Pay Down Or Pay Off Your Credit Card Debt

Payment history carries the greatest weight in determining your credit score. Thats why its important to always make sure any payments are on time. Putting your payments on auto pay and budgeting to ensure theres enough money to cover your payments is a way of ensuring your payments are never late.

While it might not make much sense, especially if credit cards were an issue for you in the past, a secured credit card is a good way to start rebuilding credit through responsible credit use and repayment. Secure credit cards require a deposit which also serves as your credit limit. Its also a good goal to keep your credit ratio between 10-30 percent of your total available credit.

Most Negative Marks Are Removed Within 7 To 10 Years

The Fair Credit Reporting Act is the primary federal statute that governs the credit bureaus where consumer credit reports are concerned. Experian, TransUnion, and Equifax aka the Big 3 credit reporting agencies are only allowed to keep negative information on a consumer credit report for as long as the FCRA allows.

Different time limits address how long a derogatory item can remain on your credit reports. Most negative marks must come off your credit report within seven to 10 years. But there are a few exceptions to these general rules.

The chart below shows how long a derogatory credit entry may be allowed to stay on your credit report under the Fair Credit Reporting Act.

Positive information can stay on your credit reports indefinitely as there is no legal requirement to remove them. But if you close an account , the credit bureaus will proactively remove the item from your credit reports after 10 years of inactivity.

This is one of the reasons why closing a credit card may negatively impact your credit scores.

Note: This choice to remove inactive accounts after a decade is a policy of each credit bureau as of the date of publication of this article. This policy can, of course, change over time.

Get Professional Assistance Now

While foreclosure might seem like the end of the world, there are steps you can take to start righting your financial situation.

Our team of qualified foreclosure and credit repair attorneys at the Law Offices of Yuriy Moshes are willing to help you get back on your feet again. Call, go online to chat with, or fill out a form for a free consultation with one of our attorneys.

Recommended Reading: Do Peer To Peer Loans Show Up On Credit Report

What Exactly Is A Foreclosure

A foreclosure is one of the worst possible outcomes when you borrow money to buy real estate.

A mortgage uses your home as collateral on the home loan. If you cant make the monthly mortgage payments, the lender will eventually foreclose.

This means the lender claims ownership of the property and sells it to pay down the loan.

You should know homeowners wont face foreclosure because of a few late payments or one or two missed payments. Lenders lose money when they foreclose so it really is a last resort for them as well as for the borrower.

But if youve gone more than 120 days without making a payment, foreclosure is a real possibility.

What Are The Consequences Of A Foreclosure

Foreclosure has a number of consequences to homeowners. Obviously, the biggest and most notable repercussion of this process is the loss of the home itself.

But in addition to losing their homes, homeowners often suffer other consequences namely, a big hit to their . Having said that, there are certain situations when a foreclosure wont affect your credit score.

The impact that foreclosure may have on your credit score will depend on your lender, your particular circumstances, the value of your home, and the outstanding balance still owed on the mortgage. In some cases, a foreclosure may not impact your credit score at all.

Recommended Reading: How To Remove Old Student Loans From Credit Report

How To Remove A Foreclosure From My Credit Report

It is very common for people to wonder how to remove a foreclosure once it has been placed on their credit report. If this sounds familiar, you are not alone. This is especially true if you are looking to purchase a new home or refinance an existing mortgage loan. Foreclosures can be tricky and they can take a long time to get removed from your credit report.

The problem with having a foreclosure listed on your credit report is that it hurts your credit score. In fact, it will have a very negative impact. A foreclosure should be avoided at all costs, even if you are looking forward to starting a home buying campaign. There are some options that can be used in order to remove a foreclosure. One of the most effective methods involves a short sale.

Foreclosure listings are usually placed in three credit bureaus: Transunion, Experian and Equifax. These credit bureaus are required by law to keep information about all transactions involving homeowners in their credit reports. This information is important for the credit reporting agencies to determine what loans are worth offering home loans. If you want to know how to remove a foreclosure from your credit report, a short sale is the way to go. A short sale allows home owners to sell their property for less than what they owe the mortgage company before the end of the contract.

Read Also: Cbcinnovis Credit Inquiry

How Does Foreclosure Work

While the foreclosure process may vary from state to state, they generally follow a similar course of events. Lenders will typically use one of two methods to begin foreclosure proceedings. The judicial sale method is executed through the court system, while the power of sale is carried out completely by the mortgage lender. The judicial sale is permitted in all states, while the power of sale is only allowed in 29 states. The judicial sale method works as follows:

The power of sale method works as follows:

- The mortgage lender serves you with papers demanding payment.

- A deed of trust is drawn following a waiting period that temporarily grants the property to a trustee.

- The trustee sells the house at a public auction on behalf of the lender.

Both types of foreclosure proceedings require that advanced notice be given to the homeowner. This is especially important if the homeowner took out an additional mortgage against the property. The additional mortgage must also be paid up ahead of the auction.

Also Check: What Credit Score Is Used For A Mortgage

How To Fix Your Credit After A Foreclosure

Fixing your credit after a foreclosure is a long process that can take many years.

In general, youll need to take the following steps:

- Pay your bills on time: Your payment history is the most influential factor that goes into calculating your credit score. It accounts for 35% of your FICO score and 40%41% of your VantageScore, so establishing a record of on-time payments is the best thing you can do to rebuild your credit.

- Keep credit utilization low: If you have high balances on your credit accounts, reducing your can boost your score. 13 According to VantageScore, using less than 10% of your available credit is ideal. 14

- Get a secured credit card or credit-builder loan: Itll be harder to qualify for new credit after a foreclosure, but you can still get a secured credit card or , which are specifically designed for people with bad credit scores or no credit history. Making all your payments on time will boost your score in the long term and reestablish your reliability as a borrower.

A foreclosure has a severe, long-lasting effect on your credit. However, like all negative marks on your credit report, itll become less harmful over time and eventually be wiped off your report entirely.

In the meantime, educate yourself on how credit works, monitor your credit reports, and responsibly manage your open accounts to ensure that your score continues to recover.

Takeaway: A foreclosure will stay on your credit report for seven years.

How Does A Foreclosure Impact Your Credit Score

While state law governs many specific aspects of how foreclosures proceed, the federal government does have restrictions on when the process can start. In most cases, lenders cant start foreclosure until youre at least 120 days delinquent on your mortgage payments. Theres a good chance youll miss at least four payments before a lender notifies you that foreclosure is on the table.

The impact of a foreclosure on your credit score, however, starts before the official notification. Missing even a single mortgage payment can have an impact on your score. Depending on your current score, one skipped mortgage payment has the potential to drop your FICO score by 100 points or more. In fact, the higher your current score, and the cleaner your record, the bigger your drop if you miss a mortgage payment.

Each subsequent missed payment leading up to the actual foreclosure impacts your credit score as it goes along. One of the reasons a foreclosure is such a big deal is due to the fact that each of your missed payments has a cumulative effect in lowering your score.

You May Like: How Fast Will A Car Loan Raise My Credit Score

Avoid Negative Credit Reporting

Aside from making on-time payments, there are other things you can do to avoid negative reports on your credit. The U.S. Department of Housing and Urban Development has several free resources and information to avoid foreclosures. You can also get access to a housing counselor in your area.

Another surprising source of help can be your own lender. Contact them to go over options to avoid foreclosure. Many lenders will be willing to help because of the risks, financial and otherwise, of completing a foreclosure. Thats also why its important to keep in touch with and not avoid your lender.

How Long Does A Foreclosure Stay On Your Credit Report

Quick Answer

A foreclosure stays on your credit report for seven years after the first missed mortgage payment that started the foreclosure. But the harm caused by a foreclosure should diminish over time.

Through December 31, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

Foreclosure occurs when a lender takes possession of a home after a homeowner misses several months of payments. Record of a foreclosure remains on your credit report for seven years from the date of the first missed mortgage payment that led to the foreclosure action.

In addition to loss of the home, it can have long-lasting negative effects on the mortgage borrower’s credit and ability to secure a new loan. Foreclosure can drag down your credit scores the entire time it’s present, although its impact typically diminishes with time.

Recommended Reading: How To Remove From Credit Report

Quick Tips For Rebuilding Your Credit

Just because a foreclosure stays on your credit report for seven years doesnt mean you cant start rebuilding your credit now. Here are five strategies for improving your credit score while you wait for a foreclosure to drop off your report.

-

Pay your bills on time Your payment history makes up 35 percent of your credit score, making it the most important factor in your score. Make sure you pay all your creditors on time every month so you dont accumulate any late payments on your credit report.

-

Become an authorized user You can piggyback on someone elses good credit by becoming an on their credit card account. Just make sure the creditor reports authorized user activity to the credit bureaus.

-

Pay off debt Paying off debt will improve your ratio, which accounts for 30 percent of your credit score. You should try to keep your ratio as low as possible and by no means higher than 30 percent.

-

Open a secured credit card A foreclosure can lower your credit score considerably, making it hard to qualify for a regular credit card. Fortunately, you can probably still qualify for a secured card, which you can use to build a positive payment history.

-

Take out a credit builder loan With a , you pay into a kind of savings account and then receive the loan money at the end. This gives you an opportunity to establish a positive payment history, which can boost your credit score.

Also Check:

How Much Does A Foreclosure Affect My Credit

Scoring systems used by both FICO® and VantageScore® consider foreclosure a derogatory event. And while the impact to credit scores will vary by consumer, it’s safe to say that a foreclosure can be very problematic.

The foreclosure itself, as well as the late payments that preceded it, will have a major impact on your credit scoresespecially if your scores were high to begin with. If your score is on the high end of the scale, you may see a much more significant impact than someone whose credit score is lower.

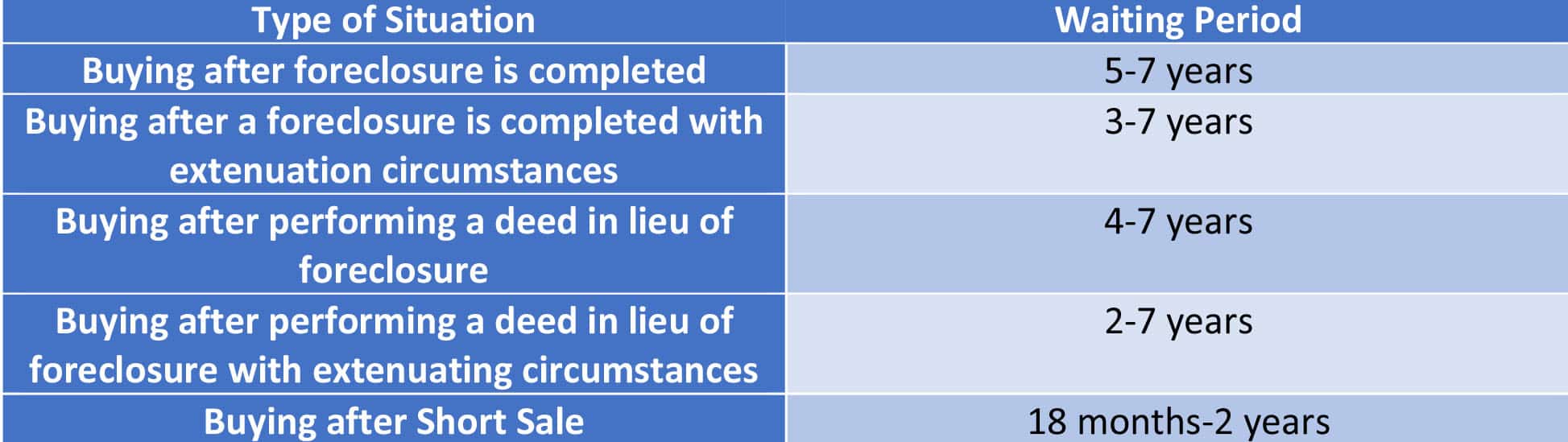

In addition to a foreclosure’s potential impact on your credit scores, it may also cause you to face consequences due to mortgage policies published by Fannie Mae and Freddie Mac. You may not be eligible for either a Fannie Mae- or Freddie Mac-backed loan for several years if you’ve gone through a foreclosure. This penalty is called a mandatory waiting period, and it may freeze you out of the homebuying market for as long as seven years regardless of how well your credit scores have recovered.

Recommended Reading: What Is A Closed Account On Credit Report

Focus On Getting Your Finances Back On Track

The foreclosure process can be overwhelming, but often it doesnt make financial sense to hold onto a property you can no longer afford. Even if you manage to stop a foreclosure and reinstate the loan by paying the overdue balance , your credit history may already be damaged. Every late or missed payment can negatively impact your credit scores.

Unfortunately, a foreclosure remains on your record with all three nationwide credit bureaus for seven years. However, the negative impact of a foreclosure lessens over time. Depending on other elements of your credit history and the type of mortgage lender, you may even be able to qualify for a new home loan as soon as two years after your foreclosure is completed.

Foreclosure Lowers Your Credit Scores

FICO credit scores, the most common type of credit scores, have a 300850 range. In general, a foreclosure will drop your FICO credit scores at least 100 points, probably more. Past-due reports for missing your payments can also drop your scores, assuming the timeshare lender or developer reports them.

The actual drop in credit scores can vary from one borrower to the next. The hit is more severe if you had very high credit scores before the foreclosure action. If you already have low credit scores, you’ll see less of an impact.

Read Also: How Long Does Chapter 7 Bankruptcy Stay On Credit Report

What Are Some Other Ways That Foreclosures Can Cost You

Many people dont realize the different ways your credit score impacts your everyday life. Along with access to loans or credit cards, your credit score is often used:

- As part of the hiring process to weed out candidates with low credit scores

- To set insurance rates to charge higher rates for poor credit or to disqualify people entirely

- To get approval for utilities to charge hefty deposit fees to establish service

- For other services for services such as cable and internet, you may not even qualify for service if your credit score is too low

It is also very common for landlords to run a credit check when screening potential renters.

Landlords usually weed out people with a poor credit score as a potential risk for nonpayment of rent. Unfortunately, this can make it almost impossible to qualify for a good home or apartment in a safe neighborhood.

Having a foreclosure on your credit report can make it even harder to find a place to live. But, unfortunately, many people dont realize that out until theyre already in the process of looking for a home or an apartment.

Large deposits will likely be required to establish necessities such as electricity, water, and garbage collection, which makes it even more difficult to start over and begin rebuilding your life after foreclosure.

Derogatory Mark: Account Charge

If you dont or cannot pay your debt as agreed, your lender may eventually charge the account off. The charge-off will appear on your credit reports for seven years.

What to do: Try to pay off the debt or negotiate a settlement. While this wont get the charge-off removed from your credit reports, itâll remove the risk that youll be sued over the debt.

Don’t Miss: How To Get A Copy Of My Credit Report

What Are Derogatory Credit Entries

John Ulzheimer is an expert on credit reporting, credit scoring, and identity theft. The author of four books on the subject, Ulzheimer has been featured thousands of times in media outlets including the Wall Street Journal, NBC Nightly News, New York Times, CNBC, and countless others.With over 30 years of credit-related professional experience, including with both Equifax and FICO, Ulzheimer is the only recognized credit expert who actually comes from the credit industry.He has been an expert witness in over 600 credit-related lawsuits and has been qualified to testify in both federal and state courts on the topic of consumer credit. In his hometown of Atlanta, Ulzheimer is a frequent guest lecturer at the University of Georgia and Emory Universityâs School of Law.

Edited by: Ashley Dull

Ashley has managed content initiatives for BadCredit since 2015, having worked closely with the worlds largest banks and financial institutions, as well as press and news outlets, to publish comprehensive content. Her credit card commentary is featured on national media outlets, including CNBC, MarketWatch, Investopedia, and Readerâs Digest.

Your credit reports are loaded with information, including personal data, employment information, public records, collections, credit inquiries, and your accounts.

Lets dive deeper into derogatory credit entries and how much trouble they can cause you.

Also Check: How To Dispute Hospital Bills On Credit Report