How You Will Know About A Cifas Warning

If there is a CIFAS warning against your name you will be able to see this on your credit file. If you are an innocent victim of fraud, CIFAS members must also send you a letter telling you that there is a CIFAS warning against your name.

A CIFAS Member is not allowed to refuse an application or cancel a service you are getting, such as an overdraft agreement, just because there is a warning on your credit reference file. They must make further enquiries to confirm your personal details before making a decision.

You can get tips and useful information from CIFAS on how to avoid identity theft and what to do if you are a victim of it.

What You Can Do If Debt Buyers Report Old Debts

If you find an old debt on your credit report, resist the temptation to pay it. Instead, you should immediately dispute the debt by doing one, or both, of the following:

Dispute the old debt directly with the debt buyer. State the reasons you dispute the debt in writing and send it directly to the debt buyer. Once the debt buyer receives your written dispute, it is required to investigate the dispute and notify the CRA of your dispute. When appropriate, it must send corrected information to the CRA and request that the CRA remove the incorrect negative information.

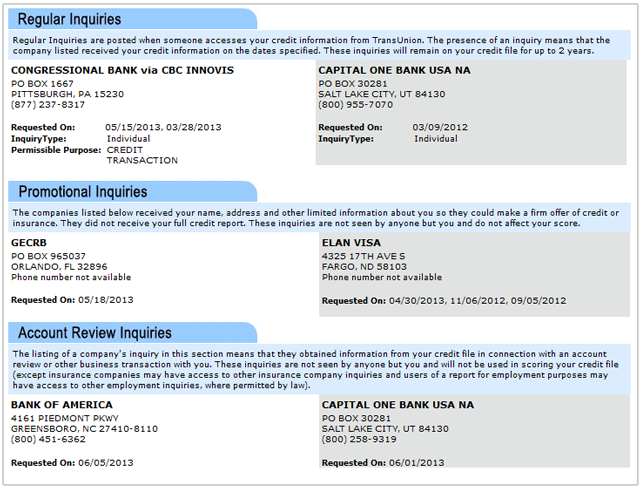

Dispute the old debt with the CRA following FCRA dispute procedure.File a dispute with the three major CRAs: TransUnion, Experian, and Equifax. Be sure to include all supporting documentation. The CRAs must then either reinvestigate the dispute or remove the negative information about the old debt from your credit report.

When Will My Credit Card Debt Appear In My Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Also Check: Carmax Installment

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

When Your Credit Score Improves After Paying Off Debt

The impact can feel like it should be immediate, but thats not the case. Even if your balance becomes $0 today, it wont be reflected on your until your lender reports the payment.

It can take one to two billing cycles or one to two months. Lenders generally report activity monthly to credit-reporting agencies.

Lets take a more in-depth look at everything involved.

Also Check: What Is Syncb Ppc On My Credit Report

Ask For A Goodwill Deletion

If you have a paid collection listed on your report, you can simply ask the debt collector or original collector to remove the collection. This usually involves sending the debt collector or collection agency a goodwill deletion letter explaining your mistake, asking for its forgiveness and showing them how your payment history has improved.

With this option, theres no guarantee your collection will be removed from your credit report, but its worth a shot. If the account is removed, it may help you qualify for better terms on personal loans, mortgages and credit cards.

Need Help With Old Debts

Remember, refusing to make payments on your debts can harm your credit, push you further into debt, and ruin your financial foundation. Be aware of the effects before you decide to wait for the debt to expire.

If youre considering not making payments because you have too many debts or cannot afford it, talk to one of our expert coaches today. We can help you find a solution that best fits your needs, and get you back on the path to financial well-being.

You May Like: Is It Possible To Remove Hard Inquiries From Credit Report

Why You Should Never Pay A Debt Collector

If the reported you to the credit bureaus, your strategy has to be different. Ignoring the collection will make it hurt your score less over the years, but it will take seven years for it to fully fall off your report. Even paying it will do some damageespecially if the collection is from a year or two ago.

You Can Still Get Credit If You Have A Low Credit Score

If you have a low credit score, a lender may ask for a guarantor. A guarantor is a second person who signs a credit agreement to say they will repay the money if you don’t. This can be a way you can borrow money or get credit when on your own you might not be able to.

If you are using a guarantor to borrow, they’ll also have to give information about their personal details so that the creditor can check they’re credit worthy. Try to pick a guarantor who is likely to have a good credit score.

The guarantor is responsible for paying the money back if you don’t and they have the same rights as you under the credit agreement. For example, the guarantor should get the same information before and after signing an agreement.

If you are thinking about agreeing to be a guarantor for someone else, make sure you understand what you are agreeing to. Read all the small print in the agreement before signing it.

You May Like: What Is Syncb Ppc

How Many Points Will I Lose After Debt Settlement

When you settle your debt, your can drop between 60 and 100 points, depending on your credit history and where you started. This is one of the major reasons why you should use a professional debt settlement company instead of trying to do it yourself. If you mess up, your score could fall even further and take even longer to repair.

Do debt settlement the right way. Well help you find the best solution for you.

Dispute Inaccurate Or Incomplete Collection Accounts

If you have inaccurate or incomplete collection accounts on your credit report, the Fair Credit Reporting Act gives you the power to dispute this information directly with the credit bureaus or creditor. You can send a dispute using the dispute form on each credit bureaus website. The Federal Trade Commission has sample dispute letters on its website if you need help crafting one.

After you submit your dispute, a credit reporting company has 30 days to investigate your claim. If the credit bureau finds the provided information correct, the collection account will be removed from your report. However, if it finds that the company reporting the information was correct, the collection account will stay on your report for up to seven years.

Don’t Miss: Free Credit Report Usaa

At A Glance: How Credit Scores Factor In Collection Accounts

|

VantageScore |

||

|---|---|---|

|

Ignores medical collection accounts that are less than six months old Weighs unpaid medical collection accounts less heavily than other types of collection accounts |

Ignores small-dollar nuisance accounts that had an original balance of less than $100 Treats medical collection accounts, including those with a zero balance, like other collection accounts |

Ignores paid collection accounts Weighs unpaid medical collections less heavily than other types of collection accounts |

What Information Is Kept By Credit Reference Agencies

Credit reference agencies are companies which are allowed to collect and keep information about consumers’ borrowing and financial behaviour. When you apply for credit or a loan, you sign an application form which gives the lender permission to check the information on your . Lenders use this information to make decisions about whether or not to lend to you. If a lender refuses you credit after checking your credit reference file they must tell you why credit has been refused and give you the details of the credit reference agency they used.

There are three credit reference agencies – Experian, Equifax and TransUnion. All the credit reference agencies keep information about you and a lender can consult one or more of them when making a decision.

The credit reference agencies keep the following information:

If there has been any fraud against you, for example if someone has used your identity, there may be a marker against your name to protect you. You will be able to see this on your credit file.

Read Also: Cbcinnovis Hard Inquiry

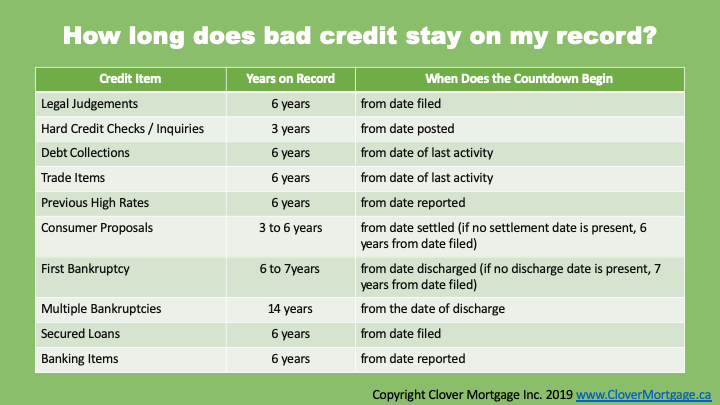

How Long Does Negative Information Remain On Your Credit Report

Other information that may appear on our credit report includes:

- Trace. A trace alert is placed on your credit report by a credit provider who has been unable to make contact with you and has asked to be notified when any updated contact information is loaded on to your credit report.

- Consumer remarks. You can ask that TransUnion include an explanation of facts or conditions that affect you on your credit report. For example, if your identity document has been stolen, you may want this information included in your credit report to try and prevent your identity being used fraudulently.

If you believe there is any information on your credit report that should not be there, or that should have been removed, you should immediately lodge a dispute with the credit bureau. The bureau is obliged to investigate and respond within 20 days.

How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

Also Check: Syncb Ntwk Credit Card

What Happens After 7 Years Of Not Paying Debt

Unpaid credit card debt will drop off an individuals credit report after 7 years, meaning late payments associated with the unpaid debt will no longer affect the persons credit score. After that, a creditor can still sue, but the case will be thrown out if you indicate that the debt is time-barred.

Can You Still Be Sued After The Statute Of Limitations Expires

Debt collectors may still seek legal actions even if your debt is time-barred. If they win the case, the court may order your paychecks to be garnished until the debt has been repaid.

There are several ways collectors may try to win the case:

- They may dispute when the statute of limitations clock began

- They may argue that the statute of limitations does not apply

- They may try to apply the longer statute of limitations of your current state rather than the debts state of origin

If you are sued, be prepared to present the correct information to the court. This includes the correct state of the debts origin, the statute of limitations for the debt type, and the last date of activity on the account.

Remember, it is up to you to keep track of the correct dates of your debts. Come to court as prepared as possible, and reach out to a lawyer if you have any specific questions about the laws in your state.

Read Also: Open Sky Loans

How To Remove A Charge

A charge-off stays on your credit report for seven years after the date the account in question first went delinquent. There is nothing you can do to get a legitimate charge-off entry removed from your credit report.

If a charge-off is reported inaccurately, or if it fails to “fall off” your credit report after seven years, you can file a dispute with Experian or one of the other national credit bureaus to have it removed from your credit reports.

Factors That Influence Your Credit Score

To better understand how your credit score can change after paying off debt, you should know the elements that make up your credit score.

There are two primary credit-scoring sources: FICO and VantageScore. Each has a different model and lenders have their own algorithms, too.

Several factors impact a FICO Score:

- Payment history: 35%

- Length of credit history: Less influential

- New credit: Less influential

Lets take a look at a few ways these factors can affect your credit score.

Your credit utilization or amounts owed will see a positive bump as you pay off debts. Generally, it is a good idea to keep your credit utilization ratio below 30%. Paying off a credit card or line of credit can significantly improve your credit utilization and, in turn, significantly raise your credit score.

On the other side, the length of your credit history decreases if you pay off an account and close it. This could hurt your score if it drops your average lower.

Recommended Reading: What Is Coaf On My Credit Report

Get A Copy Of Your Credit Reference File

You can ask for a copy of your credit reference file from any of the credit reference agencies. If you have been refused credit, you can find out from the creditor which credit reference agency they used to make their decision. Your file shows your personal details such as your name and address, as well as your current credit commitments and payment records.

You have a right to see your credit reference file – known as a statutory credit report. A credit reference agency must give it to you for free if you ask for it.

If you sign up to a free trial and decide its not right for you, remember to cancel before the trial ends or you might be charged.

Can You Go To Jail If You Owe The Bank Money

You can’t be arrested just because you owe money on what you might think of as consumer debt: a credit card, loan or medical bill. Legally, debt collectors can’t even threaten you with arrest. But they do have other legal recourse, such as suing you for payment.

You can work to clean your credit report by checking your report for inaccuracies and disputing any errors.

Don’t Miss: Credit Check Without Social Security Number

Can You Remove Collections Accounts From Your Credit Report

You can’t get a correctly reported collection account removed from your credit report early.

Even if you pay off the debt, the collection account will stay on your credit report for up to seven years. The timeline depends on when your debt first went delinquent, not whether you still owe the money.

However, if you notice an error with the collection account, you can file a dispute with each of the credit bureaus to have the account corrected or removed from your credit reports.

For example, if the collection agency doesn’t send an update to the credit bureaus once you’ve paid off or settled the account, you may want to file a dispute.

If a collection account is removed from your credit reports early, the original account and late payments that led to the collection activity can remain. Those can continue to impact your credit, and the late payments will remain on your report for seven years from the date of first delinquency.

Normal Credit Rules Still Apply

Although the DMP itself wont impact your credit score, there are potential side effects of using this option that may cause your score to drop .

Dont miss payments

If youre working with a third-party company to arrange your DMP, its important that you continue to make payments on your accounts until the company takes over your payments. Otherwise, you run the risk of missing payments which will almost certainly have a negative impact on your score. But as long as your payments are made on time and meet the requirements of the DMP they agree to, your credit score should be positively impacted by your ongoing payments.

Closing accounts can lower your score

Its important to keep in mind that accounts are usually closed when they are included on a debt management plan. One factor in your credit score is often the age of your accounts. Credit accounts that have been open for a long period of time reflect more positively than accounts that are recently opened. So if you include a number of older accounts on a DMP, your score is likely to drop in the short term as the average age of your accounts drops. If your credit is already poor, this probably isnt a big concern.

The negative impact it could have on your report is minimal when compared to your long-term positive impact of paying off your debt. On average, DMP clients have seen their .

Don’t Miss: Syncb/ppc Account

How Do Collections Affect Your Credit Scores

A collection account is a negative item that can hurt your credit scores. But the impact on your score can depend on the type of credit score and whether you’ve paid off the collection.

For example, the latest FICO® Score and VantageScore® models ignore paid collection accounts, while previous score versions may count paid collections against you.

But when you’re applying for a loan with a lender that uses older scoring modelssuch as a mortgage lenderpaying down your collections could still be important. Credit scores aside, the lender may review your credit history, and having unpaid collections could make it more difficult to qualify. While even paid collection accounts are negative, they may be viewed more positively by lenders than an account that remains unpaid.