Sign Up For Credit Monitoring

One of the best ways to maintain a good credit score is by monitoring it consistently. You can do this by signing up for a free or paid credit monitoring service. These services monitor changes in your credit report and send you regular updates.

Plus, the right credit monitoring service can help spot instances of fraud sooner. Monitoring your credit is the best way to proactively maintain a good credit rating.

Dont Miss: Is 721 A Good Credit Score

Check Your Credit Score

Most people dont know their credit score until the time comes when they need it.

Dont be one of these people!

Good credit scores are your passport to competitive interest rates for mortgages, cars, credit card offers, insurance premiums, and more. Maintaining a high credit score is worth it because it will save you from the money youd pay in higher interest rates.

Luckily, its simple to learn your credit score. I recommend the following companies:

| Company |

Create Your Credit Score Improvement Goal

Set a goal to improve your credit score by 100 points .

You can often achieve this in less than a year, with a little time and effort. If you have collections that are hampering progress, dont worry there may still be ways to remove them.

If you want a credit score improvement, then make it happen. Write your goal down somewhere and include it in as many places that are meaningful to you as possible. Add your credit score goal to a vision board or phone wallpaper.

You cant focus on and manifest something thats not within reach. Along with working hard to improve your credit score, start visualizing it as happening!

If you cant envisage a higher credit score happening how is that supposed to occur? Hint: It wont. Knowing you are capable of achieving the goal for this credit rating makes up half the struggle.

Don’t Miss: When Do Credit Companies Report To Bureaus

Correct Errors On Your Credit Report

Correcting errors on your credit report is a relatively quick way to improve your credit score. If its a simple identity errorlike a credit card thats not yours showing upyou can get that corrected within one to two months. If its an error on one of your accounts, though, it could take longer, because you need to involve your creditor as well as the credit bureau.

The entire process typically takes 30 to 90 days. If theres a lot of back-and-forth between you, the credit bureau, and your creditor, it could take longer.

The first step to correcting errors is to get a copy of your free credit reports from TransUnion, Equifax, and Experian . You can do this at no cost once a year at annualcreditreport.com.

Next, review your credit report for errors. If its an error on one of your accounts, you must refute that error with the bureau by providing documentation arguing otherwise. For example, if you paid a credit card on time and the card issuer is reporting a late payment, find a bank statement showing that you paid on time.

What Can You Do With A Credit Score Increase Of 100+ Points

Image source: Shutterstock

A jump of 100 points might be enough to bump a credit score up from the below average range into the average/fair range. Thats a critical jump, because it could make you eligible for an unsecured card, which is a vital step in your personal credit recovery journey. It would put you well on your way to qualifying for other financial milestones like a mortgage or a line of credit. You might even be eligible for more rewards-rich credit cards and for lower interest rates on loans.

Don’t Miss: How To Make My Credit Score Go Up

How To Raise Your Credit Score 200 Points

Approximately 31% of Americans have a subprime credit score, a FICO® Score below 670.1 . If youre in that group, you know how its significantly harder to qualify for accounts like a mortgage or auto loan and even when you do qualify for a loan you often pay higher interest rates and fees.

Unfortunately, bad credit tends to trap you in a vicious cycle too. Low credit scores mean high-interest rates. High-interest rates mean larger monthly payments. Larger payments are easier to miss, and missed payments mean lower credit scores.

If you want to know how to raise your credit score by 200 points or more, break the vicious debt cycle, and maintain a good credit score indefinitely, read this guide.

How To Improve Your Credit Score

The steps required to improve credit can vary from person to person. While some may apply to you, others may not. However, here are some general guidelines that can help you increase your credit score:

- Pay all bills on time.

- Get caught up on past-due payments, including charge-offs and collection accounts.

You May Like: How To Get Hard Inquiry On Credit Report

You May Like: How To Cancel Free Credit Report Membership

How To Raise Your Credit Score Fast

The quickest way to raise your credit score is unearthing an error in your credit report. If erroneous information somehow was entered in your credit report or you are the victim of fraud, you can dispute the debt. Notify one of the credit bureaus immediately and provide the correct information or evidence that you were defrauded.

Once the incorrect information is changed, a 100-point jump in a month might happen. Large errors are uncommon, and only about one in 20 consumers have one in their file that could impact the interest on a loan or credit line. Still, its important to monitor your score.

Get someone with a high credit score to add you to their existing account. The good info theyve accumulated will go into the formula for your score. It doesnt hurt to ask and explain how you might benefit. If you can make it happen, you could see a quick, significant jump in your credit score.

Another quick way to improve your score is to make payments every two weeks instead of once a month. The increased payments method helps reduce your credit utilization, which is a huge factor in your score.

Along those same lines, ask your card company to raise your credit limit. If you go from a $1,000 a month to $3,000, you help the credit utilization part of your score again, because you have more spending room.

If you are applying for a second or third credit card, only make one application a month. Applying for two or three at a time will result in multiple .

Why Is Your Credit Score Important

Your credit score is important for two main reasons. The first reason is because your credit score will determine whether lenders will approve you for a credit card, auto loan, home mortgage, and in some cases will even be checked by a prospective employer.

The other main reason is that your credit score will determine the terms you will be approved for credit from a particular lender. The most important term is your interest rate. Borrowers with strong personal credit scores can save thousands of dollars by receiving a slightly lower interest rate on a 30 year mortgage. You really cant over state the value of high credit score to your long term financial health.

Don’t Miss: Does Afterpay Report To Credit Bureau

How To Raise Your Credit Score 100+ Points In 30 Days

Before we get to the tips, lets get one thing straight: Raising Your Credit Score 100+ Points Will Take A Significant Amount Of Work And Effort On Your Part. But the good news is that it can be done.

With that being said, in order to get a huge boost to your scores in the shortest amount of time, you need to follow the tips outlined below. For the best result, you should try a combination of the steps although not all of them will be applicable to everyone.

Check And Understand Your Credit Score

Its important to know that not all credit scores are the same, and that they fluctuate from month to month, depending on which credit bureaus lenders use and how often lenders report account activity. So, while you shouldnt worry if you see your scores rise or fall by a few points, you should take note when a big change occurs.

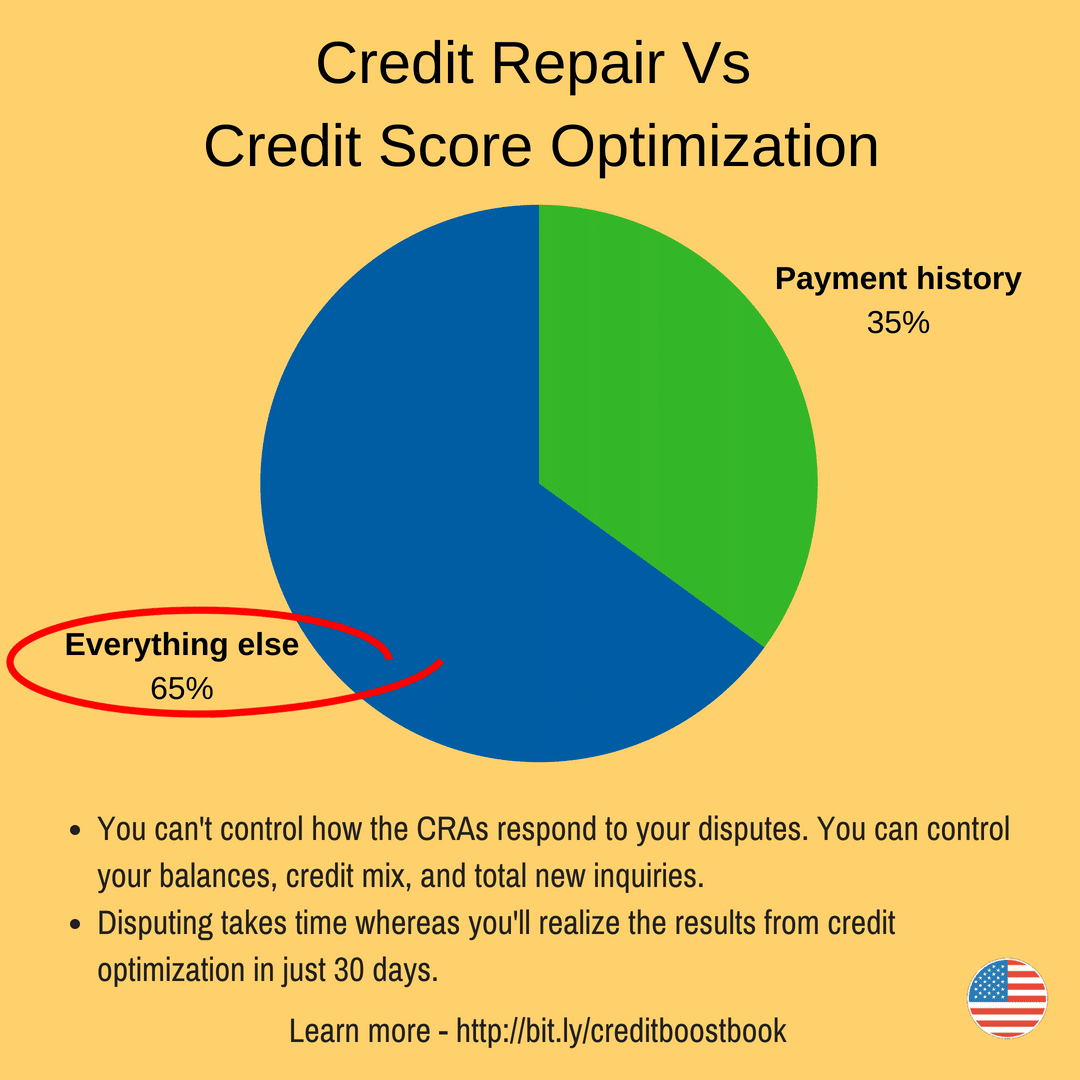

The two main consumer credit scoring models are the FICO Score and VantageScore. Here are the factors that comprise your FICO Score and how much each factor is weighed:

- Payment history

- Length of credit history

Here are the factors influencing your VantageScore:

- Total credit usage, balance and available credit

- Payment history

- Age of credit history

There are a variety of options for checking your credit score for free.

For example, Discover cardholders can get a free FICO Score from the Discover Credit Scorecard, or anyone can get a free VantageScore by creating a LendingTree account. American Express and Capital One also offer free VantageScores to both card account holders and the general public, though many other card issuers offer free access only to their cardholders.

Here are the tiers that credit scores can fall into, according to FICO:

| FICO Score tiers |

| Poor credit |

Read Also: Does Credit Karma Affect Credit Score

The Truth About Raising Your Credit Scores Fast

While a lucky few may be in a situation where they can raise their credit scores quickly, the bottom line for most of us is that building credit takes time and discipline, especially if youre trying to rebuild bad credit. Thats because your credit scores are complex and made up of several interconnected factors .

So trust us: While some credit repair agencies may promise to raise your credit scores fast, theres no secret that will help boost your credit scores quickly.

But if you start developing healthy habits now, you can build credit over time all by yourself.

Charge Small Amounts To Inactive Credit Card

Its easy to neglect older credit cards when you have a primary credit card that you use every day. If your credit cards havent had activity in the last six months, charge a small amount to the credit card. Creditors want to see that you are using the credit available to you as well as paying the balances off responsibly. Charging a small amount and paying off the balance shows that you have a different mix of credit in use, which makes up a portion of your FICO score.

Don’t Miss: Which Information Is Included On A Person’s Credit Report

Here Are 10 Ways To Increase Your Credit Score By 100 Points

How Fast Can I Get My Credit Score Up 200 Points

you might not need to! The first step is to check your credit reports to see what your credit score is. If you are already nearing 700, raising your credit score by 200 points might not be fast at all.

If you have errors on your credit reports and you get them corrected then your credit fil could improve quite quickly.

Don’t Miss: What Day Does Capital One Report To Credit Bureaus

Remove Recent Late Payments

A single late payment can drop your credit score by 60 to 110 points. Yikes!

- A 680 credit score a 30-day late payment can drop your score by 60 to 80 points. On the other hand, a 90-day late payment can drop your score 70 to 90.

- A 780 credit score a 30-day late payment can drop your score by 90 to 110 points. In contrast, it can drop 105 to 135 points if you have a 90-day late payment.

The difference between a person with a 780 score and a 680 score is that the 780 score has no late payments, while a person with the 680 may have a 30 day late payment within the last year or a 90 day late payment 2 years ago.

Removing a late payment will take persistence. There are a couple of ways to request removal. The most common and effective way is to call the original creditor and ask for a goodwill adjustment. If they resist, you can even negotiate the removal of the late payment by agreeing to sign up for automatic payments. For other late payments, you can file a dispute against the late payment for inaccuracy.

Reduce Your Credit Ratio

The gap between the amount you owe and the limit to your credit affects your credit record. This is known as your credit utilization ratio. For example, if your available credit is R20 000 and you owe R10 000, your credit utilization ratio is 50%.

A good rule of thumb is to keep your credit utilization ratio at 30% or lower. So in the above example, paying down what you owe in order to reduce the 50% rate to 30% will boost your credit score. Paying your account before the due date also increases your score.

The credit utilization ratio is one of the primary factors in determining your credit score, along with payment history.

Read Also: How To Get Free Copy Of Credit Report

Tips That Can Help Raise Your Credit Scores

Because , building credit takes time. Depending on your individual situation, there may be ways to raise your scores quickly like paying down all your debt in a very short span of time. But if youre starting out with bad credit, even a drastic measure like that may not have the immediate effect youre looking for. No matter what, the most impactful thing you can do for your credit is to create some consistent habits. Here are some tips that can help you raise your credit scores over time.

How Can I Raise My Credit Score 100 Points Overnight#

How To Raise Your Credit Score by 100 Points OvernightPay Off Your Delinquent Balances.Keep Credit Balances Below 30%Pay Your Bills on Time.Dispute Errors on Your Credit Report.Set up a Credit Monitoring Account.Report Rent and Utility Payments.Open a Secure Credit Card.Become an Authorized User.Sep 2, 2021

Also Check: When Do Collections Come Off Credit Report

How Is Your Credit Score Calculated

VantageScore and FICO calculate your credit score based on their proprietary scoring models. They calculate your credit score using data from your credit reports provided by Equifax, Experian, and TransUnion. VantangeScore and FICO utilize 5 major factors when calculating your credit score:

- Payment History

- Length of Credit History

Keep in mind, the agencies all have slight differences in how they apply these factors, so your score will typically vary by a few points depending on which agency you use for your credit score.

What Is Considered A Good Credit Score

According to the Fair, Isaac and Company , the creator of the three-digit score used to rate your borrowing risk, the higher the number, the better your credit score. The FICO score ranges from 300-850. MyFICO.com says a good credit score is in the 670-739 score range.

Your credit score is made up of five different factors.

5 categories that make up your credit score

- 35% Payment history: This is a record of your payments on all accounts for the length of the account history. Think of this as a report card for your finances.

- 30% Amounts owed: This is what makes up your credit utilization ratio. To determine your utilization ratio, take the amount of outstanding balances on each account, add them up and divide that by your total credit limit. So a credit card with a $5,000 credit line that has $3,000 in used credit would be a 60% credit utilization ratio not so good.

- 15% Length of credit history: This considers the number of years you have been borrowing. The longer your credit history of positive payments and responsible account management, the better.

- 10% Credit mix: This includes all types of credit, such as installment loans, revolving accounts, student loans, mortgages, etc.

- 10% New credit: Every time you apply for a new credit card or loan, a hard inquiry is reported on your credit report.

Read Also: What Credit Report Do Apartments Look At