How To Cancel The Experian Account On Amazon

Choose my subscriptions to see your subscription payment through your Experian account. Select the Signature you want and click cancel “cancel.” Tip: Your service is usually not canceled before the next billing day. This means that you could access all the features that you signed up for that season.

How Do Icancel My Experian Subscriptions Through An App:

As a member of the Experian account, it may be tricky in cancelling manually your subscription through email, phone number or online mode. You can choose another option for cancelling Experian subscription UK. Use the DoNotPay app to cancel the subscription.

You need to follow the instructions to complete the cancellation process:

Canceling A Creditexpert Subscription

Tip: Your service typically won’t cancel until the next billing date. This means you’ll still have access to all the features you subscribed to up until that date. However, if you cancel after a billing date and haven’t paid, you may owe for the balance of the time before you canceled.

Recommended Reading: How To Unlock Experian Credit

How To Cancel Experian Memberships

The Plum Basket provides a straightforward, step-by-step guide to help you cancel Experian accounts. Start by logging into your account, then change your account settings. Underneath the “My subscription” menu, you should see an option to cancel your subscription. Click it, and then you’re done.

Video of the Day

However, if you’re having trouble navigating the settings on Experian’s website or you are using the Experian phone or tablet app, Justuseapp.com offers detailed guidance for each kind of device, site and app you may be using to cancel your subscription.

If you would prefer to have confirmation that you’ve canceled your subscription from a human in order to avoid any technological snafus, you can call Experian’s service center at +1 284-7942. Truebill provides guidance to help you speak to a live human representative and get the most out of your conversation. They also offer a short checklist of the key points you should confirm with the Experian representative while on the phone in order to ensure that your account is definitely canceled.

How To Cancel Online Experian Service Or Membership

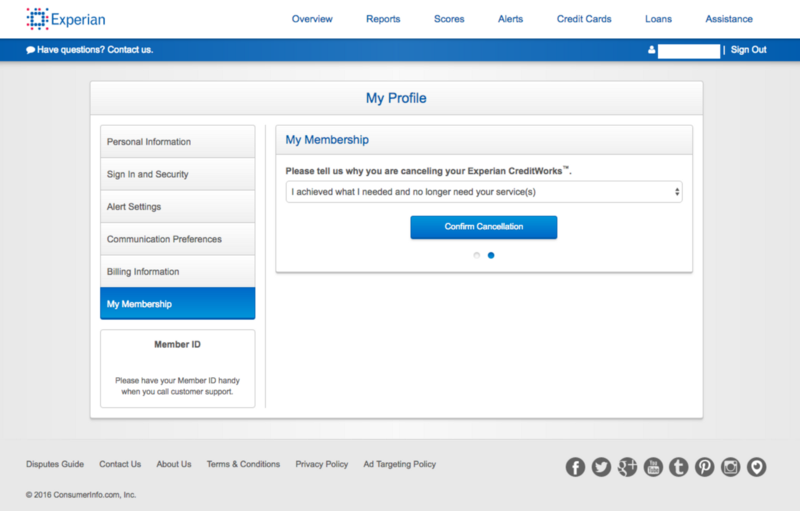

To Cancel Experian Subscription Online, perform the below guidelines

Canceling online possibly works in case if you joined through its official website usa.experian.com. In case you sign in and are diverted to experian.experiandirect.com, you shockingly cant cancel online.

- First o all, head to this connection

- Then, sign in to your account

Whenever inquired as to whether you might want to add Equifax and TransUnion, select No, Show Me Only My Experian Credit Information.

Select why you are canceling from the dropdown.

Also Check: Check Credit Score Usaa

Withdrawing A Filed Dispute From Your Credit Report

If you have ever disputed or hired someone to dispute an item on your credit report, there is a possibility that you still have an open dispute showing up on your credit history. Normally, this doesnt matter. However, with the strict new guidelines associated with conventional mortgage loans, an open dispute is unacceptable and must be closed or removed. FHA guidelines do allow open disputes, but you are limited to FHA funding amounts and fees.

In most cases, when you file a dispute, the lender acknowledges it and provides the credit bureaus with a notice that confirms or denies the fact. However, some lenders just dont respond and simply let it remain pending. This can become a nightmare if you are looking to buy a home. Yes, its unfair, but not illegal.

So now you come to find out that there is such a dispute open on your credit file and because of it, you no longer qualify for a conventional home loan. Are your home buying dreams over? NO WAY! There is a solution and its fast and easy.

Your only option is to withdraw, remove, retract, or revoke the dispute you filed or had filed. By the time you find out, its probably an urgent matter so there is a process you can follow to do this quickly, or, if you have time , you can take the snail mail approach.

Experian:

Phone Number: 714-830-7000

TransUnion:

Phone Number: 312-985-2000

Equifax:

Phone Number: 404-885-8300

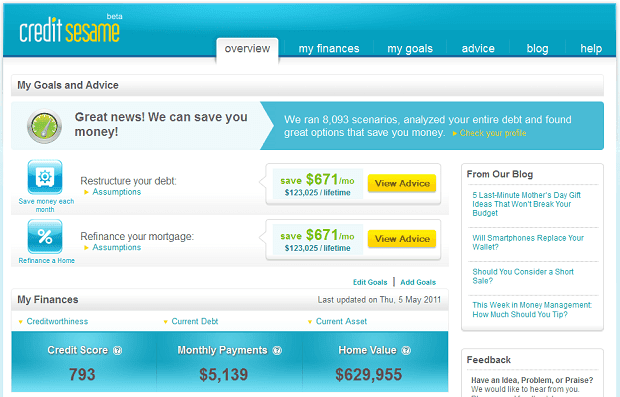

Keep An Eye On Your Credit Report And Score

Canceling a credit card may or may not affect your credit score, but it’s important to go through the process thoughtfully and carefully to make the process go as smoothly as possible.

After you close the account, check your credit report to confirm that the information regarding that closed account is accurate.

Also, keep an eye on your to see how it changes once the closure goes into effect. It may take a month or so to update but check regularly to understand its impact and take further steps as needed to get your score back to where you want it to be.

Recommended Reading: How Do I Get A Repo Off My Credit

Legal Shield Identity Theft Premium Plan

3:31

Jobs related to cancel experian creditworks premium are always available on our site. These jobs have got much attention from candidates and are highly appreciated for their transparency, as well as attractive salaries and remuneration. Besides, new jobs for cancel experian creditworks premium are also updated regularly to help job seekers find the most suitable jobs. This is to support people to find a job that you like in the shortest time without too much effort. Also, thanks to the jobs suggested by us, you can learn more about companies in your area of interest, as well as the market’s human resources needs

Which Companies Report To The Credit Bureaus

Insurers don’t file reports with the national credit bureaus, but the following do report your payment activity:

- Mortgage lenders, including banks, credit unions and online financing companies

- Student loan providers, including private lenders and issuers of federal student loans

- Auto finance companies

Landlords and property managers have the option of reporting rent payments to credit bureaus, but few of them do. If present in your credit report, only the newest versions of the FICO® Score and VantageScore® scoring systems will factor rent payments into your credit scores.

Reviewing your credit scores regularly can give you a good idea what lenders and insurance companies will find when they check your credit. You can check your Experian credit report and see a FICO® Score based on it for free every month as part of the through Experian. You’ll also be alerted whenever there’s new activity on your Experian credit report.

Read Also: Shopify Capital Complaints

Contact Your Card Issuer

Depending on the company, you may be able to request to close an account via live chat or a secure online message, though some card issuers require you to call.

Again, the card issuer might try to entice you to stay with a counteroffer. But if you’re sure you want to cancel the account, politely refuse and ask them to process the closure. Be sure to confirm that your account balance is zero.

At the end of the process, your card should be canceled immediately. They’ll send you written notice of the card’s cancellation that includes details of the closure.

Cancel Experian Over Phone

If all else fails, the most reliable way to cancel is by calling them at 6171894. Here are their hours:

- Mon-Fri: 6am-6pm PST/9am-9pm EST

- Sat-Sun: 8am-5pm PST/11am-8pm EST

Dont forget to keep a record of your cancellation just in case the subscription isnt canceled and you have to contact Experian again. If you cancel through email or online, you should have an email record. If you cancel over the phone, write down the cancellation confirmation number, the date you called in, and the representatives name and email the information to yourself for future reference.

If you enjoyed this, dont be shy about for it!!

Read Also: Does Paypal Credit Report To Credit Bureaus

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Experian Cancellation By Phone

If all else fails, phoning them at 6171894 is the most dependable way to cancel. Their working hours are as follows:Mon-Fri: 6 a.m. to 6 p.m. PST/9 a.m. to 9 p.m. EST

Sat-Sun: 8 a.m. to 5 p.m. PST/11 a.m. to 8 p.m. EST

Keep a note of your cancellation in case your membership isnt cancelled and you need to contact Experian again. You should have an email record if you cancel via email or online. If you cancel by phone, make a note of the cancellation confirmation number, the date you phoned, and the representatives name and email it to yourself for future reference.

You May Like: How To Report A Death To Credit Bureaus

Faq Experian Refund Auto Payment Cancel Service Stop Temporally

Experian Cancellation Contact Telephone Number

dial Toll Free Number 6171894 of Experian

What do I if I dont perceive an account on my Experian Credit Report?

What amount of time does it require for a default installment to be reflected in the financial assessment and report?

Is Experian Connect safe?

Is There An Annual Fee Or Security Deposit

If you’re paying an annual fee on a credit card you don’t use much, and don’t feel you’re getting enough value from the card’s rewards or perks, it may make sense to cancel it.

But if the annual fee is the only reason you want to cancel the card, call your issuer and ask them if they can either waive the fee or convert the card to another one that doesn’t carry an annual fee. This may allow you to keep the account open at no additional cost.

If you have a secured credit card and you’ve improved your credit score enough that you qualify for an unsecured card, consider asking the card issuer if you can get your deposit back but keep the account open.

If you can’t get the card’s annual fee waived, have it converted it to one with no annual fee or get your deposit back, canceling the card may be your best option.

You May Like: How To Check Credit Score With Itin

How Long Have I Had The Credit Card

The age of your credit accounts is one of the factors that help determine your credit score. There are two elements that determine the length of your credit history: how long you’ve been using credit and the average age of your credit accounts.

Canceling a credit card will affect the average age of your accounts, but not always immediately. An account in good standing will stay on your credit report for 10 years, and your payment history on that account will be factored into credit scores the entire time it remains. You might see credit score effects when it comes to length of credit history, however, since closed accounts aren’t weighted as heavily as accounts you still use, and not every credit scoring model treats closed accounts the same way. Also, once it’s closed, the account won’t continue to age and increase your length of credit history any more than it already has.

Before closing a credit card that you have had for a long time, consider whether you really need to. If you don’t use it and don’t want to be tempted by it, store the card in a secure place or even cut it up.

If you’re worried about potential fraud, some credit card companies allow you to freeze your card account via their mobile app, making it impossible for anyone to use it for new purchases.

Donotpay Can Help You Avoid Getting Billed After The Free Trial

When people sign up for a free trial, they tend to forget about canceling it on time. They usually realize that their subscription is active only when they notice unexpected expenses on their bank statements. To help you avoid this issue, DoNotPay can provide you with a virtual credit card.

DoNotPay’s virtual credit card generator enables you to create a new credit card number that you can use to sign up for services and verify your payment info without worrying about information abuse and theft. To Experian, it will seem like a regular credit card, but they wont be able to charge after your free trial is over.

You May Like: Does Carvana Report To Credit Bureaus

Canceling Your Experian Membership

One of the most common situations people get into when it comes to monthly subscriptions is forgetting to cancel a service after the free trial. If you sign up for a free trial with a service like Experian, its a good idea to set a reminder or write a note in your calendar reminding you to cancel the membership in two weeks.

That gives you plenty of room to procrastinate a couple of days, without racking up unnecessary fees. It also helps tidy up the digital legacy you leave behind.

Categories:

How Did Experian Deal With Fraud And Identity Theft

Fraud and theft are the same. you have any questions about you Experian member? Call us at 18666171894 at 6 am Monday to Friday. to 8 p.m. Pacific time to 5. Peaceful afternoon time. International callers who have difficulty dialing these numbers must contact Ask their phone service provider for help.

Also Check: Les Schwab Credit Score Requirements

Why Insurance Companies Don’t Report To The Credit Bureaus

The three national credit bureaus compile information about your history of borrowing and repaying debt in the forms of installment loans, such as mortgages, auto loans and student loans, and revolving credit, such as credit cards and lines of credit.

When you purchase insurance coverage, you agree to make premium payments on a schedule spelled out in your policy. The insurance company isn’t lending you money, and the contractual obligations to pay insurance premiums aren’t considered debts, so insurance companies don’t report payments to the credit bureaus.

Insurance companies may consider your credit when you open your policy, however. Insurers in many states, most notably auto insurers, may use what’s called a to help determine your premiums. That’s because insurance companies have found that an insured person’s credit health can help predict how likely they are to file a claim.

How Do I Maintain Experian Credit Report

International callers who have difficulty dialing these numbers must contact Ask their phone service provider for help. How you want to discussion? How I’m being criticized over the phone! Experian I believe that the best way to do this can be to provide consumers who receive a personal credit report model.

Don’t Miss: Check Credit Score Without Social Security Number

How Can I Delete My Experian Membership Online

How to Cancel Experian Online cancellation is only valid when you log in for the following reasons. When you open and redirected to Unfortunately you can’t cancel online. head to This page. Log in to The reason of these. Asked if you like it? to Add Equifax and TransUnion Select No, just show my credit. Choose the cancellation method from the list of leakage. Click Confirm to cancel. See More. How to Cancel Experian Online cancellation is only valid when you log in through the following methods and you’ll be redirected when you open in to Unfortunately you can’t cancel online. head to This page. Log in to The reason of these. Asked if you like it? to Add Equifax and TransUnion Select No, just show my credit. Choose the cancellation method from the list of leakage. Click Confirm to cancel.

How To Cancel A Dispute With Experian

I did an online dispute with a CA I didn’t recognize with Experian and then decided to call the CA myself a couple days later and it turns out it is my debt just that it was sold from a previous CA. How do I cancel my dispute with Experian cause I heard that if Experian verifies it, it’ll renew the 7 year limit and refresh the debt? Is this true

wrote:

I did an online dispute with a CA I didn’t recognize with Experian and then decided to call the CA myself a couple days later and it turns out it is my debt just that it was sold from a previous CA. How do I cancel my dispute with Experian cause I heard that if Experian verifies it, it’ll renew the 7 year limit and refresh the debt? Is this true

It wont “renew” anything because removal is based on DOFD. It will still drop of as planned.

Also, disputes do not restart SOL, so debt wont be “refreshed”

It may cause a scoring drop if it comes back as verified because it makes delinquency “appear” more recent, but there is no re aging involved.

Do yourself a favor and pay it, see if CA will do PFD first.

If they cannot verify, reporting may get removed, but debt will get resold and you’ll be right where you started.

Also Check: How To Remove Repo From Your Credit Report