Deal With Delinquent Accounts

If you have bad credit, bringing delinquent accounts current and settling accounts that are in collections can also boost your score fairly quickly. Once the creditor or collection agency reports your account update, you should see a positive bump in your score.

Keep in mind, though, that your late payment history will remain on your credit report for seven years. If you have bad accounts that have been on your report for six years or more, you may not want to worry about settling them or bringing them up to date. This can re-age the account, and if you fall behind again, it will stay on your credit report for another seven years.

Make sure you dont re-age these accounts, because theyre going to drop off soon, says Nathan Danus, CDMP and director of housing and community development at DebtHelper in West Palm Beach, FL. Negative information typically falls off your credit report after seven years, so if youre close, its best to just wait it out.

Financial Ties With Other People

Top tip

If you close a joint account, request a notice of disassociation from the credit reference agency to stop your credit files from being linked.

If youre thinking of having a joint credit agreement with someone else, their credit rating might affect yours.

Thats because your credit file will be linked to the other persons and a lender might check their file as well as your own if you apply for credit.

For example, if they fail to make repayments on credit cards or other loans, it might make your credit rating worse.

Thats why its important to end financial links with ex-partners by closing any joint accounts you still have and contacting the credit reference agency to ask for a notice of disassociation to stop your credit files from being linked.

How To Raise Your Credit Score By 100 Points In 45 Days

Insurance carriers use credit scores as part of their calculations to determine the level of risk you would pose to them as an insured. They have found a direct correlation between credit scores and claim activity. Knowing that, it’s important to keep your credit scores in good shape so that your insurance premiums stay in line.

Don’t Miss: Does Klarna Help Your Credit Score

What Factors Influence How Long It Takes To Improve Your Credit Score

The amount of time it takes to build your credit score varies, depending on a few factors:

- Length of time youve had credit. If youre just starting out, it may be easier to improve your credit score by doing things like opening a credit card and paying it off responsibly. These things can have a bigger impact if youre new to using credit than if you have a more established credit file.

- Your current credit score. If youre rebuilding your credit score after a dip, itll take longer to rebuild a high credit score back to its former glory than if youd started with a lower credit score.

- Any negative impact and the type. Not all negative marks are created equal. Paying 30 days late wont impact your credit score as much as paying 90 days late, for example. Declaring bankruptcy or going through a foreclosure can also have larger negative impacts on your credit score.

In general, most negative information stays on your credit report for seven years. Chapter 7 bankruptcy can even stay on your credit report for a full 10 years. The good news is that as time passes, the negative impact of these scores will lessen. Its possible that by the time the negative marks fall off of your credit report, theyll barely have an impact.

Use Less Than 30% Of Your Available Credit

Do your best to keep your balances way below your credit card limit. The amount you owe compared to your credit limit typically has a big impact on your credit score. If your monthly credit card spending is usually close to your credit limit, it can negatively affect your score even if you pay off your credit card bills on time. If you can get your spending down to 20% of your limit, thats a great formula for a real credit rating boost.

Also Check: Is 661 A Good Credit Score

Dont Close Your Cards

Once youve paid off a card, it can be really satisfying to cut it up! But dont close your account. Keeping your credit card account open but unused helps give you a long, established credit history, and can improve your overall credit utilization ratio. . Although sticking the credit card in a drawer has it benefits you may also be able to request a credit card freeze. You may be familiar with a credit card freeze since it used whenever you report your credit card lost or stolen. In this case, you may use a credit card freeze if you want the card open in your name but dont want or need to use the credit card for purchases.

Read Also: How To Update Credit Report Quickly

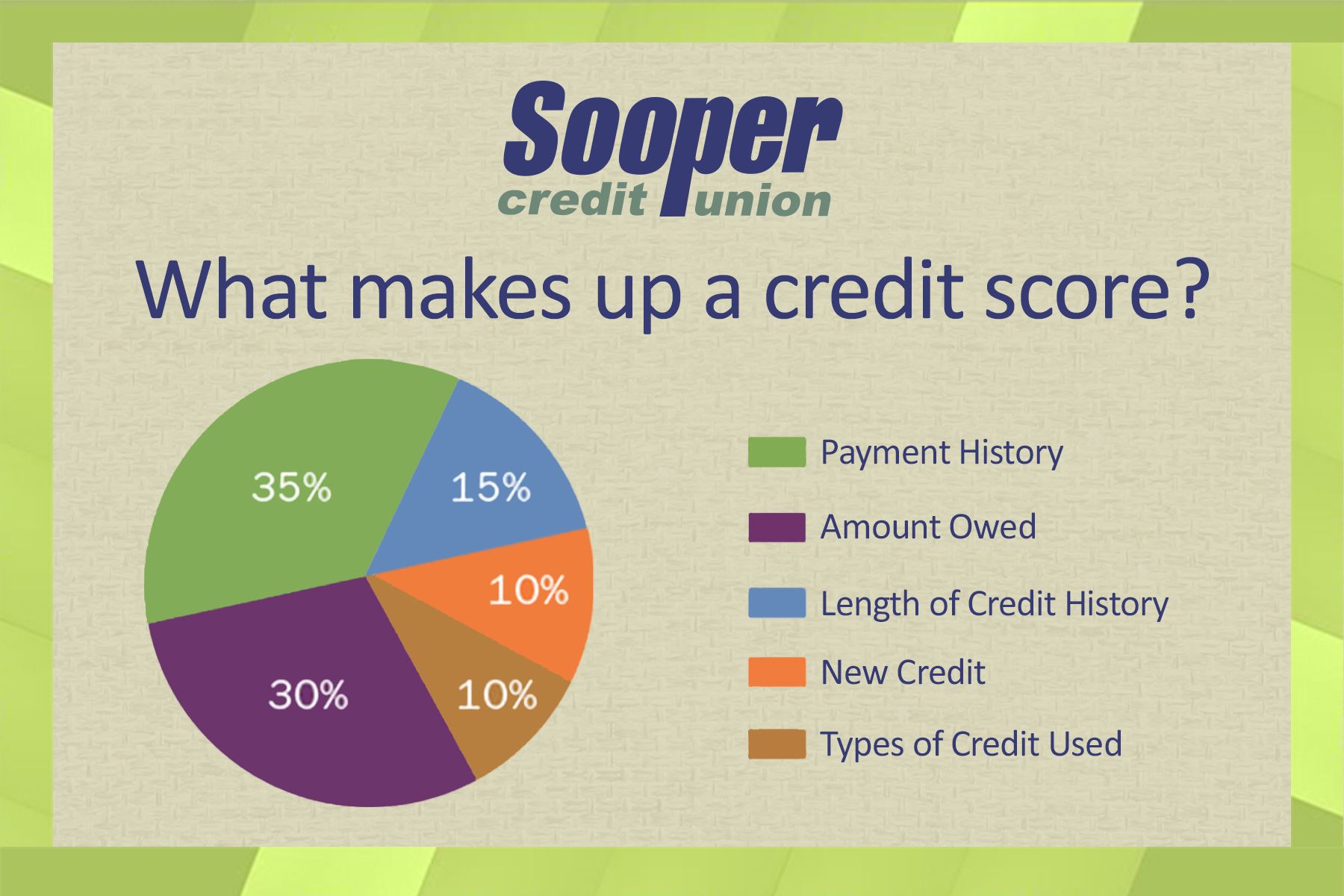

Does Avoiding Hard Inquiries Raise Your Credit Score

Yes, having hard inquiries removed from your report will boost your credit scorebut not drastically so. Recent hard inquiries only account for 10% of your overall score rating. If you have erroneous inquiries, you should try to have them removed, but this step wont make a huge difference by itself.

You May Like: How To Remove Disputes On Credit Report

And Here Are The Habits To Avoid When Youre Trying To Build Your Credit

Just as there are practices to build good credit, there are bad habits you can adopt that will result in a drop in your credit score. These are basically the opposite of the good habits, and they include:

- Missing payments and delinquencies

- Applying for new credit frequently

- Using too much of your available credit

- Having too much debt

Want To Feel More In Control Of Your Finances

Our free and flexible Couch to Financial Fitness plan will help you build confidence to manage your money.

Step by step we can help you cut your spending, develop core saving muscles, and create better habits for the future.

There are some simple steps you can take to start building a credit history.

Read Also: Will Paying Off Derogatory Accounts Raise Credit Score

Hard Hits Versus Soft Hits

Hard hits are credit checks that appear in your credit report and count toward your credit score. Anyone who views your credit report will see these inquiries.

Examples of hard hits include:

- an application for a credit card

- some rental applications

- some employment applications

Soft hits are credit checks that appear in your credit report but only you can see them. These credit checks don’t affect your credit score in any way.

Examples of soft hits include:

- requesting your own credit report

- businesses asking for your credit report to update their records about an existing account you have with them

Dont Change Houses And Jobs Frequently

Lenders want evidence that youâre a stable character. They want to see you have staying power â that youâre not here one day, gone the next. Put simply, they want evidence of stability so try not to change jobs and addresses too frequently.

Looking to change your home loan? Use our home loan selector tool or call .

Also Check: Is A Fico Score A Credit Score

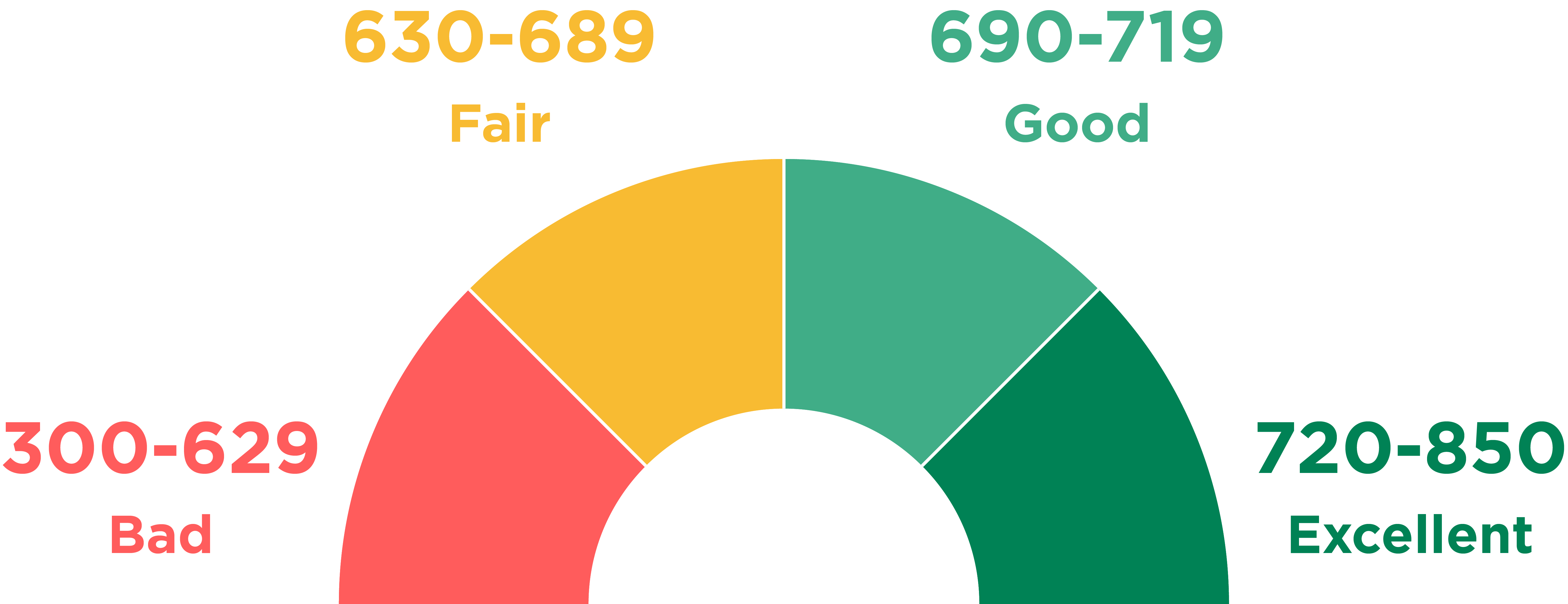

How Long To Build Enough Credit For A Mortgage

To qualify for a conventional mortgage, you will probably need a credit score in the 600s or higher, a stable income and a debt-to-income ratio of 45% or less. Those thresholds will vary by lender, however, so you should ask the lenders at which you’re considering applying for a mortgage.

According to Melinda Sineriz at Realtor.com:

âYou should know that while a âfairâ score may get you a mortgage, it wonât qualify you for the best mortgage â in terms of interest rates and other deals. To get better mortgage rates, you will need a good score or an excellent score . Unfortunately, achieving those scores will take more time.â

While some programs exist to help people buy a house with no credit or a poor credit history, in order to access the best interest rates and terms, you will need a much higher credit score.

With a mortgage loan, the rate difference may not seem wide between different credit score ranges. Your interest rate could be 6% instead of 4%, for example. But over the course of 30 years, bad credit could cost you tens of thousands of dollars if you canât manage to refinance at a lower rate in the future.

While building credit fast to qualify to buy that dream home right now might sound appealing, sometimes itâs better to wait until you build the right amount of credit. That way, you can save the most money by getting a lower interest rate.

Use ‘soft Searches’ For New Credit

When you apply for credit a lender will perform a hard credit search to check if you are eligible. This will leave a ‘footprint’ on your credit file, which will be visible to other lenders.

So it’s worth asking lenders to perform a soft search’ rather than a hard credit search when you’re looking to get new credit. This should give you an idea of whether your application would be accepted, as well as what interest rate you’d be charged, but won’t be visible to other lenders on your credit report.

More and more lenders are offering soft searches, including on loans, credit cards and mortgages.

How long will this take to boost my score?

Using soft searches won’t boost your score, but it can help protect it. By not using hard searches, your score will remain intact while you’re shopping around for a new mortgage, loan or credit card.

Also Check: Does Debt Consolidation Affect Your Credit Score

How Long Does It Take To Improve Your Credit Score

Improving your credit score can take time. For example, it can take several weeks for updated information to appear on your credit report, and a few months before any new accounts start to help build your credit score.

Information, such as late payments, can also stay on your credit report for 6 years. However, their impact will likely reduce as the record ages.

It may not happen overnight, but managing your money more effectively can make a big difference to your credit score and overall financial health. This will help you if, or when, youre ready to apply for credit.

Never Miss A Repayment

Showing that you can repay on time and stay within the credit limit you’ve been given will help convince lenders you’re a responsible borrower.

Inform your lenders as soon as possible if your debts are proving too difficult to handle. Its better to seek their help than to repeatedly miss loan or credit card repayments with no explanation.

If you are late with a payment or miss one, it will show up on your report within a month. One late payment on a credit card or loan can dent your score by as much as 130 points, according to Experian.

A missed payment will show on your report for six years, although its effect will lessen. If youve missed only one payment, your score could start to recover after around six months and should be fully recovered after a year.

Also Check: What’s The Highest Your Credit Score Can Go

How Long Does It Take To Improve A Credit Score

John S Kiernan, Managing EditorDec 7, 2017

Its possible to improve your credit score in a matter of weeks. For example, you could successfully dispute errors on your credit report, pay down credit card debt, or pay off collections accounts. Each of those steps could remove negative information from your credit report or add some positive info, either of which may benefit your credit score. Simply paying your monthly bills on time will help, too, though a single on-time payment probably wont improve your score very much. You need to consistently pay on time.

With that being said, credit improvement can be big or small. Its certainly possible to improve your credit score by a few points in a few weeks. But significant credit-score improvement is generally measured in months and years. And exactly how long it will take depends on three factors:

Below, well take a closer look at how long it generally takes to rebound from some common sources of credit-score damage.

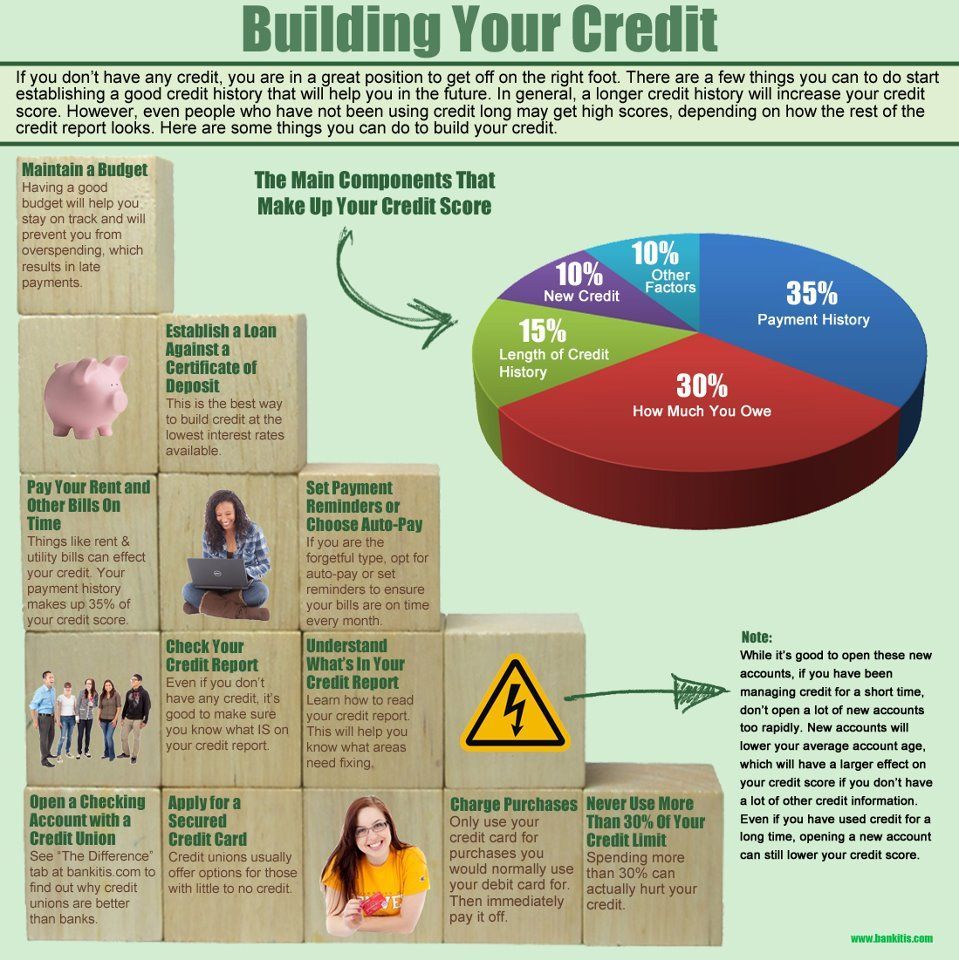

Start Simple: Pay Your Bills

The first step you can take toward repairing your credit is paying your bills on time. And, bring past-due accounts up-to-date. If youve struggled with paying bills on time in the past, then you need to get a system in place for staying on top of them if you want to rebuild your credit. For example, some of the things you can do include:

- Creating a monthly budget and tracking your spending

- Setting up direct deposit so you can get paid up to 2 days earlier

- Creating bill due date alerts through an online bank account so you know when bills are due

- Scheduling automatic payments from your checking account

- Setting up automatic savings deposits to help build an emergency cushion for unexpected expenses

Those are all simple ways to keep up with your bills and build a positive payment history. In some cases, you might be in a tougher financial situation. Figure out whats within your means and makes the most sense for your money obligations.

Don’t Miss: What Credit Score Does Navy Federal Require For Auto Loans

Verify The Contents Of Your Credit Reports

Review each of these reports thoroughly, verifying the following details are correct on each:

- Details on payments made on time

- Debt payment history

- Balances due of accounts open currently

- Number of closed accounts

- Personally identifiable information is identical across all reports complete name, address, SSN, date of birth, etc.

Use Vendors That Report To Agencies

Working with vendors that supply equipment or inventory to your business can also help you establish a strong history of paying your bills and honoring agreements with partners. This is yet another way you can build your business credit. However, make sure you choose vendors that actually report to credit bureaus. Some of these include Quill, Grainger, and Uline.

In Sallys business, she may have simply bought office supplies here and there. But signing up for an account with Quill and making regular payments ensures that her company is building business credit that gets reported to the right agencies.

Read Also: What Makes Up A Credit Score

Be Thoughtful About Opening New Accounts

While new lines of credit may help you build a credit history and lower your credit utilization ratio, you should only take on debtor spend against your available credit to the extent that you can afford to pay. Take a hard look at your budget to identify what levels of debt you are comfortable with before you request any new lines of credit or loans.

Build A Credit History If Needed

A low credit score doesnt always mean you have bad credit. It can just mean you have thin credit. In other words, you havent demonstrated enough creditworthiness to potential lenders, at least that they can see on your credit report.

If thats the case, you may need to open a credit account, such as a credit card, and make payments on it regularly. Try to get a card with no annual fee, if possible. Dont overspend, or use this as an excuse to take out loans you dont need.

You could get a secured credit card, for example, and pay for gas and other regular expenses with it. To avoid paying high interest charges or building credit card debt, track your balance throughout the month and pay the balance off every month.

Recommended Reading: Does Arrowhead Advance Report To Credit Bureaus

Keep Your Credit Usage Low

Lenders will look not only at your outstanding balances, but at how much credit you have available in their assessment of your risk.

If you have low available credit, prospective lenders may see this as a sign that youre not successfully managing your finances.

Experian says that borrowing more than 90% of the limit on a credit card can knock 50 points off your Experian credit score. Meanwhile, keeping your balance below 30% of the limit will boost it by 90 points. Keeping your credit card balance below £50 can give you a boost of 60 points.

How long will this take to boost my score?

Data from finance providers is usually fed through to CRAs every four to six weeks. So if you can reduce your overall credit usage to around a third of your overall limit across your cards, you can help boost your score fairly quickly.

Will Paying The Minimum On My Cards Improve My Credit Score

No. This is a widespread myth. You need to pay at least the minimum payment due on your credit card every month so that your cards have an on-time payment history. You do not have to pay a single cent in interest to improve your credit score. In fact, paying your credit card balances in full every month will have the greatest positive impact on your score, because it will improve your credit utilization percentage.

Don’t Miss: How To Print Credit Report