When Does Capital One Report Credit Utilization To Bureaus

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

The three biggest consumer national credit bureaus — Experian, TransUnion, and Equifax — don’t calculate your credit score from thin air. To do that, each credit bureau needs data. And one source of that data is your creditors.

If you’re a Capital One credit card holder, you might be wondering when this creditor sends your data to the credit reporting agencies.

To understand when Capital One reports credit utilization to the bureaus, we’ll:

- Discuss what the issuer reports

- Look at the hows, whens, and whys of issuer reporting

- Explore what’s important about your payment history and your credit utilization — and what you can do to improve them

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Where Does Credit Report Information Come From

Most credit report information comes from a variety of financial institutions and lenders, known as data furnishers.

When you form a relationship with a credit card issuer or loan provider, that information may be reported to the three major credit reporting agencies: Equifax, Experian, and TransUnion.

Some types of activity or accounts are considered positive, meaning they might improve your credit and cause your credit scores to go up . Other activity and accounts are negative and might harm your credit, which can cause your credit scores to go down .

Different types of accounts will remain on your credit reports for different lengths of time, having either positive or negative effects.

Credit reporting is completely voluntary there is no law that says companies have to report account information to the credit bureaus. But, if anything is included in your credit reports, the Fair Credit Reporting Act requires that information to be accurate. Errors in your credit reports can lead to lower scores and worse outcomes when applying for credit, so its important to monitor your reports to identify any harmful items and take steps to remove them as soon as possible.

You May Like: How To Check Credit Score Without Ssn

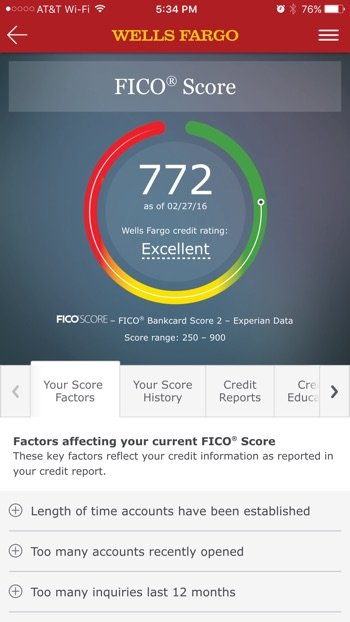

Lenders Use Different Scoring Models Based On Credit Type

When you apply for credit, one size doesnt fit all. Mortgage lenders typically use one FICO® Score model, while auto lenders and credit card issuers often choose to use the FICO® Auto Score and FICO® Bankcard Score to more accurately measure the credit worthiness of borrowers. And some lenders use scoring models other than FICO®.

Because each scoring model measures different aspects of your credit, your score can vary depending on the model used. So, if youre comparing different credit scores, make sure youre comparing apples to apples when it comes to the scoring model used.

Scores can also vary because the range is different for standard and industry-specific scoring. The standard FICO® Credit Score has a range of 300 to 850, while the FICO® Auto Score and FICO® Bankcard Score have a slightly wider range of 250 to 900.

What You Can Do

If youre concerned about your credit utilization in relation to credit reporting, you might consider asking your credit card issuer for a higher credit limit. Having more credit available and not using as much may help boost your credit. Just be sure to do your research first. And keep in mind that having more available credit could actually hurt your scores if it tempts you to rack up more debt.

Additionally, you can make multiple payments throughout the month to lower your overall balance. That way, when the balance is reported to the bureaus, your credit utilization is in good shape.

If you want to get a better handle on your credit, you can always check your credit reports from Equifax and TransUnion on and dispute any errors you see.

Recommended Reading: When Do Things Fall Off Your Credit Report

What If I Dont Want Wells Fargo To Display My Fico Score Anymore

You can opt out of the service at any time. On the FICO® Score screen, select the I no longer want Wells Fargo to display my FICO® Score link. If you decide to start the service again in the future, you can select View Your FICO® Credit Score on the Account Summary and follow the instructions to opt back in.

Who The Wells Fargo Business Secured Credit Card Is Best For

- Businesses with little to no credit history or low credit score: Wells Fargo reports payments and usage to the Small Business Financial Exchange, helping businesses build or improve their business credit.

- Business owners with cash reserves of $500 to $25,000: The Wells Fargo Business Secured Credit Card requires a cash security deposit of $500 to $25,000. The credit line is based on the amount of the security deposit.

- Business owners who cannot qualify for unsecured business credit cards: Just like a regular business credit card, the Wells Fargo Secured Business Credit Card can be used to pay for business expenses, control employee spending, and build credit. It also helps you to qualify for an unsecured small business credit card in the future.

You May Like: How Long Does Repo Stay On Credit Report

What Do The Credit Bureaus Say

As you might expect, the three credit bureaus decline to disclose which card issuers purchase their credit reports. Similarly, the Consumer Data Industry Association, a trade group representing credit bureaus, says it also is unable to shed light on the credit bureaus used by card issuers.

Tip: A hard inquiry lowers your credit score, albeit by a small amount. This is because it can send an uncertain signal to a potential lender. For instance, why did you apply for new credit? Are you going to max out a new credit line? This is why its important to only apply for credit when you need it.

What Are The Minimum Requirements To Produce A Fico Score

In order for a FICO® Score to be calculated, a credit report must contain these minimum requirements:

- At least one account that has been open for six months or more.

- At least one account that has been reported to the credit reporting agency within the past six months.

- No indication of deceased on the credit report .

Read Also: Does Speedy Cash Report To Credit Bureaus

When Do Credit Card Issuers Report To Credit Bureaus

Essential reads, delivered weekly

Your credit cards journey is officially underway.

Keep an eye on your inboxwell be sending over your first message soon.

It would make sense to assume that your activity is reported at the end of each billing cycle. However, according to Experian, every lender reports to the bureaus following its own schedule. Typically, it happens every 30 to 45 days.

This runs counterintuitive to how most people understand credit reporting, says Ty Stewart, CEO at Simple Life Insure. People tend to think of the big three bureaus almost like Big Brother, constantly monitoring your every financial move and immediately aware even when you swipe your card at a nearby Starbucks. This isnt accurate. The three bureaus are completely reliant on reports generated by creditors themselves.

Furthermore, its rare that creditors send out the reports to all three bureaus Experian, Equifax and TransUnion on the same day. That means information on your credit reports regarding your credit card usage can differ, which is one of the reasons why your multiple credit scores dont match.

See related: My credit score is 776 and 815 and 828?

Tip: Late payments only get reported once youre at least 30 days past your due date. This means your late payment wont show up on your credit report unless it has reached a 30-day mark. If it has, you can expect it to appear on your credit report within a month or two.

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

Read Also: When Does An Eviction Show On Your Credit Report

Whats In Your Credit Report

There are three major credit bureaus that produce and sell credit reports: Equifax, Experian, and TransUnion.

You have a separate credit report from each of these companies, giving you three different credit reports in all. For the most part, the information in each report will be similar. But you might notice some differences because not all lenders report to the same credit bureaus.

Your personal and financial information will be laid out differently in each of your three reports there is no uniform formatting for credit reports. But theyll each contain the same general types of information about you and your credit history.

The following types of information will be included in your credit reports:

- Personal Identification Information

- Consumer Statements/Alerts/Disputes

In addition to the list above, youll also see a description of your rights as a consumer and contact information for the credit bureau.

Example Credit Reports

Before jumping into your own credit reports, you may find it useful to browse some simple examples. Follow the links below to get an idea of how your credit reports might look, although your reports may have updated layouts.

- Current and previous addresses and phone numbers

- Current and previous employers

- Other identifying information

Take a close look at your data to make sure everything is correct. Check the spelling, and make sure all numbers are accurate.

An example Personal Information section from a TransUnion sample credit report.

The Best Bank Of America Business Credit Cards

Bank of America has over 4,600 branches and close to 16,000 ATMs across the U.S., making it one of the largest banks in America and positioning it well to serve small business customers, especially those who already have a consumer banking relationship with BofA. Bank of America has business credit cards on both the Mastercard and Visa payment networks, which are extensive in the U.S. and abroad.

Don’t Miss: Paypal Credit Credit Report

A Few Key Considerations Startups Should Make When Choosing A Business Credit Card:

- How much working capital do you need?

- If youre in a partnership or have a co-founder, whose name will be on the application?

- Who will need access to the card?

- How will it impact your personal and business credit scores?

Heres Navs pick for the best credit card for startups:

Capital on Tap Business Credit Card

With no time in business requirement, and credit limits ranging from $1,000 up to $50,000, the Capital on Tap Business Credit Card can be a great business credit card for startups. Business owners with fair credit may qualify, and applying will place only a soft inquiry on your personal credit file. Like most small business credit cards, a personal guarantee is required.

It also offers rewards of:

Is The Fico Score From Wells Fargo Accurate

4.4/5Wells FargoaccuracyaccurateFICO scorescore

Considering this, what FICO score does Wells Fargo use?

Free FICO Credit Scores

| Issuer | |

|---|---|

| Login here | FICO Score 9 |

Also Know, what is the difference between credit score and FICO score? What is the difference between the Equifax and the FICO®Score? The Equifax uses a numerical range of 280 to 850, where higher scores indicate lower risk. The FICO Score uses a numerical range of 300 to 850, where higher scores also indicate lower risk.

Herein, does viewing FICO score on Wells Fargo hurt credit?

On a smartphone, select View your FICO® at the bottom of your Account Summary. When applying for a new account at Wells Fargo, a unique scoring model is used which considers more than to evaluate applications. Remember: Accessing your FICO Score is free and will not impact your .

What credit score is needed for Wells Fargo propel card?

Here are details on Wells Fargo’s credit card: Card name: Wells Fargo Propel American Express Card. required: Score of 700+ Initial bonus: 20,000 points for spending $1,000 in the first 3 months.

Kirkland’s credit card

Recommended Reading: How To Report Tenant To Credit Bureau

How Collections Affect Your Credit

Missed payments over several months will cause a hit to your credit score. Couple that with a collection account on your credit report, and it can definitely impact your ability to qualify for new credit.

Debt collectors often buy and sell debt from one another, so this can lead to multiple collections showing on your credit reports for the same account.

When this happens, if you dont dispute the accounts, they will definitely harm your credit score.

Youve Recently Closed A Credit Card

Remember: Your score depends largely on how much available credit youre tapping into. Even if your spending habits dont change, you may reduce the amount of your credit limit by shutting down a card. Plus, losing an old card from your credit history can make you look less experienced with credit. And both of those factors can translate to a lower credit score.

You May Like: How Accurate Is Creditwise Credit Score

How Do You Buy A Car Through Carvana

The buying process with Carvana is about as simple as it gets. Go to Carvana.com to Search All Vehicles.

Youll arrive at a page where you can search for vehicles by make, model, or keyword. That means you can search for a specific vehicle or a more general category like Small SUVs.

There are also several filter options you can use to narrow down your search. These filters include:

- Price

- Transmission

- Drive Type

Once you narrow down your choices and select a vehicle, youll be taken to that cars profile page.

There, youll see an interactive 360-degree view of the actual vehicle in stock, along with multiple photos of the interior. The 360-view even allows you to highlight Hotspots, which could be minor dings or imperfections on the exterior.

When you click Vehicle Details, youll also see the cars Vehicle Identification Number , which youll want to look up to see the vehicles history. You can do that for free.

If you decide you want to buy a particular vehicle, you can click Get Started. At that point, youll be asked to create an account. Youll need to provide your name, email address, phone number, and ZIP code.

Want to move forward with a purchase? Youll just need to indicate whether you want to trade in your old vehicle, pay cash or finance. Then youll select delivery or pickup and complete the rest of the required paperwork required all online.

How Do Credit Scores Work Anyway When Does Wells Fargo Report To Credit Bureaus

A credit score is a considerable element of your financial life. It plays a key function in a loan providers decision to state yes or no to your loan or credit card application. For example, individuals with credit history listed below 640 are usually considered to be subprime debtors.

Loan provider typically charge interest on subprime home loans at a rate higher than a conventional home loan in order to compensate themselves for taking on a high threat borrower. Depending on how low your credit score is, they might likewise need a much shorter payment term or a co-signer.

On the other hand, a credit score of 700 or more is usually thought about good and might result in you receiving a lower rates of interest. On loans like mortgages, a somewhat slower rates of interest can wind up saving you tens of thousands of dollars over the payment term!

Ratings greater than 800 are considered outstanding. Its worth noting that while every creditor specifies its own varieties for credit history, the following FICO score range is often used:

- Excellent: 800 to 850

- Fair: 580 to 669

- Poor: 300 to 579

In short, your credit score is a mathematical analysis of your creditworthiness and directly affects just how much or how little you may spend for your credit. Your credit score can also determine the size of a down payment required on items like phones, utilities, or house rentals.

You May Like: Why Is There Aargon Agency On My Credit Report

The 3 Consumer Reporting Bureaus Use Different Credit Scoring Formulas

To make matters even more complicated, each of the 3 major consumer reporting bureaus Experian, Equifax, and TransUnion use different formulas in compiling your credit report and determining your credit score. Among all 3 bureaus, there are 28 different FICO® Credit Scores that are commonly used. So, depending on which bureau is evaluating your credit and the reason why you could have a dozen or more different credit scores on the same day.