Continue Improving Your Creditworthiness

You might not have to worry about removing judgments from credit reports for the time being. But other negative marks, such as late payments and charge-offs, could be hurting your credit and holding you back.

As you work on improving your credit by making on-time payments and paying off debts, you could hire a credit repair company to review your credit report. Federal law gives you the right to dispute items on your credit report, and if something isnt correct, timely, or verifiable, the credit bureaus must remove that item.

After discussing your specific situation and credit history, a credit repair specialist may be able to spot mistakes that you didnt notice when reviewing your credit report.

Credit Saint has an A rating with the BBB, five-star reviews on comparison sites, and offers a money-back guarantee if you dont see anything deleted from your credit report in the first days. There are also different packages available to consumers based on their budget and needs.

Get Your Judgment Removed Today

If youre looking for a reputable credit repair company to help you remove a judgment from your credit report and repair your credit, we highly recommend Lexington Law.

Call them at for a free credit consultation. They have helped many people in your situation and have paralegals standing by waiting to take your call.

Reviving Dormant Or Lapsed Judgments

If a judgment against you has lapsed, it probably hasn’t gone away forever. Many states allow creditors to “revive” dormant judgments, perhaps subject to a time limit. State laws vary on how the time period is calculated. The clock might begin to run from the time the creditor last tried to collect on the judgment, or it might run from the time the judgment later went dormant.

Read Also: How Long Does Negative Credit Information Stay On Your Report

Judgments No Longer Appear On A Credit Report

Quick Answer

Judgments dont appear on your credit report and dont affect your credit score. But judgments may impact your ability to qualify for credit since lenders can still search for judgments via public records.

Through December 31, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

Civil Judgments Dont Impact Your Credit Scores Anymore

Legally, civil judgments can appear on credit reports for up to seven years. And credit scoring models view these as negative marks that can lead to lower credit scores.

However, changes to credit reporting requirements and company policies in 2017 resulted in the removal of all civil judgments from the consumer credit reports from Equifax, Experian, and TransUnion.

As a result, civil judgments currently dont appear in your credit history or hurt your credit scores. The changes also lead to the removal of liens from their credit reports. If the policies change, you may see judgments and liens appear on your credit reports in the future. In the meantime, you can still find another type of public record, bankruptcies, on credit reports.

Also Check: Does Klarna Report To Credit

Recommended Reading: How To Obtain A Free Credit Report

Debts Not Included In Limitation Period

The description above applies to standard debts like credit cards and bank loans. Government enforced debts are not subject to the two year limitation period. In most cases government debts do not appear on your credit report, so there is nothing to purge after the six year time frame.

In other words, government debts dont go away.

Debts not subject to a limitation period, and that are not automatically discharged in a bankruptcy are:

- Large tax debts owed to the CRA

- Alimony or child support

- Parking tickets

Other debts like 407 ETR debts and a CMHC mortgage shortfalls can get complicated. Listen to the podcast to hear more.

Just because a debt is old does not mean that it goes away. If you have old debts, dont assume you can just do nothing. If its less than two years old, the limitations act doesnt apply and your creditor can sue you. If its more than six years old, its not on your credit report, but your chances of getting another loan at your former creditor is slim, or will come at the cost of extreme interest rates. If you owe the government money, you owe the government money. Theres no way around that.

The experts at Hoyes Michalos are here to review your debts and advise you on which actions you should take to deal with your debt. Whether theyre old or not. Book your free consultation today so we can help you make a plan to deal with your debts.

Resources mentioned in todays show:

Hope The Judgment Expires

If the statute of limitations runs out and the creditor doesn’t renew your judgment, you are free.

But you might be wondering, how can I wait out those years if a creditor can collect through garnishment and other powerful means?

The point is that creditors can only claim possessions over a certain value, and there is a limit to garnishment. Technically, it is possible to wait the judgment out.

Just remember, judgments accrue interest. Creditors sometimes use this to their advantage. Even if your situation doesn’t allow them to take money from you right now, they may keep renewing the judgment again and again, waiting for the day you’ll have the means to pay up.

Before you think about buying that nice car, find out whether your judgment is still active.

Hopefully, the creditor will just give up. But they have their own reason for asking, How long does a judgment last? Accruing interest gives creditors a reason to be persistent.

Also Check: Is 756 A Good Credit Score

What Is A Short Sale

A short sale is an alternative to foreclosure in which the homeowner gets permission from the lender to sell the home for less than is owed. Homeowners typically request a short sale due to some form of financial hardship, and must be able to prove their inability to pay.

Short sales arent common in the current market, according to Helali, but can occur when competitive buyers have overbid due to low inventory and high demand.

The Differences Between A Short Sale And A Foreclosure

A short sale and a foreclosure are slightly different in how they affect your credit and future mortgage prospects, but both will remain on your credit report for at least seven years, Helali says. One key difference between them: A short sale is homeowner-generated, while a foreclosure is initiated by the bank.

Lenders initiate a foreclosure when the homebuyer has fallen behind on loan payments usually three to six months. The lender must take legal action to seize the property of a delinquent borrower and sell it at auction. Foreclosures are common when the homeowner has abandoned the home. If the occupants are still in the home, they can often be evicted by the lender. Once the lender has possession of the home, an appraisal will be scheduled so the property can be liquidated quickly.

With a foreclosure, the bank assumes ownership of your home, relieving you of many selling tasks. But a homeowner must use a real estate agent to do a short sale, Griffin says. You cant do it on your own. One reason is that only an agent can list the property on the MLS, but youll also want an agent to help navigate the river of paperwork and negotiate with the lender on your behalf.

According to Griffin, it takes five to seven years after a foreclosure before you can apply for a new mortgage.

To summarize:

Short sale

Foreclosure

Read Also: How To Fix Errors On My Credit Report

How Long Does A Judgment Last

George Simons | July 21, 2022

Summary: Were you sued and then had a judgment filed against you? Even though you don’t have the funds to pay, it seems like the order is never going away. Have you seen no consquences and wondering if you’re in the clear? Find out how long a judgment lasts in this post.

A judgment is trying to ruin your life. It’s no joke. It sucks.

Bad things do end, though. How long does a judgment last? That’s a crucial question.

Short answer: Three to seven years is common, but it could be over 20 years.

Whether you’ve already got a judgment or you’re trying to avoid one, read on to learn more about what exactly a judgment means for you, how long it’ll follow you around, and ways to end the ugly relationship.

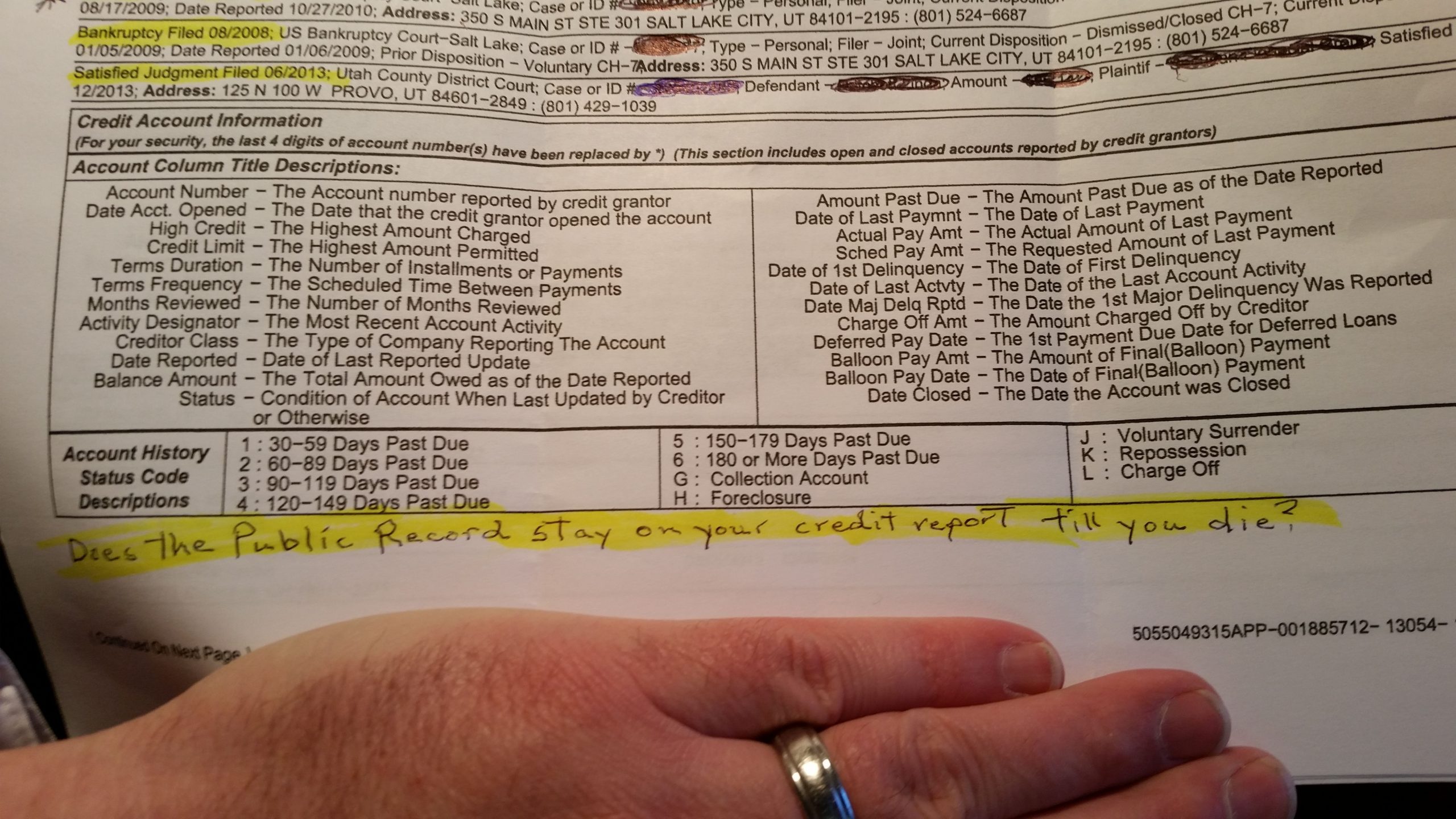

Public Records Could Plague Your Credit For The Better Part Of A Decade

Even if you repay the money you owe, public records with negative information typically remain on your credit reports for seven to 10 years.

Public records with adverse information may even occasionally wind up on your credit reports by mistake. According to a 2012 study by the Federal Trade Commission, one out of five consumers had an error on at least one of their three credit reports that was corrected by a credit reporting agency after it was disputed.

The good news is, in some cases, you may qualify for relief.

Experian®, Equifax® and TransUnion® have begun removing unverifiable public records from about 12 million credit reports.

The three major consumer credit bureaus recently adopted stronger public record data standards for consumer credit reports, requiring tax liens and civil judgments to include your name, address and either Social Security number or date of birth.

Millions of old public records dont contain all of this information, so the credit bureaus are removing them from consumer credit reports.

Theyre also removing medical collection accounts that have been or are being paid by insurance.

If you spot an error or an unverifiable public record that doesnt belong on your credit report, Credit Karma may be able to help you dispute it. And if all else fails, we can show you ways you can rebuild your credit.

Just remember, youre not alone. Were here to help.

Read Also: How Long Derogatory Information On Credit Report

How Long Does Negative Information Stay On Your Credit Report

A Tea Reader: Living Life One Cup at a Time

The length of time negative information can remain on your credit report is governed by a federal law known as the Fair Credit Reporting Act . Most negative information must be taken off after seven years. Some, such as a bankruptcy, remains for up to 10 years. When it comes to the specifics of derogatory credit information, the law and time limits are more nuanced. Following are eight types of negative information and how you might be able to avoid any damage each might cause.

Why Are Judgments And Tax Liens No Longer On Credit Reports

In 2015 the three major credit bureaus Equifax®, Experian, and TransUnion® made a settlement with 31 state attorneys general. The settlement brought about an agreement now known as the National Consumer Assistance Plan, NCAP for short.

The NCAP triggered a series of policy changes the credit bureaus agreed to implement in order to make credit reporting more accurate. Some of those changes had to do with the way the credit bureaus collected and reported public record data.

At first the credit bureaus only removed some of the tax liens and judgments from credit reports. But by April of 2018, all tax liens and judgments were deleted from credit reports and new ones shouldnt show up.

Public records can harm your credit scores and make it harder for you to get a loan or credit card. Per the states, too many consumers at the time could end up with public record data on their reports which was wrong or didnt belong to them. The states involved in the settlement wanted the credit bureaus to improve their standards to make sure any public record data included on a credit report was accurate.

Recommended Reading: Which Website Gives Free Credit Report

Getting A Release Of The Judgment

The ultimate goal in resolving any judgment is to get a release. This means that the creditor is releasing you from any and all liability. To get a release the creditor typically must agree to whatever amount you are paying them to resolve the judgment. As a result, many judgment creditors are difficult to deal with. However, if you have a lump sum payment available, the creditor may be willing to take the payment in exchange for a release.

Derogatory Mark: Missed Payments

If you are at least 30 days late, expect a derogatory mark on your credit report. Missed payments typically stay on your credit reports for 7½ years from the date the account was first reported late. The later the payment goes moving to 60 days late, 90 days late and so on the greater the damage to your credit scores.

What to do: Pay your bill as soon as you can afford to. If youve never or rarely been late before, you might be able to get the creditor to drop the late fee. Call the customer service number, explain your oversight and ask if the fee can be removed. You can also write a goodwill letter. If paying the bill is not an option, call your creditor and let them know about your financial situation to see if you can work out a hardship plan.

The negative effect on your credit scores will fade over time. Try to stay on top of all your payments so positive information in your credit reports dilutes the effect of the missed payment.

Don’t Miss: Does Requesting A Credit Limit Increase Hurt Score

The Length Of Time A Judgment Stays On Your Credit Report

A judgment stays on your credit report for seven years, although in some cases such as bankruptcy the judgment can stay for as long as 10 years, and it does not matter what type of loan the judgment relates to: a car loan, a student loan, unpaid credit card debt, a personal loan, a cosigned loan, etc. Consumers who have had a judgment placed on their credit report need to ensure the judgment is removed from their credit report after the allotted time has passed.

How Long Judgments Last

State law dictates how long a money judgment lasts. In many states, judgments only last for 5-10 years. But in some states, like New York, judgments remain enforceable for 20 years. In some states, different kinds of judgments have different time limits. Judgments against personal property may have a different time frame than a judgment lien against real property.

Also, many states allow judgment creditors to renew judgments. For example, judgment creditors in Idaho have five years to collect on a judgment. After five years, they can renew a judgment for an additional five years. Some states only allow judgment creditors to renew judgments once, while other states allow them to renew judgments indefinitely. To find out how long a judgment lasts in your state, you can contact your state court, a local legal aid office, or your stateâs attorney general.

With all judgments, after the enforcement period passes, youâll no longer owe the remaining balance. If the judgment creditor doesnât renew the judgment when it first expires, then the judgment goes away at that time. In some states, the judgment can be revived years later with a simple application for a judgment renewal.

Don’t Miss: Is Rental History On Credit Report

Filing Bankruptcy To Get Rid Of Judgments

Bankruptcy erases certain types of debts,including judgments for credit card debt, medical bills, and other unsecured debt. While the Chapter 7 bankruptcy process can take up to six months, there are some immediate advantages to filing if youâre facing a judgment you canât afford to pay on top of other debt.

For example, filing for bankruptcy puts an immediate stop to debt collection lawsuits, wage garnishments, and bank levies. If your Chapter 7 bankruptcy is successful, your unsecured debts will be discharged. That said, if a creditor has a lien against your property, that wonât be discharged in Chapter 7 because itâs a secured debt.

What Should I Do Next Time If A Debt Collector Sues Me

If you get sued, you will need to pay the debt quickly or appear before a judge in court. The worst thing you can do is ignore the lawsuit. However, thats precisely what most people do, so usually, the creditor wins by default as the defendant doesnt show up for court.

If you dont show up or lose your case in court, a default judgment will be issued against you. Typically, you will be penalized by having a tax lien placed upon your house or having your wages garnished.

In some cases, you may even be forced to forfeit your belongings. These side effects are even more severe than the damage done to your credit score, so you really need to address the lawsuit, get legal help, and show up in court. Otherwise, you have a long, hard road to financial recovery ahead of you.

It never hurts to talk to a legal professional ahead of time to explore your options. But, at the very least, you need to attend your hearing, so you dont automatically give up your rights to a fair trial.

Don’t Miss: Does Ppp Loan Show Up On Credit Report

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit youre using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|