How To Report Rent Payments To The Credit Bureaus

Reporting your rent payments to a credit bureau is fairly simple. You can either have your landlord manually report your rent for you, or you can do it yourself using a rent reporting platform like *. Most renters prefer to report their rent payments to a credit bureau themselves since they have more control over the process. But its important to note that your landlord will need to set up an account in order for you to take advantage of this tool.

helps you contribute to your FICO 9, FICO XD, and VantageScore by reporting your on-time rent payments. Your payments go directly to TransUnion, one of the three major credit bureaus, to make it easier to build your credit health.

Heres how to start reporting your on-time rent using CreditBoost: :

Create an account or log in to your tenant dashboard today to get the process started.

Use A Rent Reporting Service

There are several companies that will report rent payments on your behalf. Monthly fees vary between services, and some charge an initial enrollment fee to get started. In some cases, your landlord may have to verify your rent payments for them to be included in your credit report. Note that even when rent payments are included in your credit report, they may not be included in your credit score calculation.

Rent Reporting Benefits Landlords And Tenants

Landlords, Property Managers and Tenants can report rent payments and rental history data to Landlord Credit Bureau through FrontLobby.

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

Don’t Miss: Cricket Affirm

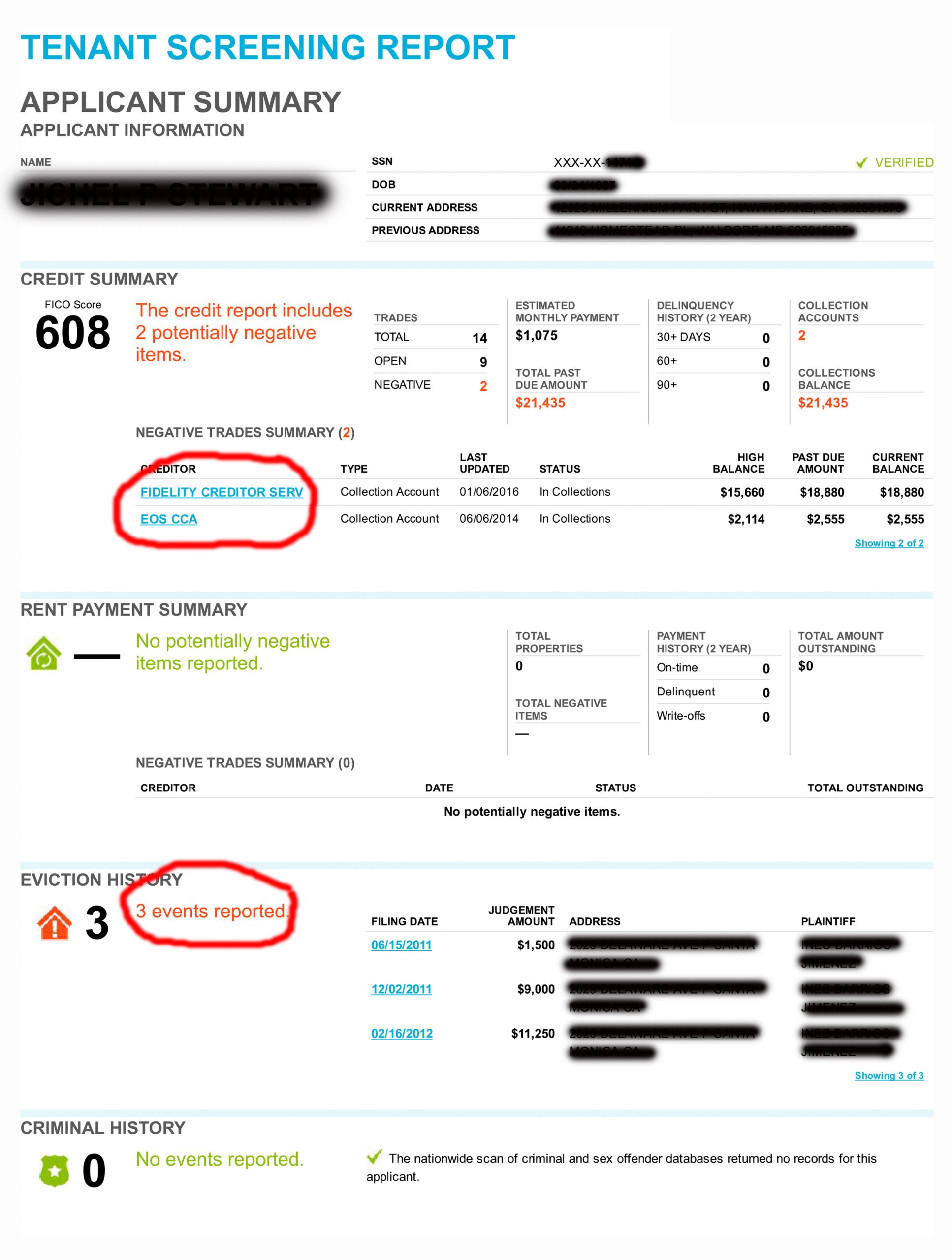

How Do I Report A Bad Tenant To The Credit Bureau

4.7/5bureaureportbureaureporttenantsbureaus

Accordingly, how do I report a deadbeat tenant to the credit bureau?

Large Landlords Can Report DirectlyThe three major , Experian, Equifax and TransUnion, allow high-volume landlords to report their rental payments directly to the each month. However, you need to generate a high number of payment records to begin reporting.

One may also ask, how does a landlord report to the credit bureau? Once you sign up, Rent Reporters verifies your rental history with your landlord and then reports the tradeline to the . The service includes a copy of your score. Rock the Score verifies your rent payments with your landlord each month and updates your score with your payment information.

In this manner, how do you report a bad tenant?

Write down every instance of bad behavior and document the actions you took. With past due rent payments, contact credit reporting bureaus. This can prompt tenants to pay to protect their credit score from a dip. If this action doesn’t get you the money you’re owed, seek the help of a debt collection company.

How do you get rid of a difficult tenant?

How to Deal with Difficult Tenants

Preserving The Integrity Of The Credit Reporting Process

When you consider the impact of a consumers credit report, it is no surprise that the reporting process is regulated. Navigating that regulatory scheme can be daunting for those not familiar with the industry. Landlord Credit Bureau complies with or exceeds all applicable laws and regulations, protecting tenants from inaccurate entries as well as insulating the landlords who report rent payments from liability.

You May Like: What Credit Card Is Syncb Ppc

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How And Why To Report A Delinquent Tenant To The Credit Bureaus

ByExpertUpdatedon April 22, 2020

If you have tried your hand at property management, you are likely to know that being a landlord is not only collecting money and dealing with maintenance requests. Sometimes its more about disputes, negotiations, and even reports to the credit bureaus. Yes, property management can boost your problem-solving skills better than a specialized class at university.

The bitter truth is that even the most competent landlords are not immune from dealing with unfaithful tenants. There is no type of renter screening that can reveal ones true colors. Given this, it is highly advisable to hope for the best, but be prepared for all eventualities. Since delinquent tenants are probably the worst of what can happen to a landlord, weve created this supreme guide on how to deal with them.

You May Like: Affirm Delinquent Loan

How Do Landlords Report Late Rent To Credit Reports

Related Articles

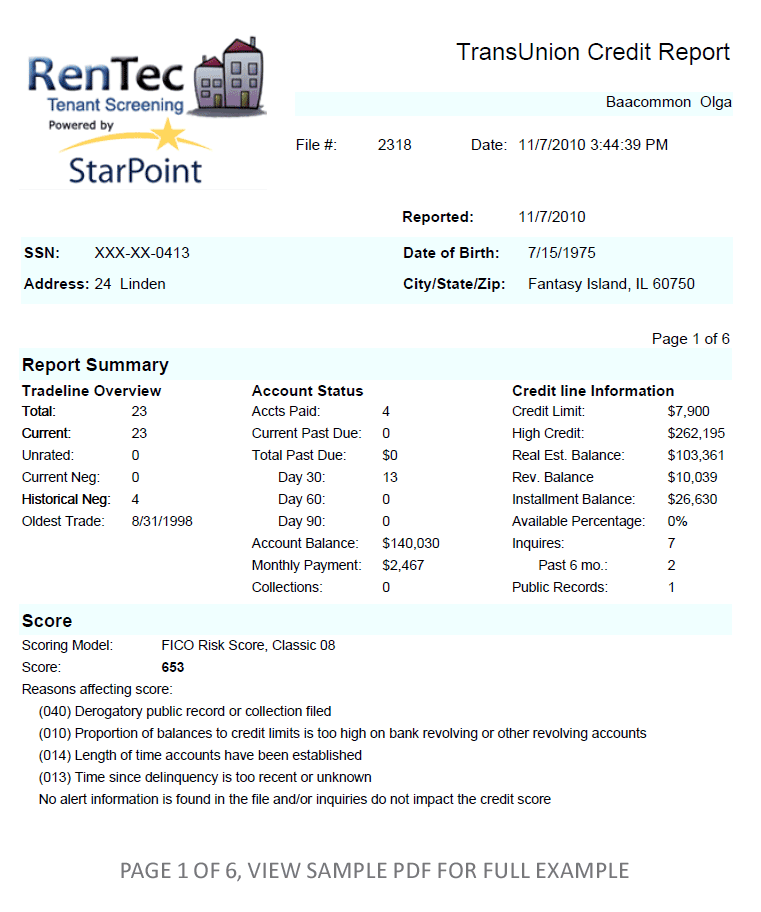

As a property owner, tenant rental payments can serve as an additional source of cash flow. Unfortunately, not all tenants make their rent payments on time. You may want to have those late payments appear on the tenant’s credit report when this happens. You must take certain steps, however, before you can report this information to the credit bureau.

Why Its Important To Report

If youve managed to get rid of a problem tenant, you might not immediately be thinking about reporting them to the big three credit bureaus. After all, your problems are over. Even if you lost some money, why would you want to spend more time on dealing with the same tenants again?

Ultimately, the main reason that you would want to report bad tenants to credit bureaus is to ensure that they are not able to easily cause the same distress to another landlord without due warning.

Sure, you might be able to finally get the money that you are owed when you hire a collection agency or tell the tenant that youre going to be reporting them, but it is difficult in most cases. The good of doing this lies in the fact that irresponsible tenants can be appropriately punished and revealed through this report.

While the report is only a small change that reveals a single bad tenant, it can help to protect another trusting landlord just like you.

Don’t Miss: Zebit Approval Odds

Icipating In Bad Tenant Lists

While the rules of reporting tenant activity to credit bureaus are pretty rigid, tenant lists are a different story. With a tenant list, you register for a database where you can log information about the tenants you’ve rented to.

The upside of these lists is that they let you report bad behavior that’s not financial in nature. For example, you can tell a credit bureau a tenant is chronically delinquent on rent payments. But what if that tenant consistently pays on time but creates a hostile environment for your other tenants? That’s not information you can convey on Experian, Equifax, or TransUnion, but you can share it on a tenant list like The National Tenant Reporting Company.

Why Report Your Rent

Credit plays a crucial role in your life. It can open doors to exciting opportunities like securing a loan for a new car or your first home. But for those opportunities to occur, you need established credit history and a good credit score. Based on your credit reports and , lenders will determine the likelihood of you repaying a loan.

Generally, to build credit, a person must secure a credit card or a loan , both of which require taking on and paying off debt something not everyone can do for one reason or another. The benefit of reporting rent payments to build credit history is that it does not require adding debt, making it a valuable credit-building option for those with a low credit score or no credit history. It is important to note that if you already have a good credit score or established credit history, adding rent payments to your credit report may not significantly impact your score, and simply, may not be worth it.

Recommended Reading: How Long Do Things Stay On Chexsystems

We Bring You Back To Life They Pay The Bill

Have you been struggling to get the credit bureaus to stop saying youre dead for months or years? Are you worried that youll have to pay some law firm or credit repair company? Well, thats the old way.We use the Fair Credit Reporting Act to not only fix the error, but to make them pay you for violating this law. Paying someone or trying to fix this yourself is a costly mistake.

- Get started on the same day

- You wont write us a check

- See how much your case is worth

*Get peace of mind with a 5-10 minute call.

Dont Miss: When Do Credit Cards Report Late Payments

Rent Reporting With Payrent

Landlords who collect rent online with PayRent can take advantage of built-in credit reporting to all three major credit reporting agencies: Transunion, Experian, and Equifax. There is no additional cost for rent reporting for landlords or tenants. Because the renters full file of payments is reported , they are incentivized to consistently pay rent on time, leading to a steadier cash flow for landlords. Aside from more consistent payments, many landlords elect to report rent payments as an amenity for their tenants.

SheRon Mercek is a Customer Success Specialist at PayRent.com, and is a graduate from Snow College. PayRent is the safe and simple way to collect rent. They help property owners and managers collect rent online safely, reliably and automatically. For more information, go to . PayRent is the preferred online payment provider of the Apartment Association of Greater Los Angeles.

Read Also: How Often Do Companies Report To Credit Bureaus

How To Report A Delinquent Tenant To The Credit Bureau

Posted by Aaron Cox& filed under Landlord-Tenant Law.

No landlord wants to deal with delinquent tenants. A tenant who doesnt pay their rent is not only a problem for you but a problem for future landlords as well. Reporting delinquent tenants to the credit bureau can indicate to other landlords that they shouldnt rent to this particular person.

However, reporting a delinquent tenant to the credit bureau is more complicated than simply filling out a form. Heres what you need to know:

Collecting Credit Check Fees From Tenants

It’s legal in most states to charge prospective tenants a fee for the cost of the credit report itself and your time and trouble. Any credit check fee should be reasonably related to the cost of the credit check $30 to $50 is common. California sets a maximum screening fee and requires landlords to provide an itemized receipt when accepting a credit check fee.

Be sure prospective tenants know the amount and purpose of a credit check fee and understand that this fee is not a holding deposit and does not guarantee the rental unit.

Also, if you expect a large number of applicants, you’d be wise not to accept fees from everyone. Instead, read over the applications first and do a credit check only on those who are genuine contenders . That way, you won’t waste your time collecting fees from unqualified applicants.

Keep in mind that it is illegal to charge a credit check fee if you do not use it for the stated purpose and pocket it instead. Return any credit check fees you don’t use for that purpose.

You May Like: Report A Death To Credit Agencies

Do You Need All Three Scores

Yes. Credit information is often not reported with the same accuracy across all three credit bureaus, so it is important for consumers to check each report and score. Under the 2003 Fair and Accurate Credit Transactions Act , an amendment to the above-mentioned FCRA, consumers are able to receive a free copy of their report from each credit reporting agency once a year.

As some creditors and collectors only report to one or two agencies, some items get disputed off one report but are verified on another. Items also get removed from one or two reports for various reasons. This variation often means a large credit score difference from bureau to bureau. When a credit score is requested, it is calculated based on what is in that particular credit report. Thus, while a consumer may have a solid credit score based on one report, they may have a dicier credit score based on another.

If a consumer is denied credit based on one bad credit score but has a better credit score with another bureau, they may have luck calling the creditor and asking for the better score to be considered, especially if there is a good reason why the first credit score is so low.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: Check My Credit Score With Itin Number

Why Not Consider A Collection Agency

A professional collections firm is certainly an option to consider, but when considering cost and long-term impact, there are significant differences between collections and credit reporting. With a collections agency, the property owner or manager pays the agency a set fee or percentage of the amount collected from the tenant. The account is subsequently charged-off the books of the property owner or manager as a loss.

What does this mean for the consumer? First, the collection agency will report the account to the credit bureaus, and the debt will appear as a collection on the tenants credit report, instantly affecting their credit score. And, of course, this will be a negative item on the credit report for seven years from the date of the first missed payment. If the tenant makes payments to the collection agency and pays the balance in full , the agency will report this information as well. Paying a collections account may have a lesser impact on a credit score, but the item will still be reflected on the report.

There is another important, but often overlooked, aspect of this process. When an account is reported to the bureaus as a collection, it can never be anything but thata collection. Datalinx recommends another alternative: consider foregoing the collection agency and reporting the past-due account to the bureaus as delinquent, especially in cases where you believe the relationship with the tenant is repairable.

Check With Your Landlord

Your landlord already may report rent payments to the credit bureaus using a service that handles the process. RentBureau partners with Experian. Esusu and Zingo partner with Equifax. Zego reports to both Experian and TransUnion.

Timely rent payments will help boost your credit score if your landlord reports them, but late payments can have a negative impact on your score.

Read Also: Does Klarna Hurt Your Credit Score

Equifax Must Provide Free Copies Of Your Credit Report

A data breach at Equifax in 2017 compromised the personal information of at least 147 million consumers. As part of a court settlement related to the hack, everyonewhether they were affected by the breach or notcan get six more free credit reports from Equifax each year, beginning in January 2020, for the next seven years.