Which Scoring Model Will A Creditor Use

That will depend. For example, an auto lender may be more interested in a consumers history of repaying loans rather than a credit card, so the lender may pick a scoring model that puts less weight on a credit cards payment history. Some scoring models offer different options based on the lenders market, or a lender can order a custom formula.

Lenders, they have choice, says Jeff Richardson, vice president of public relations at VantageScore Solutions. Thats important, because they need to have the best predictive capabilities for their businesses.

With every tweak of the math, a consumer has another credit score, and that turns into a lot of numbers to track.

Why Does My Credit Score Fluctuate So Much

Ah, the million-dollar question. While we cant provide the definitive answer, we can identify some general areas that cause fluctuation in a credit score.

Public Records Legal documents involving bankruptcy, tax liens or court judgments that are recorded by the government are available to the public and used by the credit reporting bureaus. The report is almost always negative, even if the debt has been paid off. It is best to avoid bankruptcy, tax liens or court judgments because those public records stay on your credit report for at least seven years. To protect your credit score, its always best to negotiate a settlement rather than to allow a debt to become a public record.

Hard Inquiries These occur when you apply for a credit card, auto loan, mortgage or some other type of credit. They have an adverse impact on your credit score because an inquiry generally means you expect to be taking on new debt such as a home, car or loan to help overcome a financial setback. On the other side are soft inquiries such as consumers asking for their credit score or credit history, an employer or landlord seeking a credit report and credit-card companies screening applicants for pre-approved cards, which have no effect on your credit score.

Changes in Revolving Credit If your interest rate increases, your debt could climb higher and that will be reflected on your credit report.

Why Do Credit Scores Fluctuate

Reading time: 4 minutes

-

Its completely normal for your credit scores to fluctuate

-

Information in your credit reports is updated as it is reported to credit bureaus

-

The passage of time can also cause changes in credit scores

If youre tracking your credit scores over time, you may notice the three-digit numbers may change, even if the credit score is generated by the same credit bureau or company.

Its completely normal for credit scores to fluctuate. But why does this happen?

Changing information

Your credit scores are a snapshot in time that changes based on your credit behaviors and the information in your credit reports, which is updated regularly. Credit scores are calculated based on information in your credit reports. That information is updated as new data is reported to credit bureaus by lenders, collection agencies, or other sources.

That data could include balance changes, the opening of new accounts, payments on existing accounts, or closed accounts falling off your credit report after a period of time has expired. If you check one credit score in January and then again in March, for instance, the credit score may have changed based on changes in account activity reported to the three nationwide credit bureaus — Equifax, Experian and TransUnion — during that time.

Differences among credit bureaus

While a credit score from one of the three nationwide may rise and fall, you may also see differences in credit scores furnished by the other two credit bureaus.

You May Like: What Is Syncb Ntwk On Credit Report

How Do I Get My Free Score/check My Credit Scores

If you want to keep track of your credit report, you have three main options. Only two of them include your credit score, though. Heres a brief overview of each option:

AnnualCreditReport.com

Thanks to an amendment to the 1970 Fair Credit Reporting Act , all U.S. consumers get one free credit report from each credit bureau once a year. To claim your reports, visit AnnualCreditReport.com, call 1-877-322-8228 or send an Annual Credit Report Request Form to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281. Importantly, your free annual reports do not include credit scores.

For a quick and helpful credit overview, sign up for your free credit report card at Credit.com. Youll see your Experian VantageScore 3.0 credit score right away, and youll also get a letter grade for each of the five factors that influence your credit score. The credit report card is free, but it doesnt include your full credit reports.

ExtraCredit

To develop a really in-depth understanding of your credit, choose ExtraCredit. For an affordable monthly fee, you can look at all three of your credit reports whenever you likeand you gain access to 28 of the FICO scores lenders use to make decisions. You can use ExtraCredit to delve deep into your own history, and see the areas you would most like to work on.

You Have More Than One Credit Score

At any given time, there are dozens of credit score models that can be used by lenders or insurance companies to evaluate applicants or customers. Theres no single accurate or real score the score lenders use depends on their needs at that time. If you opt to check your credit on Credit.com, youll see your VantageScore 3.0 credit score and your credit score from the credit bureau Experian.

Instead of obsessing about the number, look at what your score is telling you about your credit. Is it good? Not so good? Do you have things you need to focus on improving? Are there errors that you need to dispute?

Recommended Reading: Paypal Credit Bureau

How Soon Will Your Credit Score Improve

Unfortunately, theres no way to predict how soon your will go up or by how much. We do know that it will take at least the amount of time it takes the business to update your credit report. Some businesses send credit report updates daily, others monthly. It can take up to several weeks for a change to appear on your credit report.

Once your credit report is updated with positive information, theres no guarantee your credit score will go up right away or that it will increase enough to make a difference with an application. Your credit score could remain the sameor you could even see your depending on the significance of the change and the other information on your credit report.

The only thing you can do is watch your credit score to see how it changes and continue making the right credit moves. If you’re concerned about inaccurate reporting on your credit score or simply want to keep a closer eye on it you could use a .

How Often Does Your Credit Score Change

Content Marketer and Personal Finance Expert

by John Ulzheimer, Credit Expert for

A reader writes in looking for a clear answer on how often his credit score changes and how often he should check this all important three-digit number. John Ulzheimer, credit expert for Credit Sesame, answers.

“John, I’ve been working very hard at improving my credit scores. I’ve made all of my payments on time for years and I’ve paid off almost $10,000 of credit card debt. Unless I’m grossly mistaken, I believe my credit scores have improved because I addressed those two items that caused me to have lower scores in the first place. When do you think I should check my scores? Are they updated once a month? Or are they constantly changing as my credit reports are changing?”

First off, congratulations on all of your hard work to improve your credit reports. There’s no doubt your hard work has paid off in a variety of ways, including a higher credit score. The answer to your question regarding how often your credit score changes is going to be hard to believe. Your credit score never changes, not in the way your question suggests.

Your credit scores are not a permanent part of your credit reports. They do not change daily, monthly or annually like the accounts that are a part of your credit reports. Credit scores are a product that is often sold alongside your credit report to any entity that requests it.

Also Check: Does Opensky Report To Credit Bureaus

Estimating Credit Score Changes

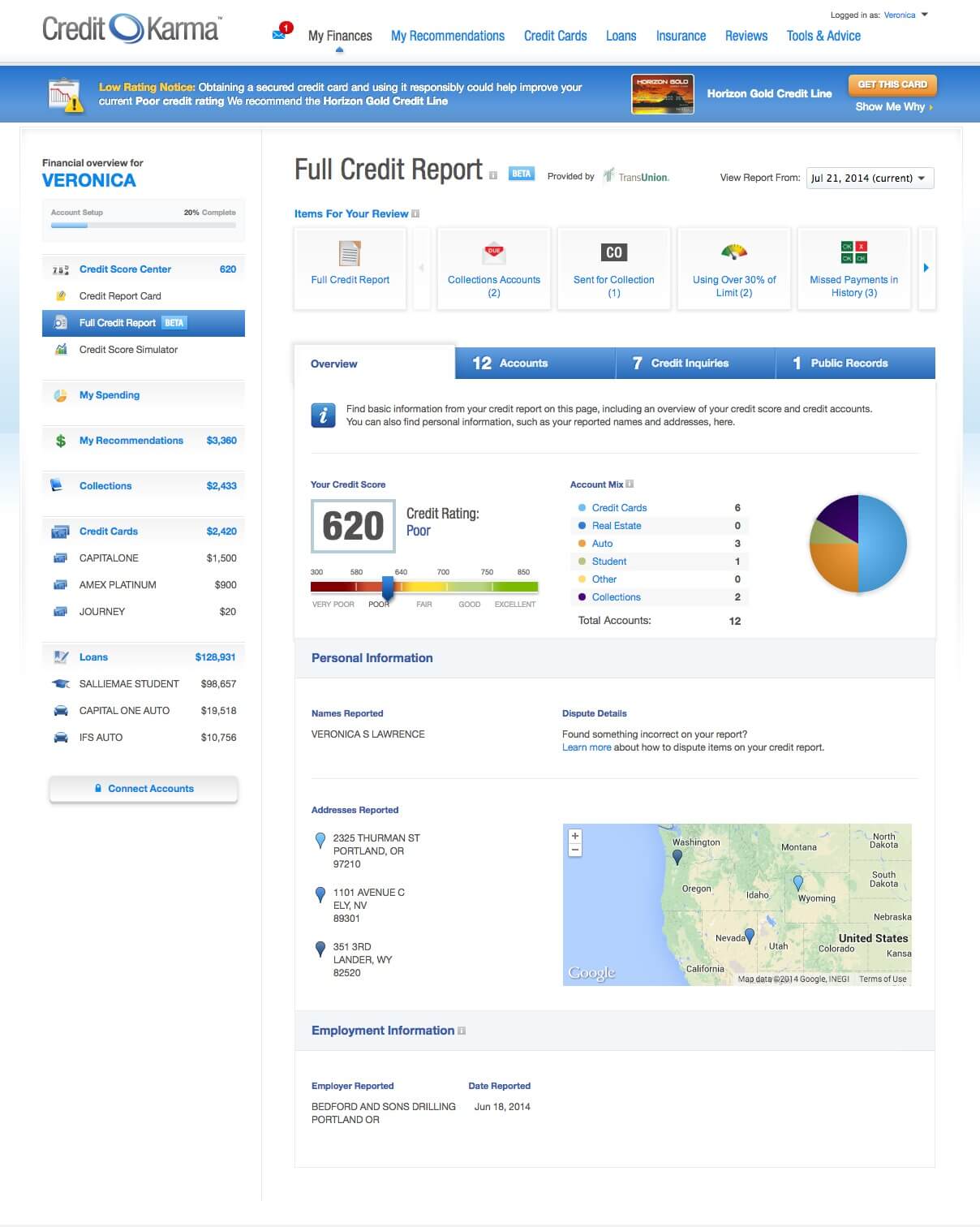

While youre waiting for your credit report and score to update, you can use a credit score simulator to estimate how your credit score might change. Credit Karma and myFICO both offer credit score simulators that can show how your credit score might change if the information on your credit report changes, like if you pay off an account or open a new loan, for example.

Debit Card Builds A Credit Score

Debit cards do not contribute to building your credit history or getting a credit score. Since a debit card is a tool to access your savings account balance and does not cover the concept of âcreditâ, any transactions done with a debit card will not be considered to build your credit history or credit score. You must avail a credit card or a loan to open your quota of credit history. Once your credit history is built, your credit score will be generated. However, it will take a few months to move from NA to a score.

Recommended Reading: Is 517 A Good Credit Score

How Credit Scores Work In 2021

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our Advertising Policy, visit this page.

Editors note: This is a recurring post, regularly updated with new information and offers.

Want more credit card news and advice from TPG?

How To Boost Your Credit Score The Traditional Way

The best way to improve your credit score is to focus on its two most important factors: payment history and amounts owed. Consistently paying your bills on time is the most important way to improve your credit score.

Thankfully, most lenders wont report delinquencies less than 30 days old and many wont even report payments that are 30 to 60 days late. But once you get beyond 60 days, each late payment will have a dramatic effect on your credit score.

Thats why its vital that you use every necessary resource to make all of your payments on time. This includes setting up alerts and reminders, as well as implementing automatic payments from credit card issuers and other lenders. Nearly all credit cards offer these features.

Related: 6 things to do to improve your credit in 2021

Next, you want to lower your debt-to-credit ratio. This is the total amount of debt you have, divided by the total amount of credit that youve been extended, across all accounts. The two ways to decrease your debt-to-credit ratio are to decrease your debt and to increase your credit.

Related:

Read Also: Does Paypal Credit Check Your Credit

What Is A Good Credit Score

Scoring models vary, but most FICO-based models rate scores from 670 to 739 as good. Meanwhile, scores between 300 and 579 are poor and scores between 580 and 669 are fair. At the upper end of the scale, scores between 740 and 799 are very good and scores over 800 are excellent or exceptional.

When Are Credit Scores Updated

Your credit score isnt included on your free weekly reports, but knowing the information in your report can help you understand credit score movements. When information is received by the credit reporting agencies, its typically added to your credit reports immediately. And when the information in your credit report changes, your scores may as well. How much they change depends on what information is updated. For example, making one more on-time payment may not cause your score to jump significantly after a year of consistent payments. But if you significantly lowered your balances across your credit cards, you may see some positive score movements. Making payments consistently and keeping balances low are good ways to keep your credit on track. Over time, with these good habits, you should see your score continue to improve.

Recommended Reading: How Can You Get A Repo Off Your Credit

Fixing Credit Report Errors

Credit reports are monitored by the three major credit bureaus under the authority of the Federal Trade Commission. Sometimes these bureaus report false information as a result of a clerical error, erroneous information from credit lenders, or even fraud. If there is an error on your credit report, there are several simple yet important steps you can take.

What Category On The Vantagescore Or Fico Credit Score Range Your Credit Score Currently Sits

If your score is very low, even a small sign of improvement in your payment history and reducing card balances might increase your credit relatively fast. But it will take more than paying your credit card bill on time for a month or two to really move your score into a range that’s considered good enough to get unsecured credit cards:

- Developing a solid payment history

- Keeping your card balances at less than 30% of each card’s credit limit

Recommended Reading: How To Unlock My Experian Credit Report

A Credit Report Agency Can Fix Your Score

You may come across âcredit repair agenciesâ when you are looking for measures to fix your low credit score. Based on the name, some people may mistake such agencies for firms that can repair a low score and build it up to a good score overnight by spending some money. However, it does not work that way.

A credit repair agency helps you file disputes with a credit rating agency if you can find errors on your credit report. The error can range from a mistake in your name to a mistake in a transaction registered under your name in the report. If you do not have the time or knowledge as to how you can dispute the errors, a credit repair agency can help you by doing the needful on your behalf.

Related Articles

How Your Credit Score Impacts Your Financial Future

Many people do not know about the credit scoring systemmuch less their credit scoreuntil they attempt to buy a home, take out a loan to start a business or make a major purchase. A credit score is usually a three-digit number that lenders use to help them decide whether you get a mortgage, a credit card or some other line of credit, and the interest rate you are charged for this credit. The score is a picture of you as a credit risk to the lender at the time of your application.

Each individual has his or her own credit score. If you’re married, both you and your spouse will have an individual score, and if you are co-signers on a loan, both scores will be scrutinized. The riskier you appear to the lender, the less likely you will be to get credit or, if you are approved, the more that credit will cost you. In other words, you will pay more to borrow money.

Scores range from approximately 300 to 850. When it comes to locking in an interest rate, the higher your score, the better the terms of credit you are likely to receive.

Now, you probably are wondering “Where do I stand?” To answer this question, you can request your credit score or free credit report from 322-8228 or www.annualcreditreport.com.

Because different lenders have different criteria for making a loan, where you stand depends on which credit bureau your lender turns to for credit scores.

Read Also: How To Get Collections Off Credit Report

Aging Of Negative Items In Your Credit Report

Events such as bankruptcy, foreclosure, or late payments are examples of negative items that affect your credit score. These events remain on a credit file for a number of years. A late payment, for example, remains on a credit file for about seven years. As these events age and move into the distant past, however, the affect they have on your credit score diminishes. As a result, as these items age, all other things being equal, your score can go up.

Your Credit Scores Can Change Frequently Thats Why Credit Karma Is Now Providing Daily Updates To Your Transunion Credit Score

But now that you can get an update on your TransUnion score every day, youll be able to keep a closer eye on your progress as you build credit. Daily updates could also help you make more-timely decisions when it comes to applying for new auto loans, credit cards and mortgages.

You May Like: Paypal Credit Reporting To Credit Bureaus 2019

How Frequently Will My Credit Score Change

Changes to your credit score depends on how often your credit report is updated by your lenders, and the score could change as often as daily since creditors and lenders may report at different times of the month. Your credit score is calculated based on what appears on your credit reports such as payment history, amount of debt you have and the length of time youve had credit. Information that is added to or deleted from your report can affect your score which is why you could see one number one day and a different number the following day.

Keep in mind, while your score could change daily, it may take some time before it reflects positive actions youre taking to improve your credit like paying down credit card debt. Thats because there could be a delay between the time you pay down your debt and the time your bank or lender reports the activity.