How To Pick The Right Loan Program For Your Credit Score

Conventional loans are a good fit if you have a credit score of at least 620 and can make a 20% down payment. If youre making a lower down payment, pay close attention to your private mortgage insurance premium: The lower your credit score, the higher your mortgage insurance premium and monthly payment will be.

FHA loans are often the only choice for borrowers with a credit score between 500 and 619. Youll pay for FHA mortgage insurance that includes an upfront premium of 1.75% of your loan amount and annual mortgage insurance premiums ranging between 0.45% and 1.05%. However, unlike with PMI, the premium percentage is the same regardless of your credit score.

VA loans can only be made to eligible veterans, active-duty service members, reservists and surviving spouses. Lenders dont require mortgage insurance or a down payment. Although the VA has no minimum score requirement, most lenders set their minimum between 580 and 620.

USDA loans are guaranteed by the U.S. Department of Agriculture to help low- and moderate-income buyers finance rural homes. No down payment is required, but youll pay upfront and annual guarantee fees that work like FHA mortgage insurance. The USDA doesnt set a minimum credit score, but most lenders require at least 640.

THINGS YOU SHOULD KNOW

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Check Your Credit Report And Correct Any Errors

Before applying for a mortgage, request a copy of your credit reports from the three major credit agencies: Experian, Equifax andTransUnion. Normally you can access your credit reports from each bureau for free once per year, but due to the COVID-19 pandemic, youre entitled to a free credit report from each of the agencies once a week through the end of 2022.

If you find inaccurate or missing information, file a dispute with the credit reporting agency and the creditor. Clearly identify each item youre disputing and be sure to include supporting documents.

Also Check: What Makes You Have A Bad Credit Rating

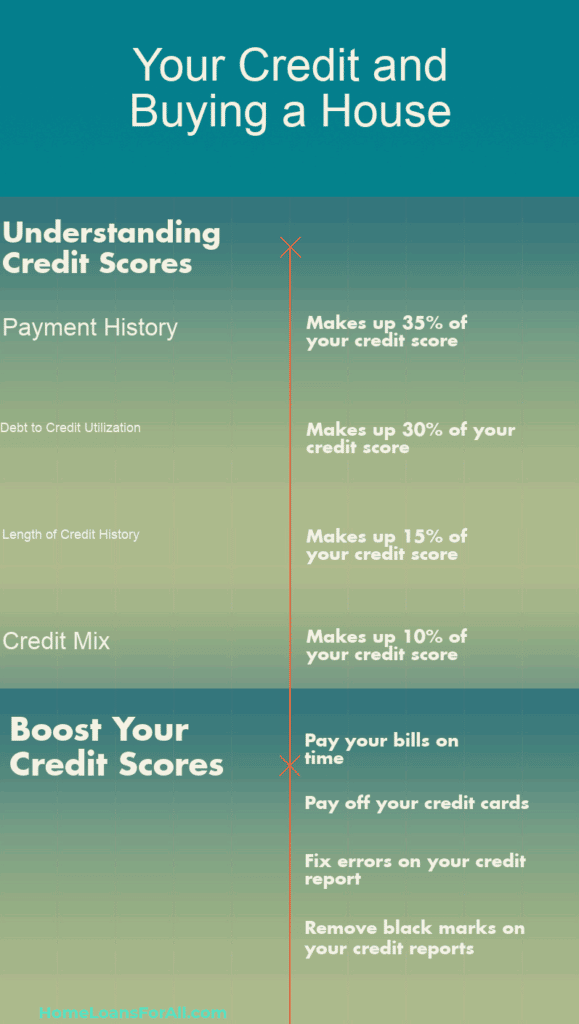

What Changes Your Credit Score

These 5 factors provide a glimpse into your financial habits and history and help lenders assess your financial health.

Home buyers with lower credit scores are typically assigned a higher interest rate.

There is no way to get around a credit check. It is one of the things you need to buy a home during the mortgage pre-approval stage so be sure to learn more about how a mortgage pre-approval affects your credit score.

Get pre-approved for a mortgage today.

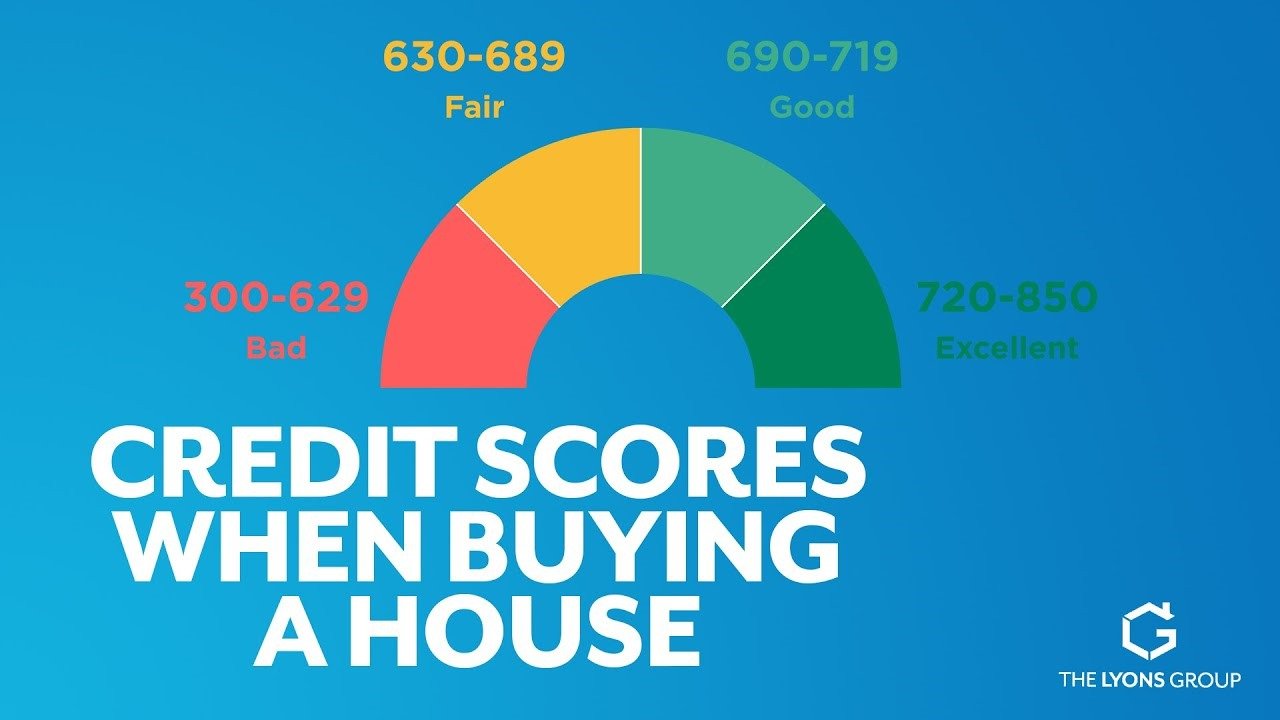

What Is A Good Credit Score To Buy A House

During the mortgage application process, lenders commonly check the borrowers FICO® credit score, which grades consumers on a scale of 300 850, with 850 being the highest score possible.

According to FICO® credit bureau data, the best credit score to buy a house is 760 and higher, which tends to unlock the best mortgage rate.

However, to qualify for a home loan, youll need at least the minimum credit score to buy a house, which ranges from about 500 680, depending on the mortgage program. But a higher credit score can boost your chances of qualifying for a mortgage because it shows the lender that youre likely to repay your loan on time.

Also Check: What Is The Highest Equifax Credit Score

Determining A Qualifying Credit Score

Before we get into the credit score you need to qualify, you might be wondering how lenders determine your credit score. After all, your FICO® Score is reported by three different bureaus.

If you’re applying for a loan on your own, lenders get your from each of the three major credit rating agencies and use the middle or median score to qualify you.

If there are two or more borrowers on a loan, the lowest median score among all clients on the mortgage is generally considered the qualifying score. The exception to this is a conventional mortgage with multiple clients being backed by Fannie Mae. In that case, they average the median scores of the borrowers on the loan.

If you have a median score of 580 and your co-borrower has a 720 credit score, the average credit score would be 650. Because the minimum qualifying score for conventional loans is 620, this can mean the difference between qualifying for a mortgage and not.

One thing you should know is that for the purposes of your rate and mortgage insurance, the lowest median score is the one that gets reported, so your rate might be slightly higher. There are also certain situations in which Fannie Mae still uses the lowest middle score for qualification. We recommend speaking with a Home Loan Expert.

Requirement #: Credit Score

Mortgage lenders consider your entire financial situation when applying for a loan but your FICO score can take center stage. Your credit scores indicate to lenders how likely you are to repay what you borrow. If you have a bad or, even worse, no credit history at all, it will be very difficult to qualify for a mortgage.

So what credit score do you need for a mortgage? Again, the answer depends on what type of mortgage loan you’re seeking.

Amy Tierce, a senior loan officer with Radius Financial Group, notes that although the Federal Housing Administration offers financing options to borrowers with a credit score as low as 500, most lenders have their own requirements. So it may be a challenge to find a lender who’ll work with a borrower with a credit score below 620 or 640.

Checking your credit scores before applying for a home loan can give you a better idea of whether you meet the lender’s requirements to buy a house. This can also give you a feel for what kind of interest rates you’re likely to pay for a mortgage.

Read Also: How Often Does Your Credit Score Update On Credit Karma

How To Boost Your Credit Score Before Buying A House

Estimated reading time: 7 minutes

can be a big factor in the mortgage application process. They can affect everything from a borrowers loan options to interest rates. The good news is that if yours could use a boost, there are ways to improve! Although everyones financial situation is different, here are a few suggestions on how to increase your credit score before you buy a house and insights into the type of credit score most mortgage lenders use.

Avoid Credit Inquiries And Closing Certain Accounts

While youre focusing on increasing your credit score, dont forget to avoid some common mistakes before you buy a house.

- Limit credit inquiries: Also, be aware that multiple hard inquiriesversus soft inquiriesin a short period of time can lower your credit score. Additionally, hard inquiries may stay on a credit score for up to two years, according to Equifax.

- Keep credit card accounts open, if appropriate: If paying the full balance on a credit card, Experian says its usually best to leave the cards account open if youre trying to boost a score. Ideally, you should keep those accounts active by making small purchases, and then make monthly payments in full, they add. In contrast, closing a credit card account can lower your available credit limit and may increase your credit utilization rate. If you decide its best to close a credit card and have more than one, consider keeping older accounts open. Length of credit history impacts 15% of a FICO Score.

If youre thinking about buying a new home, see how we can help with cost, convenience, and a commitment to close on time. Contact one of our Mortgage Professionals to learn more about your options at or get started online.

Read Also: How Fast Will A Car Loan Raise My Credit Score

Find The Right Lender

All mortgage lenders that operate in Pennsylvania are not created equal. Some might tempt you with really low rates but charge high fees that add to your closing costs. Others might promise low costs but not be able to close very quickly. And some might be able to give you the best of everything: low fees, low rates and outstanding customer service. Be sure to compare offers from at least three lenders to find the deal that best fits your finances.

Other Factors Lenders Consider

Mortgage lenders don’t just look at your credit score when determining your rate, though. They’ll also consider your debt-to-income ratio how much of your gross monthly income goes toward debt paymentsas well as your down payment and available savings and investments.

So while it’s important to work on your credit score before you apply for a mortgage, avoid neglecting these other important areas of your financial situation.

Don’t Miss: What Credit Score Do You Need To Rent A House

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureaus data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

Buying A House With No Credit

If your credit score is low because you havent borrowed much in the past, you have a thin credit file.

Some people buy everything with cash instead of using credit cards, which is a sign of fiscal responsibility thats not reflected in a credit score. In this case, your lower credit score doesnt reflect your willingness and ability to repay a loan.

As a result, many lenders will look at alternative records not included in your credit report, like rent and utility payments. This can help first-time home buyers get approved even without an extensive credit history.

Similarly, if youve had credit issues in the past like bankruptcy or short sale its still possible to buy a house.

A bankruptcy can stay on your credit report for 7 to 10 years. But if you keep your finances in order and make on-time payments following a bankruptcy, you could potentially qualify for a mortgage in as little as two years.

You May Like: What Is The Highest Credit Score A Person Can Have

First Lets Talk About Credit Scores

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you dont need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans.

Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if youre likely to pay your future bills like your mortgage, for example.

What Is A Home Mortgage Loan

A home mortgage loan is used to finance the purchase of a house or real estate. It makes homeownership more accessible since the entirety of the house doesnt have to be paid upfront. Home mortgage loans are typically the largest loans youll ever take out, but also typically have lower interest rates than other types of loans.

Because theyre such large amounts, they have multiple moving parts and can typically last anywhere from 10 to 30 years. These loans are paid back in monthly payments with interest, a principal, and many other costs like property taxes, hazard insurance, or private mortgage insurance .

Home loans usually include:

Because these loans have much longer terms, its important to keep in mind how much debt you want to take on when applying. Weigh your current situation with your future plans to assess if taking out a substantial loan is feasible for your situation.

Recommended Reading: Does Consolidating Debt Help Credit Score

Want To Buy A House Heres The Credit Score Youll Need To Do It

Your credit score plays a major role in your ability to secure a mortgage loan. Not only does it impact your initial qualification for a loan, but it also influences your interest rate, down payment requirements, and other terms of your mortgage.

Are you considering buying a house, and making sure your credit is ready? Heres what you need to know.

Dont Open Any New Lines Of Credit Or Take Out Large Loans

Generally, the less debt you have, the better off you are when you apply for a mortgage. FICO recommends not opening new credit accounts to increase your credit utilization ratio because each credit request can lower your score slightly. Once your credit has improved, rate shop within a 30-day window. Spreading out the rate inquiries can hurt your score. You can also use our mortgage calculator to estimate your monthly mortgage payments.

Read Also: How Much Does A Hard Inquiry Affect Your Credit Score

How Your Credit Score Affects Mortgage Rates

Your plays a role in determining the interest rate and payment terms on a mortgage loan. That’s because lenders use what’s called a risk-based pricing model to determine loan terms.

The more likely you are to pay your bills on time, based on your credit history, the lower your interest rate may be. With a less-than-stellar credit score, however, you may end up paying more.

What Factors Go Into A Credit Score

Its important to know your credit score and understand what affects it before you begin the mortgage process. Once you understand this information, you can begin to positively build your credit score or maintain it to give yourself the best chance of qualifying for a mortgage.

One of the most common scores used by mortgage lenders to determine creditworthiness is the FICO® Score . FICO® Scores help lenders calculate the interest rates and fees youll pay to get your mortgage.

While your FICO® Score plays a big role in the mortgage process, lenders do look at several factors, including your income, property type, assets and debt levels, to determine whether to approve you for a loan. Because of this, there isnt an exact credit score you need to qualify.

While exact scoring models may vary by lender, some variation of the standard FICO® Score is often used as a base. FICO® takes different variables on your , such as those listed below, from the three major credit bureaus to compile your score. FICO® Scores range from 300 850.

From this information, they compile a score based on the following factors:

- Payment history

- Types of credit

- New credit

The higher your score, the easier itll be to qualify for a lower interest rate on a great mortgage.

Don’t Miss: Is 752 A Good Credit Score

When Theres No Money Down

The higher your down payment, the more likely you are to qualify for a loan with a low interest rate, too. If you put at least 20% down and want a conventional home loan, you can avoid private mortgage insurance âan added monthly expense to protect lenders in case you default on your loan.

But youâre not required to put that much money down. And sometimes, you can even get a mortgage requiring no money down at all. Just keep in mind that no down payment can have some downsides as well.

With no money down, youâll have higher monthly payments, potentially a higher interest rate and less chance of approval compared to someone who provides more cash up front. VA loans and USDA loans both offer financing for low- or no-down payment loans. Some private lenders offer this tooâbut it will vary depending on the lender.

Limit Your Hard Credit Inquiries

When you apply for credit of any kind, it generates a hard credit inquiry. Since applying for new credit can be an early sign that someone is dealing with financial troubles, hard inquires will have a slight negative effect on your scores temporarily.

If you want to get a really high score, youll want to limit your hard inquiries meaning you should only apply for new credit when necessary.

Also Check: Does Student Debt Affect Credit Score