Affirm Reviews: Is An Affirm Loan The Best Choice For You

Affirm is a service that offers loans for online and in-store purchases. It provides short-term loan options at checkout with many retail partners.

This can make a larger purchase more affordable by spreading the cost.

Before you use Affirm, its worth reading some Affirm reviews to make sure you understand the interest rate and payment terms offered.

Read Also: What Credit Score Does Carmax Use

File A Complaint With The Consumer Financial Protection Bureau

After you revoke your authorization or stop a payment, be sure to monitor your accounts to see if an unauthorized payment gets withdrawn from your account. File a complaint with the CFPB if you experience any of the following.

- The payday lender refuses to stop withdrawals after you notify it to do so.

- The bank allows a withdrawal after you notify it that you revoked authorization for the withdrawal.

- The bank didn’t stop payment after you requested it.

- The ACH Authorization doesn’t specify how to stop automatic withdrawals.

The CFPB is a federal agency that enforces regulations applicable to payday lenders, banks, and other financial institutions. The CFPB will work with your lender or bank to resolve your complaint. You may also contact your state regulator or state attorney general.

Under federal law, you get the right to dispute an unauthorized transaction and get your money back if you notify your bank in time. You can use the CFPB’s sample letter to notify the bank.

Again, keep in mind that stopping an automatic bank withdrawal doesn’t mean you don’t have to repay the loan. Consider working out other payment arrangements with the lender to avoid your account going to collections.

Why Cant Cash Advance Customers Just Go To A Bank Instead

Most banks do not provide small-dollar, short-term loans that our customers need. The average amount of a Cash Advance and Payday Loan is about $350, an amount significantly lower than what a bank will loan. Some banks and credit unions have begun to offer products they promote as “alternatives” to Cash Advances, but these options are not broadly available and involve a variety of restrictions and complex fee structures. And in some cases, though our customers all have a bank or credit union account, they may choose not to obtain credit from these institutions because of a negative past experience, such as encountering hidden fees. We support a competitive market and encourage our customers to weigh all of their options before choosing our service. Cash Advances are not for everyone, but our customers make informed decisions, and choose Advance America because they appreciate the simplicity, reliability and transparency of our Cash Advance services.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Update: Heres What You Should Know

Our Review of Arrowhead Advance

Reviewer: Brian Allen

Review Summary

On the lower side, its actually a fairly reasonable interest rate for risky borrowers. However, the 830% APR is cause for concern. Thats an astronomical interest rate and should be avoided if possible. You can borrow as little as $100, up to a maximum of $1,000 for first time borrowers. That said, you should compare all bad credit loan options before making a decision.PROS Offers fast funding, typically within 24 business hours Decent solution for an emergency bad credit loan if you cant obtain financing from a traditional lender Allows you to pay back the loan in installmentsCONS Doesnt have the best interest rates. On the lower side, the APR is 200%. However, many customers will not qualify for this and may see interest rates as high as 830% Not a good option for people with average to excellent credit Not a good solution for large financial purchases

Close Your Bank Account

You should close your bank account to stop the transfers only as a last resort. You might have to do this if:

- your payday lender doesn’t respond to your request to stop the withdrawal

- you don’t have time to notify your bank to stop the withdrawal, or

- you can’t afford the stop-payment fee.

You should ask your bank whether closing the account is necessary.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

How To Apply Online

Once youve completed the application process you will submit the application and await verification from a representative of Arrowhead Advance. Its common for places to verify via phone and as a potential borrow you may find confidence in that process. Also, when applying for a loan there will not be an impact on your credit score as the company does not pull a credit report from the major 3 reporting companies.

What Is The Difference Between An In Store And Online Payday Loan

An in-store Cash Advance/Payday Loan allows you to visit one of our stores and receive your money in person. The entire process typically takes about 15 minutes and could get you the money you need on the spot. An online Payday Loan gives you the convenience of processing your loan completely online without the need to visit a store. Simply submit an online loan application and, if approved, the funds from this payday loan will be deposited directly into your bank account as soon as the same day.* To learn more about the options in your state, .

Read Also: How Can Personal Responsibility Affect Your Credit Report

Applying For A Personal Loan

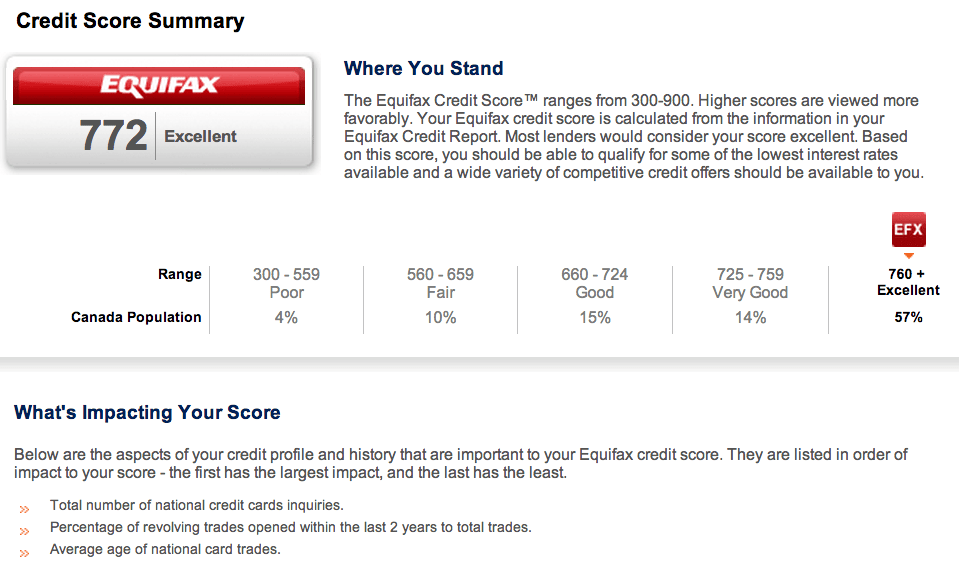

Applying for a personal loan can lead to a five-point credit score drop or most people. Thats because when youre ready to apply for the loan, the lender does a more detailed credit check, known as a hard credit pull. This actually does get recorded on your credit report as a credit inquiry, and because shopping for loans is a somewhat risky activity, your credit score usually goes down a few points accordingly.

The good news is that these credit inquiries only last a short period of time. After a year theyll stop negatively affecting your credit score, and theyll fall off your credit report entirely after two years.

What Is The Difference Between An In

An in-store Cash Advance/Payday Loan allows you to visit one of our stores and receive your money in person. The entire process typically takes about 15 minutes, and you could get the money you need on-the-spot. An online Payday Loan gives you the convenience of processing your loan completely online without the need to visit a store. Simply submit an online loan application, and if approved, the funds from this personal loan are deposited directly into your bank account, as soon as the same day.*

*Online approvals before 10:30 AM ET are typically funded to your bank account by 5 PM ET same-day. Approvals after 10:30 AM ET are typically funded in the morning the next banking day.

Read Also: Syncb/ppc Closed

Buy Now Pay Later Services Offering No Hard Credit Checks

Disclosure: This post may contain affiliate links, meaning we get a commission if you decide to make a purchase through our links, at no cost to you. Please read our disclosure for more info.

Buy now pay later no credit check loans are increasing in popularity. Youve probably seen it on your favorite retailers websites. When you checkout theres the option to buy now and pay later, allowing you to pay in four equal installments and usually for no interest or fees and with no hard credit check.

If you have no credit or bad credit, these can seem like a great optionbut only if you know how they work, and which companies are the best options for those in search of no-credit-check online financing.

In This Post:

How Does Affirm Make Money

Affirm makes money on the interest it charges for its consumer loans as well as fees paid by the merchants to handle payments on their behalf.

So far, the firm has stirred away from focusing on any other income channels. Given that the global market for online payments is valued at almost $5.5 trillion, theres plenty of money to be made within its current business model.

Lets take a closer look at each of the two revenue streams down below.

You May Like: Paypal Credit Soft Pull

Also Check: Ccb/mprcc

Who Is The Typical Cash Advance Customer

Our customers are hardworking individuals including teachers, nurses, bus drivers and first responders who make a positive contribution to their community. All customers must have a steady source of income and a checking account to receive a Cash Advance.

According to customer surveys, 92% of customers think Cash Advance lenders offer a valuable service and 90% are satisfied with their understanding of the terms and costs of Cash Advances.

Getting Arrowhead Advance Pre Approval

Getting pre-approved means being accepted and given that loan offer. Now, if your wanting to also deliver away a credit card applicatoin, think about whenever you can pay the repayments. Make use of their sites Rates and Terms page to see a breakdown of this amortization routine. You might additionally make reference to an Arrowhead Advance review.

Also, start thinking about other loan options such as for example getting payment extensions from creditors. Nonetheless, if you opt to simply just take an arrowhead loan out, simply navigate for their web site and obtain started using the form. offer details that are accurate counter-check the proper execution before giving it. Thats since the details are later confirmed through the loan processing.

Recent Posts

Also Check: How To Report A Death To Credit Bureaus

Struktur Organisasi Fakultas Psikologi

Saat ini Fakultas Psikologi Unjani sudah memperoleh Akreditasi B yang dicapai pada tahun 2011, pengembangan kurikulum, peningkatan jumlah dan kualitas sarana prasarana, menyempurnakan sistem administrasi dan sistem informasi, pengembangan sumber daya manusia , peningkatan kualitas dan kuantitas mahasiswa dalam berorganisasi dan bidang-bidang lain di lingkungan Fakultas Psikologi Unjani.

Are Payday Loans Regulated

Yes, Advance America follows all applicable laws and regulations at both state and federal levels, including INFiN. Were also members of the Community Financial Services Association of America, so we follow all industry best practices where applicable to provide the most beneficial, responsible personal loan services.

Also Check: Does Paypal Report To Credit Bureaus

Can I Have 2 Personal Loans At Once

You can have 1-3 personal loans from the same lender at the same time, in most cases, depending on the lender. But there is no limit to how many personal loans you can have at once in total across multiple lenders. … So the more loans you have open, the more difficult it will become to open any more.

Is It Better To Pay Off Loans Early Or Save

The best reason to pay off debt early is to save money and stop paying interest. … So, it’s best to not pay for any more time than you need. Some loans drag on for 30 years or more, and interest costs add up over time. Other loans might have shorter terms, but high-interest rates make them expensive.

You May Like: Syncb/ppc Credit Inquiry

Arrowhead Advance Offer Code

Don’t be afraid to get Arrowheadadvance.com offer code. In most cases, payday cash advances scare many people, but if used correctly, they can be of great help. The first thing you should do is read reviews about the company. This will help you distinguish legitimate lenders from scammers who are just trying to steal your money. Spend a good research companies. Choose credit carefully. You have to look at the interest, how long you will pay to pay off your loan. See what your best options are and then make your choice to save money.

What If I Cannot Pay Or Will Be Late Repaying My Cash Advance

Advance America will work with you to establish payment arrangements for your Cash Advance. We’re also committed to collecting past due accounts in a professional, fair and lawful manner. Past due payments may impact your ability to transact with Advance America or other lenders. If you are unable to pay your Cash Advance on time, please contact us at your local store or our toll free number 5626480.

Read Also: What Is Syncb Ntwk On Credit Report

How Payday Loans Work

Payday loans are short-term loans for smaller amountstypically $500 or lesswhich you have to repay on your next payday or when you get income from another steady source, like a pension or Social Security. The annual percentage rate on payday loans often ranges from 200% to 500%or even higher. Triple-digit APRs are the norm when it comes to payday loans, which is exponentially higher than what traditional lenders typically offer. Depending on your state’s laws, you might be able to get a payday loan in a store by giving the lender a postdated check, in person by providing the lender access to your bank account, or online.

Qualifying for a payday loan is quite easy. Ordinarily, you’ll have to show proof of your income, like two recent pay stubs, and meet other qualifications, such as having a bank account or prepaid card account, a working phone number, a valid government-issued photo ID , and providing a Social Security numberor Individual Taxpayer Identification number. But in most cases, the lender won’t do a credit check to look at youror review your.

Affirm And Your Credit Score

When you sign up for an Affirm point-of-sale loan, you are taking a credit instrument. But Affirm doesnt perform a hard credit check, only a soft pull on your credit information, so simply taking out the loan will not affect your score.

However, if you pay back the loan on time, youll experience a boost to your credit score, which helps you get financing from the banks. Its important to note that the converse is also true. If you dont pay back your loan on time, miss payments or are late with payments, it will affect your credit score negatively.

You May Like: Capital One Reporting Date

Is It Better To Use Affirm Or A Credit Card

If you have access to a credit card, its the better option if you make full use of the grace period but then repay your bill before incurring any interest charges. However, if youre like many Americans and prefer to keep the credit card for emergencies, Affirm is a viable alternative.

While your credit card might have a $15,000 limit, your bank or card issuing authority probably doesnt want to see you have an outstanding balance of more than $5,000 at any time. If you go over this ratio, youll end up affecting your credit score.

Since Affirm offers loans up to $17,500, its the ideal choice for financing a bigger-ticket item as opposed to using your credit card.

However, there are some issues with using Affirm. The company can charge a high interest rate, and if youre getting an 18% APR on your card, you can expect the rate at Affirm to be similar or higher. However, you get flexible spending limits, with up to 12-months to pay off your purchase.

Some retailers may partner with Affirm to offer a 0% APR on certain purchases.

Also Check: Carmax Financing Bad Credit

Arrowhead Advance Loan Summary Of Benefits

The lender has a website that is intuitive. Finding appropriate pages will be time-saving. Candidates simply just take about 2 to 10 min doing the conventional online application form. Plus, it may be finished on mobile phones.

Arrowhead Advance Loans are tailored towards the requirements of all of the customers it doesnt matter how much they get hold of at the conclusion associated with thirty days. You simply require a minimum earnings of $1,000 each month.

The business provides loans by the next day time. To be eligible for next day time money, apply early in the day, to get authorized ahead of the close for the day time. Additionally, maintain the after papers prepared copies of banking account statements, paystubs, government-issued ID, etc. forward them immediately if the lending company requests them.

The lending company charges prorated charges, this means youll pay just for the quantity of times youve got applied for the mortgage. Clear the loan in front of routine to reduce the loans term. Additionally the loan worldloans.online/bad-credit-payday-loans/ website provider shall maybe maybe not charge a fee any charges.

You May Like: Sync/ppc On Credit Report

What If I Have More Questions

If you need clarification about any part of our Privacy Policy, please contact us so that we can answer your question and make our policies more clear for you and our other customers.

| WHAT DOES WLCC II D/BA/ ARROWHEAD ADVANCE DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Consumers have the right to limit some but not all sharing. This notice tells you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include:

|

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information the reason WLCC II D/BA/ ARROWHEAD ADVANCE chooses to share and whether you can limit this sharing. |

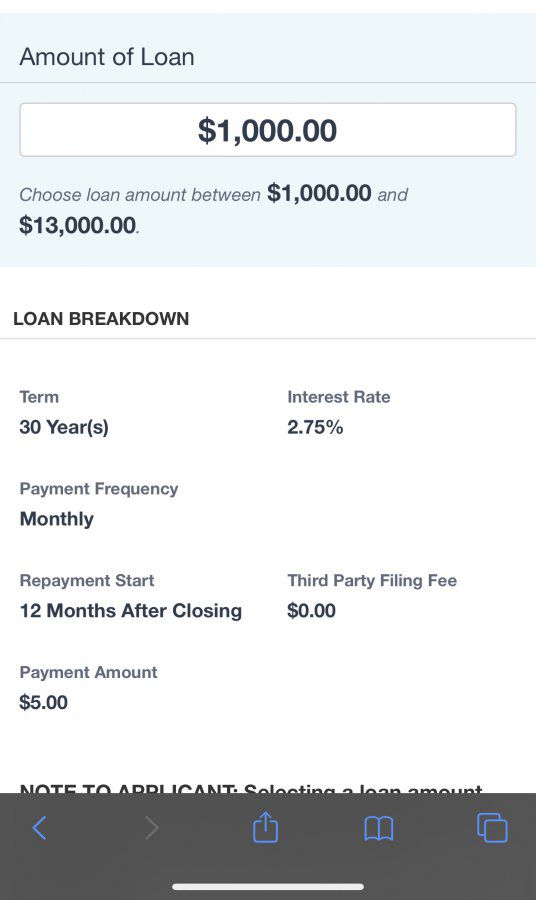

Overview Of Arrowhead Advance Loans

You are shown the beginnings of the installment loan application process by selecting the amount you wish to borrow. As a potential customer, you can borrow between $100 and $1,000 and the application process should only take two minutes. Arrowhead Advance called the application process, simple, secure. The application process is accessible anywhere at any time.

Scrolling further down the page, you are shown that short-term installment loan proceeds are put into your account as quickly as the next business day. Also, you can repay you loan over time or repay the loan early with penalty. This is an effective way to save on interest expense, which can quickly add up.

At the end of the homepage, you are shown the simply three step application process. First you apply, then a verification specialist will contact you, and then upon approval you will receive your funds within the next day or two, depending on cutoff times.

To qualify for a loan, you must meet the following criteria:

- Make at least $1,000 per month.

- Be at least 18 years of age and a United States citizen.

- Have a valid checking account.

- Currently have a steady source of income.

- Other requirements may apply.

Recommended Reading: Mprcc On Credit Report