Increasing Your Credit Score

Knowing how credit scores are calculated means its fairly easy to figure out how to raise your score. But raising your score does take time. In most cases, you can instantly improve your score. The only way to get fast results is through credit repair, which can improve your score in as little as 30 days. But that only works if there are mistakes in your credit to correct. If you legitimately incurred a lot of negative items on your credit report, then its going to take some work to improve it.

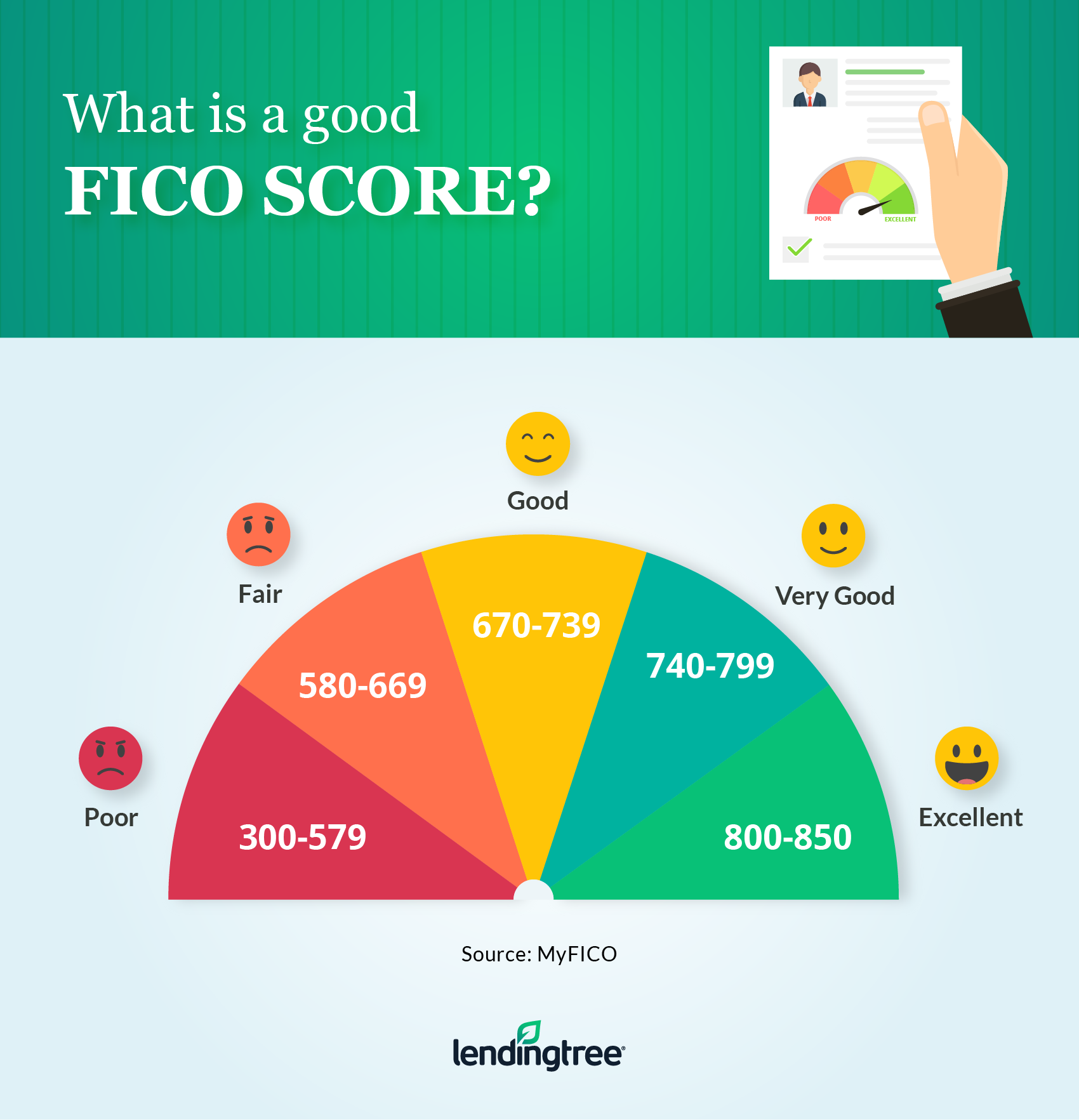

What Is A Good Fico Score

A good FICO score lies between 670 and 739, according to the company’s website. FICO says scores between 580 and 669 are considered “fair” and those between 740 and 799 are considered “very good.” Anything above 800 is considered “exceptional.”

According to FICO, the average credit score in 2021 was 716, which falls in the good range.

FICO comes from Fair Isaac Corp., the company that first developed a credit scoring system. It uses data about consumers from the three major credit reporting bureaus: TransUnion, Equifax and Experian.

FICO scores typically express a consumer’s creditworthiness as a number between 300 and 850.

Catch Credit Report Errors Early

Credit report errors can quickly turn a good score into a bad credit score, so its important to stay on top of your credit report. You can get a free credit report every year from all three major credit bureaus Experian, Equifax and TransUnion via AnnualCreditReport.com.

If you find any reporting errors that negatively impact your credit score, you can dispute them.

You can also monitor your credit more regularly through a wide range of free credit score and monitoring sites, like and .

Don’t Miss: Which Uses Credit History To Determine Credit Score

Who Calculates Your Credit Score

Your credit score is calculated by a credit reference agency . There are three CRAs in the UK: Equifax, Experian and TransUnion. At ClearScore, we show you your Equifax credit score, which ranges from 0 to 1000.

Each CRA is sent information by lenders about the credit you have and how you manage it. Other information, such as public records like the electoral roll and court judgments, are also sent to the CRAs and form part of your credit report.

Subprime Vs Prime Credit Score Designations

Prime refers to the type of financing that a consumer can receive. Prime loans are conventional loans that offer low interest rates based on a consumers credit score, with traditional terms.

By contrast, subprime refers to financing thats designed for high-risk borrowers with low credit scores. The interest rates tend to be higher and may be variable. The terms of the loans are also generally more restrictive and may be less favorable for the borrower.

Subprime loans became a buzzword during the 2008 mortgage crisis that led to the Great Recession in 2009. Mortgage lenders relaxed their standards to qualify for some loans. Customers with bad credit could qualify for adjustable-rate mortgages, often without any income verification.

When the housing bubble popped and home values fell, millions of borrowers could no longer afford their loans. It led to widespread foreclosures and created a rippling effect that crippled the American economy.

Mortgage lenders have since increased their standards again. However, this serves as a cautionary tale for any borrower with a subprime credit score. Just because you can get approved for a loan, it doesnt necessarily mean that you should get the loan. In fact, Debt.coms Chairman Howard Dvorkin warns that these same subprime lending tactics are being used in the auto loan industry.

Start improving your score so you can qualify for prime loans at the best rates and terms.

Don’t Miss: How To View My Credit Score

Lower Monthly Loan Payments

Since loan payments are directly tied to the interest rate, having an excellent credit score can make it easier to afford your mortgage or car loan payments.

Consider getting a $25,000, 60-month auto loan. With an excellent credit score above 720, you could qualify for a monthly payment of $462. A credit score of 640, on the other hand, would give you monthly payments of $538. That amount can make a big difference in your monthly budget.

What You Will Need To Close The Auto Loan

There are two main ways to get an auto loan.

Preapproval by bank or auto lender: Similar to a mortgage preapproval, this method gives you an idea of what type of auto loan you qualify for before ever stepping onto the car lot.

Your dealers partner lenders: This allows you to conveniently take care of everything at the car lot but may end up being more expensive.

Regardless of which route you take, youll need to gather some paperwork to submit with your application.

Read Also: How To Cancel Experian Credit Report

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, Experian and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate a credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

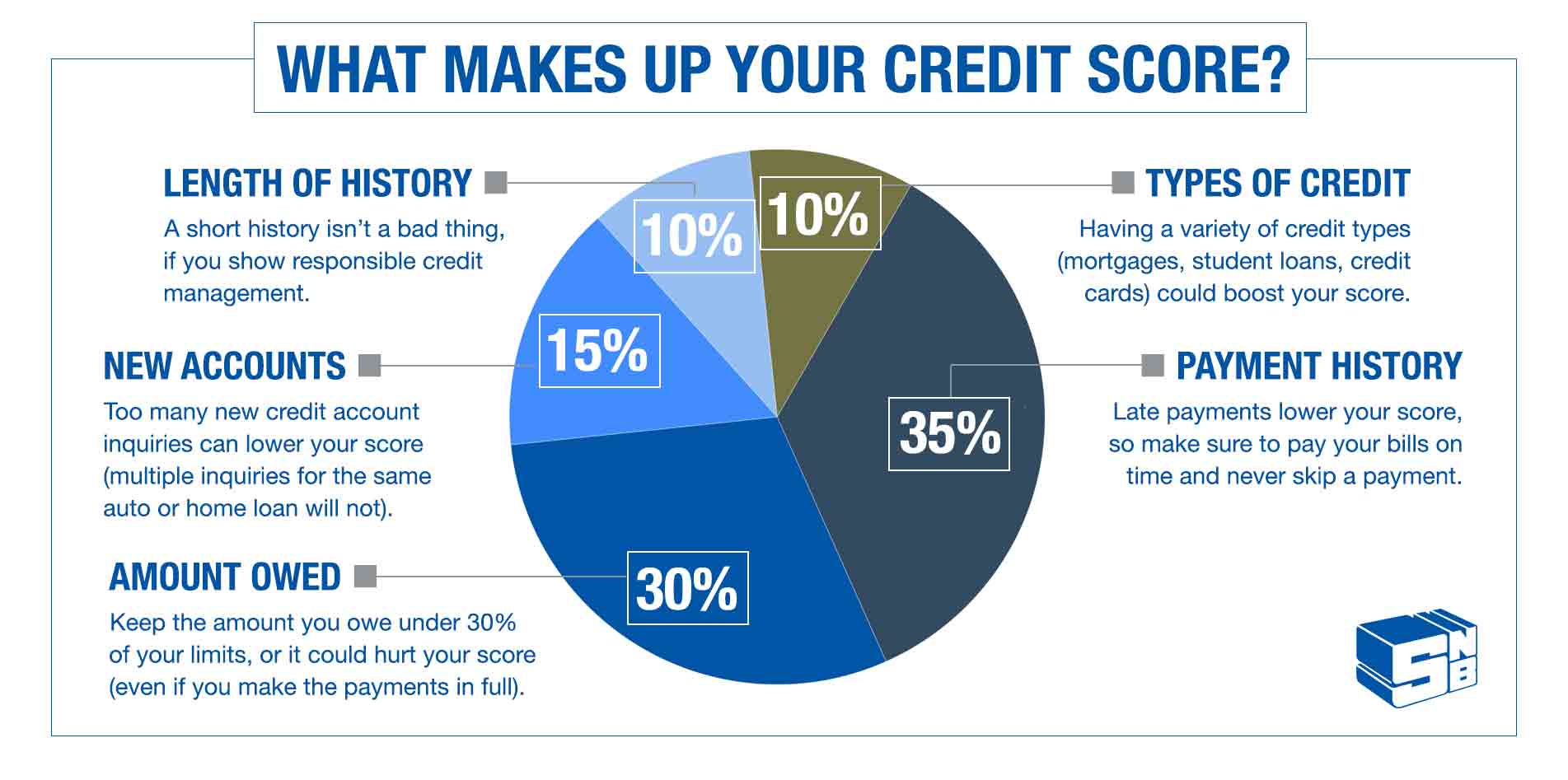

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

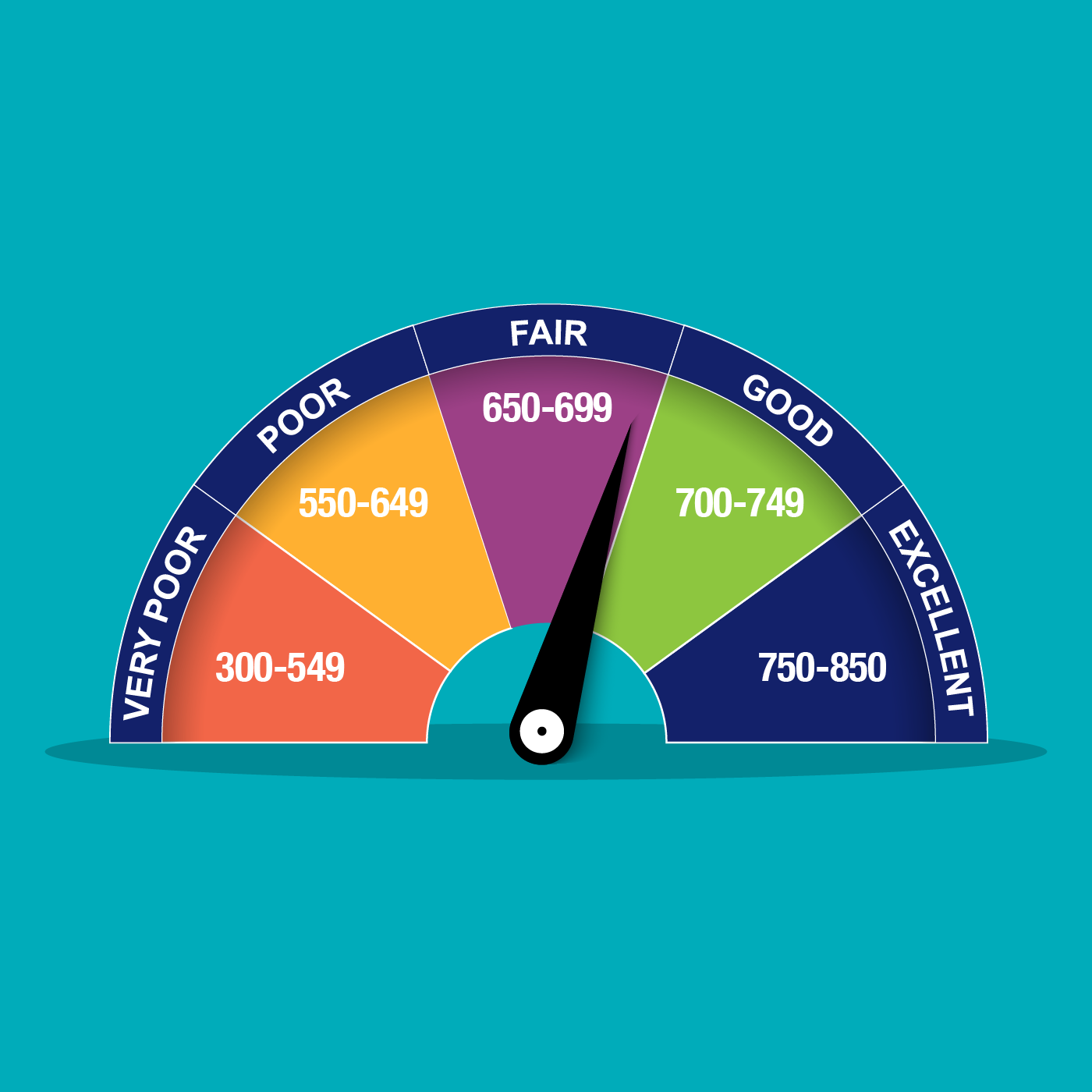

What Is A Good/bad Credit Score

There is no âmagicâ credit score that will guarantee that you get accepted for credit. Also, different lenders are looking for different things, so you might get refused credit by one lender and accepted by another.

Remember, your credit score is a useful indication of your creditworthiness, but lenders will look at other factors before deciding whether to lend to you.

You May Like: Does Apple Card Pull Credit Report

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Read Also: Does Your Credit Score Change Daily

What Changes Your Credit Score

These 5 factors provide a glimpse into your financial habits and history and help lenders assess your financial health.

Home buyers with lower credit scores are typically assigned a higher interest rate.

There is no way to get around a credit check. It is one of the things you need to buy a home during the mortgage pre-approval stage so be sure to learn more about how a mortgage pre-approval affects your credit score.

Get pre-approved for a mortgage today.

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be one reason peopleâs credit scores tend to increase as they get olderâtheir accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just the age of your accounts.

Recommended Reading: Is 684 A Good Credit Score

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

How Can You Check Your Credit Score

Its important to keep a close eye on your credit report so you can identify the factors influencing your credit score and come up with strategies for improving your credit.

Under federal law, youre entitled to a free credit report from each of the three major credit bureaus Equifax, Experian, and Transunion once each year. You can request one through the federal governments official credit report website.

When you do a , keep an eye out for errors, such as incorrect information or accounts that dont belong to you. Removing mistakes from your credit report can boost your credit score.

If you notice an error, you can reach out to the credit bureau to dispute it and possibly get it removed. Each bureau has a slightly different process, so check with the credit bureau for the best way to get errors corrected.

You May Like: How Long Derogatory Information On Credit Report

The Usefulness Of A Credit Score Is In The Eye Of The Lender

Whats more, if a particular lender considers credit scores, they are free to use whichever score or combination of scores they feel will best help them make a decision. They can also assign whatever weight or significance to a score or scores they would like.

So, generally speaking, whats a good credit score for an applicant? Its a score which, if used by a lender, is high enough to convince that lender to lend to that applicant under favorable terms.

What Credit Score Is Needed To Buy A House

You dont need flawless credit to get a mortgage. But because credit scores estimate the risk that you wont repay the loan, lenders will reward a higher score with more choices and lower interest rates.

For most loan types, the credit score needed to buy a house is at least 620. However, a higher score significantly improves your chances of approval, as borrowers with scores under 650 tend to make up just a small fraction of closed purchase loans. Applicants with scores of 740 or higher will also get the lowest interest rates.

Read Also: How To Remove Ad Astra Recovery From Credit Report

How To Maintain A Good Credit Score

Practicing healthy credit habits can help keep your score in a good range. Its smart to keep your balances as low as possible. Your credit utilization, which is how much of your available credit limit youre using, is a major factor in credit score calculations. Popular advice is to keep your utilization rate below 30%. But the lower the better its smart to leave some breathing room should an unexpected expense come up.

Because your payment history is another important credit score factor, youre likely to achieve and maintain a good credit score by not missing payments. Automate payments when you can because with multiple services, subscriptions and accounts, it can be easy to let one accidentally slip.

Aim to only apply for credit when needed. Of course, theres no need to avoid credit altogether. For many people, lifes major purchases may require loans or other credit, and a good credit score lays the groundwork for your credit goals. But because new credit may result in hard inquiries on your report its smart to limit credit applications.

Some people like to take advantage of rewards credit cards that are geared toward those with good credit scores. Just make sure youre mindful in your approach and not overspending and over-applying for the sake of some cash back or travel points.

How Can I Improve My Credit Scores

The good news is your credit score is not a fixed number. With time and responsible choices, it can be improved. Just keep in mind that this process takes patience. This is especially true if you haven’t kept the best credit habits in the past.

Some credit habits that could improve your score in the long term include making your payments on time, keeping old accounts open to lengthen your credit history and keeping your credit utilization rate low.

You’ll also want to make sure to keep tabs on your credit report to confirm that the information included is up to date. .

You May Like: How To Dispute A Missed Payment On Credit Report

Regularly Read Your Reports

Since your credit score is based off of the information in your credit report, take time to review your reports regularly. You want to be sure everything is an accurate, true reflection of your financial story. As you become more comfortable reading and understanding the data in your report, the easier it is to identify which information is potentially causing changes in your credit score.

To help you understand your credit report, weve created an interactive guide that breaks down each section and explains how the information may impact your credit score.

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located .

What Is A Good Credit Score Range For Buying A Home

If your credit score range is between 740 and 850, you are likely to have the widest range of choices and the most attractive interest rates for your mortgage loan. Most lenders determine mortgage rates by credit score, making it less likely to achieve low interest rates if your FICO® scores are below 740.

You might still be offered a mortgage loan with lower scores, but the terms may not be as favorable. You could also be approved for a lower mortgage amount than the sum for which you originally applied.

The Federal Housing Administration may also be an alternative for first-time home buyers who meet certain criteria. If you are wondering how to buy a home with bad credit, an FHA loan may be the answer for you. Some of the primary requirements for an FHA mortgage include the following:

- You must provide a down payment of at least 3.5 percent of the homes value.

- You must be a legal resident of the U.S. with a valid Social Security number.

- Your debt-to-income ratio, including all outstanding loans and your new mortgage, must usually be 43 percent or less.

- You must have worked for the same employer for at least two years or have a generally stable employment history to qualify.

Also Check: How Do You Get Your Credit Score Up

How A Bad Credit Score Can Hurt You

Denials for credit

A bad credit score can reduce your approval chances for credit cards and loans, making it difficult to accomplish many goals. If you want to get out of debt with a balance transfer card, such as the Discover it® Balance Transfer, you’ll need good or excellent credit. And if you want to earn rewards or receive luxury travel perks, it’ll be near impossible to find a card that accepts bad credit.

Less favorable loan terms

If you’re approved for credit, odds are you’ll receive less favorable terms, such as high interest rates or annual fees, compared to applicants with good credit. For example, one of CNBC Select’s best credit cards for bad credit, the OpenSky® Secured Visa® Credit Card, has a $35 annual fee though there are no annual fee options.

Limited credit card choices

Bad credit limits which credit cards you can qualify for the options you have will be primarily secured cards. While a secured card, such as the Discover it® Secured Credit Card or the Capital One Platinum Secured Credit Card, can help you rebuild credit, you’re required to make a security deposit typically $200 in order to receive an equivalent line of credit.

Take note that even if your credit score falls within the bad range, that is not a guarantee you’ll be approved for a credit card requiring bad credit. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

Work With A Trusted Mortgage Loan Officer

Your mortgage lender is the ideal resource for asking questions about any part of the homebuying process before you are even ready to apply.

The professional loan officers at Homefinity can get you pre-approved so you can solidify your budget and take the proper next steps. or apply now to get started.

Recommended Reading: Can You Dispute A Closed Account On Your Credit Report