How To Raise Your Credit Score Fast

The quickest way to raise your credit score is unearthing an error in your credit report. If erroneous information somehow was entered in your credit report or you are the victim of fraud, you can dispute the debt. Notify one of the credit bureaus immediately and provide the correct information or evidence that you were defrauded.

Once the incorrect information is changed, a 100-point jump in a month might happen. Large errors are uncommon, and only about one in 20 consumers have one in their file that could impact the interest on a loan or credit line. Still, its important to monitor your score.

Get someone with a high credit score to add you to their existing account. The good info theyve accumulated will go into the formula for your score. It doesnt hurt to ask and explain how you might benefit. If you can make it happen, you could see a quick, significant jump in your credit score.

Another quick way to improve your score is to make payments every two weeks instead of once a month. The increased payments method helps reduce your credit utilization, which is a huge factor in your score.

Along those same lines, ask your card company to raise your credit limit. If you go from a $1,000 a month to $3,000, you help the credit utilization part of your score again, because you have more spending room.

If you are applying for a second or third credit card, only make one application a month. Applying for two or three at a time will result in multiple .

Why Did My Credit Score Go Up 30 Points

Asked by: Mrs. Winifred Muller

Common reasons for a score increase include: a reduction in credit card debt, the removal of old negative marks from your credit report and on-time payments being added to your report. The situations that lead to score increases correspond to the factors that determine your credit score.

Never Miss Or Be Late On Any Credit Repayments It Can Have A Disproportionate Impact

Sounds obvious? Well, it is. Even if you’re struggling, try not to default or miss payments because it can have a disproportionate impact. Doing this once or twice could cause problems that can cost you for years. Defaults in the previous 12 months will hurt you the most.

The easy solution is to pay everything by direct debit, then you’ll never miss or be late. While we normally caution against only making minimum repayments on debts one technique is to set up a direct debit to just repay the minimum, purely as a vehicle to ensure you’re never late. Then manually pay more each month on top.

If you are in difficulties, the cliché “contact your lender” is a good one. Hopefully it will try to help. Changing your repayment schedule is preferable to you defaulting and though it will hit your credit score, it’s better than a county court judgment or decree against you.

Also Check: 672 Credit Score Auto Loan

Cibil Asks Lenders To Speed Up Monthly Credit Data Submission

TransUnion CIBIL credit bureau has asked lenders such as banks and non-banking finance companies to submit borrowerâs credit data much faster, according to a report from The Mint. The credit information company has asked banks to submit the credit data of borrowers within a week, instead of 15 days. Harshala Chandorkar, chief operating officer, TransUnion CIBIL told the publication that the credit bureau is taking measures to make sure that they get the credit data at the earliest. They are aiming to receive the data within a week of every month-end, instead of a fortnight at present, she added.

In 2015, Reserve Bank of India directed all banks and non-banking financial companies to become members of credit information companies and share all credit data with them. CICs maintain data on borrowings and payment details of consumers on a monthly basis. Thanks to the credit data, lenders are able to analyse the ability of a borrower before sanctioning a loan. CIBIL credit bureau offers CIBIL score to individuals which is a measure of their creditworthiness. The 3-digit number ranges from 300-900. You can check your CIBIL score for free by visiting CIBILâs website.

25 March 2019

What Can Affect How Long It Takes

Your score is determined by the three credit bureaus , but its up to your lenders to contact them to report information about you. It can be as simple as your credit card company reporting that you made a monthly payment on time, increased your debt or decreased your balances. These are all positive influences on your score, but there may be a slight lag in timing due to the reporting process.

In addition to a potential delay in the telephone game between your credit issuer and the credit bureaus, certain financial events can linger on your credit history for years. Unfortunately, the more harmful events are often the ones that stick around the longest, so its best to know what actions will be the biggest burdens:

| Event | |

|---|---|

| Chapter 7 bankruptcy | 10 years |

This may seem ominous, but heres the good news: recency bias is alive and well in the credit scoring world. Even if theyre still present, the old items that appear on your report have less weight than your newer ones.

Read Also: How Long Repossession Stay On Credit Report

Monitor Score Changes With Creditwise From Capital One

Staying on top of the information in your credit report can help alert you to potential problems. But waitâdoesnât checking your credit report hurt your credit score?

Thankfully, thatâs a myth. The Consumer Financial Protection Bureau confirms that requesting your credit report wonât hurt your credit score.

You could use a credit monitoring tool like . CreditWise is free and available to everyoneânot just Capital One customers.

With CreditWise, you can access your free TransUnion® credit reports and weekly VantageScore® 3.0 credit score anytime, without hurting your score. You can even see the potential impacts of financial decisions on your credit score before you make them with the CreditWise Simulator.

You can also get free copies of your credit reports from all three major credit bureausâEquifax®, Experian® and TransUnion. Just call 877-322-8228 or visit AnnualCreditReport.com to learn how.

Ask For Late Payment Forgiveness

Paying on time constitutes 35% of your FICO Score, making it the most important action you can take to maintain a good credit score. But if youve been a good and steady customer who accidentally missed a payment one month, then pick up the phone and call your issuer immediately.

Be ready to pay up when you ask the customer rep to please forgive this mistake and not to report the late payment to the credit bureaus. Note that you wont be able to do this repeatedly requesting late payment forgiveness is likely to work just once or twice.

You have 30 days before youre reported late to the credit bureaus, and some lenders even allow as long as 60 days. Once you have a late payment on your credit reports, it will stay there for seven years, so if this is a one-time thing, many issuers will give you a pass the first time youre late.

How much will this action impact your credit score?

If youre a day or two late on a credit card payment, you might get hit with a late fee and a penalty APR, but it shouldnt affect your credit score yet. However, if you miss a payment by a whole billing cycle, it could drop your credit score by as many as 90 to 110 points.

You May Like: What If My Credit Score Changes Before Closing

How Long Does It Take Your Credit Score To Improve

Your is a sensitive numberthree digits that can move up or down on any given day depending on how the information in your credit report changes. If youve been working to improve your credit scoreby paying off past-due accounts, correcting errors, making timely payments, or having negative items deleted from your credit report you undoubtedly want to see the results of your efforts as quickly as possible. And if you need your credit score to increase a few points so you can qualify for a loan or better interest rate, you’re probably eager to see improvement soon.

The Summary Of What Makes Your Credit Score Go Up And Down

With the price of homes in the Puget Sound area, if you are not planning to pay cash for a house or condo, it will be important for you to have a good credit score.

The majority of lenders will use your FICO credit score to determine if you are eligible for credit and at what rate. The better your interest rate the better your buying power.

There are some things that you can do right now too and some things you can do long-term to increase your credit score.

You May Like: Does Paypal Working Capital Report To Credit Bureaus

Benefits Of Using Credit Repair Consultants

Most of us are not familiar with the inner workings of Equifax and TransUnion and the laws that govern them. However, a little-known secret to credit rebuilding is to seek out the help of professional credit repair consultants. Yes, not an app, but a person.

These individuals are fully versed in the laws that these credit reporting agencies must abide by. With your permission, the credit repair consultants contact the credit reporting agency and have the incorrect information removed as soon as possible. The experts will go through your report with a fine-tooth com and come up with a plan to improve your credit score. Remember, these credit repair professionals have worked on thousands of accounts and have documented success.

Think about this situation: you are shopping for a mortgage but also have errors on your credit score. If you are in a situation where you need to see quick results but are disputing your score on your own, these experts can really save the day. It may be worth the money to hire help.

However, when using a credit repair consultant, you must provide them with full transparency. Things that seem trivial to you can impact the outcome of your credit rebuilding goals. Be honest about everything.

Does Paying Off A Loan Help Or Hurt Credit

Paying off a loan frequently hurts credit because it impacts your credit history and your credit mix. If the loan that you have paid off is your oldest credit line, then the average age of your credit will become newer and your score will drop. If the loan that you pay off is your only loan, then your credit mix suffers.

Don’t Miss: Minimum Credit Score For Care Credit

Will Paying The Minimum On My Cards Improve My Credit Score

No. This is a widespread myth. You need to pay at least the minimum payment due on your credit card every month so that your cards have an on-time payment history. You do not have to pay a single cent in interest to improve your credit score. In fact, paying your credit card balances in full every month will have the greatest positive impact on your score, because it will improve your credit utilization percentage.

Msmes Meet Rbi Governor To Apprise The Rbi Of Smes Credit Woes

The industry chambers representing a wide section of the Micro and Small & Medium Enterprises met the RBI Governor Shaktikanta Das to apprise the Reserve Bank of India about the credit and finance issues being faced by MSME. The Federation of Indian Micro and Small & Medium Enterprises is looking forward for the Central Bankâs intervention in addressing Non-Performing Assets in MSMEs. The industry body has asked for setting up of a separate track for dealing with non-willful defaulters, classification of accounts into viable and non-viable categories and creation of a viable, revival scheme for stressed MSMEs. In a bid to offer maximum support to MSMEs, FISME suggested for specific support measures for accounts having exposure greater than Rs.5 crore. It has also asked to define the credit rating parameters by RBI to bring transparency to the entire process. FISME also stated that MSMEs should be considered at par with financial creditors and their dues should be secured in IBC and guidelines to be issues for Credit Rating Agencies for BLR . Indiaâs MSME sector contributes to nearly a third of the gross domestic product, accounting for about 45% of manufacturing output and 40% of countryâs total outward shipments, as per latest RBI data.

9 January 2019

Don’t Miss: Transunion Account Locked

Why Do Credit Scores Fluctuate

Reading time: 4 minutes

-

Its completely normal for your credit scores to fluctuate

-

Information in your credit reports is updated as it is reported to credit bureaus

-

The passage of time can also cause changes in credit scores

If youre tracking your credit scores over time, you may notice the three-digit numbers may change, even if the credit score is generated by the same credit bureau or company.

Its completely normal for credit scores to fluctuate. But why does this happen?

Changing information

Your credit scores are a snapshot in time that changes based on your credit behaviors and the information in your credit reports, which is updated regularly. Credit scores are calculated based on information in your credit reports. That information is updated as new data is reported to credit bureaus by lenders, collection agencies, or other sources.

That data could include balance changes, the opening of new accounts, payments on existing accounts, or closed accounts falling off your credit report after a period of time has expired. If you check one credit score in January and then again in March, for instance, the credit score may have changed based on changes in account activity reported to the three nationwide credit bureaus — Equifax, Experian and TransUnion — during that time.

Differences among credit bureaus

While a credit score from one of the three nationwide may rise and fall, you may also see differences in credit scores furnished by the other two credit bureaus.

Whats Considered A Good Credit Score

Your FICO Score the credit scoring model thats typically used when lenders are deciding whether to extend you credit ranges from 300850. Within that range, scores are separated into five credit bands.

In short, a FICO Score of 670739 is considered good credit, and above that is very good or excellent.

Your FICO Score is generated from information on your credit reports, which are maintained by the three major consumer credit bureaus: Experian, Equifax and TransUnion. Note, however, that the bureaus themselves do not create your FICO Score. In addition, under federal law, each bureau is required to provide one free copy of your credit report per year which can be obtained at annualcreditreport.com.

During the coronavirus pandemic, the credit bureaus have been offering free weekly reports.

You May Like: How Do I Unlock My Credit

How Your Credit Score Is Calculated

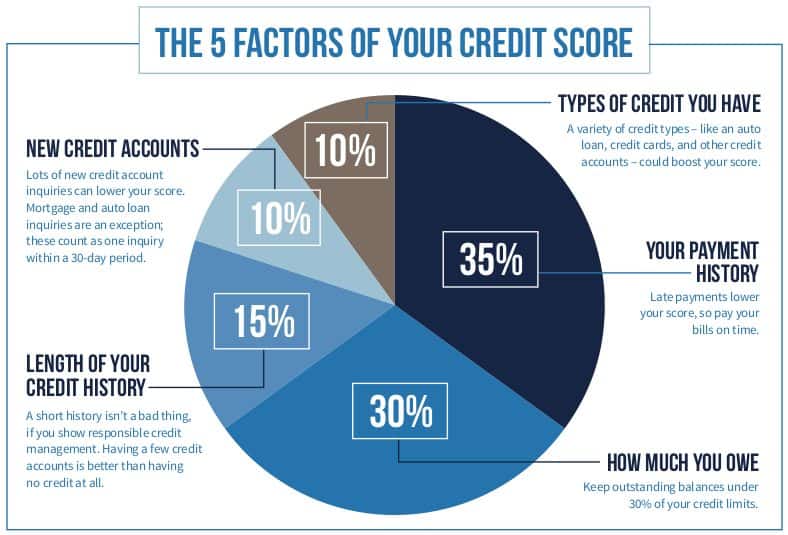

There are multiple scoring models, and they all use data from your to determine your score. The data is broken down into five categories. For FICO scores the most commonly used scoring model some categories have a bigger impact on your than others:

- Payment history: Your payment history is the most influential factor and affects 35% of your score. It shows creditors whether youve paid past credit accounts on time or have a history of late or missed payments.

- makes up 30% of your score. It reflects the amount of available credit you use, and is calculated by dividing your total debts by your total available credit.

- Length of credit history: Lenders want to see that you have successfully handled credit for several years, so the length of your credit history determines 15% of your score.

- Your credit mix or the assortment of credit available to you affects 10% of your score. Lenders like to see that applicants can handle multiple types of credit, such as credit cards, mortgage loans, and personal loans.

- New credit: When you apply for several new credit accounts within a short time, lenders worry youll be overextended. Your new credit impacts 10% of your score.

Can You Raise Your Credit Score By 100 Points In 30 Dayswritten Byglen Luke Flanaganedited Byjulie Sherrierupdated On: September 29th 2021

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

Your credit score affects everything from the interest rate youll pay on an auto loan to whether youll be hired for certain jobs, so its understandable if youre wondering how to raise your credit score quickly.

While there are no shortcuts for building up a solid credit history and score, there are some steps you can take that can provide you with a quick boost in a short amount of time. In fact, some consumers may even see their credit scores rise as much as 100 points in 30 days.

Learn more:

- Lower your credit utilization rate

- Ask for late payment forgiveness

- Dispute inaccurate information on your credit reports

- Add utility and phone payments to your credit report

- Check and understand your credit score

- The bottom line about building credit fast

Read Also: Brandon Weaver Credit Repair Reviews

How Long Does It Take To Rebuild A Credit Score

There’s no set timeline for rebuilding your credit. How long it takes to increase your credit scores depends on what’s hurting your credit and the steps you’re taking to rebuild it.

For instance, if your score takes a hit after a single missed payment, it might not take too long to rebuild it by bringing your account current and continuing to make on-time payments. However, if you miss payments on multiple accounts and you fall over 90 days behind before catching up, it will likely take longer to recover. This effect can be even more exaggerated if your late payments result in repossession or foreclosure.

In either case, the impact of negative marks will diminish over time. Most negative marks will also fall off your credit reports after seven years and stop impacting your scores at that point if not sooner. Chapter 7 bankruptcies can stay for up to 10 years, however.

In addition to letting time help you rebuild your scores, you can follow the steps above to proactively add positive information to your credit reports.