How To Get Business Credit Card

Category: Credit 1. 11 Business Credit Card Requirements You Must Know to Get Nov 19, 2020 Plus, with a loan, you would face a lengthy application process and potentially high-interest rates. Although some business credit cards have Personal information, including your name, birthdate, Social Security number, home address,

Should I Even Bother With The Credit Karma Score

Since most major lenders utilize the FICO model, you need to be very cautious about relying solely on your Credit Karma score. As I have shown, in some instances, this score can be really different from your FICO score like when you only have a couple of months of credit history or when you have closed a lot of credit card accounts.

Sometimes a lender might have a hard cut off for approvals or for certain interest rates. For example, if your score is below 700 your interest rate could go up another 1% or 2%. Or if your score is below 650 you might not be able to get approved for a certain loan or card.

In those cases, when you were dealing with hard cutoffs, it becomes very important that you get a truly accurate and up-to-date score. This is especially true if you are dealing with a large sum of money like in the case of a mortgage.

In those situations you would want to stray away from Credit Karma and do what you can to obtain an official FICO score. It will also benefit you to try to figure out exactly which credit score model your lender uses, since there are many different versions of FICO score.

And some point you might actually run into a lender that uses the Vantage score model . If they are pulling from Equifax for TransUnion then Credit Karma could be very useful for that lender.

You Were The Victim Of Identity Theft

Finally, lets address what might be the most frightening reason for a drop in credit scores: Someone could have stolen your identity and applied for credit accounts in your name.

If you discover that an impostor is using your identity, dont panic. There are actions you can take to help reverse the damage it may have caused to your credit scores.

But how do you spot identity theft in the first place? One step to consider is . Keeping a close eye on your credit scores and credit reports may help you catch suspicious activity faster than if youre not regularly monitoring your accounts. Youre entitled to one free credit report periodically from each of the three major consumer credit bureaus at annualcreditreport.com.

If youve been a victim of identity theft, youll likely want to make a recovery plan. Placing a fraud alert on your credit file could be a good place to begin. You only need to place the alert with one of the national credit bureaus. The other two bureaus will be automatically notified.

After youve added your fraud alert to your credit profile, you may want to fill out an identity theft report with the FTC. Then you can begin the process of disputing inquiries on your report if necessary.

Also Check: Synbc Ppc

Something Fell Off Your Credit Report

Thankfully, missed payments and derogatory marks wont stay on your credit report forever. The greater the age of those marks on your credit score, the less impact they have, so you may see your score recover over time while your behavior is kept consistent.

Late payments over 30 days will remain on your credit report for 7 years, while derogatory marks like bankruptcy can remain on your report for up to 10 years. Over time your score will recover, and once these marks fall off your credit report, you may see an instant boost in score.

An Easy Way To Get Your Credit Report

The three major credit reporting bureaus, TransUnion, Equifax, and Experian, are required to give you a free credit report once a year by federal law. You have to apply for your reports through AnnualCreditReport.com.

While these reports are handy to see what lenders have reported to the credit reporting agencies and find inaccuracies to correct and improve your credit they do not include your actual credit score.

Since you need to know your credit score to get an idea of where you stand when applying for credit, the reports lack of a credit score is problematic. The reporting agency provided a less than an adequate solution offering to sell you your score for a steep price.

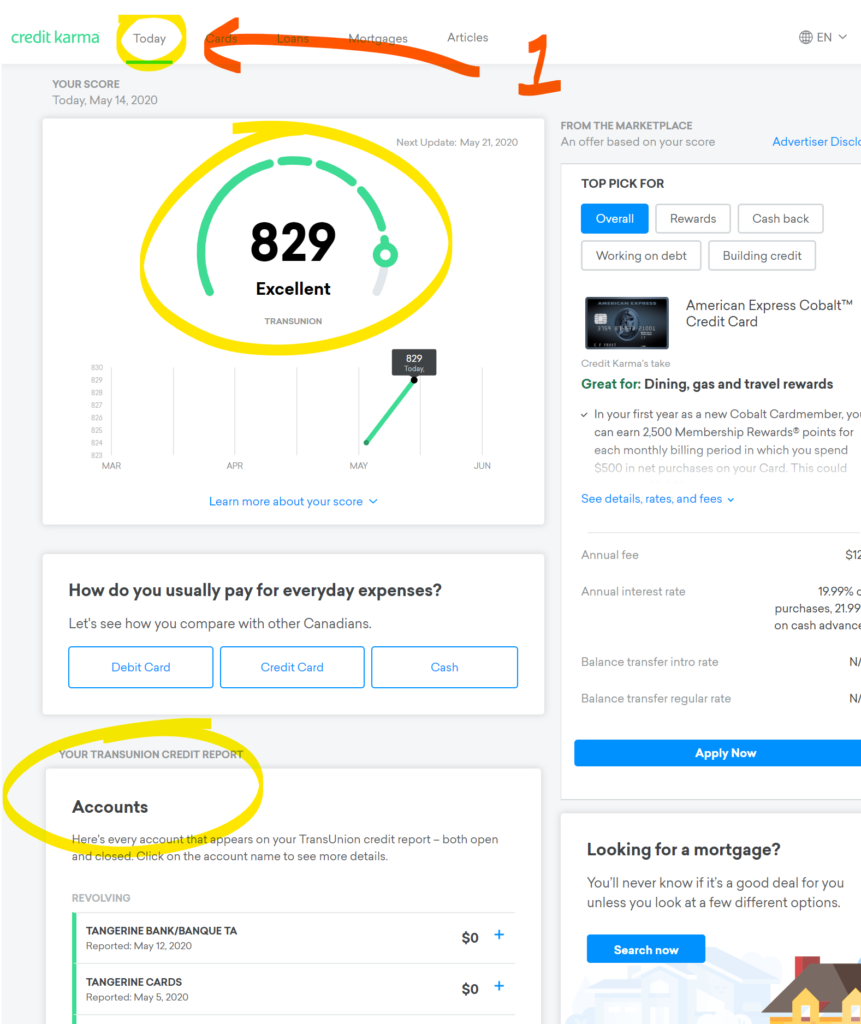

In 2007, Credit Karma came on the scene with a better option. They partnered with Equifax and TransUnion to give members ongoing access to their credit reports and credit scores.

Instead of having to wait once a year to check your reports or being price gouged to get your actual credit score, you could sign up for Credit Karma and get what you needed. This is how Credit Karma works and one of its best features.

So, to be crystal clear the company offers a free service where youll have access to your credit profile.

Recommended Reading: Does Rent A Center Report To The Credit Bureaus

Which Should You Check Regularly

Hardeman recommended picking one and sticking with it. It can be surprising to know that there are potentially hundreds of credit scores, she said. However, credit scores are highly correlative. That means if you rated good in one scoring model, you most likely have a good credit rating in all other models. Whether youre building your credit from scratch, working on bouncing back after a hardship, or just in maintenance mode, I recommend tracking one score for changes over time.

Examples Of Hard Credit Inquiries And Soft Credit Inquiries

The difference between a hard and soft inquiry generally boils down to whether you gave the lender permission to check your credit. If you did, it may be reported as a hard inquiry. If you didnt, it should be reported as a soft inquiry.

Lets look at some examples of when a hard inquiry or a soft inquiry might be placed on your credit reports. Note: The following lists are not exhaustive and should be treated as a general guide.

You May Like: Verizon Late Payment Credit Report

Hard Inquiries Vs Soft Inquiries

Hard inquiries occur when people apply for a mortgage, auto, student, business, or personal loan, or for a credit card. They also occur when someone requests a credit limit increase. While one or two hard inquiries a year may hardly dent credit scores, six or more hard inquiries at once can cause harm.

Soft inquiries, on the other hand, pivot around investigations, such as credit checks made by businesses who offer goods or services, employer background checks, getting pre-approved for offers, and checking personal credit scores. Soft inquiries can also be inquiries made by businesses with whom people already have accounts. Most of these inquiries are not lending decisions. Theyre considered promotional and conditional, and therefore, wont affect the person’s score. Soft inquiries can be done without the persons permission and may, or may not, be reported on the credit report, depending on the credit bureau.

Other activities, such as applying to rent an apartment or car, getting a cable or internet account, having your identity verified by a financial institution, such as a credit union or stock brokerage, or opening a checking account may result in a hard or soft inquirythis depends on the credit card bureau or type of institution that instigates the inquiry. Credit Karma requests the information on its members behalf, so it is a soft inquiry and therefore does not lower the member’s credit score.

Other Differences To Recognize

In addition to differences between VantageScore and FICO credit score calculations, each major player in the consumer credit scoring market has had several versions designed and implemented over the years. FICO has developed no less than 56 versions of its credit score one for each of the three major credit bureaus along with one for each specific industry that may use it.

For instance, auto loan lenders have an Auto Score available from FICO that uses the same credit information to determine specific risk factors a borrower may show as it relates to defaulting on a new car loan. The same is true for credit card issuers , mortgage lenders, and general credit inquiries.

While VantageScore does not have as many iterations of its credit scoring model, there are at least two versions still in use today by consumers and some lenders. The differences between these credit scoring versions might be subtle, but the details used to calculate an individuals credit score are varied enough to create multiple scores for a single person at any given time.

If youre ready to use Credit Karma to monitor your credit score, check out its website by clicking below.

Recommended Reading: Apply At Affirm Com Walmart

Why Your Free Credit Scores From Equifax And Transunion May Be Different

You may think that your VantageScore 3.0 credit scores from Equifax and TransUnion should be the same, but thats not always the case.

Remember, VantageScore 3.0 is ultimately just a scoring model. The three-digit number it produces depends largely on the information that lenders report to each credit bureau.

When credit scores that use the same model differ between credit reporting bureaus, its typically because they dont have the same information. Here are a few of the reasons you might see different credit scores.

- Your scores are from different dates. Different bureaus receive information from lenders at different times. If new information is accounted for in one credit score and not the other, the scores may differ.

- Your scores are calculated using different credit reports. Its up to lenders to decide which credit bureaus they report your information two. Some report to all three major credit bureaus, while others report to only one or two. If your Equifax credit report has information that your TransUnion report doesnt , your scores may differ.

- Your credit reports contain incorrect information. Its possible that one or several of your credit reports contain errors. Thats why we recommend regularly checking your credit reports for errors that may affect your scores anddisputing those errors, if need be.

Is Credit Karma Safe

As mentioned above, they dont ask for a credit card number, and you only have to enter the last four digits of your social security number to get started. Furthermore, even that information isnt stored permanently, so theres no risk of someone hacking in and stealing part of your social security number.

Read Also: Commenity Bank Stores

How Does Credit Karma Make Money

For example, if you apply for one of the personalized credit card offers using their link, theyll get a kickback from that credit card company. So while you can easily opt-out of emails at signup, youll still get offers when you visit the website.

Some of the recommended credit cards Credit Karma offers include:

- Balance transfer credit cards

Each credit card recommended on their best credit cards list is based on your credit profile.

Is Credit Karma Really That Inaccurate

The difference between your FICO Scores scores and your Credit Karma scores can be quite extreme. There are reports of people with Credit Karma scores over 700 with both bureaus but with FICO scores in the lower 600s.

Other times, the opposite might be true. Your Credit Karma score could be much lower than your FICO score. It all depends on the make up of your specific credit profile.

Read Also: Does Les Schwab Report To Credit Bureaus

How To Dispute Hard Credit Inquiries

We recommend checking your credit reports often. If you spot any errors, such as a hard inquiry that occurred without your permission, consider disputing it with the credit bureau. You may also contact the Consumer Financial Protection Bureau, or CFPB, for further assistance.

This could be a sign of identity theft, according to Experian, one of the three major credit bureaus. At the very least, youll want to look into it and understand whats going on.

Keep in mind, you can only dispute hard inquiries that occur without your permission. If youve authorized a hard inquiry, it generally takes two years to fall off your credit reports.

Your Credit Karma Score May Be Insufficient

Credit Karma updates its scores once per week. For most people, that’s plenty, but if youre planning to apply for in the near future, you may need a more timely update.

Although VantageScore’s system is accurate, its not the industry standard. Credit Karma works fine for the average consumer, but the companies that will approve or deny your application are more likely to look at your FICO score.

Recommended Reading: Usaa Fico Score

Maxing Out Your Credit Cards Each Month

Lets say you pay your bills early every single month and never miss a payment, but you cant help but rack up balances that continue growing every month. This can be a huge problem for your credit since the amounts you owe in relation to your credit limits, called , make up 30% of your FICO score.

Whats the problem? According to myFICO.com, credit score formulas see borrowers who constantly max out their cards as a potential risk. Thats why its a good idea to keep low credit card balances and not overextend your credit utilization, they report.

Whats the best utilization rule? Credit reporting agency Experian says you should strive to keep your credit balances below 25% to 30% of your limits to achieve the best results. This means that, if your total credit limit across all your is $10,000, you should never owe more than $2,500 to $3,000. If you maintain balances higher than that in relation to your credit limits, you should fully expect your credit score to take a hit.

A Credit Karma Account Has Security Measures

For example, you can get a texted code to verify your identity with two-factor authentication if you plan on logging in from different devices.

You will be able to turn credit and identity monitoring on or off. You will also be able to request email notifications for changes to your credit score, special promotions, etc. Having these options comes in handy, especially if there is suspicious activity.

If you need to reach Credit Karma by phone, you can do so by calling their phone number at1-888-909-8872. They are available to answer your calls from 8 a.m. to 11 p.m. Eastern time.

Using their toll-free number will be how you reach Credit Karma customer service.

Also Check: Does Rent A Center Report To Credit Bureau

Youve Recently Opened Or Applied For Multiple Lines Of Credit

When you open several credit accounts in a short period of time, you represent more of a risk to lenders. For this reason, your credit scores may drop if youve had several hard credit inquiries placed on your credit reports recently.

Its important to point out that checking or monitoring your credit with tools like Credit Karma doesnt affect your scores because it only results in a soft credit inquiry.

If youre rate shopping, FICO® recommends that you do so in a short period of time. For example, if youre shopping for a mortgage or auto loan within a 30-day period, the credit bureaus will typically group the inquiries together. But if youre considering applying for a credit card, keep in mind that youll get a ding on your credit reports for each credit card you apply for, no matter how close those hard inquiries are over a matter of days. So be sure to only apply for credit cards that you truly need.

Does Credit Karma Offer Free Fico Scores

You may have read reviews that say the credit scores you see on Credit Karma are useless because theyre not FICO® scores. Though Credit Karma does not currently offer FICO® scores, the scores you see on Credit Karma provide valuable insight into your financial health.

Its important to keep in mind that no one credit score is the end-all, be-all. There are dozens of different FICO® scoring models alone. Even if youre confident in a specific FICO® score, it may not necessarily match the scores a lender pulls when you apply for a loan.

At Credit Karma, we believe that because you can have so many different scores, the exact number you get at a given time isnt of foremost importance. Whats more important are the changes you observe over time in a single score, and where that number puts you in relation to other consumers.

Don’t Miss: When Does Opensky Report To Credit Bureaus

Why Are Credit Karmas Scores Higher Than What My Bank Tells Me

Tuesday, Dec 11, 18

I have been getting this question often lately. Before I answer the question, lets review what scores are provided by Credit Karma. As of my last check, Credit Karma provides consumers with 4 different free credit scores. All of these scores are based on Trans Unions data only.

So what are these scores?

Two of the scores are insurance risk scores. These are not used in lending.

One of the scores is a Trans Risk score. Trans Rick is a Trans Union score model which is not used in lending. I often hear this called a FICO score copy- cat. It is by no means the same as FICO.

Vantage Score- This is a real credit score used in some lending transactions. Vantage Scoring was developed in 2006 by the big 3 credit reporting agencies, Trans Union, Equifax, and Experian. To date, Vantage Scoring has 3 versions. The first 2 versions use a score range of 501-990 and the newest Vantage 3.0, has a range of 300-850. Credit Karma provides a score based on the older version of Vantage, meaning a range of 501-990. This leads to much confusion.

Now that we know more about Credit Karmas free scores, it is time to answer the question. Without knowing the actual score model and version your bank uses, it is impossible to give a 100% answer. I can tell you most lenders and certainly, mortgage lenders use FICO scores. FICO also has many score versions. The standard score range is 300-850.