit report while Credit Karma has partnered with TransUnion.

These companies make money through affiliate partnerships with various loan and credit card companies. You will receive credit offers based on your credit score. You are under no obligation to apply, and I would exercise extreme caution before doing so. Instead, take advantage of the free credit reporting, as well as the educational resources both companies offer to help you improve your credit score.

Read Also: Does Getting Married Affect Your Credit Score

How To Raise Tier 2 Credit Scores

Want to try and raise your credit score to a higher tier? If this is your goal, its important to understand the factors that go into determining your credit score. Credit bureaus will look at the following categories when compiling your credit report and credit score:

- Payment history

- Length of credit history

- Recent hard credit inquiries

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Recommended Reading: How To Report Credit Card Theft To Police

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be one reason peopleâs credit scores tend to increase as they get olderâtheir accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just the age of your accounts.

What Is A Credit Score

A credit score is a number from 300 to 850 that depicts a consumers . The higher the score, the better a borrower looks to potential lenders.

A credit score is based on : number of open accounts, total levels of debt, repayment history, and other factors. Lenders use credit scores to evaluate the probability that an individual will repay loans in a timely manner.

There are several different credit bureaus in the United States, but only three that are of major national significance: Equifax, Experian, and TransUnion. This trio dominates the market for collecting, analyzing, and disbursing information about consumers in the credit markets.

You May Like: Does Paypal Working Capital Report To Credit Bureaus

What Is Considered An Excellent Credit Score

Image source: Getty Images

Recent research suggests that 60% of Americans don’t know their credit scores, according to LendingTree.

This is astounding knowing that your credit score is one of the most important numbers in your financial life. Short of the eventual size of your nest egg, there may be no more important financial number. Excellent credit is the gateway to the lowest loan and mortgage rates and some of the best credit card offers, including our picks of the best credit cards for excellent credit.

In the video segment below, The Motley Fool analysts Hamilton Hamilton and Michael Douglass talk more about credit scores and highlight what score will land you in excellent territory.

What Is The Average Credit Score In Canada And How Do You Compare

What is the average credit score in Canada, and how do you rank among average Canadian credit scores? More so, what is a good credit score in Canada?

Often, Canadians want to know how they measure up to other people when it comes to their credit score. Is your credit score better than the average credit score? Maybe its worse?

First, let’s answer the question you are here to find out:

Read Also: How Do You Get A Credit Score

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Avoid Applying For New Loans Or Credit Cards

Each time you apply for a loan or credit card, your credit score takes a small hit. While you may see your score only drop five points or so with each credit inquiry, these can add up quickly. Avoid an unnecessary decline in your credit by only submitting credit applications when it is absolutely necessary. Before you apply for funding, ask yourself the following:

- Do you have enough money in a savings account to cover your expenses?

- Can you organize your budget and spend more responsibly to make room in your finances?

- Do you have a trusted friend or family member who would be willing to lend you money interest-free?

- Would you be willing to get a part-time job or have a garage sale to earn the money you need for your expenses?

Read Also: What Is The Credit Score Scale

Factors That Affect Credit Ratings

The agency also looks at the borrower’s cash flows and current debt levels. If the organization has steady income and the future looks bright, the credit rating will be higher. If there are any doubts about the borrower’s economic outlook, their credit rating will fall.

These are some of the factors that can influence the credit rating of a company or government borrower:

- The organization’s payment history, including any missed payments or defaults.

- The amount they currently owe, and the types of debt they have.

- Current cash flows and income.

- The market outlook for the company or organization.

- Any organizational issues that might prevent timely repayment of debts.

Note that credit ratings involve some subjective judgments, and even an organization with a spotless payment history can be downgraded if the rating agency believes that its ability to make repayments has changed.

For example, in 2011, Standard and Poor’s reduced the credit rating of United States sovereign bonds from AAA to AA+, in response to Congressional roadblocks that could have caused a default. Even though the government ultimately made all of its payments on time, even the mere discussion of nonpayment was enough to cause a more negative outlook on U.S. government debt.

S To Improve Your Credit Score

If you want to learn how to get an excellent credit scoreor if you already have excellent credit and want to work toward that perfect 850here are some steps you can take to improve your credit score.

Start by making on-time payments every month, if you arent doing so already. Since 35 percent of your credit score is based on your payment history, making on-time payments is one of the best things you can do to boost your credit score.

Next, start paying down your balances. The lower you can get those balances, the more available credit youll havewhich is good for your credit utilization ratio and even better for your credit score. Keeping a low credit utilizationbelow 30 percent at least, but ideally within single digitsis another surefire way to keep a strong credit standing. To quickly determine your current ratio, check out Bankrates credit utilization ratio calculator.

You can also increase your available credit by requesting a or applying for a new credit card. If your credit already falls in the Very Good range, going online and requesting a credit limit increase on one of your existing credit cards might give you the point boost you need to take you over 800.

Read Also: How To Remove Child Support Arrears From Credit Report

What Information Is Kept In My Credit File

Your credit file contains information on all of your credit accounts submitted to the credit bureaus, including balances, limits, payment history, etc, as well as identification information such as your name, address, age, social insurance number, marital status, spouses name and age, number of dependents, occupation, and employment history.

Auto Loans For Excellent Credit

Having excellent credit can mean that youre more likely to get approved for car loans with the best rates, but its still not a guarantee.

Thats why its important to shop around and compare offers to find the best loan terms and rates available to you. Even with excellent credit, the rates you may be offered at dealerships could be higher than rates you might find at a bank, credit union or online lender.

You can figure out what these different rates and terms might mean for your monthly auto loan payment with our auto loan calculator.

And when you decide on an auto loan, consider getting preapproved. A preapproval letter from a lender can be helpful when youre negotiating the price of your vehicle at a dealership, but be aware that it might involve a hard inquiry.

If you have excellent credit, it could also be worth crunching the numbers on refinancing an existing auto loan you might be able to find a better rate if your credit has improved since you first financed the car.

Compare car loans on Credit Karma to explore your options.

Recommended Reading: How Long Do Things Stay On Credit Report Canada