How Long Does It Take For A Credit Score To Update After Paying

It can take 30-60 days for reports to update, although this is usually closer to 30 days. As for the requirement, I think the law does not specify the duration, but only the time. 2. My assumption is that the original lender still owned the account and had just contracted with a CA to obtain it on their behalf.

How Often Does Your Credit Score Update Or Change

While most lenders and credit card companies update your information at least once a month, your credit history is not updated immediately. Instead, your credit score will be recalculated upon request. After you update your credit report, the new information will be reflected in your score the next time someone asks you to calculate it.

If The Information On A Credit Reference File Is Wrong

If you think any of the information held on your credit reference file is wrong, you can write to the credit reference agencies and ask for it to be changed. But you can’t ask for something to be changed just because you don’t want lenders to see it.

You can also add extra information about your situation. For example, you can add information if you have had a past debt but have now paid it off. This is called a notice of correction. This might help you if you apply for credit in the future.

Also Check: How Long Does An Eviction Stay On Your Credit

If You Want To Improve Or Maintain Good Credit

Lets say your credit score isnt in bad shape but you want to increase it. Here are some tips to help:

- Check your credit report annually: and dispute any errors that you come across quickly.

- Apply for a : doing so will decrease your credit utilization, which, remember, makes up 30% of your score.

- Pay all your bills in full and on time: this will continue to demonstrate that you can handle credit responsibly and help you avoid acquiring debt in the process.

- Pay off your debts: by keeping a low-to-zero balance on your debts you maintain a great credit history for lenders to view.

Some may worry that increasing your credit limits is counterintuitive to paying off debt.

Just remember that if you increase your credit limit, you shouldnt increase your balance. Otherwise, youve done nothing to improve your credit utilization or your credit score.

How To Improve Your Credit

The factors that go into your score point out ways to build up your score:

-

Pay all bills on time.

-

Keep credit card balances under 30% of their limits, and ideally much lower.

-

Keep older credit cards open to protect the average age of your accounts, and consider having a mix of credit cards and installment loans. Space out credit applications instead of applying for a lot in a short time.

There are several ways to build credit when you’re just starting out, and ways to bump up your score once it’s established.

You May Like: Removing Items From Credit Report After 7 Years

What Does A Credit Score Mean

A credit score is a number which can range from a low near 300 to a high of 850 or 900 .

If someones score is 580, it means that 580 people out of 850 are likely to repay their debt. If someones score is 780, it means that 780 people out of 850 are likely to repay their debt.

The number represents the odds that a lender will get the money back that they lend someone. The higher the number, the better the odds.

How Does Credit Reporting Work

The national credit reporting agencies collect information from lenders who report it. For example, if you have a credit card, it’s likely that your card’s issuer reports your account activity to one or more credit reporting agencies once a month.

The agencies then collect and organize the information into tradelines, which is a term used to describe individual credit accounts. Depending on the type of credit, you may see several different pieces of data, including your recent payment history, monthly payment, balance, original loan amount and more.

It’s important to note that financial institutions aren’t legally required to report account information to the credit reporting agencies. As a result, not all credit activity helps improve your credit history. Most banks, credit unions and other lenders, however, report to the agencies regularly.

Read Also: How To Clear A Repossession From Your Credit

Where Can You Find Your Free Credit Score

Under federal law, the website remains the only website eligible for a free annual credit report . To always know your creditworthiness, you must pay it with one of the three major US rating agencies – Equifax, Experian and TransUnion.

Credit karma españolIs faith karma really effective?Credit karma works second saving you money but falls short in terms of maximizing savings. Conclusion: Credit Karma is both accurate and effective . It does what it is supposed to do, allowing you to know what your credit history is and how it changes over time. Is free karma free?The faith of karma is complete free service For users. The company heâ¦

How Can I Check And Monitor My Credit

You can check your own credit it doesn’t hurt your score and know what the lender is likely to see.

You can get a free credit score from a personal finance website such as NerdWallet, which offers a TransUnion VantageScore 3.0.

It’s important to use the same score every time you check. Doing otherwise is like trying to monitor your weight on different scales or possibly switching between pounds and kilograms. So, pick a score and get a game plan to monitor your credit. Changes measured by one score will likely be reflected in the others.

Remember that, like weight, scores fluctuate. As long as you keep it in a healthy range, those variations wont have an impact on your financial well-being.

Also Check: Itin Credit Check

How To Improve Your Credit Score

The best things you can do to improve your credit score are to manage your money wisely using a realistic spending plan and to deal with your debts. Despite what some might claim, there is no quick-fix for factual but negative information on your credit report. Time and living within your means are what it takes to improve your credit rating. However, in some situations there may be a couple of things you can do to improve your score more quickly.

How To Use Your Credit Card Responsibly

Once you’ve received your card, make sure you know how to use it responsibly so you can build and maintain solid credit.

It’s easy to rack up charges on a credit card, but don’t forget to repay them along with any interest they may have accrued. Make sure you only charge what you can repay, ideally in full.

Paying your credit card bill on time every month will make a big positive impact on your credit, as will keeping your credit utilization low. Make sure you don’t max out your card, and avoid carrying a balance larger than 30% of your credit limit.

You May Like: Affirm Walmart Phone Number

How And Why You Should Check Your Credit Report

7 reasons to regularly check your creditworthiness. Keep your bankroll in good shape. Please make sure your credit information is correct. You will not be surprised by the results of your applications. Get a sense of the actions that hurt and improve your credit. Respond quickly to changes. Find out when you might qualify for better credit card offers.

What Factors Affect Your Credit Score

The two main credit scoring models, FICO and VantageScore, consider much the same factors but weight them somewhat differently. For both scoring models, the two things that matter most are:

-

Paying bills on time. A misstep here can be costly, and a late payment that’s 30 days or more past the due date stays on your credit history for years.

-

How much you owe. Credit utilization, or how much of your credit limits you are using, is weighted almost as heavily as paying on time. It’s good to use less than 30% of your credit limits lower is better. You can take several steps to lower your credit utilization. Scores respond fairly quickly to this factor.

Much less weight goes to these factors, but they’re still worth watching:

-

The longer you’ve had credit, and the higher the average age of your accounts, the better for your score.

-

Credit mix: Scores reward having more than one type of credit a traditional loan and a , for example.

-

How recently you have applied for credit: When you apply for credit, a hard inquiry on your credit report may result in a temporary dip in your score.

Read Also: Credit Carmax

How Does A Credit Score Work In The Usa

Two people talking, one explaining something

While credit is a part of the economy of many countries, perhaps no country is more dependent on credit than the U.S. Your credit score can determine whether or not you can rent an apartment, be hired for certain jobs, and borrow money for a car, a home, to attend college, or to start a business.

Well explain everything you need to know about how credit scores work in the USA and how you can work on yours!

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Usually, you can access your report online within a day or two. Or you could have to wait up to 10 days to get your report by email or mail.

Contact these credit reporting agencies for your free credit report:

Since different agencies can hold different information, you may have a credit report with more than one agency.

Some credit reporting agencies may provide your credit score for free check with them directly.

Alternatively, you can get your credit score for free from an online credit score provider, such as , Finder or Canstar. This usually only takes a few minutes.

Typically, you agree to their privacy policy when you sign up, which lets them use your personal information for marketing. You can opt out of this after you sign up.

Avoid any provider that asks you to pay or give them your credit card details.

Read Also: How To Remove Hard Inquiries From Experian

Check Your Credit Score Government

Federal law gives you the right to receive one free copy of your credit report every 12 months. During a pandemic, anyone can get a free weekly credit report from three national credit bureaus at.

Experience boostDoes Experian boost cost money? While Experian Boost is free, you have the option to upgrade your account for as little as $5 per month. The different plans available offer different services such as CreditLock and Score Simulator, all of which are described in their Experian app. Experian Boost is also not permanent.Is experian boost worth it 2020There is nothing wrong with trying Experian Boost. It’s completely free, Experian protects youâ¦

Is Knowing Your Own Credit Score Important

Some people really want to know what their credit score is. However, it changes often, so be prepared. Also, keep in mind that your credit score is intended to reflect the likelihood that you will repay any money that you borrow. Most people dont need a score to know if they will pay themselves back the money they lend themselves. Instead, focus on managing your money carefully with a budget and only apply for credit that you need your score will take care of itself.

Getting a copy of your credit report, however, is important and can be done for free. It will allow you to spot concerns, inaccuracies, or potential fraud.

Recommended Reading: Does Care Credit Check Your Credit Score

How Credit Scores Work

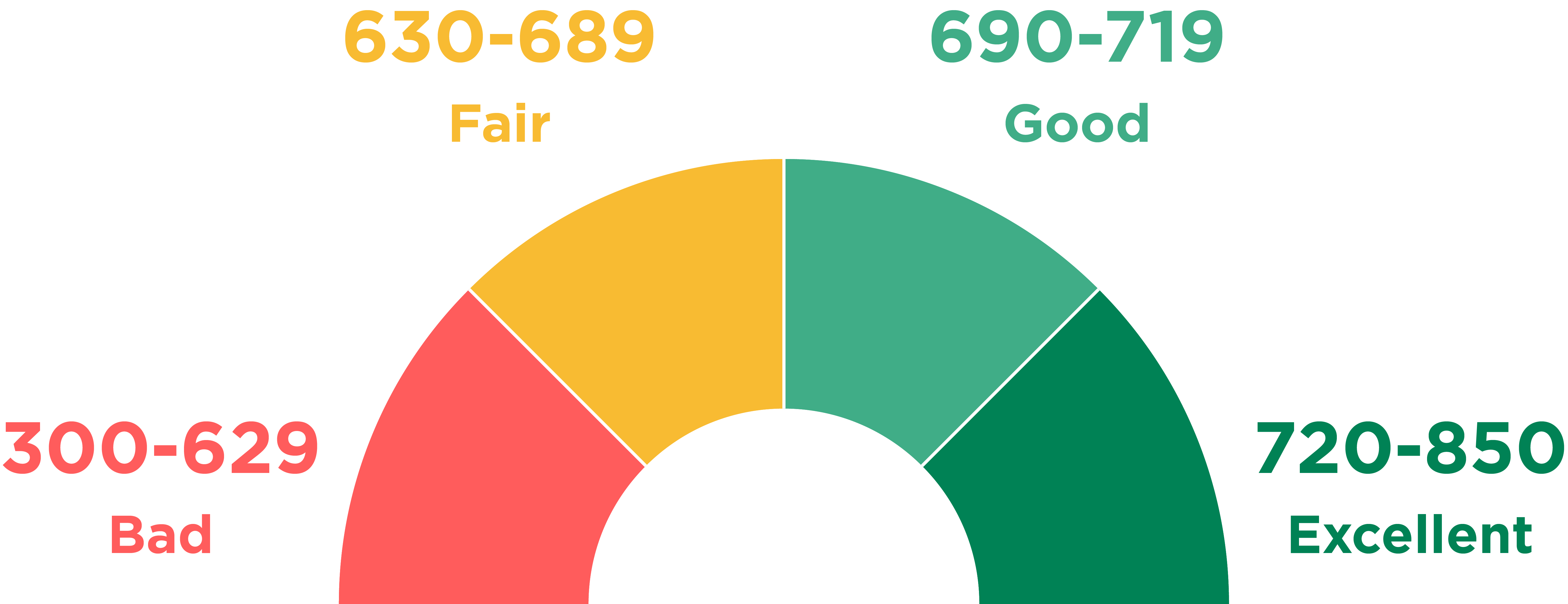

A credit score can significantly affect your financial life. It plays a key role in a lender’s decision to offer you credit. People with credit scores below 640, for example, are generally considered to be subprime borrowers. Lending institutions often charge interest on subprime mortgages at a rate higher than a conventional mortgage in order to compensate themselves for carrying more risk. They may also require a shorter repayment term or a co-signer for borrowers with a low credit score.

Conversely, a credit score of 700 or above is generally considered good and may result in a borrower receiving a lower interest rate, which results in their paying less money in interest over the life of the loan. Scores greater than 800 are considered excellent. While every creditor defines its own ranges for credit scores, the average FICO score range is often used.

- Excellent: 800 to 850

- Fair: 580 to 669

- Poor: 300 to 579

Your credit score, a statistical analysis of your creditworthiness, directly affects how much or how little you might pay for any lines of credit you take out.

A persons credit score may also determine the size of an initial deposit required to obtain a smartphone, cable service or utilities, or to rent an apartment. And lenders frequently review borrowers’ scores, especially when deciding whether to change an interest rate or credit limit on a credit card.

What Is A Credit Score?

How Good Is Your Credit Score

22 Tips to Improve Credit in 2022

The purpose of this question submission tool is to provide general education on credit reporting. The Ask Experian team cannot respond to each question individually. However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. If you have a question, others likely have the same question, too. By sharing your questions and our answers, we can help others as well.

Personal credit report disputes cannot be submitted through Ask Experian. To dispute information in your personal credit report, simply follow the instructions provided with it. Your personal credit report includes appropriate contact information including a website address, toll-free telephone number and mailing address.

To submit a dispute online visit Experian’s Dispute Center. If you have a current copy of your personal credit report, simply enter the report number where indicated, and follow the instructions provided. If you do not have a current personal report, Experian will provide a free copy when you submit the information requested. Additionally, you may obtain a free copy of your report once a week through April 2022 at AnnualCreditReport.

Resources

Get the Free Experian app:

Experian’s Diversity, Equity and Inclusion:

Read Also: Unlocking Credit Report

Types Of Credit Scores & Ranges

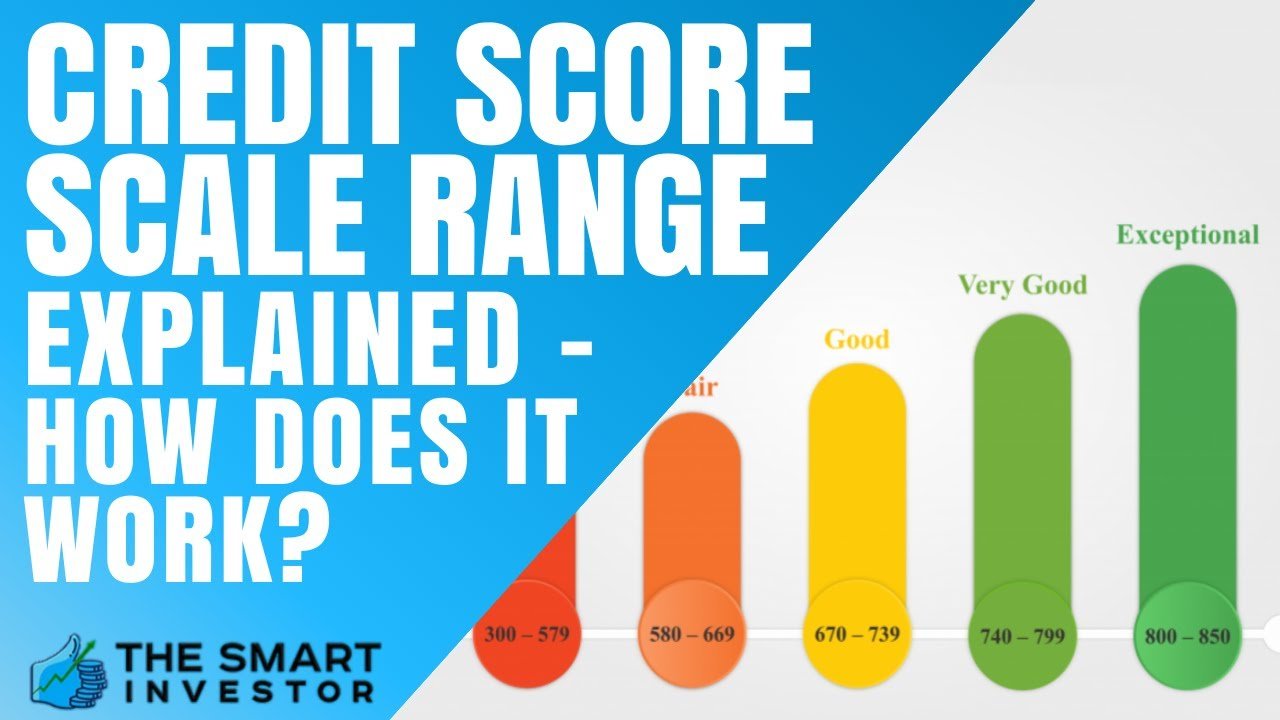

Now lets discuss the different types of credit scores and ranges. Much like with schools which follow the same general grading principles but vary slightly based on their individual rubrics credit scores often differ by credit bureau.

The U.S. has three main credit bureaus: Equifax, Experian and TransUnion. The job of these for-profit agencies is to analyze credit information and pass their findings along to lending institutions and credit issuers to help them make informed loan decisions. The output of their analysis is your credit score.

FICO is one type of credit score and its pretty widely used by lenders. Below is a breakdown of these scores by range reflecting how good or bad you are at managing your money:

Poor: 300579 Very Good: 740799 Exceptional: 800850

These ranges are important because, with a bad credit score, its much harder to get approved for a credit card or loan. Like your GPA, which is a key factor in determining what colleges you can get into, your credit score can hold you back when it comes to getting the best rates for borrowing money. However, unlike your high school GPA, there are always ways to improve your credit score.

Ask A Friend Or Relative For A Helping Hand

Your length of credit history plays a role in your credit score. FICO bases 15 percent of your credit score on factors such as the age of your oldest account and your average age of all accounts. Older is better.

In many cases, you just have to sit back and wait for your credit scores to improve within this category. However, if you have a loved one with a well-managed credit card account, you may be able to ask for a helping hand.

If a friend or relative adds you to an existing credit card as an authorized user, it might help lengthen your credit history. Assuming the account is in good shape , becoming an authorized user may improve your score if and when the account shows up on your report.

It may be tempting, but be careful not to piggyback onto a strangers credit card. Although there are companies who will help you rent authorized user status on another persons credit card for a fee, this practice may be considered fraud if you apply for financing after the fact.

Also Check: What Bureau Does Comenity Bank Pull

What Is A Fico Score Fico Score Vs Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A FICO score is a three-digit number, typically on a 300-850 range, that tells lenders how likely a consumer is to repay borrowed money based on their credit history.