Myth: Its Best To Pay Off Your Balance Completely As Fast As You Can

Its not true that you need to keep your credit card balances at $0 to get a good credit score. FICO® has reported that the people with the best credit scores typically do have multiple credit cards with balances, but they keep the balance owed low.

Thats not to say that one must carry a balance to build a good credit score paying off your balances in full and not incurring finance charges, is the best way to save money and generate a great score.

Sign Up To Have Rent Payments Reported

If you rent, you may be able to use your on-time payments to build your credit score. Rent payments arenât usually reported to agencies by default, but itâs OK to ask your landlord or management company if itâs an option. There are a few independent reporting companies that will take on this responsibility for you as well. Experian, for example, partners with several through its RentBureau partnership. Prices for these services vary.

Minimum Credit Score Required For Mortgage Approval In 2021

Categories

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.

Recommended Reading: What Credit Score Does Carmax Use

Don’t ‘spend’ Your Applications Too Often

Every time you apply for a credit product , it adds a footprint to your file for a year.

Too many, especially in a short space of time, can trigger rejections as it makes it look like you’re desperate for credit. Therefore, space out applications if you can and don’t do them frivolously.

In fact it’s almost worth thinking about applications as ‘spending’. Is it really worth spending an application on what you’re doing, or could you save it for something else?

So if you fancy a cashback credit card and have no other credit you need to apply for in the next six months or so, great, spend your application. But if you’re just about to apply for a mortgage, wait until after you’ve done that. Prioritising is important.

For the same reason, if you apply for a cheap credit card and don’t get the credit limit you need, don’t automatically apply for another one. Read the Low Credit Limit guide for more information.

Why My Credit Score Showing Zero

What is the Credit Score?

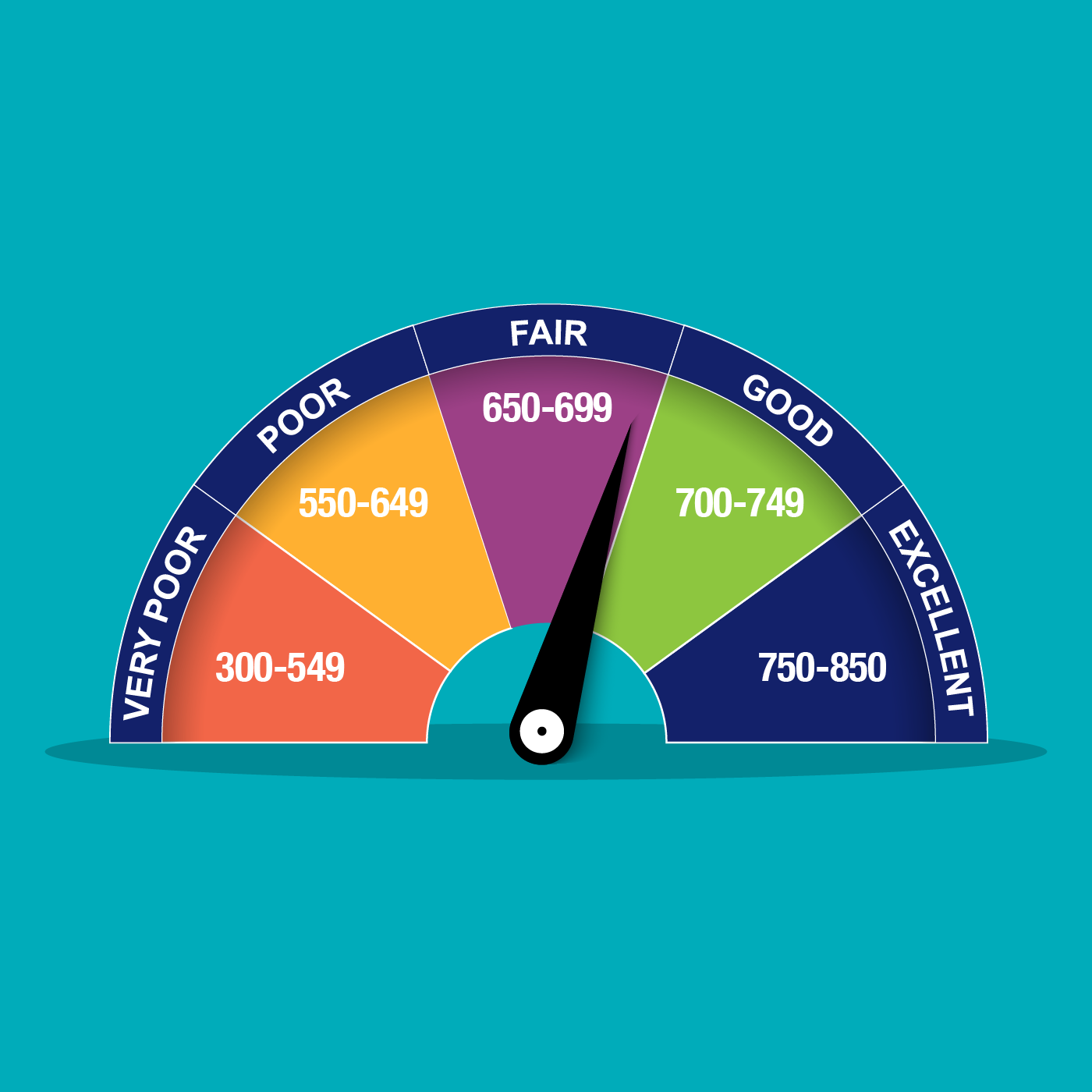

The credit score is reflected in the individuals Credit report, which is prepared by the main credit bureaus . Credit Score increases or decreases depending on how borrower maintain his credit account.If they are not paying their dues on time and applying for many hard inquiries in a short period of time than it will affect the credit score negatively, and credit score surely will drop. But on the other hand, if the person is maintaining his credit account wisely, with good payment history and no or less hard inquires than their Cibil score will rise. Below table shows the range of credit score:-

| CIBIL Score Range |

|---|

Recommended Reading: How Long Does A Repossession Stay On Your Credit Report

Limit How Often You Apply For New Accounts

While you may need to open accounts to build your credit file, you generally want to limit how often you submit credit applications. Each application can lead to a hard inquiry, which may hurt your scores a little, but inquiries can add up and have a compounding effect on your credit scores. Opening a new account will also decrease your average age of accounts, and that could also hurt your scores.

Inquiries and the average age of your accounts are minor scoring factors, but you still want to be cautious about how many applications you submit. One exception is when you’re rate shopping for certain types of loans, such as an auto loan or mortgage. Credit scoring models recognize that rate shopping isn’t risky behavior and may ignore some inquiries if they occur within the span of a couple of weeks.

Don’t Panic If Your Credit Score Drops Slightly It’s Actually What’s On Your Credit Report That Matters

The idea that getting accepted for credit is all based on a simple score given to you by one of the credit reference agencies is false. At best, it’s a guide to roughly how good or bad a risk you are. As we say above, lenders will judge you on three main criteria when you apply for credit:

Yet the first two aren’t factored in to your credit score so it’s based on incomplete information. Plus, different lenders are looking for different things. When you apply, they assess you based on their own ‘ideal customer’ scorecard and each lender is different. Just because one lender rejects you doesn’t mean another will do the same. So bear in mind:

The impact of a slight credit score drop is near meaningless

It’s inevitable at some point that your credit score will drop. However, this shouldn’t be a cause for panic, especially if it’s only a slight dip. In general, the impact of your score going down a small amount is near meaningless. Have a watch of this video to see why:

Recommended Reading: How To Get Navient Off Credit Report

Why Do Your Credit History And Score Matter

Banks stay in business by issuing credit to people who are responsible enough to pay it back. Without an intimate knowledge of how you spend your money, a credit score and credit history are the next best thing. They give the lender an idea of the risk they are taking when they lend to you. Then, they can approve or deny your application based on that risk.

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

Read Also: Credit Score Needed For Les Schwab Credit

Free Credit Scores From Experian

The largest credit reference agency offers new customers a free 30-day trial of its , which gives you access to your credit report, score, and email alerts about any changes on your file.

After the trial ends, it will cost you £14.99 a month.

You can access your Experian credit score through a free Experian account. This is designed to help people shop around to see how they can save money by comparing credit deals based on their financial profile.

Once you’ve signed up, your score will remain free to access, but unlike the paid-for CreditExpert service, you won’t be able to see your credit report.

To be able to access both your Experian credit report and score free forever, you can sign up to the Money Saving Expert Credit Club.

You can also see how likely you are to be accepted for the best rates on cards and loans and work out how much you can afford to borrow.

Unlike CreditExpert, you won’t receive alerts about any changes to your report.

What Is Not Included In Your Credit Rating

There is nothing in your credit rating about your:

- Criminal record

- Lenders cant see declined applications either

Lenders can only see youve applied but not whether you were accepted or not. However, they may be able to guess by examining when your credit accounts were opened.

The information in your credit report is debt-related. For example, if you bought a car on credit, the type of car will not appear in your credit report it will just be the loan itself and the amount owed.

Bankruptcy will appear on your credit rating, while the less serious cases of library fines and parking tickets are not included.

Find out more: Guide to child benefit

Read Also: Syncb Ppc

What Are Credit Reference Agencies

Your score can range between 0-999 depending on your financial history but also the agency doing the scoring. In the UK, there are three main credit reference agencies:

- Experian

- Equifax

- TransUnion

They work with banks, building societies, mobile phone companies and retailers to help them decide whether the person applying for credit is likely to pay it back.

They may score you slightly differently and a lender may use just one or several agencies when deciding whether to offer you a financial product and at what interest rate.

Find out more: Applying for a mortgage with bad credit

Use Loans To Build Credit

If you have outstanding student loans, one of the easiest ways to build credit is simply to make all your loan payments on time. If you don’t have student loans, getting a car loan or a personal loan and repaying it on time is another way to demonstrate you can use credit responsibly. If you have trouble getting good loan terms on your own, asking someone to cosign on the loan with you can help.

Another option: Some smaller banks and credit unions offer designed to help you establish credit. As with a secured credit card, these loans require you to make a deposit, which you then pay off over six to 24 months. Those payments are reported to the credit bureaus, and you get your deposit back once the loan is paid.

Whatever type of loan or credit you obtain, remember the factors used to calculate your credit score. Be sure to make your payments on time, keep your credit utilization ratio below 30%, and avoid generating too many hard inquiries on your credit report.

You may even be able to build credit and improve your credit score simply by paying bills related to daily living. For example, Experian Boost is a free service that adds your positive cellphone and utility bill payments to your credit file, often instantly improving your FICO® Score.

Don’t Miss: How To Check Your Credit Score With Itin

American Express Mycredit Guide

Available even if you are not an American Express customer. All for free.

Not a Card Member?

Why MyCredit Guide?

We believe everyone should know their credit score and have the tools to understand it better. That’s why we’re giving you VantageScore® 3.0 by TransUnion, and the key factors that affect your score.

Using MyCredit Guide won’t hurt your credit score.

Use it as often as you like, it wont affect your credit score.

There is no cost to using MyCredit Guide.

We provide a secure login that helps keep your information safe.

MyCredit Guide offers you tools and information to help you take charge of your credit.

In addition to your credit score, get a detailed TransUnion credit report that helps you stay informed.

Alerts

We will let you know if there are any changes to your TransUnion credit report to help detect identity theft. Alerts include address updates, new inquires on your credit report, new accounts opened, and more.

See how different actions like paying down debt or opening a new account, could affect your score.

Apply For A Store Charge Card

If you shop in-store, itâs common to be asked to sign up for a store card when you pay for your purchase. While these cards generally have higher interest rates and very low credit limits, they can be an ideal tool for building credit. Approval rates are generally higher, and these cards can sometimes come with extra perks, such as a percentage off your initial purchase or special in-store coupons.

Also Check: How To Fix A Repo On Your Credit

Youre In Complete Control Of Your Finances

Like weve said before: Cash is king, baby! When you start saving up for lifes big purchases , youll find that a credit score is worthless. Not only will you have the power of negotiation on your side, but youll also find out how much easier it is to buy things outright. Whos going to turn down cash?

It Can Take Time To Build A Credit Score

Theres no set amount of time it takes you to get a score. Many factors contribute to your score, including your payment history and how long youve had credit.

Building credit essentially means showing your ability to repay debts over a period of time. Once youve established credit by getting a loan or opening a credit card account, youll begin building your credit history as you pay those bills back responsibly.

Recommended Reading: Speedy Cash Credit Check

How To Check If You Have A Credit Score

One way to know if you have a score is to use one of the available credit score services, such as , , or Mint, to see where you rank. If youâve opened a loan account with a bank or credit card company more than six months ago, you should have a score. You can also check your free credit history each year at AnnualCreditReport.com to see what credit activity youâve participated in that would also contribute to this score.

Build Your Credit File

Opening new accounts that will be reported to the major credit bureausmost major lenders and card issuers report to all threeis an important first step in building your credit file. You can’t start laying down a good track record as a borrower until there are accounts in your name, so having at least several open and active credit accounts can be helpful.

These could include or secured cards if you’re starting out or have a low scoreor a great rewards credit card with no annual fee if you’re trying to improve an established good score. Getting added as an on someone else’s credit card can also help, assuming they use the card responsibly.

Additionally, you can sign up for Experian Boost to add positive utility, cellphone and streaming service payments to your Experian credit report. These on-time payments wouldn’t otherwise be added to your credit report, but using Boost means they’ll be factored into your Experian credit scores.

Don’t Miss: Carmax For Bad Credit

Having No Credit Score Doesnt Mean You Have Bad Credit

Not having a score may suggest you havent needed to use credit yet, which isnt necessarily a bad thing. And its not an indicator that you have poor credit, either. In fact, once you get a score, it may be better than you think.

A 2016 study of more than half a million Credit Karma members from 2008 to present shows that members who initially did not receive a TransUnion score later achieved an average first score of 639.

Once you have a score, your contribute to whether it increases or decreases over time, so its important to make all of your payments on time once youre able to get your first credit card or loan.

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Recommended Reading: How To Unlock My Experian Credit Report

What Is A Credit Rating

A credit rating shows how likely a typical lender would be to offer you credit.

When you apply for credit such as a loan, credit card or mortgage the lender tries to predict your future behaviour based on the way you’ve acted in the past. To do it, they look at lots of different data. This may include how many applications you’ve made recently, how much you owe, what credit products you’ve had and whether you paid them all off on time.

But the world of credit ratings is rife with misinformation and misunderstanding. Much of it’s because lenders don’t want it understood, and credit reference agencies want you to think it works a certain way so they can sell you extra products based on your fear.

Here are our 10 credit rating need-to-knows: