Check Your Credit Reports For Errors

Its smart to check your credit reports from time to time at annualcreditreport.com and look for errors. For instance, if you spot an account you didnt open, its possible your personal information was used fraudulently, or that someone elses information has become mixed up with yours. In cases like these, you can file a dispute to remove the account.

Youll want to file a dispute with each of the three credit bureaus, assuming the error shows up on all three of your credit reports. The Consumer Financial Protection Bureau provides information on how to initiate disputes for each credit bureau online, by phone or through the mail.

After youve filed a dispute, the credit bureau youve filed it with has 30 days to investigate your claim.

Note that you can only dispute inaccurate information. If theres a negative mark on your credit reports for something you actually did, that isnt grounds to file a dispute.

Does Checking My Credit Scores Hurt My Credit

Checking your free credit scores on Credit Karma doesnt hurt your credit. These credit score checks are known as soft inquiries, which dont affect your credit at all.

Hard inquiries generally happen when a lender checks your credit while reviewing your application for a financial product. This kind of check can negatively affect your credit.

Read more about the difference between hard and soft credit inquiries.

What Should I Do When I Get My Credit Report

Your credit report has a lot of information. Check to see if the information is correct. Is it your name and address? Do you recognize the accounts listed?

If there is wrong information in your report, try to fix it. You can write to the credit reporting company. Ask them to change the information that is wrong. You might need to send proof that the information is wrong for example, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.

Recommended Reading: How Is Credit Score Determined

Whats The Best Site To Get A Free Credit Report

The best site for free credit reports depends on what you need.

If you want to take a look at your credit reports from Equifax and TransUnion, you can do so on Credit Karma.

The Fair Credit Reporting Act entitles you to one free copy of your credit report from each of the three major consumer credit bureaus every 12 months. You can order them online at annualcreditreport.com.

Apply For New Credit Sparingly

Though applying for a new credit card can help boost your credit score, its important to note that you should limit how often you apply for new credit products. Applications can hurt your situation in a few ways:

- Generating hard inquiries. When you apply for credit, this typically generates a hard inquiry, where the lender pulls one or more of your credit reports to evaluate your creditworthiness. A hard inquiry will typically hurt your credit score by 5 to 10 points, and will stay on your reports for two years .

- Reducing your average age of accounts. Length of credit history accounts for 15% of your FICO Score, and part of this is the average age of all your accounts. Opening new accounts reduces that average age, particularly if youre new to credit and dont have many other accounts to balance things out.

- Signaling that youre desperate. If lenders see a lot of recent inquiries on your credit reports, it might signal that youre desperate for credit and unlikely to pay back what you borrow and that means lenders will be more likely to reject your applications going forward.

Don’t Miss: How To Increase Transunion Credit Score

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

Why Your Credit Score Matters

Your credit score affects:

The higher your FICO Score the more likely you are to get approved for a or loan plus, itll usually reduce the interest rate associated with that particular loan or card. Lower scores can raise your interest rates significantly, or may even disqualify you for a product or service completely.

Loans

For many credit cards, especially the most lucrative rewards cards, the cards are only offered to consumers that meet a minimum credit quality. Many of the best cards are exclusively marketed to consumers with excellent credit scores. And when it comes to credit cards, your credit score can determine the breadth of options you can choose from. Most cards are also marketed with a range of interest rates and APRs. The actual interest rate on your specific card will be inversely related to your credit score with higher creditworthiness receiving lower interest rates and vice versa.

Loans

With mortgages and auto loans, lenders behave similarly. Your credit score is used as a component of whether or not a bank will choose to approve a loan or may force you to make additional concessions for approval. It can and generally will move the interest rate you pay on the loan as well.

Read Also: How To Analyze A Credit Report

Always Make Payments On Time

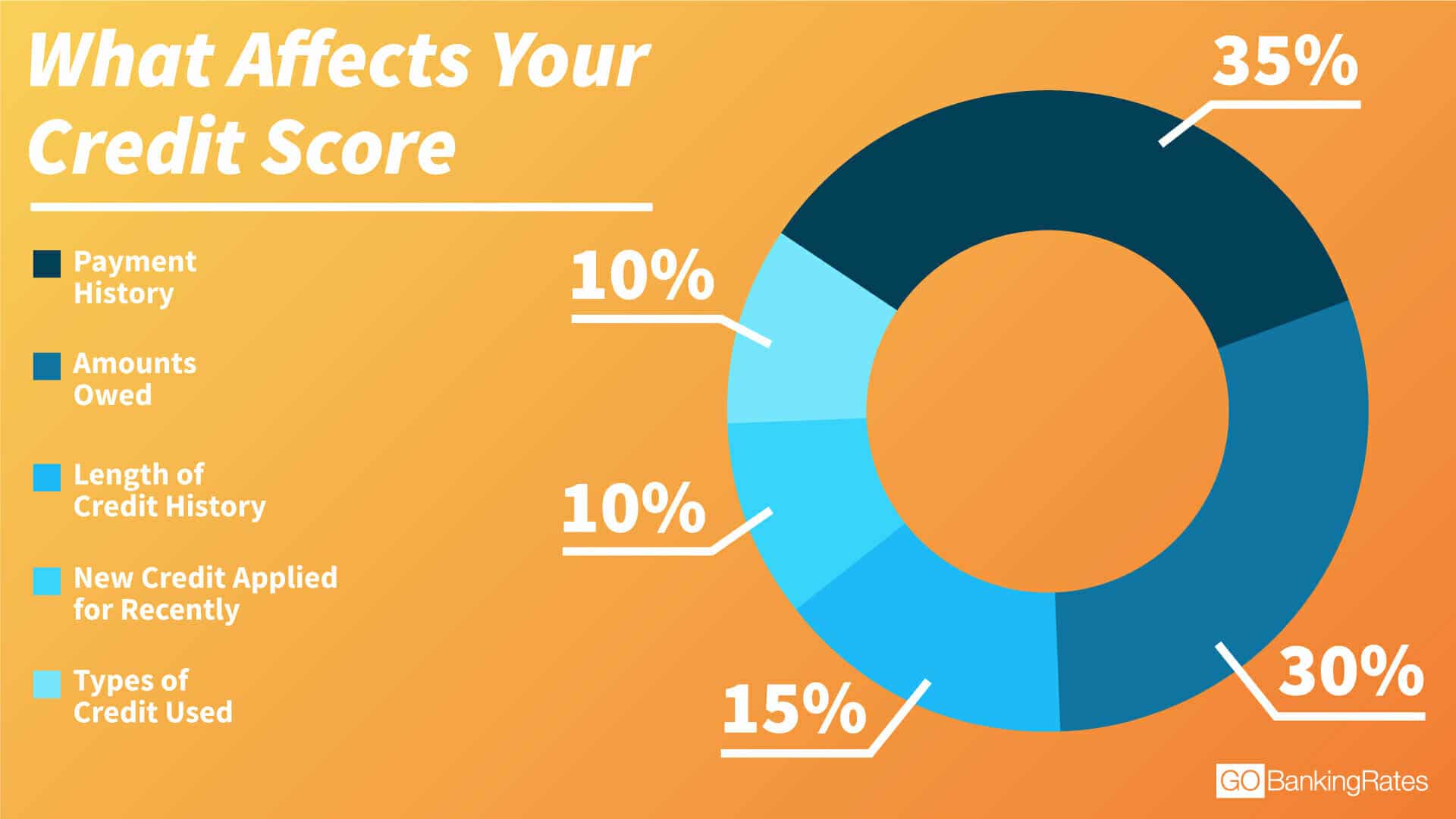

Once you have a credit card, make sure to pay your bill on time every month. Your payment history is the single most important factor in your credit score, accounting for 35% of your FICO® Scoreâ .

Keeping your credit utilization ratio low is another way to build good credit. This ratio refers to the percentage of your available credit you’re using. If your credit card has a limit of $200 and you’re carrying a balance of $100, you’re using 50% of your available credit. Maintaining a credit utilization ratio below 30% of your credit limit will help to boost your credit score. Paying your balance in full each month helps tooâand will also prevent you from accruing interest on your purchases.

Do you have any outstanding student loans? Paying those bills on time can help improve your credit score. Student loans are installment credit, while credit cards are revolving credit. Having a mix of both types of credit helps to increase your credit score. Finally, if you pay your own cellphone bills or utility bills, consider signing up for Experian Boostâ¢â , a free service that adds on-time payments for those services and more to your credit report, potentially helping improve your FICO® Score.

Were There Different Varieties Of Money Having Reasonable Credit Throughout The British

You age financing possibilities that will be online in the event that your credit score was basically good. However, there could be plenty available to complement your position, including:

- Signature loans, that are not secure against people property like assets

You can expect unsecured personal loans having reasonable credit score without guarantor. Once we nonetheless perform borrowing from the bank and you will cost checks and come up with yes the payday loans MO loans is reasonable, it indicates its not necessary to risk your assets or challenge to obtain an excellent guarantor.

Also Check: How High Can Your Credit Score Get

Get A Secured Credit Card

If youre building your credit score from scratch, youll likely need to start with a secured credit card. A secured card is backed by a cash deposit you make upfront the deposit amount is usually the same as your credit limit. The minimum and maximum amount you can deposit varies by card. Many cards require a minimum deposit of $200. Some companies such as Avant, Deserve, Petal and Jasper now offer alternative credit cards that don’t need a security deposit.

Youll use the card like any other credit card: Buy things, make a payment on or before the due date, incur interest if you dont pay your balance in full. Youll receive your deposit back when you close the account.

NerdWallet regularly reviews and ranks the best secured credit card options.

Secured credit cards arent meant to be used forever. The purpose of a secured card is to build your credit enough to qualify for an unsecured card a card without a deposit and with better benefits. Choose a secured card with a low annual fee and make sure it reports payment data to all three credit bureaus, Equifax, Experian and TransUnion. Your credit score is built using information collected in your credit reports cards that report to all three bureaus allow you to build a more comprehensive credit history.

Request Credit Reports & Answer Any Security Questions

After you fill out the form, you can request your credit reports from the three major credit bureaus. Youll likely be asked to answer some security questions to verify your identity. For example, you may be asked when you were born or information about past accounts you may have owned. In addition, you may be asked to provide your phone number to receive a one-time password.

Also Check: Does An Arranged Overdraft Affect Your Credit Rating

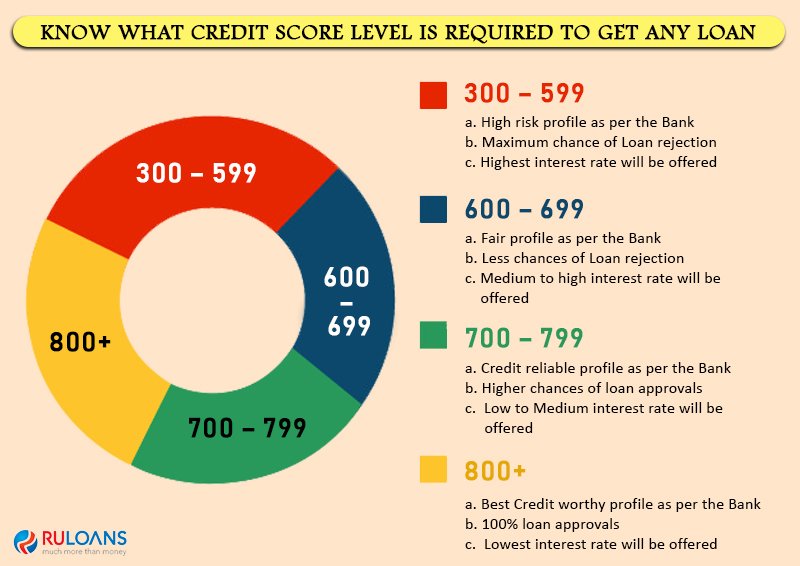

What Your Credit Score Means

Your credit score represents the likelihood that you’ll repay a loan based on your history with credit accounts. Credit scoring calculations use your credit history to generate a three-digit score based on five key factors: your payment history, amount of debt, length of credit history, types of credit, and recent applications for credit.

High credit scores are better and represent a history of doing positive things, such as paying bills on time and using available credit responsibly, and avoiding the negatives, like late payments more than 30 days overdue, accounts going to collections, and bankruptcy. On the other hand, borrowers with lower scores typically have had trouble making payments in the past and carry more risk for lenders, resulting in higher interest rates, if they get approved.

Negative information generally affects your credit score less as it gets older and you add positive information to your credit history. After seven years, most negative information wont affect your credit score.

There are multiple credit scoring models available and each one has its own formula for calculating your score. VantageScore and FICO are two well-known brands of scoring models.

Whats The Difference Between Fico Score And Vantagescore

While FICO® Score is the most well known score, VantageScore® is their direct competitor. Both of these companies use a credit score range of 300 850.

FICO® and VantageScore® share data but tend to weight scoring factors differently, such as payment history, new credit, credit history, etc. But keep in mind, your credit score will be similar with both.

Don’t Miss: How To Get A Truly Free Credit Report

Why Is My Credit Report Important

Businesses look at your credit report when you apply for:

- loans from a bank

- jobs

- insurance

If you apply for one of these, the business wants to know if you pay your bills. The business also wants to know if you owe money to someone else. The business uses the information in your credit report to decide whether to give you a loan, a credit card, a job, or insurance.

How Does A Credit Scoring System Work

- Have you paid your bills on time? If your credit report shows that youve paid bills late, had an account put in collections, or declared bankruptcy, thats likely to affect your score negatively.

- Are you maxed out? Many scoring systems look at the amount of outstanding debt you have compared to your credit limits. If the amount you owe is close to your credit limit, its likely to hurt your score.

- How long have you had credit? Generally, scoring systems consider your credit track record. A short credit history may hurt your score, but paying bills on time and having low balances can offset that.

- Have you applied for new credit lately? Many scoring systems look at inquiries on your credit report to see whether youve applied for credit recently. If youve applied for too many new accounts recently, it could hurt your score. Not every inquiry is counted: for example, inquiries by creditors who are monitoring your account or making prescreened credit offers arent counted against you.

- How many credit accounts do you have, and what kinds of accounts are they? Although its generally considered a plus to have established credit accounts, too many credit card accounts may hurt your score. Also, many scoring systems consider the type of credit accounts you have. For example, under some scoring systems loans to consolidate your debt but not loans for buying a house or car may hurt your credit score.

Don’t Miss: How To Check My Credit Rating For Free

Ways To Get Your Credit Score For Free In Canada Jul 2022

Want to check your credit score for free in Canada? There are now multiple ways to achieve that.

Gone are the days when you needed to pay $20 or more to TransUnion or Equifax to view your credit score. Using the resources below, you can get access to your credit score for FREE and also get updates on a weekly, monthly, or quarterly basis.

Some of the companies offering free credit score access also have other services they promote including credit cards, personal loans, etc. However, you are under no obligation to subscribe to any of these offerings or services.

Whats A Good Credit Score

Credit bureaus have slightly different scales for what makes a good or bad credit score. FICO typically considers a good score to be from 670 to 739, with anything from 580 to 669 considered a fair score. From 740 to 799, those scores are very good, with scores at 800 and above marked as exceptional.

Read Also: What Can Affect Credit Rating

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

How To Improve Your Credit Score

Read Also: What Is The Max Credit Score

Free Credit Scoring Website

One of the best ways to check your credit score for free is by visiting a free credit scoring website. These websites typically offer access to your credit report, score and/or credit monitoring and are updated anywhere from weekly to monthly. Theres no fee to sign up for basic credit score updates. However, some websites offer more advanced services for a monthly fee.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Recommended Reading: Will Closing A Credit Card Hurt My Credit Score

Why Is It Important To Check My Credit Report

Its important to check your credit report because credit reporting mistakes happen. They can be the result of a creditor reporting inaccurate information or a sign of identity theft. If the error lowers your , it can decrease your approval odds when applying for a loan and it could prevent you from securing the best rate.

What Impacts Your Credit Score

In order to understand how to maintain a nice, high credit score, here are a few factors that may affect it:

- Payment history: A solid history of on-time payments helps boost your credit score, while late payments hurt it.

- Outstanding balances: Your is how much of your total available credit youre using. By paying off your outstanding balances, you lower this ratio, which helps your credit score.

- Length of credit history: The longer your credit history is, the better it is. If possible, try to keep your oldest credit accounts open.

- Applications for new credit accounts: Hard inquiries can temporarily lower your credit score, but it will bounce back over time.

- Types of credit accounts: Lenders like to see that you have experience managing multiple types of credit at the same time.

You May Like: When Do Late Payments Drop Off Credit Report