Can A Collection Agency Report An Old Debt As New

You may have heard of another date pertaining to collection accounts: the date of last activity .

You might have heard it said that you should never make payments on a collection because that action would change the DLA on the account. If the DLA changes, so the advice goes, this resets the clock on the seven-year period after which the collection will fall off your credit.

In reality, debt collectors cannot change the DLAonly the credit bureaus can do that. Furthermore, the DLA does not affect the timeline of your collection account.

The seven-year period begins at the DOFD, not the DLA, and not the open date of the collection. The collection agencies are not legally allowed to change the DOFD, so there should be no legitimate way for them to restart the seven-year timeline. Yet there are many cases in which consumers report that their collection accounts are suddenly being updated as new accounts, even if they are several years old. What is going on in these situations?

This shady practice is the collection agency re-aging the debt.

Its illegal to re-age a collection account by incorrectly changing the DOFD.

When a debt collector acquires an account, they sometimes improperly update the DOFD to be the same as the date that the new collection account was opened. If you make a payment on the collection, they may replace the DOFD with the DLA, which is the date that you made the payment. This explains why the seven-year clock seems to restart in these situations.

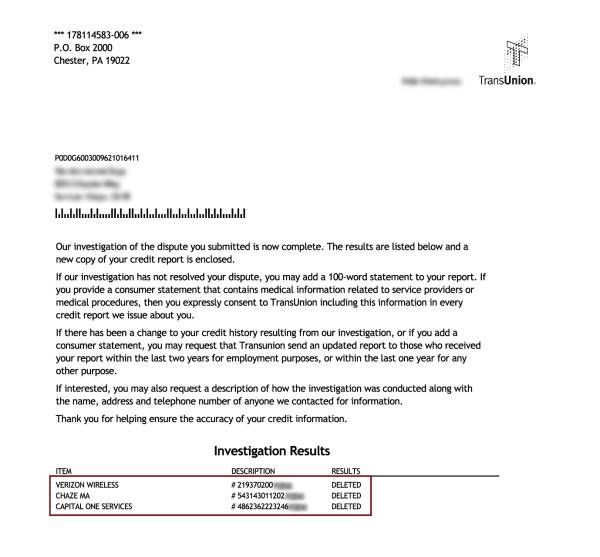

Get Your Credit Report

While many people suspect that there may be errors on their credit reports, there is no way to know for sure unless you have a copy and can locate the specific problem. The FCRA requires the credit bureaus to give a free copy of your credit report annually. Experian, TransUnion, Equifax and Innovis must each follow this requirement. These four credit bureaus provide most of the credit data used to evaluate consumers’ credit applications. You can request a copy of your credit file using our free request letters.

When A Collection Agency Steps In

Charge-offs don’t end your obligation to repay the debt.

Even if your original creditor no longer owns the account, you’ll still owe the debt to the collection agency that acquired it. Charge-offs and other negative account history, such as late or missed payments, can stay on your for up to seven years.

Read Also: Zzounds Financing Review

Multiple Collection Agencies Same Debt

If your credit report looks as Experian describes, with the old collection accounts accurately reporting as closed, there may not be much you can do besides wait seven years for the collections to fall off your credit report.

However, if the original creditor and/or multiple collection agencies report the same debt as if they are all separate open collection accounts, that may be an error that you need to dispute with the credit bureaus.

Wait For The Account To Be Sold To Another Agency And Dispute It

Debt is continually being sold and re-sold from collection agencies. When one collection agency cant get a payment on a debt, they may choose to sell the debt to another collection agency to try and collect.

At this point, the creditor listed on your credit report no longer has your account information, so you can dispute it and may have luck having it deleted.

Recommended Reading: Business Credit Cards That Don T Report To Personal Credit

How To Remove A Disputed Account From Your Credit Report

One piece of the is to dispute any erroneous and/or inaccurate information found on your credit report with the credit reporting agencies. Lets say you reviewed your credit reports and you see there is an account marked with a late payment but you are sure you paid this account on time, all the time. You mail a letter to the reporting credit bureau disputing this late payment. After 30 days, you get a letter saying they are investigating and now the account is marked Dispute Status on your report. This can be a bad thing if you are trying to apply for a mortgage or any type of credit. Learn why having a disputed account on your credit report can hurt you and what to do about getting it removed.

Hire A Credit Repair Service

A reputable company like may be a viable solution if your report is riddled with inaccuracies that further complicate the repair process. can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Handling creditor negotiations

If you decide to hire a credit repair service, know that laws govern how they operate and what they can do. The establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the service

- They cannot receive payment for the performance of any service until said service has been entirely performed

- There must be a written contract detailing the services to be performed, the time frame during which these services will be performed, and the total cost for those services

- They cannot promise to remove accurate information from a credit report before the term set by law

- The consumer will have three days in which to review the contract and cancel without penalty

You May Like: How To Remove Repossession From Credit Report

How To Remove Closed Accounts From Credit Reports

Closing a credit account isnt a guarantee that it will automatically drop from your credit report.

You might perceive that closing a credit card account would eliminate it from your credit report, but operates in an entirely different approach.

While closing the account prevents you from taking further loans using it, it is still going to appear in your report.

Legally, credit information centers have the right to have all the information displayed in your report.

This provision, however, doesnt mean that you cant remove it from your report.

In this article, were going to highlight the essential steps that youll go through before removing closed account from credit reports.

How To Remove Collection Accounts From Your Credit Report

Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card. Explore our free tool

In a Nutshell

You have a legal right to dispute debt reported by collection agencies and debt collectors. You can ask for validation or that it be removed from your credit report.

Written by the Upsolve Team. Reviewed by Attorney Andrea Wimmer

An individualâs credit history affects their ability to secure housing, credit, jobs, and to benefit from economic security. Once a collection agency account is noted on your credit report, your credit score may tumble. You have a legal right to dispute debt reported by collection agencies and debt collectors. You can ask for validation, or, if the debt is old, ask that it be removed from your credit report. If misinformation concerning collection accounts appears on your credit report, you have the ability to correct that information. Read on to learn how to remove collection accounts from your credit report.

Read Also: Does Paypal Credit Report To Credit Bureaus

What Is A Pay

A pay-for-delete letter is when you offer to settle a balance on a negative account in exchange for the debt being deleted from your credit report. The creditor or debt collector is not obligated to agree to your request, but it may be worth sending the request. If you’re sending the request to a collection agency, you’ll need to offer enough for it to be profitable for them to settle. There’s no way to know how much that is, though. If you’re close to the seven-year mark for the item to fall off your credit report, it may not be worth sending a pay-for-delete letter.

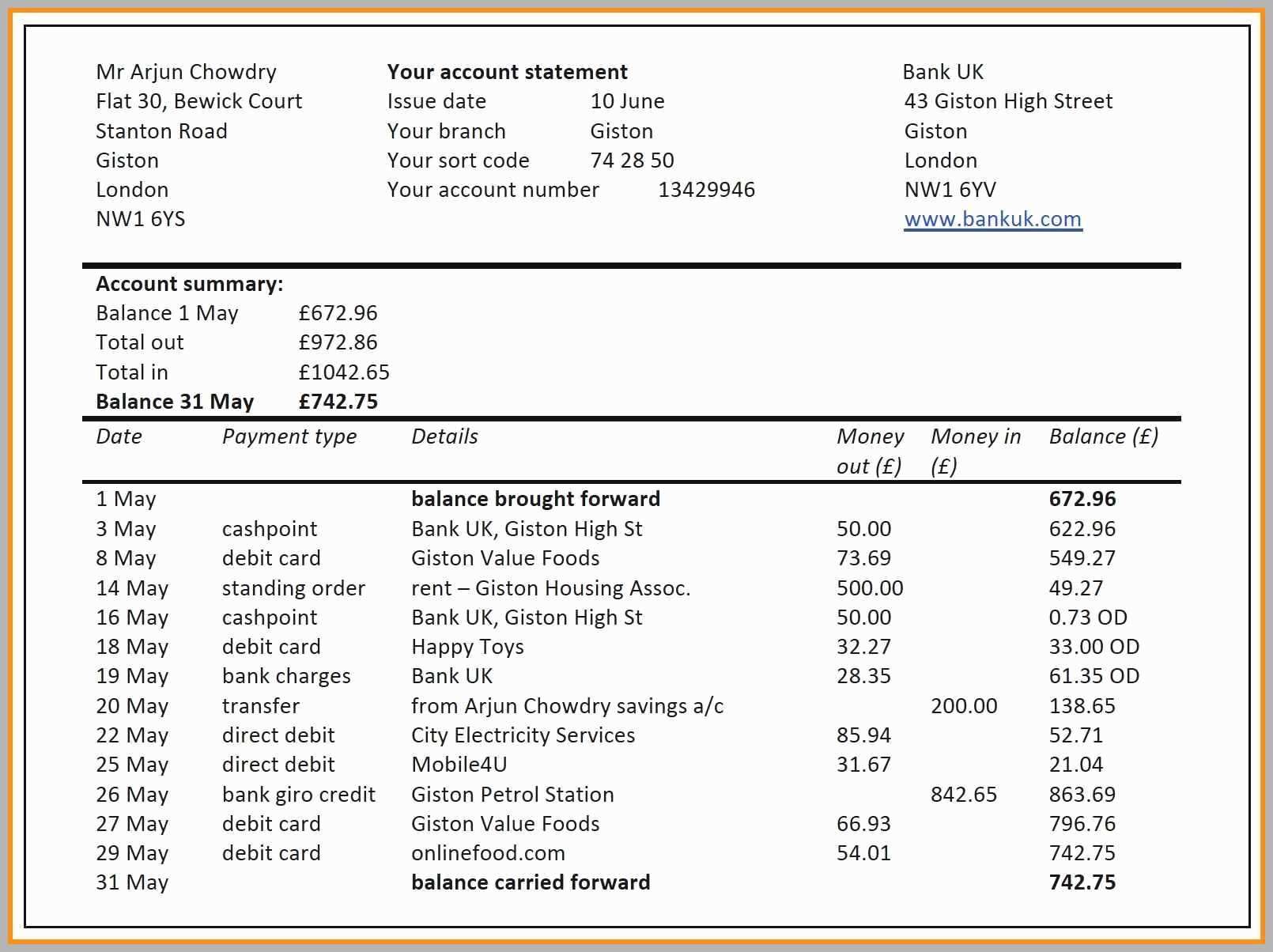

Check The Validity Of The Collection Account

When you examine your credit report for inaccurate information, ask yourself whether each debt is yours and whether each debt amount has been correctly reported. A recent report from the Bureau of Justice Statistics states that 17.7 million people in the United States, 16 and older, are victims of identity theft annually.

The Federal Trade Commission reports that imposter scams and identity theft are the two biggest categories of fraud. The first thing you should do when youâre contacted by a collector seeking your money is to check the validity of the account. But do it fast. The Fair Debt Collection Practices Act only gives you 30 days from the first contact to confirm the validity of the debt. A debt collector must stop collection activity for 30 days if they get a request to validate an account. Keep in mind that one original creditor account can pass through the hands of different collection agencies and debt buyers, so you could have an âinitial contactâ from different agencies for the same debt.

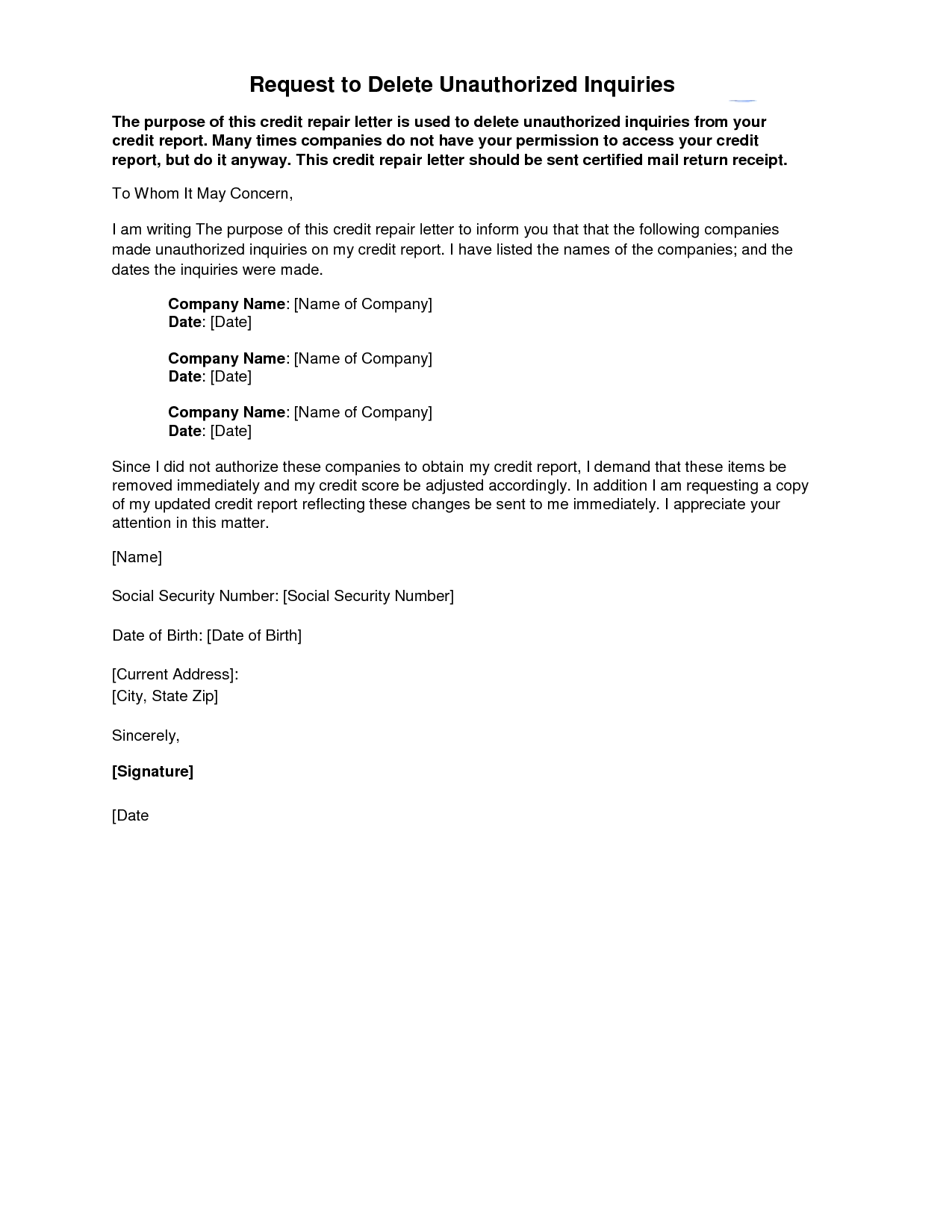

If you want to request validation of new debt, send a letter to the collection agency with the account information and tell them that you dispute the validity of the debt. Ask them to provide information to verify the original account and the debt amount, and make sure to request contact information regarding the original creditor.

You May Like: What Is Cbcinnovis On My Credit Report

Do I Need To File A Dispute With All Three Credit Bureaus

You dont always need to file a dispute with every credit bureaujust the ones that are reporting inaccurate information. That could be just one or two of them, or all three.

As mentioned, if the mistake originated with one of your creditors , then you only need to file a dispute with themyou dont need to contact the bureaus at all. Theyre obligated to follow up with each bureau and correct the error. 5

You only need to file with the credit bureaus if the error originated with them, like if they accidentally added someone elses account to your credit report.

What If You Disagree With The Credit Bureau’s Investigation

If you tell the information provider that you dispute an item, a notice of your dispute must be included anytime the information provider reports the item to a credit bureau while that dispute is being investigated.

Finally, if the investigation does not produce the results you feel are correct, and inaccurate information in your credit report is causing you harm, you may consider hiring a lawyer to help resolve your dispute as a last resort.

The secret to success is to be vigilant and tenacious when it comes to reviewing, repairing, and correcting the record regarding your credit reports.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Read Also: 586 Fico Score

If A Phone Number Doesnt Work:

In the event youre not able to get through with the numbers above, try to pull a credit report from www.annualcreditreport.com or the particular credit bureaus website.

Whats good about this is that this report will give you a phone number as well as your personal credit report id#.

Moreover, this may help in getting your call through quicker, especially when dealing with Experian.

Can A Collection Agency Change The Open Date Of A Collection

The open date of a collection account is the date that the account was acquired by the debt collector. Every time the debt changes hands, the new collection account will thus have a new open date.

The open date does not affect how long the collection remains on your credit report because its the date of first delinquency that determines when the collection will be removed from your credit. While each debt collector will have a different open date, the DOFD cannot be changed unless it was reported incorrectly.

Read Also: Does Paypal Credit Report To Credit Bureaus

Removing Closed Accounts From Your Credit Report

In some cases, a closed account can be harmful to your credit score. This is especially true if the account was closed with a delinquency, like a late payment or, worse, a charge-off.

Payment history is 35% of your credit score, and any late payments can cause your credit score to drop, even if the payments were late after the account was closed.

Removing the account from your credit score could potentially lead to a credit score increase.

Removing a closed account from your credit report isn’t always easy, and is only possible in certain situations.

If the account on your credit report is actually open but incorrectly reported as closed, you can use the to have it listed as an open account. Providing proof of your account status will help your position.

Having a credit account reported as closed could be hurting your credit score, especially if the credit card has a balance. You can dispute any other inaccurate information regarding the closed account, like payments that were reported as late that were actually paid on time.

Will My Credit Score Increase If A Collection Account Is Removed

Since payment history accounts for 35% of your FICO score, your score might build if a collection account is removed. However, how much it increases will depend on other items listed in your credit report. For example, if this negative account is the only one listed on your credit report, removing it could boost your score more than if you had several other collection accounts on your report.

Recommended Reading: What Credit Score Does Carmax Use

How To Remove Items From Your Credit Report In 2021

Weve outlined how to remove negative items from your credit report, the paid services you can opt to use, and additional information to have on hand. It is important to clarify that only incorrect items can be removed. If youve done this already, but your credit score is still low, you will need to repair bad credit over time. Although accurate items cannot be removed by you or anyone else, there are still many credit report errors that can damage your score, and these are worth looking out for.

Sample Letter To Remove Closed Accounts From Credit Report

A closed credit account is no longer active, meaning that no future transactions can be processed. For example, a credit card holder may choose to close their account if they no longer use the card, have fears of identity theft, or have financial hardship.

A misconception exists that closing a credit card or paying off a car or student loan will remove any details related to the account from your credit report. Credit reports do contain closed accounts from data furnishers that continue to impact your credit and might be best removed.

You May Like: What Is Cbcinnovis On My Credit Report

When To Write A Goodwill Letter Instead

A goodwill letter is a request that asks a lender or creditor to remove derogatory information from your credit report. Unlike a dispute, the creditor has no obligation to take any action in response to a goodwill letter or assist your credit repair efforts.

Goodwill letters are most effective when consumers had some temporary difficulty that resulted in failing to make timely payments. For example, your goodwill letter may explain that you suffered a severe injury or illness that prevented you from working and created struggles with paying bills.

The effectiveness of a goodwill letter that cites extenuating circumstances is further increased when the account has since been back into good standing. Accounts that have been forwarded to a collection agency and left unpaid are less likely to be successful using a goodwill letter.

Keep in mind that some goodwill letters involving unpaid accounts may be open to a compromise. The creditor might respond to the goodwill letter stating they will consider removing the negative credit entry if the debt is paid however, these arrangements should always be first put in writing.

The pay-for-delete option has risks because the organization is not legally obligated to remove the entry from your credit report regardless of whether the debt is paid. Also, if the debt was sold to a third-party collector the original creditors negative entry may remain and affect your credit score.

Send A Request For Goodwill Deletion

Like pay-for-delete, writing a goodwill letter seems like a long shot, but its an option for borrowers who want to exhaust every possible alternative. Write to the creditor and ask for a Goodwill Deletion. If you have taken appropriate steps to pay down your debts and have become a more responsible borrower, you might be able to convince the creditor to remove your mistake.

There is no guarantee that your plea will get a response, but it does get results for some. This strategy is most successful for one-off problems, such as a single missing payment, but it may be futile for borrowers with a history of missed payments and credit mismanagement.

When writing the letter:

- Assume responsibility for the issue that caused the account to be reported to begin with

- Explain why the account was not paid

- If you can, point out good payment history before the incident

Read Also: Does Zzounds Report To Credit Bureau

Newer Accounts And Credit Score

If your account is relatively new, it will less likely impact your credit score.

While closing the new account may have some impact on your credit score, the effect would depend entirely on the existential credit mix. The components generally include the credit utilization ratio and a couple of other factors entailing credit score calculations.

Closing the new account means you cut down the available credit for you, so youll be utilizing a significant percentage of credit allocated to you.

If you close a new account, it might affect your credit score, but differently from the conventional way that it affects slightly older accounts.