What Is The Fastest Way To Fix A Fair Credit Score

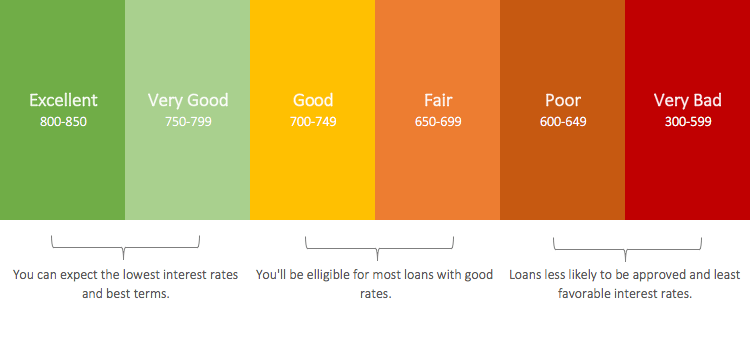

The good news about having a fair credit score is that youre only a few points away from a good credit score. If youre smart with your finances, you can improve your credit score relatively quickly.

The first step to improving your credit score is making all your payments on time and in full. This shows the credit bureaus you can be trusted with credit.

Next, youll want to check your credit report for any inaccurate items that may be dragging your score down. If you find any, you can dispute them and potentially see a significant increase in your credit score.

Lastly, you must understand the five factors that affect your credit. When researching the five factors, youll learn which factor affects your credit the most. Understanding the five factors will teach you to:

- Keep your credit utilization below 30%

- Avoid opening several new accounts all at once

- Avoid multiple hard inquiries at once

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans. Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of TransUnion Canada explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

What Is A Good Credit Score For A Car Loan

If you plan to buy a new car, you will most likely need a car loan to help pay for it. Today, the average cost of a new car is more than $40,000. The vast majority of buyers in the United States do this. Whether you apply for a Credit score for a car loan through a dealer or a bank, as part of the process, the lender will check your credit score. Here are the credit scores you need to get approved for a car loan, and what you can do if your credit isn’t perfect.

Read Also: Does Titlemax Go On Your Credit

How Is My 648 Credit Score Calculated

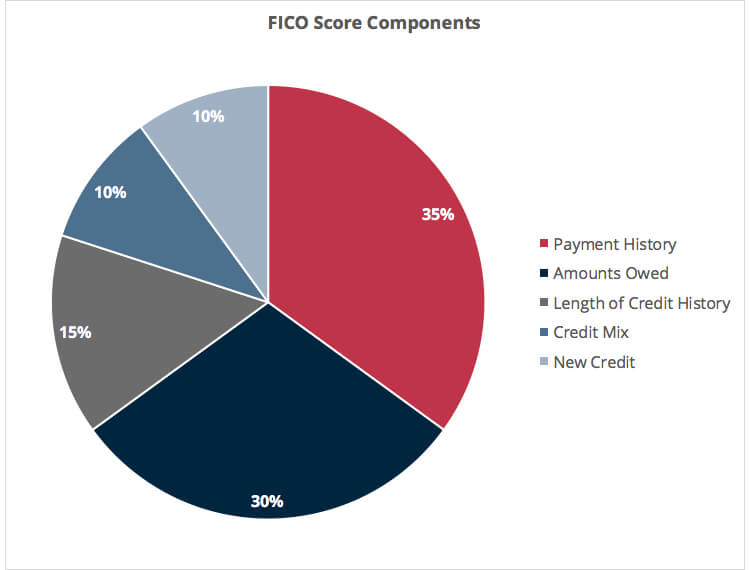

Lenders need to judge if you’re a credit-worthy individual before they give you a loan or whatever financing you need. That is where your credit comes in handy. Most lenders look at your FICO score, since it is the most widely used credit score, to determine your credit-worthiness. The specifics of how FICO calculate the score are not known, but it all boils down to the information on your credit report. Your credit report is made up of the following components: payment history , the amount owed , the length of credit history , new credit , and types of credit used .

From Fair To Anywhere: Raising Your Credit Score

A FICO® Score in the Fair range typically reflects credit-management problems or mistakes, such as multiple instances of payments that were missed or paid 30 days late. Consumers with more significant blots on their credit reports, such as foreclosures or bankruptcies, may also see their FICO® Scores rise from the Very Poor range into the Fair range once several years have passed after those events.

The credit reports of 42% of Americans with a FICO® Score of 648 include late payments of 30 days past due.

If you examine your credit report and the report that accompanies your FICO® Score, you can probably identify the events that lowered your score. As time passes, those events’ negative impact on your credit score will diminish. If you’re patient, avoid repeating past mistakes, and take steps that can help build up your credit, your credit scores will likely begin to increase.

Recommended Reading: Does Klarna Financing Report To Credit Bureaus

How Long Does It Take To Fix A Fair Credit Score

How long it takes to fix a score of 648 will depend on various factors. If you have accurate negative items on your report, such as a collection account, these items can stay on your report for up to seven years. Until these items fall off your report, itll be much more challenging to see significant increases in your credit.

On the other hand, if you dont have anything serious bringing your score down, a few months of on-time payments and responsible financial patterns can result in a relatively quick improvement in your score.

As we mentioned earlier, a fair score is only a few points away from a good credit score. If you take the right actions, your score might improve to the good range within a few months.

Reduce Your Debttoincome Ratio

Your debttoincome ratio compares the minimum monthly payment on all your current debt, including your mortgage, to your gross monthly income.

A ratio over 43% is considered high by many lenders, so lower is better.

If you apply and get turned down for a mortgage, its not the end of the world. Ask your lender what youd need to do to change your denial to an approval. Or simply find another lender with more forgiving guidelines theyre out there.

Don’t Miss: Minimum Credit Score For Affirm

Inaccurate Credit Histories Are Common

Many people in this situation discover they have a few negative entries on their credit reports that are not accurate.

When you discover inaccurate credit information on your credit report, youll want to get that negative entry removed as soon as possible so your credit score can be all that it can be.

Unfortunately, when you apply for credit, credit card issuers and other lenders wont care whether your credit score doesnt really reflect your actual credit risk. No matter how well you explain things, the lender will rely on what myfico says.

The terms of your new car loan or personal loan will reflect this reported credit risk. In other words, youll pay higher interest rates because of your inaccurately low score.

When you have worked hard to establish a long history of on-time payments and responsible credit utilization, these kinds of lending decisions are beyond frustrating!

So removing inaccurate credit information from your credit history is a must. Doing this should restore your credit history within a couple months.

There are a couple ways to go about it:

- Do It Yourself Credit Repair: You can call the lender who reported incorrect credit information and ask that they correct the inaccurate data. I always recommend handling this in writing.

- Professional Credit Repair: If youre the type of person who would rather pay a professional handle it and just be done with the whole thing, I suggest you check out Lexington Law.

Poor Credit Score: 550 649

This grand score is on account of several late or pending payments, numerous defaults on products from different lenders. This score can also be due to bankruptcy which is a scar that will remain on your record for a whole decade. Getting a new credit is near to a miracle for such individuals. It would be advisable for them to look up a professional finical advisor that will aid them in repairing their credit.

Recommended Article:

Recommended Reading: 827 Fico Score

Average Tenant Credit Score Ranges

What is the average number you can expect to see when checking into what should be considered an acceptable credit score for renting?

Here at RentPrep, we run a lot of for the landlords who use our services. This gives us some insight into what you might see from renters. We are not the only ones who have insight into acceptable credit scores, however.

These are some of the most popular numbers used as a measure of what is an average credit score for tenants in America.

649

This is the exact average score we have seen in one year of data among all of the reports weve completed. This means if the score is lower than 649, it should be at least a little concerning. According to Experian, an acceptable credit score to rent an apartment is around 638.

These numbers are based on the data we have here at RentPrep. We run thousands of credit checks every month and this is a result of our findings. Understand that this is not based on all renters, but it is based on renters of landlords who run background checks.

673 699

According to an article from ValuePenguin, the average credit score of Americans in a 2021 report was 688 for the Vantage scoring model and 711 for a FICO model. Keep in mind that this is not industry-specific it takes into account everybody and not just renters. Renters statistically have a lower credit score than homeowners.

662

Chief Factors That Affect Your Credit Score

The following factors may make or break your credit score:

- Payment history: learn from this history, repeat it. Timely payments go a long way. Payments are considered late when theyre 30-60 days past the due date. Timely payments go a long way. This might just be the best thing you can do for your credit score.

- the runner-up to payment history. This is the second most important factor to keeping an envious credit score. This is basically the amount of credit available that is being used by you. Financial advisors commend that each card you own should have a balance of below 30% according to your credit limit. Say if your limit $7000, the balance should be under or equal to $2100.

- Length of credit history: patience is a virtue and time is money. Both these things are the MVPs when it comes to building a rock-hard credit score. The longer the mean age of our account, the better.

- The type of credit in use: An assortment of different credit account types donates to a healthy credit score. A blend of debt and credit cards with a pinch of installment debt i.e. loans on automobiles or mortgages keep the credit score running in a smooth way.

- New credit: new credits or loans you apply for. This may simple but isnt so. Each new credit will help in eventually racketing up a good score, but the duration of our credit length is key here. The longer the length of our credit history, the less the new credit applications will harm our score.

Read Also: Qvc Card Credit Score

Getting Mortgages With A 648 Credit

Just like with personal loans, a credit score between 550 and 649 will provide you with sub-par rates and terms. In fact, with a 648 credit score, you may not even qualify for mortgages with many lenders. If you will you should anticipate interest rates ranging from five to six percent.

Considering these things, your credit score is one of the most important numbers in your life. It can affect every action you take, from the house you live in to the car you drive. Taking steps to improve your 648 credit score is the best way to save money and make your life easier down the road. Theres no excuse to not improve your credit score!

What makes an impact on your credit?

The three major credit bureaus rely on five types of information to calculate your credit score. They collect this information from a variety of sources, and compile it to give you an overall score. The score is comprised of 35% payment history, 30% amount owed, 15% credit history, 10% new credit, and 10% credit diversity.

The third factor in play is your length of credit history, which assesses the average age of your accounts and how long its been since those accounts were actually used. The last two, smallest factors are how often you apply for new accounts and how diverse your credit portfolio is. In other words, opening multiple accounts at a time hurts your score, while having different types of accounts improves it.

Credit Score Mortgage Lenders

Below is a list of some of the best mortgage lenders for borrowers that have a 648 credit score. All of the following lenders offer conventional and FHA loans, and can help you determine what options might be available to you. If you would like some assistance finding a lender, we can help match you with a lender that offers loan options to borrowers with a 648 credit score. To get matched with a mortgage lender, please fill out this form.

Read Also: When Does Wells Fargo Report To Credit Bureaus

Upgrade Visa Card With Cash Rewards

Our pick for: Cash back + flexibility

The $0-annual-fee Upgrade Visa® Card with Cash Rewards is a cross between a credit card and a personal loan, and it can offer the best of both worlds: flexibility, but with predictable terms from month to month. The card also lets you see what terms you’d qualify for before officially applying. And on top of all that, it earns cash back, too. Read our review.

Getting Auto Loans With A 648 Credit Score

There is no credit score too low to get an auto loan, and you should be able to get one when your credit score is 648, but it might have a relatively high interest rate. Before taking out an auto loan, consider whether the potential toll itll take on your finances is worth it or if you can wait until you get your score in the good range.

According to a 2020 quarterly report by Experian, people with credit scores of 648660 had average interest rates of 10.13% on their used car loans and 6.64% on new car loans, whereas people with credit scores of 781850 received average rates of 3.80% and 2.65%. 11Waiting until your score improves could save you hundreds of dollars each month and thousands of dollars over the life of the loan.

If you need to buy a car before your credit improves, then consider getting a used car that you can pay for upfront.

If youre set on getting an auto loan with bad poor credit, then you should pay as large of a down payment as you can afford, and consider getting prequalified or applying for a preapproval from your bank or credit union to increase your bargaining power.

Read Also: How Often Does Bank Of America Report To Credit Bureaus

Best Loan Programs For Fair Credit Scores

A fair credit score wont necessarily disqualify you, but you may have to pay more for your mortgage.

Applicants with lower credit scores pay more through higher interest rates. In some cases they could also pay higher private mortgage insurance premiums.

In most cases, governmentbacked loans have more forgiving credit history guidelines.

What’s In A Credit Score

Here’s a more detailed breakdown of the specific factors that influence your FICO® Score:

Public Information: If bankruptcies or other public records appear on your credit report, they can have severe negative impacts on your credit score.

Among consumers with a FICO® Score of 658, the average credit card debt is $13,429.

Payment history. Delinquent accounts and late or missed payments can harm your credit score. A history of paying your bills on time will help your credit score. It’s pretty straightforward, and it’s the single biggest influence on your credit score, accounting for as much as 35% of your FICO® Score.

. To determine your , add up the balances on your revolving credit accounts and divide the result by your total credit limit. If you owe $4,000 on your credit cards and have a total credit limit of $10,000, for instance, your credit utilization rate is 40%. You probably know your credit score will suffer if you “max out” your credit limit by pushing utilization toward 100%, but you may not know that most experts recommend keeping your utilization ratio below 30% to avoid lowering your credit scores. Credit usage is responsible for about 30% of your FICO® Score.

Total debt and credit. Credit scores reflect your total amount of outstanding debt you have, and the types of credit you use. The FICO® Score tends to favor a variety of credit, including both installment loans and revolving credit . Credit mix can influence up to 10% of your FICO® Score.

Also Check: What Credit Score Does Navy Federal Use For Auto Loans

Pay Off Any Past Due Balances

If you have any charge-offs or collections, pay them off as soon as possible. The same is true for judgments and tax liens. Paying them off wont remove them from your credit report. But a paid delinquency is always better than an open one. Your credit score should begin to rise soon after these delinquencies are paid.

How Credit Scoring Works

Many creditors use the popular FICO scoring system, which combines financial data collected from major credit bureaus Equifax, Experian and TransUnion. Those credit bureaus also have their own scoring system, VantageScore, which bases ratings on internal financial data.

Your credit score is tied directly to the financial decisions you make, such as paying your loans or on time.

Read Also: Qvc Card Approval