What Is A Credit Scoring Model

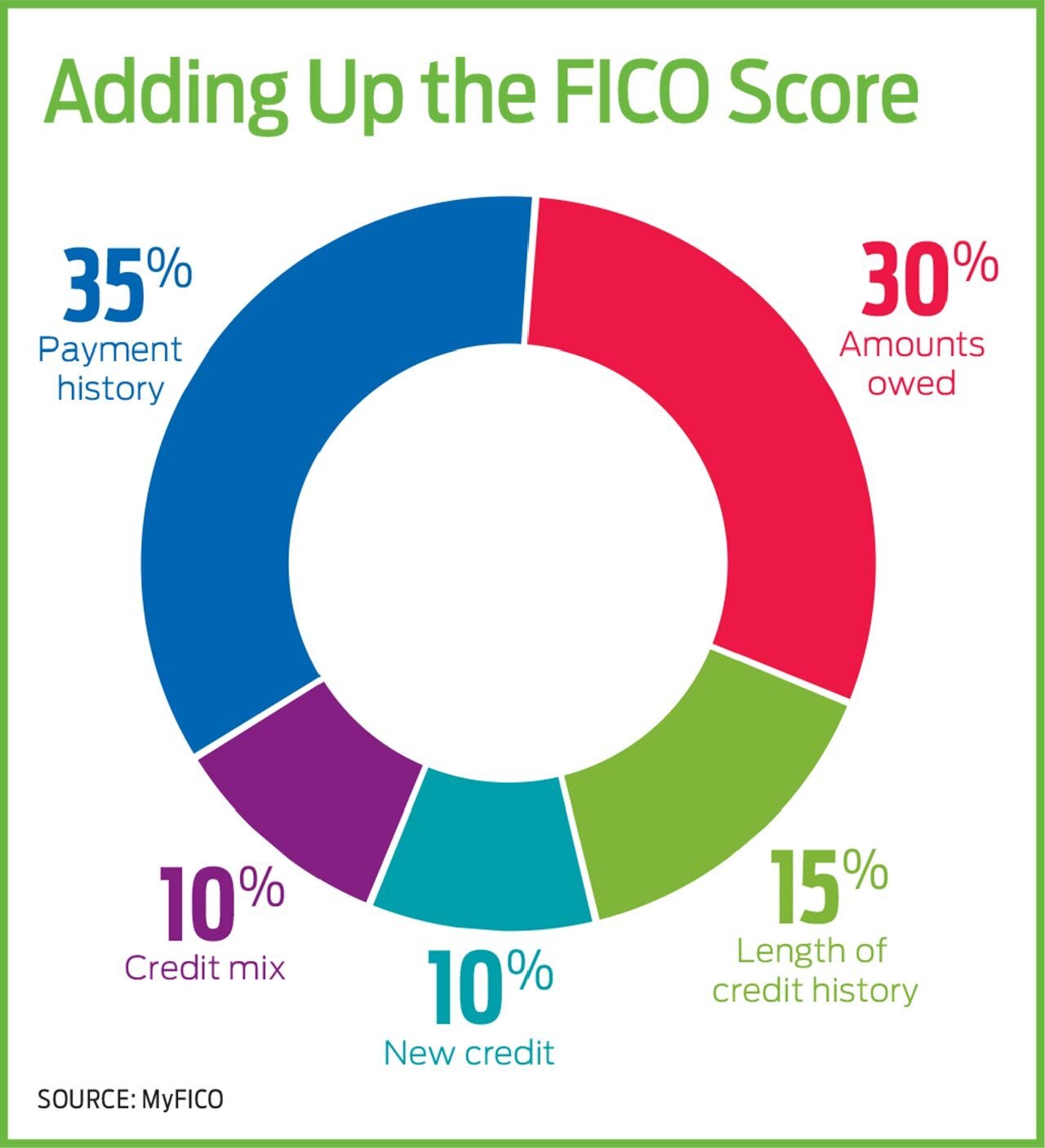

Scoring calculations are based on payment record, frequency of payments, amount of debts, credit charge-offs and number of credit cards held. A weight is assigned to each factor considered in the models formula, and a credit score is assigned based on the evaluation.

Scores generally range from 300 to 850 .

Lenders use credit scores to help determine the risk involved in making a loan, the terms of the loan and the interest rate. The higher your score, the better the terms of a loan will be for you. There are different credit score models, which emphasize varying factors.

The Minimum Required To Calculate A Credit Score

For a credit score to be calculated, your credit report must contain enough informationand enough recent informationon which to base a credit score.Generally, that means you must have at least one account that has been open for six months or longer, and at least one account that has been reported to the credit bureau within the last six months. What are the minimum requirements to have a FICO Score?

The Credit Reporting Agencies Use Slightly Different Versions Of Each Of Fico Score

The credit reporting agencies also use slightly different models on the newer versions of the FICO score including the general FICO scores and the industry-specific FICO scores. Moreover, the most common scores used will vary according to the credit bureau reporting the score.

The most widely used version by all 3 credit reporting agencies is FICO Score 8.

- For auto lending: FICO Auto Score 8

- Experian: FICO Auto Score 2

- Equifax: FICO Auto Score 5

- TransUnion: FICO Auto Score 4

Note that all 3 credit reporting agencies use the same VantageScores regardless of the type of lending, since they developed the VantageScore. Unlike FICO, VantageScores do not have industry-specific scores.

Home Mortgage Lenders Use Older Versions of FICO Scores

Most home mortgage lenders use older versions of the FICO score, because Fannie Mae and Freddie Mac both require the use of such scores for loans that the lenders sell to these government agencies. These scores are the FICO Scores 2, 4, and 5, depending on the credit bureau that calculates the score. The credit bureaus also use slight modifications of the scores and new names to distinguish themselves from their other 2 competitors:

- FICO Score 2 based on Experian data

- FICO Score 5 based on Equifax data

- FICO Score 4 based on TransUnion data

Recommended Reading: Does Capital One Report Authorized Users To Credit Bureaus

Fewer Credit Cards Are Better

Like many award-travel enthusiasts, I have numerous credit card accounts. In response to hearing that, some conclude that my credit must be terrible. They might be surprised to learn that I have excellent credit not despite my numerous accounts, but because of them.

Each account, when managed responsibly, adds positive information to my credit history and helps me to maintain my high credit scores. So if you have little-used accounts with no annual fee, theres really little reason to close them.

Look at it from the lenders perspective: Would you rather offer a new line of credit to someone with a very limited record of paying back loans, or someone with a very extensive history of managing multiple credit lines responsibly?

How Your Credit Score Is Used

When you apply for a credit card or loan, the creditor or lender uses your credit score to inform their decision on whether to issue you credit or not. The credit score gives a snapshot of how reliable you are as a borrower, which lets lenders know whether you are a good risk for a loan or credit card or not.

Lenders aren’t the only ones who check credit scores, however. Your utility company, landlord, and cell phone company may all check your credit score to get a picture of how reliable and financially stable you are.

These higher interest rates are designed to lower the risk that lenders take on by offering loans or credit cards to less reliable borrowers.

Read Also: Credit Score To Get Chase Sapphire Reserve

Where Does My Credit Score Come From

Your credit score is based on information the three major credit bureaus Equifax, TransUnion® and Experian collect about you from creditors. Creditors include companies you borrow from or make payments to. Your mortgage or student loan lender, your credit card company, your landlord and your utility company can all report information to the credit bureaus about how you make payments.

Your credit score comes from the information on your credit report. Credit reports are detailed summaries of your borrowing history. They show previous and current credit accounts and your payment history. When you apply for a loan, your lender uses your credit report and score to determine whether to lend you money.

There are many places where you can learn your credit score. Youll probably find that your score changes depending on where you look. There are a couple of reasons for this:

- Each credit bureau gets slightly different information about you based on which creditors report to them and what information they report.

- The credit bureaus use different calculations to determine your score. These calculations are known as credit scoring models. Many banks and lenders use the FICO® Score, but there are many other models available.

How Do I Improve My Credit

Look at your free credit report. The report will tell you how to improve your credit history. Only you can improve your credit. No one else can fix information in your credit report that is not good, but is correct.

It takes time to improve your credit history. Here are some ways to help rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing you can do.

- Lower the amount you owe, especially on your credit cards. Owing a lot of money hurts your credit history.

- Do not get new credit cards if you do not need them. A lot of new credit hurts your credit history.

- Do not close older credit cards. Having credit for a longer time helps your rating.

After six to nine months of this, check your credit report again. You can use one of your free reports from Annual Credit Report.

Recommended Reading: Syncppc

Read Also: How To Remove Car Repossession From Credit Report

How Long Of A Credit History Do You Need

Credit history is important to improve your chances for loan approval. Lenders look closely at your credit history to determine how likely you are to repay your loan on time.

Lenders are taking a risk on any individual who requests a loan. Your credit history is the best indicator they have to assess your overall credit health and reliability.

A longer credit history shows you have more experience using credit, and this helps lenders be more accurate in the level of risk they take when lending to you. If you have a history of on-time payments, it indicates youre likely to make your payments on time if extended credit.

If you have no credit history, the lender has no real basis for the decision. The catch-22 is that you need a credit history in order to get credit or a loan. This can make it difficult for first-time credit applicants to get approved for credit. In the next section, we outline ways to improve your credit history when youre starting out.

Types Of Credit In Use

FICO will take into consideration your mix of credit cards, retail accounts, installment loans, finance company accounts and mortgage loans. This does not mean that you need to go out and have one of each type of credit line. You do not want to open new credit lines that you do not need. It is just not a good idea to open multiple credit accounts trying to get that mix. Some lenders will use too much available credit against you in the decision-making process. Conversely, if all you have is one credit card, that may affect your score negatively but also not fit the lenders requirements for credit.

Many people feel that they are being responsible never having to use credit but that is not the case. The FICO scoring model wants to see how you handle access to credit. If you have no credit accounts then you have no history showing you can handle it.

- The scoring model and lenders will want to know what types of credit accounts are on your report? Do you have experience with both revolving and installment accounts? Has the credit experience been limited to one kind of account?

- How many accounts of each type exist? FICO also looks at the total number of accounts established. For different credit profiles, how many is too many will vary depending on the overall credit picture.

Donât Miss:

You May Like: Carvana Interest Rates

New Accounts And Credit Inquiries

Hard and soft inquiries happen when you apply for new credit accounts, or sometimes when you set up utilities or rent an apartment. Hard inquiries typically stay on your credit reports for two years. And if you have a large number of hard inquiries in a short period of time, it may lower your scores because lenders could view you as a borrower whos seeking credit.

How To Improve Credit History

Be careful with opening new credit accounts, as it can drag the average age of your accounts down. It can also lead to a temporary dip in your score because its a hard inquiry. This isnt to say you shouldnt get new credit but consider the implications before doing so.

Likewise, avoid closing accounts if you dont need to, as that also brings the average age of your accounts down. Its better to keep the account open and active instead.

Another idea to try is becoming an on an old account. This may especially be useful if youre relatively young and havent been eligible for credit long enough to have a long history. For example, if your mom has had a credit account for 20 years with good credit history, you could ask her to add you as an authorized user. This is helpful if youre new to credit and need somewhere to start while you build your own credit history.

Aside from the mentioned, an overlooked tip to try is to check your credit report to ensure there are no mistakes. You can get a free copy from any of the three major credit bureaus. Be sure your name, Social Security number, other personal information, and credit history are all accurate.

To improve credit history, the best credit advice is to wait it out and keep all your accounts in good standing. Also, remember credit age isnt the most important aspect of a credit scorethere are bigger factors to focus on. Making payments on time for all the accounts you have is the best thing you can do for your score.

Read Also: Qvc Card Approval

How Do Landlords Use Credit Scores

Landlords, however, are not lenders in the traditional sense. How are you going to use the credit score of prospective tenants to run your rental business?

Landlords use credit scores for the same base reason as lenders: to determine how likely a tenant is to pay their rent in a timely manner. By reviewing a prospective tenants credit report, you can get an idea about how they have handled payments in the past on loans, credit cards, and other things.

You May Like: Does Paypal Credit Report To Credit Bureaus

Variations In Scoring Requirements

If you dont have a long credit history, VantageScore is the score you want to monitor. To establish your credit score, FICO requires at least six months of credit history and at least one account reported to a credit bureau within the last six months. VantageScore only requires one month of history and one account reported within the past two years.

Because VantageScore uses a shorter credit history and a longer period for reported accounts, its able to issue credit ratings to millions of consumers who wouldnt yet have a FICO Score. So, if youre new to credit or havent been using it recently, VantageScore can help prove your trustworthiness before FICO has enough data to issue you a score.

Read Also: Minimum Credit Score For Carmax

What’s In A Credit Report

Your credit report lists what types of credit you use, the length of time your accounts have been open, and whether you’ve paid your bills on time. It tells lenders how much credit you’ve used and whether you’re seeking new sources of credit. It gives lenders a broader view of your credit history than do other data sources, such as a bank’s own customer data.

A credit report also includes information on where you live, and whether you’ve been sued or arrested, or have filed for bankruptcy.

What Should I Do When I Get My Credit Report

Your credit report has a lot of information. Check to see if the information is correct. Is it your name and address? Do you recognize the accounts listed?

If there is wrong information in your report, try to fix it. You can write to the credit reporting company. Ask them to change the information that is wrong. You might need to send proof that the information is wrong for example, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.

You May Like: Public Record On Credit

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Dont Miss: Les Schwab Credit Score Requirements

Is 728 A Good Credit Score

A 728 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

Also Check: Affirm Credit Score Requirement

Why Is My Experian Score Lower Than Transunion And Equifax

This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. These factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureauswhich is also unusual.

How Do Credit Scores Work In Canada

Typically, a score above 650 will allow you to easily qualify for a loan in Canada. While a score of 650 and under can bring difficulty in securing a loan, there are plenty of Canadian lenders who specialize in those with a low credit score.

According to one of Canadas financial bureaus, TransUnion, most Canadians will have a credit score between 620 and 679.

You May Like: How To Report Bad Tenants To Credit Bureaus

Option #: Secured Credit Cards

This type of card provides many benefits including being very easy to get approved for. Why? The financial institution has zero risk as its up to the cardholder to use their own money to pay for the deposit. All payments will be made on the cardholders credit report and most have a limit of $200 up to $5,000. Plus, there is a low annual fee between $10-$30.

Different Scores At Each Credit Bureau

Because each credit bureau could have different information on file about you, your credit scores will most likely differ for each of the three credit bureaus: Equifax, TransUnion and Experian.

Sometimes the difference is just a few points. Other times, the difference in your credit scores from each bureau can be vast due to an error or mistake in your credit report. These differences can cost you thousands over the life of a loan. Be sure to check your reports regularly or sign up for alerts to be notified when your score changes.

Don’t Miss: Unlock My Experian Credit Report

Length Of Credit History

Responsibly managing credit accounts over a long period of time can help your credit scores. Credit scoring models may look at the age of your oldest account, newest account and the average age of all your accounts when factoring in credit history.

There’s no shortcut to building a lengthy credit history, although becoming an on an account that the primary user has had for a long time may help. If you decide to close a credit card account in good standing, it can remain on your credit report for up to 10 years, and could continue to help your credit scores during that time. However, closing an account reduces your overall available credit, which could have a negative effect on your scores.

Tip #: Update Your Information And Correct Misleading Information

Reviewing your free credit report can notify you about any credit cards in Canada that are open in your name that shouldnt be there. Additionally, youll be able to spot any information that isnt correct and reach out to a credit bureau to get it rectified.

Sometimes you can find negative information thats hurting your credit score. Youll want to make sure thats addressed sooner rather than later.

You May Like: How To Fix A Repo On Your Credit