Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

What Are The Three Main Credit Bureaus

The three main credit bureaus in the United States are Experian, Equifax and TransUnion. Your credit data is reported to these providers who then determine your credit score based on the FICO scoring system. Each credit bureau will produce a different credit score, as they each use a slightly different scoring system and not all three bureaus typically have the exact same data about your credit history. This often occurs when an account in your credit history has been reported to one bureau but not another.

How Missed Mortgage Payments Or A Foreclosure Affects Your Credit Score

Missed mortgage payments and a subsequent foreclosure will damage your credit score. Lenders report missed payments as 30 days late, 60 days late, and 90+ days late to the credit reporting agencies. According to FICO, a person’s credit score drops about 50 to 100 points when the lender reports the account as 30 days past due, and each subsequent delinquency lowers the score further.

After a foreclosure, your score will likely go down by at least 100 points. How much the score will fall depends, to some extent, on your score before the foreclosure started. Someone with a higher score before foreclosure generally loses more points than someone who already has a low score. Short sales and deeds in lieu of foreclosure have a similar effect on credit scores.

Beware of Credit Repair Scams

Avoid credit repair organizations that charge a fee to improve or repair your credit you can take steps to improve your credit yourself.

You May Like: Why Did My Credit Score Drop 50 Points

Does A Fico Credit Score Accurately Predict A Borrower’s Future Ability To Repay Debt

FICO did a study on how well its credit scores mirrored borrowers’ risks for defaulting on their debt, and according to an analysis for the Federal Reserve, it looks like its credit score does correlate with a borrower’s ability to repay debt in the future. It looked at the actual performance of borrowers between 2008 and 2010, relative to their credit scores and found this:

|

FICO® Score |

|---|

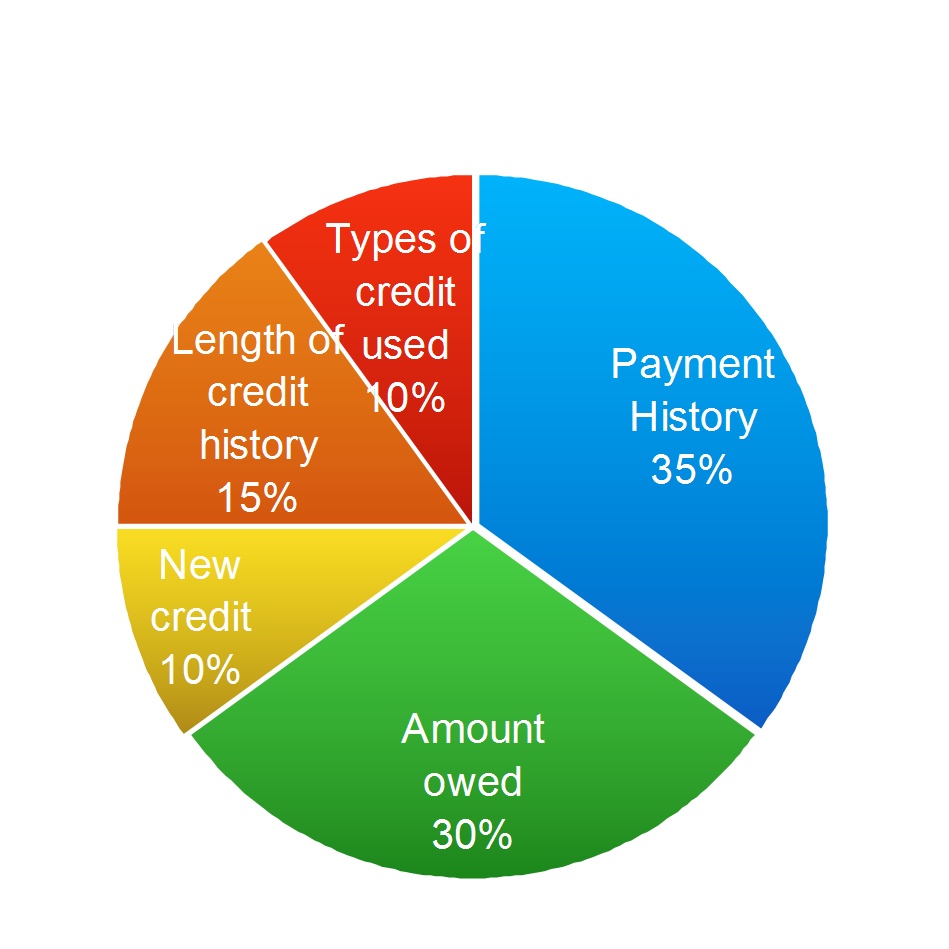

The Five Pieces Of Your Credit Score

Your credit score is based on the following five factors:

Ultimately, the best way to help improve your credit score is to use loans and credit cards responsibly and make prompt payments. The more your credit history shows that you can responsibly handle credit, the more willing lenders will be to offer you credit at a competitive rate.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Score plus tools, tips, and much more. Learn how to access your FICO Score.

Read Also: What Goes Into A Credit Score

Is Knowing Your Own Credit Score Important

Some people really want to know what their credit score is. However, it changes often, so be prepared. Also, keep in mind that your credit score is intended to reflect the likelihood that you will repay any money that you borrow. Most people dont need a score to know if they will pay themselves back the money they lend themselves. Instead, focus on managing your money carefully with a budget and only apply for credit that you need your score will take care of itself.

Getting a copy of your credit report, however, is important and can be done for free. It will allow you to spot concerns, inaccuracies, or potential fraud.

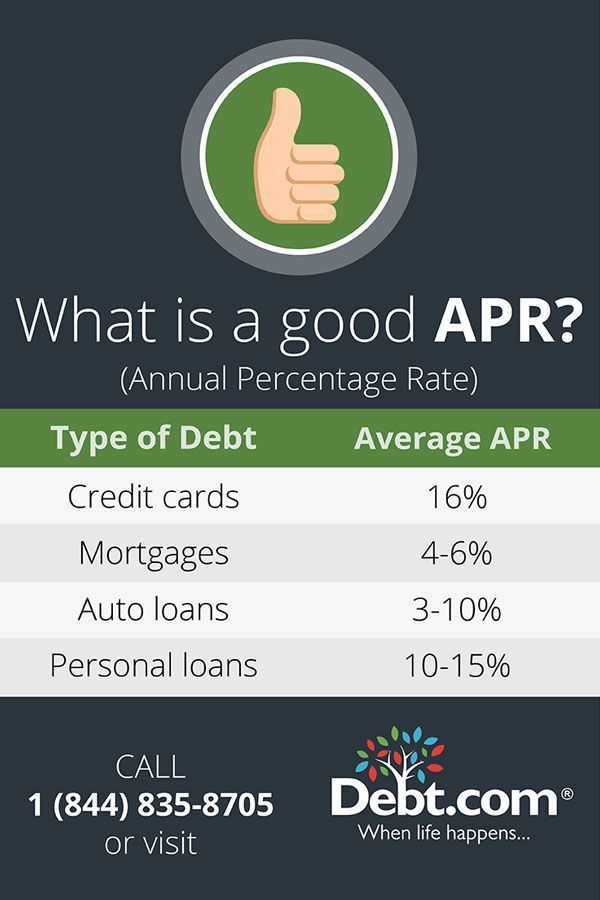

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

You May Like: Is 773 A Good Credit Score

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Using Your Insurance Score

Insurance companies may “score” you, for a number of reasons, including:

- To decide whether to insure

- To give discounts based on good credit, to pull you in

- To assess how well you can keep up with payments over time

- To offer better rates and lower prices to keep you as a client when it’s time to renew

It can be hard to know the full picture of what goes into your insurance ratings, but if you can put yourself in the mind of an insurer, you can learn what types of traits are positive . Once you have a notion of how they will be rating you, you can use this insight. For example, you may be able to try and renegotiate rates when the factors are in your favor. You may be able to work on your credit and improve factors that are hurting you, or you may decide to take that knowledge and seek out a new insurance company that’s willing to offer you better prices.

Also Check: What Number Is Considered A Good Credit Score

The Minimum Required To Calculate A Credit Score

For a credit score to be calculated, your credit report must contain enough informationand enough recent informationon which to base a credit score.Generally, that means you must have at least one account that has been open for six months or longer, and at least one account that has been reported to the credit bureau within the last six months. What are the minimum requirements to have a FICO Score?

What Is The Difference Between A Good And Excellent Credit Score

“Excellent” is the highest tier of credit scores you can have. For FICO, it falls between the range of 800 to 850, and for VantageScore, it’s between 781 to 850. A perfect credit score of 850 is hard to get, but an excellent credit score is more achievable.

Many of the best credit cards require good or excellent credit. If you want to benefit from competitive rewards, annual statement credits, luxury travel perks, 0% APR periods and more, you’ll need at least a good credit score. And if you have an excellent credit score, you can maximize approval odds.

For instance, if you’re looking to earn generous rewards on groceries and dining out, the American Express® Gold Card offers 4X Membership Rewards® points when you dine at restaurants and shop at U.S. supermarkets . But you’ll need good or excellent credit to be approved for the Amex Gold, which Select named the best rewards card of 2020. Terms apply.

And if you want to finance new purchases or get out of debt with a balance transfer card, such as the Chase Freedom Unlimited®, you’ll also need good or excellent credit.

Even if your credit score falls within the excellent range, that is not a guarantee you’ll be approved for a credit card requiring excellent credit. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

See rates and fees, terms apply.

Recommended Reading: Why Is There Aargon Agency On My Credit Report

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

What Are The Factors That Make Up Your Credit Score

These are the factors that FICO considers when calculating your score, according to Experian:

- Payment history : Whether you pay your credit card bills on time

- Amounts owed : The total amount of credit and loans you’re using compared to your total credit limit, also known as your

- Length of credit history : The length of time you’ve had credit

- New credit : How often you apply for and open new accounts

- Having a variety of installment loans and revolving credit accounts, including credit cards, auto loans, mortgages and personal loans

These factors influence your VantageScore:

- Extremely influential: Payment history

Recommended Reading: How Can You Improve Your Credit Score

Used Credit Vs Available Credit: ~30%

A key part of your credit score analyzes how much of the total available credit is being used on your credit cards, as well as any other revolving lines of credit. A revolving line of credit is a type of loan that allows you to borrow, repay, and then reuse the credit line up to its available limit.

Also included in this factor is the total line of credit or credit limit. This is the maximum amount you could charge against a particular credit account, say $2,500 on a credit card.

How To Check Your Credit Score For Free

Once you understand how your credit score is calculated, you should check your score. This will give you insight into what products you may qualify for and what interest rates to expect. If you have a low score, you can take steps to improve it. If you have a good or excellent score, you can work to maintain it.

Checking your credit score doesn’t hurt your credit, and even if you’re not applying for a new card or a loan, it’s smart to get into the habit of checking it regularly.

Most credit card issuers provide free credit score access to their cardholders, making it easier than ever to check and know your score.

Some issuers, such as Citi and Discover, provide free FICO Scores, while others, such as Chase and Capital One, provide free VantageScores.

You can check your credit score in less than five minutes by logging into your credit card issuer’s site or a free credit score service and navigating to the credit score section. There will typically be a dashboard listing your score and the factors that influence it.

FICO and VantageScore will pull your credit score from one of the three major credit bureaus, Experian, Equifax or TransUnion.

Here are some free credit score resources that you can access even if you don’t have a credit card yet:

- Chase Credit Journey: Free VantageScore from TransUnion

- Discover Credit Scorecard: Free FICO Score from Experian

You May Like: How To View My Credit Score

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

Other Factors That Can Influence Your Insurance Premiums

In addition to reviewing the information on your credit reports and your credit-based insurance credit scores, insurance companies also take your previous insurance claims into account. This information is collected, stored and delivered to insurance companies by LexisNexis. The LexisNexis database containing information about your auto and homeowners claims is called the C.L.U.E. database.

If you’ve filed an auto or homeowners insurance claim in the past seven years, that information is likely to be included in your C.L.U.E. report. And because the C.L.U.E. report is legally considered a consumer report by the Fair Credit Reporting Act, you can check your auto and homeowners C.L.U.E. reports for free once every 12 months through LexisNexis Risk Solutions. Only claims filed in the past seven years will show up on your C.L.U.E. reports.

Other factors that can influence your auto and homeowners insurance rates include your age, gender, marital status, the type of car you drive, where you live and the value of your home. The deductible amount on your insurance policy will also influence your insurance premiums.

You May Like: How Long Does Bankruptcy Affect My Credit Rating

What Is A Good Credit Score And Why Does It Matter

So, whats a good credit score? Though it varies across credit scoring models, a score of 670 or higher is generally considered good. For FICO, a good score ranges from 670 to 739. VantageScore deems a score of 661 to 780 to be good.

A credit score that falls in the good to excellent range can be a game-changer. While financial institutions look at a variety of factors when considering a loan or credit application, higher credit scores generally correlate with a higher likelihood of getting approved.

A good credit score can also unlock the door to lower interest rates and more-competitive terms. And if you have excellent credit scores, you have an even better chance of being offered the best rates and terms available.

On the other hand, if you have poor or bad credit scores, you may be able to get approved by some lenders, but your rates will likely be much higher than if you had good credit. You may also be required to make a down payment on a loan or get a cosigner.

How Credit Scores Are Created

Your credit reports include information about your and activity. The credit bureaus rely on credit scoring models such as VantageScore and FICO to translate all this information into a number.

While each credit scoring model uses a unique formula, the models generally account for similar credit information. Your scores are typically based on factors such as your history of paying bills, the amount of available credit youre using and the types of debt you have .

Federal law prohibits credit scores from factoring in personal information like your race, gender, religion, marital status or national origin. That being said, its not necessarily true that the American financial system is unbiased or that credit lending and credit scoring systems dont consider factors affected by bias. To learn more about racial justice in lending and initiatives seeking to create change, connect with organizations leading the fight, like the ACLU.

You May Like: How To Check Credit Rating

What Is Available Credit

Your available credit is the amount of money you have available through your credit cards given your current balance. For example, if your credit limit is $2,000 and your balance is $500, your available credit is $1,500 . If you have two cards, each with a $1,500 limit and a balance of $200 on one card, your available credit is $2,800 .