What Is Considered A Good Cibil Score Range

A credit score ranging from 750 to 900 is considered an excellent credit score. Banks, NBFCs and other online lenders prefer candidates who have a credit score in this range. If your credit score is in this range, you will be eligible for most credit products. The following table will help you understand the CIBIL score range and its meaning.

|

Immediate Action Required |

Approval chances are very low |

As the table illustrates, having a credit score of 750 and above is considered to be excellent and it can help in easily availing several credit opportunities.

How To Improve 678 Credit Score

With a credit score of 678, youre already on the right track to receiving good credit. It all lies, however, with the efforts you put in to physically improving your score. The following suggestions will be important if you wish to turn your fair credit into good credit:

Whats A Good Credit Score For Your Age

As you age and increase your payment history, increasing your credit score should be part of your goals. While you can do many things to speed up the process and have a better credit score, a good credit score keeps up with the national average. In your 20s and 30s, a good credit score is between 663 and 671, while in your 40s and 50s, a good score is around 682. To get the best interest rates, terms and offers, aim for a credit score in the 700s.

In your 20s, youre only just starting to build your credit score, which is why it may be difficult to get the same average score of 754 that those in their 70s achieve. A number of factors can affect your score over time, such as your payment history, credit history length and revolving balance. Credit bureaus have a better idea of your creditworthiness if you have a long payment history of on-time payments.

In the meantime, focus on reducing your debt and improving your credit score by making on-time payments, reviewing your credit regularly and keeping your credit utilization as low as possible.

Average Age by Credit Score Tier

Scroll for more

Regardless of your age, its important to cut back on unnecessary expenses where possible. Having monthly savings can be used to pay down debt, invest for retirement or contribute to an emergency fund to avoid overspending on credit cards.

Don’t Miss: 623 Credit Score Credit Card

Ideal Credit Score For Home Loans

A home loan is a secured loan as the home you are purchasing acts as the collateral. Hence, it is possible to get a home loan even if your credit score is lower than 750. Some lenders sanction home loans if your credit score is around 550 or more.

It is important to remember that the lower your credit score is, lower the loan amount might be sanctioned on approval. That is why applying for a big loan amount when your credit score is low is not advisable. In some cases, lenders provide only 65% or less of the required loan amount if your credit score is low. It would be better to improve your credit score before applying for a home loan.

Additional Read: Where to check credit score

Even though you may get a loan even if your credit score is low, it is important to realise your credit score will always be considered for loan approval. This is why it is better to have a good credit score instead of risking rejection from a potential lender, which may lower your credit score further.

Bajaj Finserv offers pre-approved offers on a variety of loans. Just share your details and check out your pre-approved offer to avail the financing you need.

*Terms and conditions apply

Discover It Cash Back

Best for first-year rewards

- This card is best for: Strategic spenders who dont mind keeping track of rotating bonus categories to maximize rewards.

- This card is not a great choice for: People who may forget about enrolling in bonus categories each quarter.

- What makes this card unique? This card offers a Cashback Match on all of the cash back you earn in your first year with the card. So, you essentially double your cash back earnings for the first year.

- Is the Discover it® Cash Back worth it? If you dont mind keeping up with rotating bonus categories and enrollment deadlines each quarter, this card offers some significant cash back rewards. Plus, the Cashback Match program that essentially doubles your cash back earnings in the first year is a rare and unique boost.

Jump back to offer details.

Recommended Reading: 1?800?859?6412

Getting A Mortgage With A 678 Credit Score

Youre eligible for any type of standard mortgage if you have a credit score of 678. The following are all the mortgages you can get:

- FHA loan: Your credit score qualifies you for maximum financing on a mortgage backed by the Federal Housing Administration . Its worth noting that you wont be eligible for an FHA-backed loan if you had a foreclosure in the past three years or filed for chapter 7 bankruptcy in the past two years. 10

- Conventional mortgage: Most lenders will consider giving you a mortgage because your credit score is above 620, which is the minimum score required by the Federal National Mortgage Association and Federal Home Loan Mortgage Corporation . 1112

- VA loan: The US Department of Veteran Affairs backs VA home loans, which are exclusively for members of the military and their families, and they dont impose a minimum required credit score. 13 They instead leave it up to lenders, most of whom will be willing to issue you a mortgage with a credit score of 678.

- USDA loan: As long as you have two tradelines that have been open for 12 months in the past two years, youll meet the credit requirements for a USDA loan because your credit score is above 640. 14 However, you wont be eligible if you have an outstanding judgment, and you might have a hard time qualifying if your credit history shows a foreclosure, bankruptcy, or debt settlement in the past 36 months.

Things To Consider Before You Apply

Any time you apply for a loan or credit line, from mortgages to credit cards, the lender will request a copy of your credit history from one or more of the three major credit bureaus. Its part of how lenders separate qualified candidates for credit from applicants who may be more of a risk.

This request is called a hard inquiry or hard pull. It can lower your credit score, but the effect is usually temporary. Soft pulls involve the kind of credit checks that dont require your consent, such as pre-approved credit card offers, and they dont affect your credit score.

The lesson here is to limit the number of times you apply for credit, triggering a hard inquiry that can cause a short-term dip in your credit score.

Exceptions apply in some cases. If youre rate-shopping for a student loan, car loan or mortgage, for instance, some FICO models treat multiple hard inquiries for the same type of credit within a short period as a single inquiry.

However, the rate-shopping exception doesnt mean your credit score will escape unscathed if you submit applications for multiple types of credit in a short window say, a mortgage and a car loan in the same week.

Recommended Reading: How Long Do Evictions Stay On Credit Report

Staying The Course With Your Good Credit History

Having a Good FICO® Score makes you pretty typical among American consumers. That’s certainly not a bad thing, but with some time and effort, you can increase your score into the Very Good range or even the Exceptional range . Moving in that direction will require understanding of the behaviors that help grow your score, and those that hinder growth:

Late and missed payments are among the most significant influences on your credit scoreand they aren’t good influences. Lenders want borrowers who pay their bills on time, and statisticians predict that people who have missed payments likelier to default on debt than those who pay promptly. If you have a history of making late payments , you’ll do your credit score a big solid by kicking that habit. More than one-third of your score is influenced by the presence of late or missed payments.

Utilization rate, or usage rate, is a technical way of describing how close you are to “maxing out” your credit card accounts. You can measure utilization on an account-by-account basis by dividing each outstanding balance by the card’s spending limit, and then multiplying by 100 to get a percentage. Find your total utilization rate by adding up all the balances and dividing by the sum of all the spending limits:

| Balance | |

|---|---|

| $20,000 | 26% |

42% Individuals with a 688 FICO® Score have credit portfolios that include auto loan and 29% have a mortgage loan.

Is 678 A Good Credit Score Research Maniacs

In other words, is a persons creditworthiness good if his or her credit score is 678? First, to put the 678 credit score in perspective, credit scores

FICO Score. Your FICO Score, developed by Fair Isaac Corporation, is the most commonly used credit score method by far. It heavily weighs your

Credit scores of 650, 660, 670, 680, and 690 fall in the range of average to above average.

Also Check: What Is Considered A Serious Delinquency On Credit Report

Tips On How To Get A Good Credit Score

Dont lose hope if you do have an application rejected by your bank, as South Africas leading home loan comparison service, ooba Home Loans, can apply to multiple banks on your behalf, and have been successful in securing home loan financing for two in every three applications that are initially turned down by their bank.

ooba Home Loans also offer a range of home loan calculators to help make the home-buying process easier. Start with their Bond Calculator, then use their Bond Indicator to find out what you can realistically afford. Then, when youre ready, you can apply for a home loan with ooba Home Loans.

Do you know your credit score?

Check your credit score for free in minutes.

Length Of Credit History

Lenders like to see that you can manage credit positively over a long period of time. This is generally measured by how long your current credit accounts have remained open.

Theres no shortcut to increasing the length of your credit history. But in the long run, keeping your old credit card accounts open, even after you get a new credit card, can help your credit age like a fine wine. At the very least, try to avoid closing your oldest credit account.

As someone with fair credit, you may be in the market for your first credit card. If thats the case, it pays to think ahead. Consider shopping around for a credit card that has no annual fee, so theres no pressure to close it if and when you graduate to a better card. You can compare offers for cards with no annual fee on Credit Karma to explore your options. Many of the cards available to people with fair credit tend to charge annual fees, but you might be able to find one that doesnt.

Also Check: Whats A Good Credit Age

Negotiating With Your Creditors

Despite what many people believe, your creditors are not your adversaries and they are not working against you. Therefore, you should not treat them as such. Instead, your creditors are working with you in an attempt for both of you to gain a profit.

If you fail to do things, such as pay your bills on time, it negatively impacts the ability of your creditor to do business with you. While they should be understanding of any reasonable financial hardships that youhave undergone in the past few weeks or months, they can tell the difference between short term financial problems that were out of your control and blatant financial responsibilities on your part.

Ultimately, its your responsibility to communicate effectively with your creditor so that you can both benefit equally from your business agreement.

For an example, if you are forced to skip on a payment or to default on an entire loan the very first thing you need to do is to contact your creditor and talk about the Issue in detail with them. This action alone will tell them that what has happened is out of your control and that you are trying to correct the Issue in contrast to them believing that you are just behaving irresponsibly. In addition, this will also strengthen your business relationship.

Examples of how your creditor may be willing to help you after you have discussed your problems with them include the following:

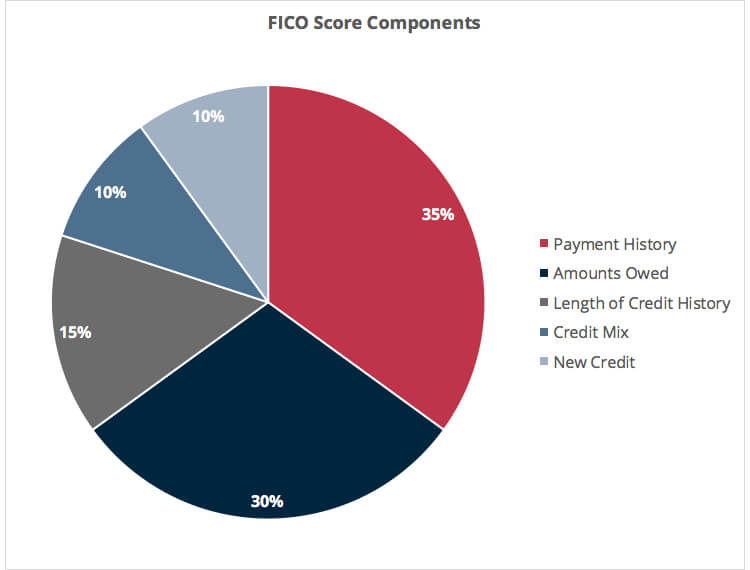

What Counts Towards Your 678 Credit Score

In essence, your credit score tells you whether you have a responsible credit management and a history showing that you have been financially stable. So what factors contribute to showing that you are fiscally responsible and stable?

The first and most critical factor will be your overall payment history. This is simply whether you have paid all of your bills on time. There are also a variety of aspects of your payment history that your credit rating will include, including how late you were on your payments , how many bills you paid and how many you did not, if any of your accounts have gone into collections and if you have a history of foreclosures, bankruptcies, and debt settlements.

The second biggest factor that counts towards your credit score is the total amount of money that you owe. Again, there is a variety of aspects of this that goes into your 678 credit score. One such example is the amount of your allotted credit that you have used up. Heres a piece of advice: the less you owe on the credit, the better your credit score will be.

Another aspect of your amounts owed is how much money you owe on each of your loans, including your credit cards, your car payments, and your mortgage payment. The best way to have a positive credit rating here is to have a variety of credits and loans and to manage each of them in a very responsible manner.

You May Like: What Credit Bureau Does Comenity Bank Use

Heres How To Improve A 675 Credit Score:

- Dispute Negatives: If you can prove that negative information on your credit report is inaccurate , you can dispute the record to have it corrected or removed.

- Pay Off Collections Accounts: Once you bring a collection accounts balance down to zero, it stops affecting your VantageScore 3.0 credit score.

- Reduce Utilization: Its best to use less than 30% of the available credit on your credit card accounts each month. You can reduce your credit utilization by spending less, making bigger payments or paying multiple times per month.

- Pay On Time: Payment history is the most important ingredient in your credit score. Paying on time every month establishes a track record of responsibility as a borrower, while a single late payment on your credit report can set back credit improvement efforts significantly.

You can track your credit scores progress for free on WalletHub, the only site with free daily updates and personalized advice.

Was this article helpful?

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Related Scores

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

Also Check: Aargon Agency Hawaii

Learn Whats Considered A Fair Credit Score How Scores May Affect You And What You Can Do To Help Improve Average Credit Scores

There are multiple credit scores out there. And the most popular versions range from 300 to 850. But what exactly are fair credit scores? And where do fair credit scores fall in that range?

As with many things related to credit scores, the answers can vary. Keep reading to learn how to tell whether you have a fair credit score, why credit scores are important and what you can do to help improve yours.

Credit Score Is It Good Or Bad How To Improve Your 678 Fico Score

Before you can do anything to increase your 678 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and dont count towards your score.

Read Also: Credit Monitoring Services Usaa