Applying For Business Credit Hard Inquiries

When you apply for a business credit card or business loan, the potential lender will generally check your credit history as part of the application process. Depending upon the type of business financing you apply for, the creditor may want to review your business credit report, personal credit report, or both.

If a lender pulls your personal credit, a hard inquiry will be added to your consumer credit report with Experian, TransUnion, or Equifax. Business credit checks may also be recorded on your business credit reports, like those sold by Dun & Bradstreet, Experian, and Equifax.

Hard credit inquiries might impact your business credit score, depending on the business credit reporting agency and business credit score used. But a hard credit inquiry is typically less important when it comes to business credit scores than it is where your personal credit history is concerned. In fact, many business credit scoring models dont even take inquiries into account.

You Bought A Car From A Dealership

You may notice multiple hard inquiries in a short period after taking out an auto loan to buy a car. This indicates that the dealership sent your application to multiple lenders to find the best deal.

Although youll receive multiple hard inquiries in situations like this, theyll count as one for the purpose of your credit score. When you receive multiple hard inquiries for a certain type of loan within a short period, both FICO and VantageScore treat them as a single inquiry. This way, youre not penalized for shopping around to find the best rates.

FICOs shopping period is 14 days in older models and 45 days in newer models, whereas VantageScores is 14 days. 34

Can You Ask A Creditor To Remove A Hard Inquiry

Disputing hard inquiries on your credit report involves working with the credit reporting agencies and possibly the creditor that made the inquiry. Hard inquiries can’t be removed, however, unless they’re the result of identity theft. Otherwise, they’ll have to fall off naturally, which happens after two years.

Also Check: Remove Repo From Credit

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Once it receives a dispute, a lender is also required to investigate and respond to all disputes that might impact your score.

Remember to include as much documentation as possible to support your claim. It’s also helpful to include a copy of your report marking the error.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

Check Your Credit Reports For Free

The first step is to get your credit reports from each of the three credit bureausEquifax, Experian and TransUnion. Often, the same information is recorded on all three, but not always, and thats why its important to check all three.

You can typically pull your credit reports for free once per year on AnnualCreditReport.com. However, due to Covid-19, you can order free weekly credit reports until April 20, 2022.

Also Check: When Does Paypal Credit Report To Credit Bureau

How To Remove Items From Your Credit Report In 2022

Your credit report is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

Inquiries Arent A Major Factor In Your Credit Score

Examples of soft inquiries include when a utility company considers whether they need security deposit from you, when credit card companies decide what types of credit cards to market to you and for setting premiums on insurance. Additionally, when you pull a credit check on yourself through a credit monitoring service, itâs a soft inquiry. Since these credit inquiries do not deal with lending you money, but still provide valuable information about your credit history, it would be unfair if they counted against your credit score.

According to Experian, inquiries wonât affect you unless you also have other – more serious – issues impacting your credit score. Multiple credit inquiries are ultimately a reality of life. For example, when you are looking to buy a car and want the best auto loan rates, a dealership might engage in rate shopping, where they send your information to an array of lenders. Due to this issue, all inquiries related to an auto loan that are sent within 14 days will all count as one inquiry.

Additionally, there are even credit scoring systems that will not count a credit inquiry after more than one year. As noted above, hard inquiries will not remain on your credit report for more than two years. So over time, an individual inquiry counts less.

You May Like: When Does Opensky Report To Credit

How Long Do Inquiries Stay On My Credit Report

All credit inquiries are listed on your credit report for two years. After that, they should fall off naturally. On the plus side, an inquiry only affects your credit score for one year. Once that period is up, your score should rebound a few points.

Again, its no big deal if you just have a few hard inquiries listed on your credit report. But if you have a long list of them, you might want to try getting one or more of the inquiries removed.

This is especially true if you dont remember authorizing the inquiry. To dispute a hard credit inquiry, you must contact each credit bureau that lists it.

Applying For Credit Hard Inquiries

When applying for new credit you will generally give your name, address, phone number and social security number. These are needed to accurately identify the correct credit record to pull.

Your credit application will require your signature, giving the lender or a financial consultant permission to access your credit file. You may be familiar with this approach if you have ever bought a car.

If you walk into the dealership, they will ask you to fill out a credit application before they allow you to test drive. You may be subject to multiple hard inquiries using this approach, as the dealership will shop around for the best deal for you. Events like this results in a hard pull.

After I bought my car from a national dealership, I viewed my credit report and saw eight entries. I immediately panicked because I was not aware that the dealers finance personnel petitioned that number of lenders.

After some research, I found that the FICO scoring models treated multiple inquiries for one type of loan as one inquiry, indicating that you were shopping around for the best rates. This method prevents your score from taking a complete nosedive.

How long do hard inquiries stay on your report? Hard inquiries impact your score for about a year, but generally fall off your report within 2 years.

Also Check: How To Report Death To Credit Bureaus

How Much Does 2 Hard Inquiry Affect Credit Score

For most people, one additional credit inquiry will take less than five points off their FICO Scores. For perspective, the full range for FICO Scores is 300-850. Inquiries can have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk.

How To Dispute A Hard Inquiry On Your Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If youve checked your credit reports, you may have noticed youre not the only one taking a peek.

-

Utilities use them to decide whether to charge you a deposit.

-

Companies may check your credit standing so they can market products to you.

-

Potential landlords and employers may look to see how reliable you are.

Inquiries stay on your report for two years, but not all of them affect your score. Heres what you need to know about when and how to remove a hard inquiry from your credit report.

You May Like: How To Get A Repossession Off My Credit Report

What Is A Soft Inquiry

Soft inquiries, on the other hand, occur when a creditor checks your credit without your permission. This could be a lender with whom youve talked to for a pre-approval quote but havent actually applied for a loan.

Sometimes a soft inquiry might even be pulled by an existing creditor just checking on your current credit situation. Another example of a soft inquiry is from a credit card issuer that would like to send you credit card offers.

How To Remove Hard Credit Inquiries

When they make a hard inquiry it will show on the consumers credit report. If this is done without the consumers knowledge or permission, it may result in too many inquiries that will lower the consumers credit score.

The consumer should view their credit report at least once or twice a year to see if there are any irregularities. If they are applying for credit and constantly getting turned down, it may be because their credit score is unfairly low.

Don’t Miss: What Is Cbna Bby

Why Lenders Use Hard Inquiries

Since inquiries can reveal whether you’ve been shopping for credit recently, potential creditors can attempt to predict whether you’ve recently taken on other debt that will make it harder for you to pay off the credit card or loan you’re applying for.

According to FICO, consumers with six or more inquiries on their credit report can be up to eight times more likely to declare bankruptcy than people with no inquiries. That is why the company considers hard inquiries made within the past year in its credit scoring calculationand why lenders consider them in making decisions about extending credit.

How Do Hard Inquiries Affect Your Credit Score

You wont be penalized for a soft inquiry because it doesnt mean anything negative about you or your personal finances. Repeated hard inquiries, on the other hand, can indicate financial instability and damage your good credit.

Repeated hard inquiries in a short timespan can indicate youve been unsuccessful in securing a loan because of a bad credit score, or you are applying for more credit than you can afford to repay. In short, potential lenders see you as a financial risk, and your FICO score or VantageScore will reflect that belief.

That said, hard inquiries dont always hurt your credit score significantly. If youre shopping around for a mortgage or auto loan, different mortgage finance companies or auto dealerships may conduct hard pulls on your credit in a brief time period. As long as they all occur roughly within a 14-day window, theyll only appear on your credit score as a single inquiry.

Other hard inquiries that wont affect your credit score include credit checks conducted by utility companies, auto insurers and credit card companies to determine:

- If then need a security deposit from you

- How to set your premium

- Ways to market new products to you

In fact, applying for a credit card can affect your credit because it’s generally a hard inquiry. If you suspect you might be rejected or dont need the credit, it may be wise not to apply not just to avoid the hard pull, but because opening too many new credit accounts can hurt your credit, too.

You May Like: Does Qvc Easy Pay Report To Credit Bureaus

What To Do If You Spot A Problem

If you cant trace the reason for a hard inquiry or you believe it was done without your consent, you can dispute it online. If the credit bureau cant confirm it as a legitimate inquiry, its required to remove it. Contact each credit bureau individually:

If you suspect fraud, you can have a fraud alert added to your credit reports, which flags applications in your name as requiring extra scrutiny. Alert any one credit reporting agency it will share information with the other two.

Or, for the best protection, simply freeze your credit with all three bureaus to stop anyone from opening new credit in your name.

How To Reduce The Impact Of Hard Inquiries On Your Credit

Hard inquiries on their own generally aren’t enough to significantly reduce your score in a lasting way. This is especially true for those who have a positive credit history. In most cases, hard inquiries result in a temporary credit score drop that rebounds within a few months.

Improving your credit score is one of the best ways to cushion the blow of hard inquiries. To do this, focus your attention on the following areas:

- Always make on-time payments across all your accounts.

- Pay down your debt and keep your below 30% the lower, the better.

- Pay off any past-due accounts, including collections or charge-offs.

- Periodically check your credit report and credit score and pay close attention to the risk factors included with your score.

- Apply for credit only when you need it.

Also Check: Experian.com Viewreport

Large Number Of Hard Inquiries

A large number of inquiries on a credit report can make it extremely difficult or impossible for the consumer to buy a house, car or any purchase that requires credit. Consumers should take the time to review their credit report to find out if there are any unauthorized credit inquiries on their credit report.

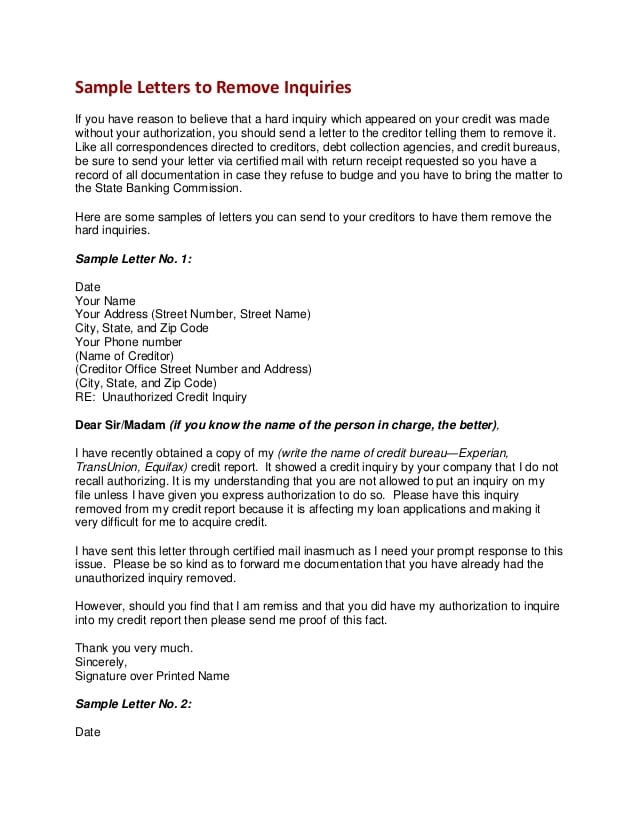

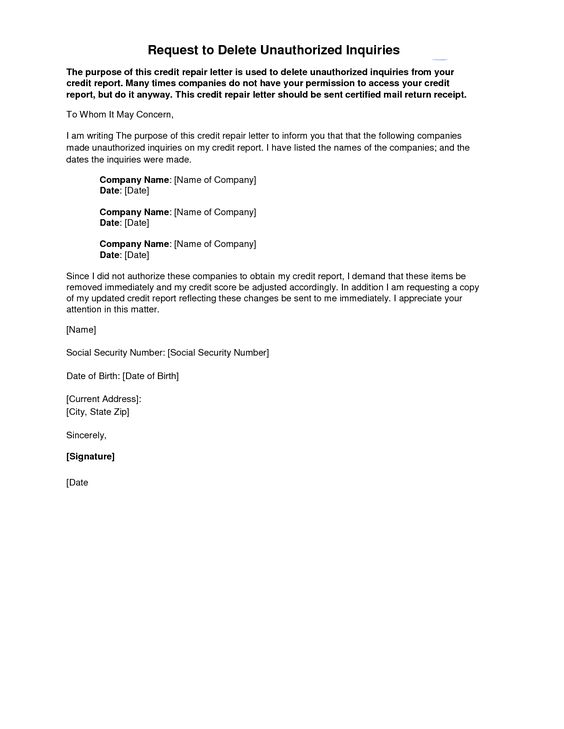

If this is the case, they can send a credit inquiry removal letter and have all or some of the hard inquiries removed. This would most likely raise their credit score. According to the Fair Credit Reporting Act , consumers have the right to dispute any inaccurate information on their credit report.

How Many Points Does A Hard Inquiry Deduct From Your Credit Score

As Canadaâs credit bureaus donât reveal the exact algorithms they use to calculate your credit score, itâs impossible to say exactly how much a hard inquiry will cause your credit score to decrease. Obviously, the higher your credit score, the better you are positioned to weather a few negative hits.

Read Also: Credit Score Care Credit

Whats The Difference Between Hard Inquiries And Soft Inquiries

Each time a bank, lender, credit card issuer, or insurance company receives an application from you, an inquiry is made on your credit report. They have been authorized by you and are called hard inquiries.

Unsolicited credit card offers that come in the mail are called soft inquiries. Credit card issuers, insurance companies, and lenders make those inquiries. You did not make them, so they dont impact your credit score, even though they appear on your credit report.

Pre-approvals and pre-qualifications initiated on your own usually also only constitute a soft inquiry. To be sure, however, check with the creditor before agreeing to one.

See also:Hard vs. Soft Inquiries: How They Affect Your Credit Score

Disputing Inaccurate Hard Inquiries Yourself

It’s important to check your credit reports regularly for accuracy. If, while doing this, you’ve noticed a hard inquiry on your credit report that you believe is the result of identity theft, you can file a dispute with each of the three national credit reporting agencies and petition to have them update the inaccurate information.

The first step is to review your Experian credit report through our Dispute Center and verify your information. Next, confirm that the inquiry was not a result of identity theft.

There may be situations where you don’t recognize the name of a company that checked your credit or you don’t remember applying for a loan with a company you do recognize. Here are a few scenarios when inquiries you don’t recognize may be legitimate:

If you don’t recognize the company name that performed the hard inquiry, contact the company for more information. When you check your credit report through the Experian Dispute Center, the hard inquiry will be accompanied by the company name and typically the mailing address and a phone number.

If you have verified that the hard inquiry is due to identity theft, then the dispute would be handled over the phone with Experian specialists. You can visit our Dispute Center to find out support options. There is no charge to use this service.

Recommended Reading: How Often Does Discover Report To Credit Bureaus

Avoid The Following Strategies

While the following methods can be tempting options when trying to repair your credit, they can often cause more harm than good. Stay away from the following:

Closing a line of credit that is already behind on payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Filing for bankruptcy

There are two types of bankruptcies available for individuals: Chapter 7 and Chapter 13. A third type, Chapter 11, is meant for businesses.