Does Transunion Offer Free Trials

Yes, TransUnion offers free trials as a way of attracting new customers. The terms of the free trials are specific to the products that are provided by it. You will need to provide your debit or credit card details before you are allowed to use your free trial. You wont be charged for anything you have access to until the trial expires. Note that you may be offered a payable upgrade to your trial while it lasts. If you accept, you will be charged for the upgrade, your trial will be terminated, and you will be on a paid subscription to TransUnion.

Q I Corrected Things On My Credit Report And My Score Went Down Can You Explaina The Effect On Your Score Due To Changes Made To Your Transunion Credit Report Depends On The Nature Of The Information That Was Changed What Information Is Left Intact And What Other Items On Your Credit Report Have Been Updated During The Time That The Corrections Were Made

Some specific reasons why your score may not have improved include:

- Your TransUnion credit report included several negative items and some but not all of them were removed. The presence of one or more negative items may still have an adverse impact on your score.

- Your TransUnion credit report reflects some positive changes but there may have been new updates to your file that offset them such as higher balances reported on accounts, new account openings or new credit inquiries.

Will Property Rental Data Impact My Credit Score

Yes. Property Rental data will contribute to your overall credit score.

Just like all other credit commitments you take out, ensuring that you maintain your rental payments on time may help to improve your credit score. Equally any missed rental payments may have a detrimental impact on your credit score.

Also Check: How Often Does Discover Report To Credit Bureaus

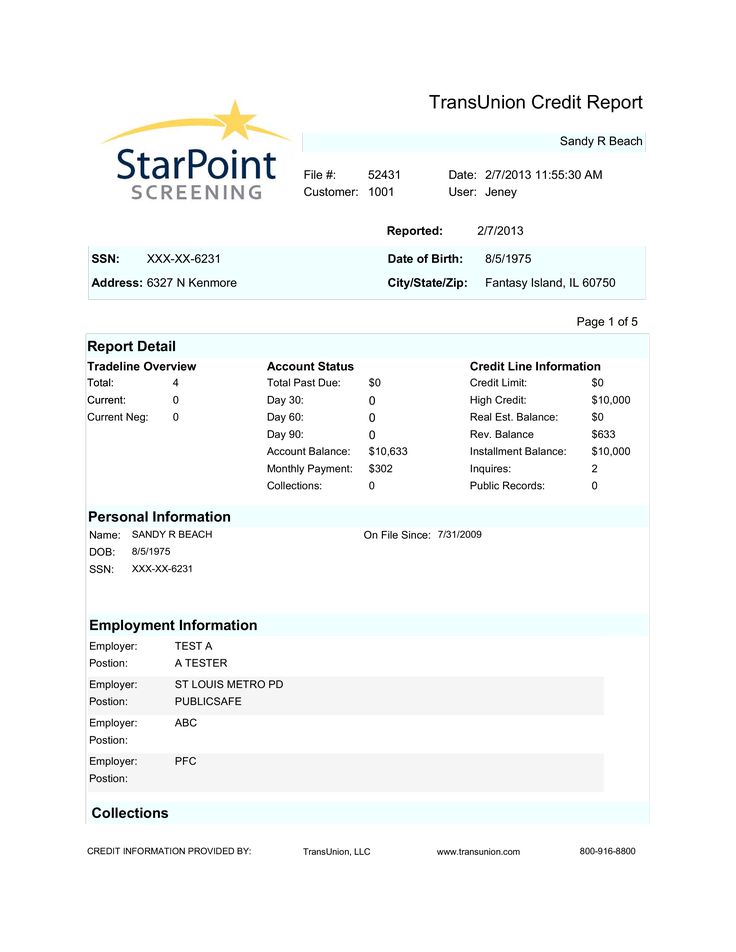

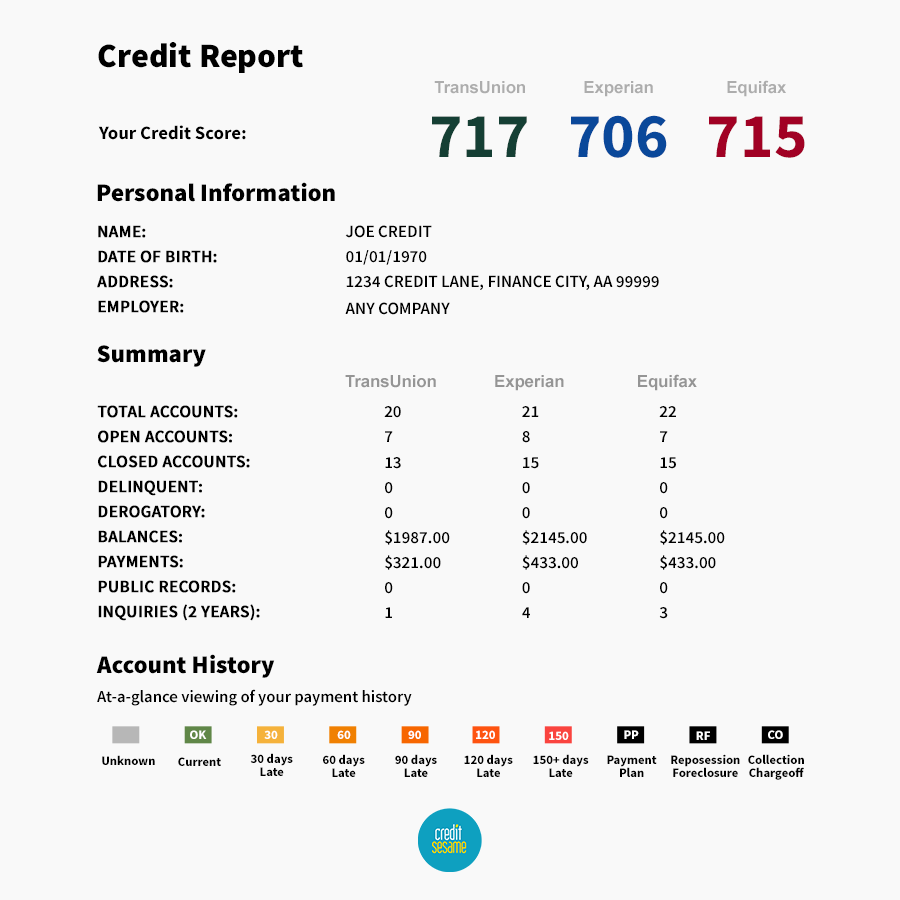

What’s In Your Credit Report

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus. Much of it is used to calculate your FICO® Scores to inform future lenders about your creditworthiness.

Although each of the credit bureausExperian, Equifax and TransUnionformat and report your information differently, all credit reports contain basically the same categories of information.These four categories are: identifying information, credit accounts, credit inquiries and public records.

Which Credit Report Do Lenders Look At

It may be difficult to know which credit report and score a lender is using to evaluate your credit. You can ask, but the lender isnt obligated to tell you.

But if a lender denies your credit application, federal law requires the lender to

- Tell you the main reasons why you were denied.

- Tell you the numerical credit score it based its decision on.

- Give you the name, address and phone number of the credit-reporting agency that provided your credit report.

- Inform you of your right to get a free copy of that report from the credit-reporting company .

- Explain how you can fix mistakes on your report or add information to it.

The reporting agency is required to provide you with a copy of the report used for the decision to deny your credit application. If you spot any errors in your report, you can dispute them and the agency is required to investigate and correct any errors it finds.

Don’t Miss: Carmax Financing Rates

What Does A Credit Report Include

The information that appears on your credit report includes:

- Personal information: Your name, including any aliases or misspellings reported by creditors, birth date, Social Security number, current and past home addresses, phone numbers, and current and past employers.

- Accounts: A list of your credit accounts, including revolving credit accounts, such as credit cards, and installment loans, such as mortgages or auto loans. The list includes creditor names, account numbers, balances, payment history and account status .

- Public records: Bankruptcies.

- Recent inquiries: Who has recently asked to view your credit report and when.

Note that your credit report does not include information about your marital status , income, bank account balance, or level of education. Your credit report could include your spouse’s name if reported by a creditor. After a divorce though, the only way to remove a spouse’s name from your credit report is to dispute the information.

Each of the three credit bureaus may also have different information about you. Creditors are not required to report information and may not furnish data at all, and if they do, it may only be to one or two of the credit bureaus.

How Do Lenders Make Their Decisions On Whether Or Not To Give You Credit

Lenders may use a combination of the following to help them make their decision:

- Information supplied by you when you applied.

- Data supplied by a credit reference agency like TransUnion. This data allows lenders to check if you’re on the electoral register at your current address if you’ve paid your credit commitments on time and if you have insolvencies or County Court Judgments.

- Your financial connections Anyone youre financially connected to, such as those with whom you have a joint bank account, or taken out a loan or mortgage. When lenders assess your credit history, they may also look at your financial associates credit histories, as they may affect your ability to repay money you borrow.

- Information about any existing accounts you already have with the lender

- Their own policies and rules

You May Like: How To Get Inquiries Off Your Credit Report

Experian Vs Transunion: Whats The Difference

- Banks Editorial Team

When youre checking your credit report or credit score, you may hear about different credit bureaus, including TransUnion and Experian. What are the similarities and differences between these credit reporting agencies, and does it matter which one you use to check your information?

Q How Do I Initiate A Dispute

A.There are three ways you can launch a dispute into item on your report:

- Online: to visit our self-service website.

- Over the telephone: simply call 1-800-663-9980 to reach one of our TransUnion representatives for assistance with your inquiry.

- In writing: for mailing instructions and TransUnion requirements.

You May Like: How Long A Repossession Stay On Your Credit

How Long Does Positive Information Stay On Your Credit Report

Positive information on credit reports includes types of loans youve held, length of a loan, amounts of loans, and repayment history. However, you must manage debt responsibly for this information to reflect as positive. Essentially any account paid as agreed, both active and closed, provide positive information.

This could show creditors you pay regularly and on time, and that you can manage many types of loans. Positive information can stay on your credit report forever. Usually, credit bureaus will stop showing positive information after 10 to 20 years.

The credit bureaus of Canada are TransUnion and Equifax. They each have unique reporting practices. They hold information for slightly different time lengths.

What Does It Mean That Transunion Does Not Have Enough Information On File To Get My Credit Score

There are several reasons why TransUnion may indicate that they do not have enough information on file, also known as a thin file, to provide your credit score.

You havent yet established credit

If youve never had a traditional credit account, such as a car loan or credit card, or of its been several years since youve had traditional credit, and your credit has been inactive for years, TransUnion may not have enough information on file to provide a credit score.

Youve just recently started to establish your credit, or youre working to re-establish credit

It can take as long as four to six months for a newly-opened account to be reported by your creditor or tracked by TransUnion. This may also be the case if you’ve recently started re-establish your credit.

TransUnion believes you are deceased

If you have established credit, and you believe you should have a credit score, but TransUnion is indicating that they dont have enough information on file to provide your credit score, you may want to confirm that they do not believe you are deceased.

Also Check: Aargon Collection Agency Bbb

Why Are My Equifax And Borrowell Scores Different

Even though Borrowell pulls your score from Equifax doesnt mean that the two scores will be the same either. The same goes for Credit Karma and Transunion. This is because the score that the bureaus provide to Borrowell and Credit Karma are slightly different than the one they provide directly to individuals. Both are legitimate credit scores, but the Borrowell and CK scores are the ones used by lenders, while the score you obtain directly from Equifax is more for educational purposes.

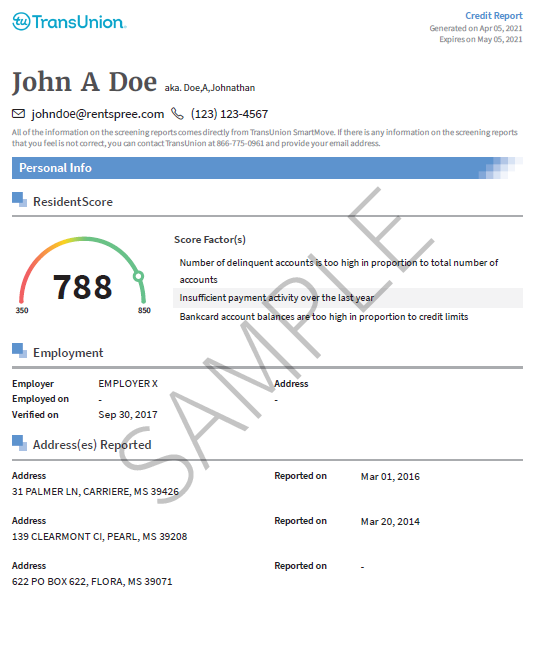

What Is A Credit Report

Your credit report is a record of how youve managed your credit accounts, including whether youve made payments on time or late and the balance on your credit cards. The three main nationwide credit bureaus collect information about you from your lenders and use this information to make your credit reports.

The information contained in your credit reports is then used to calculate your credit score, usually based on a credit scoring model produced by either FICO or VantageScore.

Don’t Miss: Does Sezzle Affect Credit Score

Why Doesn’t The Dollar Amount On My Public Record Match The Balance Due

The dollar amount reported on a public record does not reflect the balance due rather, it is the total amount owed prior to any payments. The amount reported on the public record remains the same regardless of whether payments are being made. However, if the item has been paid, it should reflect Paid Civil Judgment if a paid Judgment, or Released if a paid lien.

Fico Vs Vantagescore: Which Is Better

VantageScore and FICO are both software programs that calculate credit ratings based on consumers’ spending and payment history. FICO is the older and better-known model, having been introduced in 1989. VantageScore, released in 2006, was developed by the three leading consumer credit agencies, Experian, Equifax, and TransUnion.

Because they are different models, your VantageScore will inevitably be a little different from your FICO score. For that matter, you may get a different FICO score from various sources at any given time, depending on whether the source uses a specialized variety of FICO or the most frequently used base model and which of its many versions is used.

The key point is that your score should be in the same range on any or all of those models. You should not have a “good” VantageScore and only a “fair” FICO score.

Recommended Reading: Does Affirm Approve Bad Credit

Why Isnt My Credit Card On My Credit Reports

If youve checked your credit reports and found that a credit card or other account is missing, it could either be an error or your lender may not report to the credit bureaus. With the major card issuers, if your card isnt showing up on your reports its more likely an error than a reporting policy.

Every lender and creditor has its own reporting policies, but most include some sort of regularly scheduled automatic update that transmits your account information electronically to the credit agencies every 30 days.

Based on the individual lenders policies, it may report to all three major credit reporting agencies, or it may only report to one or two. This is one reason why credit reports and credit scores can vary from bureau to bureau.

Smaller credit unions and financial institutions may not report to all three bureaus, but you wont run into this problem when youre dealing with major lenders and card issuers, like American Express, Chase, Citi, and others. If youre not sure, you can simply call customer support and ask.

If your lender isnt reporting an account, you can contact it directly to request that it begins doing so.

Legally, however, you cant force your lender to report an account. Credit reporting is completely voluntary, although theres legislation that governs information once its reported. Unfortunately, if the lender wont honor your request, theres really not much you can do other than find a different company to do business with.

What Is A Credit Score

A credit score is a snapshot of your financial trustworthiness represented as a number. Lenders use this number to help them determine the risk in lending money to you. It is an objective, non-biased lending tool used by lenders to provide you with a faster, fairer, and more consistent response.

The Credit Score is made up of six main categories of information from your credit report:

- Payment history What is your track record?

- Amount of credit you owe How much is too much?

- Utilization of creditHow close are your balances to your credit limits?

- Length of time credit established How established is your credit?

- Acquisition of new credit Are you taking on more debt?

- Types of credit established Is your credit a healthy mix?

Read Also: Carmax Pre Approval Application

How Do I Fix Inaccuracies On My Credit Report

If you see something on your report that you believe is inaccurate, it may be a good idea to contact the business that reported the account, as they are the ones who can provide you more details. Your other option is to start a dispute with the credit reporting agency that issued the credit report. To start a dispute with TransUnion, visit transunion.com/disputeonline and well start an investigation.

Your Credit Karma Score May Be Insufficient

Credit Karma updates its scores once per week. For most people, that’s plenty, but if youre planning to apply for in the near future, you may need a more timely update.

Although VantageScore’s system is accurate, its not the industry standard. Credit Karma works fine for the average consumer, but the companies that will approve or deny your application are more likely to look at your FICO score.

Recommended Reading: Tri Merge Credit Report With Fico Scores

Q How Often Should I Check My Credit Report

A. You should review your credit report at least once a year to make sure the information is accurate. If you are planning important financial transactions over the next few months, you should order your report before doing so. This allows for enough time to contact TransUnion regarding any information that you feel needs to be amended or removed.

Question: How Do I Dispute Information On My Credit Report

Answer: If you believe something on your credit report is inaccurate, you may want to contact the lender or company that reported the information to give you more details. You can also start a dispute with the credit reporting agency that issued the report. The fastest and easiest way to start a dispute with TransUnion is to dispute online.

Also Check: Get Repo Off Your Credit Report

How Credit Scores Are Determined

Information found in your credit report is used to determine your credit scores, which might include the following:

- Your history of debt payments

- Hard inquiries6 on your credit score from new credit applications

- The amount of debt you currently have on your credit accounts

- The age of your credit accounts

- The amount and type of loan accounts you have open

- The percentage of available credit you’ve utilized

- If and when you had a foreclosure, declared bankruptcy, or had debt sent to collections

It’s common to see varying credit scores when you look at different sources. Credit Karma and other services might display different credit scores, like TransUnion VantageScore, which is different from the TransUnion FICO score that’s used for your Apple Card application. Your credit report and the timing of when your credit score is updated can affect your credit score.

For information about credit scores from TransUnion, please click here.

Q What Is The Procedure For Releasing A Copy Of A Consumer Disclosure To Me If I Have Power Of Attorney Rights

If the appropriate information has been supplied, TransUnion will send the Consumer Disclosure to the Power of Attorneys address via standard mail.

Don’t Miss: Reporting A Death To Credit Agencies

What Is Considered A Good Score

- There isn’t any one score cutoff used by all lenders.

- There are many different score ranges used by different scoring models, so it is hard to say what a good score is outside of the context of a particular lending decision.

- Your lender might be able to give you guidance on the criteria for a given credit product.

How To Monitor Your Credit Report

Everyone should review their credit report every 6 months to a year. To ensure there is no suspicious activity. This allows you to follow up with your goals as well. Thereby allowing you to improve your credit score and correct any mistakes you have made.

Below are the links to contact both Canadian credit reporting agencies. Both agencies offer a free credit report in Canada each year.

Recommended Reading: Bestbuy/cbna

How Do I Check My Credit Score

Both Equifax and Transunion are required to offer Canadians a free credit report upon request, once per year. Requests can be ordered by phone or by downloading a request form and mailing it in. You can choose to pay the bureaus for regular monthly online reporting, but there is a way to get monthly reporting, and an updated credit score, for free.

Q How Can I Contact Your Fraud Department

A. Please contact the Fraud Victim Assistance Department through the following phone or mail channels:All information should be supplied to:Correspondence in EnglishTransUnion Fraud Victim Assistance Department3115 Harvester Road,Suite 201 Burlington ON L7N 3N8Correspondence in FrenchService daide aux victimes de la fraude TransUnion3115 Chemin Harvester,Suite 201 Burlington ON L7N 3N8

Don’t Miss: Does Drivetime Pre Approval Affect Credit Score