What About Business Loan Inquiries

Business loan applications are subject to similar inquiries about the financial capability of the business, which can affect their credit score. Unfortunately, many small businesses in Australia either do not know about or neglect the importance of business credit scores. On the other hand, your business credit score is separate from your personal credit score. This means any inquiries you make as a business, as long as youve registered your business name with ASIC, wont impact your personal credit score.

Did you find this helpful? Why not share this article?

This article was reviewed by Personal Finance Editor before it was published as part of RateCitys Fact Check process.

Jodie Humphries

Personal Finance Editor

An Editor for Personal & Home Finance working across the site, Jodie has worked for banks and comparison websites for a number of years, writing articles across Sharesight, Finder, and other places. Now, Jodie spends her time working on ways to make money make sense for everyone else.

By signing up, you agree to the RateCity Privacy Policy, Terms of Use and Disclaimer.

Why Credit Inquiries Affect Everyone Differently

Its important to keep in mind that FICO does treat different types of credit inquiries differently and that the same credit inquiry can affect people in different ways.

According to Tina Hay of Napkin Finance, different peoples scores will be affected differently by a hard pullsome may not lose any points, while others may lose several for a single new inquiry.

The reasons for this ultimately come down to your own credit history. However, theres one more important point that can change how individual hard credit inquiries affect your credit score. And its a neat little trick that everyone should be aware of .

Ready for the trick on dropping hard inquiries from your credit report with minimal effort? Here it is:

FICO considers multiple same hard credit inquiries done within the same period of time as one single hard inquiry.

Why is this important? When youre searching for a business loan or are looking to rent an apartment, people often apply at several different locations before they find a deal that works best for them. For this reason, FICO considers these inquiries as one single hard inquiry provided it falls within the 45-day window .

This is great to keep in mind the next time youre shopping for a loan or are looking to apply for credit to make a purchase because you can use this to your advantage to not only maintain your current credit score while maximizing your opportunities to shop around for the best deal possible.

Does Removing Hard Inquiries Improve Your Credit Score

Yes, having hard inquiries removed from your report will improve your credit scorebut not drastically so. Recent hard inquiries only account for 10% of your overall score rating. If you have erroneous inquiries, you should try to have them removed, but this step wont make a huge difference by itself.

Don’t Miss: Can You Use Klarna At Walmart

How Does A Credit Inquiry Affect Your Credit Score

Your credit score is an important part of getting a loan, credit card, or a mortgage. So naturally, you want to ensure that your credit score is healthy so you can get access to all of these things without any issue. But there are many misconceptions regarding whether a credit inquiry can affect your credit score and impact your number. When youve worked hard to maintain good credit, the last thing you want is for your credit score to be impacted by something as insignificant as a credit inquiry from a lender. So let us set the record straight for you. Myth or fact does a credit inquiry affect your credit score?

How Do Credit Inquiries Affect Your Credit Score Overall

Inquiries make up 10% of your credit score, so their impact is relatively small. How much you can expect your score to change depends on your credit history. An inquiry might have a greater impact if you have few credit accounts or short credit history, or you have numerous inquiries. But most consumers see their score drop five points or less per inquiry, according to Fair Isaac, the company that created the FICO scoring model.

Although hard inquiries can affect your credit score for up to a year, their impact lessens within a few months, according to Experian.

Soft inquiries have no impact on your credit score.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

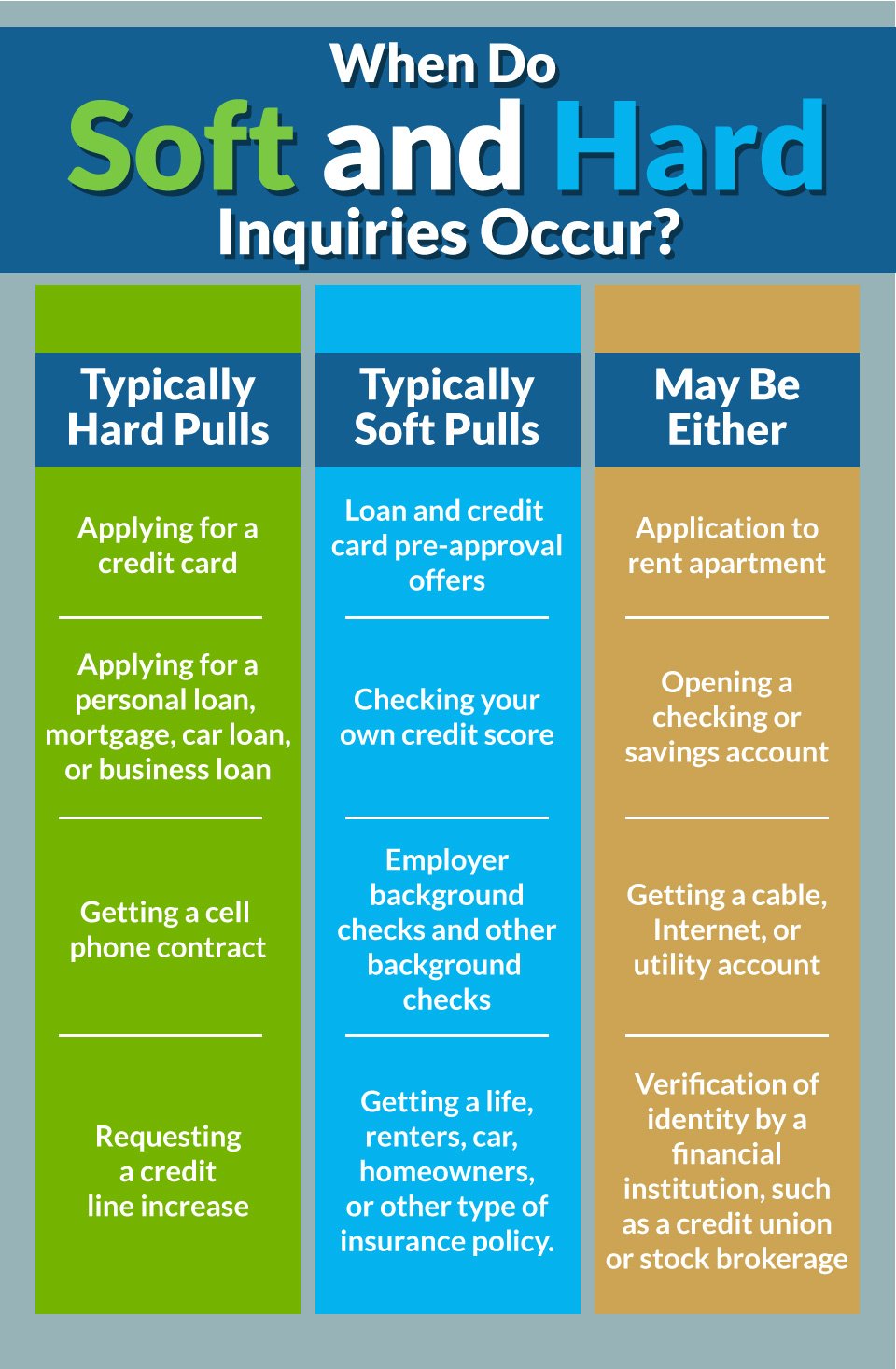

What Is A Soft Vs Hard Credit Inquiry

There are 2 different ways for an institution to check your credit: a soft pull and a hard pull. Soft inquiries can be done without your permission and typically wont affect your credit.

For example, a credit card company might conduct a soft pull on your credit check to see if you qualify for certain credit cards. An employer might complete a soft pull if you are applying for an accounting position.

In most cases, you might not realize that your credit score was pulled unless the organization that pulls it lets you know.

You typically need to authorize a hard credit inquiry because the hard pull can impact your credit score. Your score may drop a few points, and the hard pull will be recorded in your financial history.

Hard credit inquiries are often done when you plan to take out a loan or mortgage. They will also be completed by credit card companies if you decide to apply for the cards they offer.

A hard credit inquiry isnt necessarily a bad thingand might not affect your credit at all. For example, if you seek out financing to buy a car, other lenders wont see that hard pull as an issue. However, if you have multiple hard queries over a short period, it could serve as a warning sign to lenders that you are trying to accumulate a large sum of money or that your applications arent getting approved.

What About Rate Shopping

You can typically check your interest rate with a lender without a hard credit check through a prequalification process. After you prequalify and choose a lender, thats when it will run a hard credit check.

However, not every lender offers prequalification and you may encounter hard credit checks while rate shopping for some products. For example, if you shop around for mortgage preapprovals, lenders are likely to run a hard credit check from the start.

In these cases, theres still good news. If you do all of your rate shopping for mortgages, student loans or auto loans within a short period of time, itll be recorded as a single hard credit inquiry on your report, even though multiple lenders may have done a hard credit check.

The time period you have to complete your rate shopping varies. FICO has many different credit scoring models that lenders can request. For some of these models, your rate-shopping period is 14 days, while for others, its 45 days. Plan on doing all of your rate shopping within the same two-week period if you can to be on the safe side.

Also Check: What Credit Score Do You Need For Chase Sapphire Reserve

What Is A Hard Credit Check

A hard credit check is when a lender pulls your credit report because youve applied for new credit, such as a credit card, a car loan, a home loan or an increase to an existing line of credit. Hard credit checks can affect your credit score because seeking new credit can make you seem like more of a risk to lenders, who may worry about your ability to pay back the debt.

Your Current Creditors Check Your Credit Reports

Creditors also regularly check current customers credit reports to monitor their creditworthiness and manage their accounts. For example, your credit card issuer might decide to increase your cards credit limit if you have a good payment history. Alternatively, the issuer can lower your credit limit if it sees youre falling behind on other bills.

You May Like: How To Get Credit Report With Itin Number

Don’t Miss: Credit Score Without Ssn

How To Dispute Hard Inquiries

Going through your credit reports from time to time is important because, among other things, it gives you the ability to find hard inquiries that you dont recognize. Finding these is important as such inquiries could be a sign of criminal activity.

Once you find a suspicious hard inquiry, use the information in your credit report to contact the lender in question. For all you know, the creditor might be associated with a business you received a store card or financed a purchase through, such as a car or a home appliance.

If, upon contacting the creditor, you still feel you might be a victim of fraud, contact the credit reporting agency and dispute the hard credit inquiry. You may also consider filing a complaint with the police and reporting the incident to the Federal Trade Commission.

Dont Miss: When Does Citi Card Report To Credit Bureaus

How Long Do Hard Inquiries Stay On Your Credit Report

A hard inquiry will remain visible on your credit report for two years before dropping off. However, it will only factor into your credit score calculation for one year.

You will not be able to remove an authorized hard inquiry on your credit report before those two years are over. However, if you notice a hard inquiry on your credit history that you did not authorize, you can go to the dispute center to resolve it. These inaccuracies may come from a hard inquiry that a lender pulled without your permission or, more severely, you may be a victim of identity theft, which means someone is trying to open a new line of credit using your personal information.

Read Also: When Does Comenity Report To Credit Bureaus

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Hard Credit Inquiry Or Soft Inquiry

Some inquiries can be either soft or hard. If you rent a car, apply to rent an apartment, sign up for cable TV or internet service, open an account at a financial institution, or someone just needs to verify your identity, you may get hit with either a hard inquiry or a soft inquiry. The only way to know ahead of time is to ask the potential landlord or service provider.

Finally, if you believe a hard inquiry is on your credit report but should not be, you can dispute a hard inquiry just as you can other inaccurate information. It’s definitely worth pursuing because it could suggest fraud or identity theft.

Read Also: What Is Coaf On My Credit Report

You Can’t Remove A Hard Inquiry From Your Credit Score

You can’t have a hard inquiry removed from your report unless a company made the hard inquiry in error or without your consent, Experian points out. In the latter case, you can contact a credit bureau to strike the inquiry from the file.

Even though hard inquiries take a toll on your credit score, it might be better that you cant remove them. Otherwise, it would be harder to spot signs of identity theft. If you do see hard inquiries from lenders you dont recognize, its possible someone else is trying to get a line of credit in your name.

Some Hard Pulls On Your Credit Are Combined

FICO can detect when youre shopping around for the best interest rate for an installment loan for a house, car, or even student loan . When it detects this, it lumps the inquiries into one. So, for example, if you went car shopping and had your credit pulled 8 times in a week, those inquiries should only impact your credit score as if they were one single inquiry.

Related: Can You Pay for a Car with a Credit Card?

The time period in which inquiries will be combined varies based on the credit score model. Generally, the time period is 30 days but it can be as soon as 14 days or as long as 45 days. Personally, Id try to keep the inquiries as close together in time as possible but thats just because I like to play things like this conservatively.

Another instance when hard pulls can be combined is when you apply for credit cards from the same bank at the same time. Some banks, such as American Express, will allow you to apply for multiple cards at once and the bureaus that receive the will combine them.

This doesnt work 100% of the time but if you apply for credit cards within minutes of each other, youll have a good shot at combining hard pulls and thus reduce the negative impact on your credit score.

Recommended Reading: 824 Credit Score

How Do Credit Inquiries Affect Your Credit Score

A lot of people often wonder if credit inquiries hurt their credit score or wonder what the difference is between a hard pull and a soft pull. Theres a big difference between the two and becoming informed about what kind of credit inquiries affect your credit score can help you make better decisions when pursing credit cards in order to preserve your credit score. So heres the low down on how credit inquiries affect your credit score.

Getting Hard Inquiries With Strong Credit

If your credit score sits around the high 600s or low 700s, every point for you counts. A few small decreases of 5 to 10 points can put you in a position where you cant get loans or the loans you get are much less favorable for you. However, having hard inquiries on your account when you have strong credit is much easier to handle. This is why its important to do everything you can to build strong credit so you can take these hits. Losing 5 to 10 points on a good score really wont affect you that much. Your lender will see these hard inquiries as just a consequence of you seeking a loan instead of you being desperate or untrustworthy. Lets dive into some of the things you can do to help build strong credit.

Recommended Reading: Itin Credit Score

How Does A Hard Inquiry Affect Your Credit Score

if you download a recent copy of your credit report to review it and find something called a ‘hard inquiry, it might be because you applied for credit within the last two years. the new credit can be in the form of a new or a loan. you should know that a hard inquiry can damage your and it may stay there on your credit report for a longer time than you expected. we are here to help you know all about hard inquiry and what it means for your credit report and credit score.

Multiple Hard Inquiries Count As One When Youre Rate Shopping

When youre rate shopping for an auto loan, a student loan, or a mortgage, FICO will treat multiple hard inquiries that you trigger within a 45-day period as a single hard inquiry.6 Theres also a 30-day grace period before hard inquiries of those types start to affect your score at all.4

Similarly, VantageScore treats any hard inquiries that occur within a 14-day period as a single hard inquiry.

These exceptions only apply to hard inquiries of the same type, and they only apply to auto loans, student loans, and mortgages. They dont apply to hard inquiries for other types of credit, such as credit cards.

This means that if you apply for five auto loans in a short period, those will be counted as one hard inquiry. However, if you apply for an auto loan, a mortgage, and a personal loan, those will be counted as three separate inquiries, and each will lower your score. Similarly, five hard inquiries for credit cards will be counted as five separate hard inquiries.

FICO and VantageScore have put this exception in place because they know that responsible borrowers often shop around before taking out loans, and doing so doesnt signify that they present a risk to lenders.

Takeaway: Hard inquiries can take up to five points off your credit score

Article Sources

Also Check: Aargon Agency Complaints

Examples Of Hard Credit Inquiries And Soft Credit Inquiries

The difference between a hard and soft inquiry generally boils down to whether you gave the lender permission to check your credit. If you did, it may be reported as a hard inquiry. If you didnt, it should be reported as a soft inquiry.

Lets look at some examples of when a hard inquiry or a soft inquiry might be placed on your credit reports. Note: The following lists are not exhaustive and should be treated as a general guide.

How To Remove Hard Inquiries From Your Credit Report

If you find hard inquiries on your report that you didnt authorize, dispute the error by calling or writing to the creditor to have it removed from your report. Otherwise, you cant remove the inquiries, but you can minimize their impact.

Most importantly, avoid applying for credit you dont need. When you do need it, research a few lenders ahead of time so you can apply to all of them at the same time the longer the time between applications, the more they can impact your score.

Daria Uhlig contributed to the reporting for this article.

Our in-house research team and on-site financial experts work together to create content thats accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates processes and standards in our editorial policy.

Recommended Reading: Does Home Depot Report Authorized Users