What Is A Credit Report

A credit report is a collection of information about your financial history. Creditors report information to the credit bureaus, including the date new accounts are opened, applications you submit for new credit, payment history, and balances. This information is used to produce your credit report and credit scores.

Does Paying Off Collections Boost My Credit Score

Historically, paying off your collections does not improve your credit score because a collection stays on your report for seven years. Newer ways of calculating credit scores no longer count collections against you once they have a zero balance, but it is not possible for you to predict which method your lender will use to calculate your score.

Don’t Close Your Cards

Once you’ve paid off a card, it can be really satisfying to cut it up! But don’t close your account. Keeping your credit card account open but unused helps give you a long, established credit history, and can improve your overall credit utilization ratio. . Although sticking the credit card in a drawer has it benefits you may also be able to request a credit card freeze. You may be familiar with a credit card freeze since it used whenever you report your credit card lost or stolen. In this case, you may use a credit card freeze if you want the card open in your name but don’t want or need to use the credit card for purchases.

Read Also: How To Update Credit Report Quickly

What Is A Good Credit Score

A credit score is a 3-digit number that credit bureaus provide to lenders and others who want to assess your creditworthiness. These include banks, mortgage lenders, insurance companies, utility providers, and in some cases, potential employers.

Your credit score can range from bad to excellent. In Canada, credit scores range from 300 to 900, with the following rankings:

- 800 900: Excellent credit score

- 720 799: Very Good credit score

- 600 649: Fair credit score

- 300 599: Poor credit score

In the United States, the range is from 300 to 850.

If your credit score is ranked in the good to excellent range, it makes it easy for you to get loan and credit approvals, and also qualify for competitive rates.

When your credit score falls in the poor to fair category, you may be required to pay sub-par rates on credit lines or be denied outright.

Where Does Your Credit Score Start

Having no credit history doesnt necessarily mean your credit score starts at zero. Thats because the FICO and VantageScore credit models dont go that low. Instead, the lowest possible credit score you can have with either model is 300. A score of 850 is the highest score you can achieve.

If you have no credit history at all, then you likely have no credit score. Once you begin to build and improve credit, your score may start at 300 and climb from there. So what affects your credit scores?

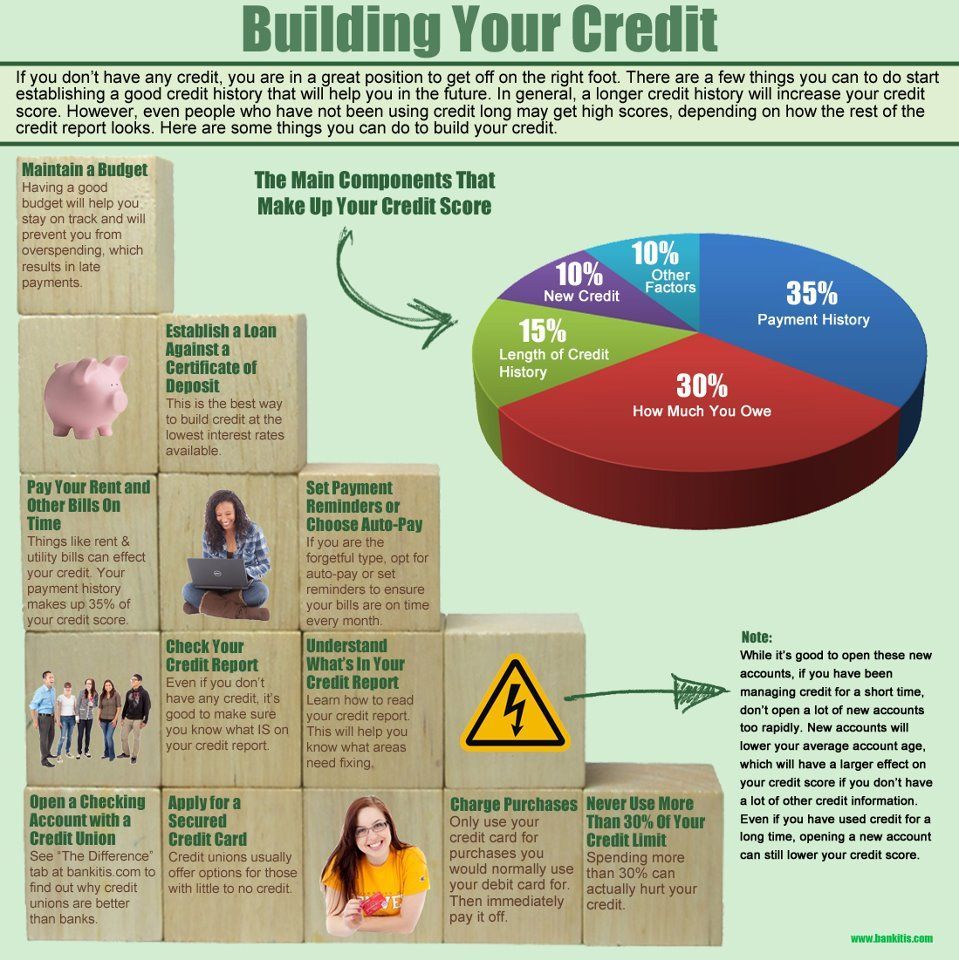

The short answer is that it depends on the credit scoring model. As FICO scores are most widely used by lenders, heres a breakdown of how these scores are calculated:

- Payment History: Thirty-five percent of your FICO score is based on payment history, with on-time payments helping your score and late payments hurting it.

- Thirty percent of your FICO score is based on credit utilization, which is the amount of your available credit limit youre using at any given time.

- Fifteen percent of your FICO score is based on your credit age, which is the length of time youve been using the credit.

- Ten percent of your FICO score is based on the types of credit youre using, such as revolving credit lines or installment loans.

- Ten percent of your FICO score is based on how often you apply for new credit, which results in a hard credit check.

You can visit AnnualCreditReport.com to obtain a free copy of your credit report, which can tell you if theres enough information to generate a credit score.

Don’t Miss: How To Increase Credit Score

Tips To Help Improve Your Credit Scores

Doing the things you want to do. Seeing the places you want to see. Living life with a little less worry and a little more freedom. The flexibility that comes with higher credit scores can make decisions about money a little easier. While increasing your credit scores may not happen overnight, these six tips can help you start moving in the right direction.

Key Takeaways

- Monitoring your credit can give you an idea of your creditworthiness and a chance to check your credit reports for errors.

- Making payments on time, keeping credit utilization low and avoiding unnecessary credit inquiries can help you improve your credit scores.

- Focusing on good credit-building habits, rather than quick fixes, can help improve your credit over time.

How To Start Building Credit: Open New Accounts

You cant establish a credit history without credit. This may seem like a catch-22 to some, since in order to get an offer for credit you need to have credit history. Fortunately, that last bit is not always true there are ways of opening a line of credit without any prior credit history.

- Become an authorized user on a credit card. If a close relative or significant other has a credit card account, have them add you to it. This will put your name on the map, and will shortly generate a score for you.

- Apply for a student or secured credit card. These credit cards are designed for individuals with no credit history. Often times all you have to do is provide some sort of proof of income or a security deposit, and you can obtain these cards.

- Take out a student loan. Another way of building credit is to take out a student loan to pay for your college/university. Even if you can afford to pay for school, and do not need a loan, it will benefit you to take one out. Simply put away money , and when it’s time to pay off the loan, you can do so at once thus avoiding any interest. The net financial result on your account will be the same, but you will have a credit file opened as a result.

It is a good idea to combine two or more of the above suggestions. The greater the diversity of your credit portfolio, which includes credit cards, loans, mortgages, etc., the better impact it will have on your total credit score.

Also Check: How Do You Read A Credit Report

How To Repair Your Credit And Improve Your Fico Scores

You can improve your FICO Scores by first fixing errors in your credit history and then following these guidelines to maintain a consistent and good credit history. Repairing bad credit or building credit for the first time takes patience and discipline. There is no quick way to fix a credit score. In fact, quick-fix efforts are the most likely to backfire, so beware of any advice that claims to improve your credit score fast.

The best advice for rebuilding credit is to manage it responsibly over time. If you haven’t done that, then you’ll need to repair your credit history before you see your credit score improve. The following steps will help you with that.

How Can I Raise My Credit Scores By 100 Points

If you have poor credit and are looking to increase your scores by 100 points, you will need to put in the work. This wont happened overnight and depending on your credit profile it could take several months. But, dont be discouraged, it is still an attainable goal.

Practicing the healthy credit habits weve outlined in this article is the best way to improve your credit. If a company or service promises that they can guarantee your credit will improve by 100 points, they are likely lying. All credit scores react differently, keep that in mind during your credit improvement journey.

Also Check: Will Paying Off Derogatory Accounts Raise Credit Score

Cluster Your Hard Credit Inquiries

By grouping your mortgage or credit card applications into the same two-week window, credit reporting bureaus will usually view them as a singular inquiry. But if you apply for a mortgage and five months later apply for a credit card, you may find a drop in your rating due to those multiple inquiries. Those small dings add up and eventually, they can affect your interest rates.

Dispute Credit Report Errors

A mistake on one of your credit reports could be pulling down your score. Disputing credit report errors can help you quickly improve your credit.

You’re entitled to free reports from each of the three major credit bureaus. Use AnnualCreditReport.com to request them and then check for mistakes, such as payments marked late when you paid on time, someone else’s credit activity mixed with yours, or negative information thats too old to be listed anymore.

Once you’ve identified them, dispute those errors.

Impact: Varies, but could be high if a creditor is reporting that you missed a payment when you didn’t.

Time commitment: Medium to high. It takes some time to request and read your free credit reports, file disputes about errors and track the follow-up. But the process is worthwhile, especially if you’re trying to build your credit ahead of a milestone such as applying for a large loan. If you’re planning to apply for a mortgage, get disputes done with plenty of time to spare.

How fast it could work: Varies. The credit bureaus have 30 days to investigate and respond. Some companies offer to dispute errors and quickly improve your credit, but proceed with caution.

Read Also: How To Boost My Credit Score 100 Points Fast

Identify Why You Have A Credit Problem

If you obtain a copy of your credit report along with your credit score, you can find out if you have bad credit. Knowing that you dont have good credit is not enough. You need to know why you have bad credit.

For many people their credit problems may have been brought on by circumstances largely beyond their control like an injury or illness, unemployment, reduced income, or a separation or divorce. If this is what has happened to you, then skip ahead to point number 2. If you arent exactly sure why you have credit problems, then read on.

Some people focus on easy credit solutions like and dont take the time to figure out how they got into a financial mess until they are facing the prospect of a second or third bankruptcy. It is important to figure out why you got into the trouble you are in so that you can learn from your mistakes and not repeat the same mistake twice.

If you cant figure out why you are having financial or credit problems, speak with someone who can help you. Talk with a trusted friend or family member, a Financial Planner or a Credit Counsellor.

Only Charge What You Can Afford

Credit cards are a tool, not an excuse for a shopping spree. If you open a card to start building a credit score, use it for small purchases that fit your budget and pay the card off in full each month. Regular use and full payment are important, because your credit utilization ratiothe proportion of debt compared to available creditis the second biggest factor impacting your credit score.

Also Check: How Often Does Ally Financial Report To Credit Bureaus

Use Vendors That Report To Agencies

Working with vendors that supply equipment or inventory to your business can also help you establish a strong history of paying your bills and honoring agreements with partners. This is yet another way you can build your business credit. However, make sure you choose vendors that actually report to credit bureaus. Some of these include Quill, Grainger, and Uline.

In Sallys business, she may have simply bought office supplies here and there. But signing up for an account with Quill and making regular payments ensures that her company is building business credit that gets reported to the right agencies.

How Credit Scoring Works

Credit scores dont magically appear out of thin air instead, theyre calculated using different credit scoring formulas. The FICO credit score model is the one used by 90% of top lenders in credit decisions.VantageScore is another credit scoring model.

Both models use the information contained in your credit report to calculate credit scores. A credit report contains details of your past financial history, including:

- Number of credit accounts you have in your name

- Balances and payment history for those accounts

- Inquiries for new credit applications

- Public records, including judgments, bankruptcies, and foreclosure proceedings

If you have no credit history, there may not be much information on your credit report. This, in turn, can make it difficult to calculate a credit score. According to the Consumer Financial Protection Bureau, an estimated 45 million Americans are credit invisibles, meaning they dont have enough credit history to generate a score.

Having no credit history at all is not the same as having bad credit, which means you do have a credit score and it is low because of past financial mistakes.

You May Like: What Is A Good Credit Score To Get A Car

Easy Ways To Increase Your Credit Score Fast In Canada In 2022

An excellent credit score is your key to lower rates and easy approval for credit cards and loans. If your credit score has taken a hit, there are some simple strategies you can implement to improve your credit score quickly, starting today.

How long does it take to improve your credit score? It varies and will depend on how bad your credit score is to start with. With the right approach, you can start seeing significant improvements in your credit score in as little as 30 days.

No matter how bad your credit score is, following the right strategy can increase it by 100 to 200 points in no time at all.

How To Maintain Your Good Credit

Limit your accountsNumerous store and/or credit card accounts may lower your credit score even if accounts are not used and balances are paid in full

Don’t close old accountsLowering your available credit will lower your credit score

Use your accountsMake purchases and pay the full balance each month

Maintain a low balance-to-limit ratioUsing less of your available credit will help raise your credit score

Pay bills on timeLenders consider payment records to help determine your reliability

Maintain employment and/or primary residence for 2 or more yearsLenders use this information to help determine your stability

Review your credit report

Also Check: How To Check Business Credit Score For Free

Age Of Credit Accounts: Be Patient

One of the other major contributing factors to credit scores is the duration of time your credit accounts have been open. The longer the better. This is where patience comes into play. There is very little you can do to improve your score from this angle, outside of opening up a credit account as quickly as possible, and waiting for it to mature.

How To Maximize The Age Of Your Credit Account

Become An Authorized User At An Early Age. Earlier in the guide, we mentioned that becoming an authorized user can be a great way to establish credit when you have none to begin with. Another benefit of this method is that you can establish a credit account at an early age even as young as 16. This will give you a jump start on your “credit age.” Provided that the account is not closed before you reach adulthood, it will benefit your credit score greatly by opening up your own lines of credit once you’re old enough.

Do not close credit accounts unless its absolutely necessary. Keeping credit accounts open is key to maximizing your credit score. Closing down an account, even voluntarily, can have a strong, negative impact on your FICO score. The older the age of the account, the larger the hit to your score. This is why you should avoid having to have your first credit account be one on which you do not pay an annual or monthly fee. Opting for a “free” account means there will be little to no harm in keeping it open indefinitely, and your FICO score wont be at risk.

How Often Should You Check Your Credit Score

You should check your credit score regularly to check for errors, but make sure that you are doing so through soft inquiries so that your score isnt dinged. Many banks offer free credit monitoring to their customers check with yours to see if you can enroll in their service and get alerts whenever your score changes.

Don’t Miss: How Fast Will A Car Loan Raise My Credit Score

Establish A Separate Business Identity

- Set up corporation or LLC If you run your business as a sole proprietorship, like Sally, your business credit is tied to your personal credit. Creating a separate business entity makes it clear that your personal and business credit and finances are separate. Specifically, the credit bureau Dun & Bradstreet recommends incorporating or setting up an LLC.

- Get an Employer Identification Number / EIN An EIN is basically a Social Security Number for your business. Its free to get one from the IRS, and youre required to have one if you have employees or if youre taxed as a C corporation or LLC.

- Obtain a DUNS number A DUNS number is another identifier used to track businesses. Its monitored by Dun & Bradstreet, and its free to apply for one online. Youll also need this number if you plan to apply for federal contracts.

- Get a business phone number A dedicated phone number listed in your companys name offers extra credibility. Youll also use it to sign up for a DUNS number and other accounts in your company name, which go towards securing your business credit.