Question: What Is A Credit Report

Answer: Your credit report is a record of your credit activity and history. It includes the names of companies that have extended you credit and/or loans, as well as the credit limits, loan amounts and your payment history. You can think of it as your financial resume it tells the story of your financial health to potential lenders.

How Can You Get Your Credit Score

You might have access to your credit score via your credit card provider. If this is a benefit you get as a card holder, you can typically see the score by logging into your credit card account online or via a mobile app. The downside is that this is only one possible version of your score.

You can see another version of your score by signing up for Credit.coms Credit Report Card. Youll get a score that updates every 14 days as well as information about the five major factors that go into determining credit scores and how youre faring with each.

If you want to get more bang for your buck, it might be time to look at ExtraCredit. Youll get access to five useful services, including TrackIt, which will give you a look into 28 of your FICO Scores.

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Also Check: Affirm Loans Credit Score

What’s The Best Way To Find Out My Credit Score

Having a good credit score can boost your chances of being accepted for credit. Here’s how to check yours for free

Whenever you apply for a , a personal loan or a mortgage, your lender will look at your credit history and your credit rating or score. That means if youre thinking of applying for new credit its a good idea to get hold of your credit file first to see what it says about you. That way youll be able to see if there might be any issues before you apply. You can also take steps to correct any mistakes and look at ways to boost your score.

In this guide well show you how to check your credit score quickly, easily and for free and without damaging your credit record. Well tell you everything you need to know about what your credit score means for you and your finances.

How To Get Your Credit Report

There used to be a time when you had to pay for your credit report. Iâm happy to say thatâs no longer the case. By providing some basic information, you can obtain a copy of your credit report for free.

You can to receive weekly updates of your credit report and credit score for free.

Itâs fast and easy to get your free credit report from Borrowell. All you need to do is supply some personal information to confirm your identity to start receiving it.

The major credit bureaus Equifax and TransUnion allow you to get your credit report as well, but the processes arenât as seamless and there are sometimes fees involved.

You May Like: What Credit Score Does Usaa Use For Credit Cards

What If The Cifas Marker Is There By Mistake

If you think a Cifas warning has been put on your credit file in error, you can contact the lender who put it there to see if theyll remove it.

Be aware that credit rating agencies are unlikely to remove any entry on your report if they believe the reason the marker was put on your credit file was justified. Lenders are legally obliged to report any fraudulent attempt on your account to the credit reference agencies.

Find out more about Cifas markers on the Cifas website

When Can Someone Check My Report

Federal law allows businesses to check your credit references, in the form of a credit report, before they agree to do business with you. However, the federal Fair Credit Reporting Act strictly limits who can access your credit report and under what circumstances. In addition to providing you the ability to get a free copy of your own credit report, the FCRA lists the specific reasons others may get a copy of your credit report:

- When you apply for credit or insurance

- In connection with a business transaction initiated by you

- To extend a “preapproved” offer of credit or insurance

- When you apply for services such as utilities or cellphone accounts

- When a business has an existing credit or insurance relationship with you

- For employment purposes, with your written permission

- For the purposes of a potential investor assessing the risk of a current obligation

- When you apply for a license or other benefit granted by the government

- In connection with a child support determination

- In response to a court order or federal grand jury subpoena

Also Check: How To Dispute Repossession On Credit Report

Why Is It Important To Know When Credit Companies Report

Some confusion can be cleared up by knowing when credit-card companies report to the CRAs. Its usually at your statement closing date.

Dont be alarmed if you check your credit report and see a balance when you know your card is paid off in full each month. At the end of your billing cycle, theres a great fluctuation, sometimes causing as much as a 30% shift in the credit score for most consumers. But when the payment is accounted for, it shifts back into form.

Billing cycles can vary. Some credit-card companies might do it at mid-month and others at the end of the month.

Credit-card companies probably are providing a snapshot of your current balance when they report to the CRAs. If this is a concern, keep track of your spending by your statement closing date. Making a payment before your statement closing date will keep the balance lower when its reported, helping your overall credit.

This also helps your credit utilization rate, an important factor when it comes to your credit score. Your credit utilization rate is your total credit-card balance divided by your total credit-card limit. Experts advise consumers to keep that ratio under 30%. Paying down your revolving debt and carrying a lower balance is a possible way to help your credit score, although it is influenced by several factors.

The bottom line is if you pay your bills on time and you keep a low credit-card balance, your credit score will take care of itself.

All that being said, here are some tricks:

How To Quickly Improve Your Credit Score

Recommended Reading: Syncb Ppc On Credit Report

Q How Can I Place A Fraud Warning If I Hold Power Of Attorney For A Consumer

A. TransUnion Fraud department cannot flag or change a consumers credit report without the consumers knowledge. Therefore, Power of Attorney papers, two pieces of the consumers identification and two pieces of the Power of Attorneys identification is needed. This is to ensure the Power of Attorney is current and valid. If the appropriate information has been supplied and is correct, the request will be processed and a copy of the file sent to the Power of Attorneys address.

How Often Should I Check My Credit Report

Credit reporting errors happen more frequently than many people realize. A Federal Trade Commission study found that one in five Americans has an error on a credit report.

The best way to discover whether you have credit reporting errors is to check your three reports from Equifax, TransUnion, and Experian. The FCRA gives you the right to claim a free copy of each of your credit reports from all three credit bureaus once every 12 months. To exercise this right, visit AnnualCreditReport.com.

But if you want to make sure that your credit reports stay accurate, checking them once every 12 months isn’t nearly enough. You should check your credit reports at least once a quarter, and once a month is probably best.

Recommended Reading: Can You Dispute Inquiries

Who Can’t Access Your Credit

Unless youre posting pictures of your credit reports on social media, your credit information shouldnt be available to the public. It wont show up as a search engine result, and your loved ones cant request it, regardless of your relationship.

If an individual does use your personal information to obtain your credit history, you can sue for actual damages or $1,000 whichever is greater according to legal website Nolo.

How Often Should You Check Your Credit Score

You have probably heard about the importance of your credit score and credit history, and may have even shrugged it off, but there are a number of reasons to check both. First you need to know whats a good credit score. Then you know that the better your credit score, the better your chances of being approved for a loan, and the lower the rate. But thats only half of the equation. Even more important than your actual score is your credit report, or credit history.

Your credit score comes from your credit report, so its important to understand that in order to improve your credit score you must first improve your credit history. Think of it this way. Remember when you were in school or college? You received individual scores or grades on assignments and then received a final grade at the end of the year. All of your assignments throughout the course of that semester or year are like items on your credit report. Some received good scores, and some may have been bad scores. But all of those assignments come together to give you a final grade, which is how your credit score is calculated. Remember sleeping through that freshman math midterm that brought your entire grade down by 25%? Thats like missing a payment on your credit card or other loan.

Also Check: Ccb Ppc Credit Inquiry

Does Checking Your Credit Reports Hurt Your Credit

The good news is that checking your credit reports yourself doesnt hurt your credit scores.

When a lender has checked your scores , your scores may have dropped a few points. Because of this, you may be concerned that checking your own credit reports might lower your scores, too. But you dont need to worry.

When you check your scores or reports yourself, its a soft inquiry. When lenders check your credit to decide whether to give you a loan or a credit card, its generally a hard inquiry.

Soft inquiries dont negatively affect your credit score at all. These are mainly used for reasons other than underwriting for a loan, says Frank Acocella, an attorney and founder of CounselPro Lending.

Hard inquiries, on the other hand, can happen when a potential lender checks your credit, which they typically do to assess your creditworthiness. Unlike soft inquiries, hard inquiries could have a negative impact on your credit scores.

Because hard inquiries could mean youre taking on new financial obligations, multiple hard inquiries within a short period of time have the potential to lower your scores. This is because certain credit-scoring models may determine that opening multiple credit accounts in a short period of time represents a greater credit risk.

How Often Should You Check Your Credit Report

We have three major credit bureaus here in the United States: Experian, Equifax and TransUnion. Each is required to let you see your once every 12 months.

You can look at each one just once a year, and they might have different data on them, making this question a bit difficult to give a straight answer to.

You May Like: Ntwk Synchrony

Ways To Help Maintain And Improve Your Credit Scores

Remember: Itâs normal for your credit scores to fluctuate a little. And credit scores can change significantly over time. But you can maintain good credit scores and even improve your scores by regularly practicing responsible financial habits.

Here are some ways you can maintain and improve your credit scores:

Speaking of applying for credit: Want a better idea of whether you might be approved? Pre-approval or pre-qualification can help you find out whether you might be eligible for a credit card or a loan before you even apply.

With Capital Oneâs pre-approval tool, for example, you can find out whether youâre pre-approved for some of Capital Oneâs credit cards before you submit an application. Itâs quick and only requires some basic information. And checking to see whether youâre pre-approved wonât impact your credit scores, since it requires only a soft inquiry.

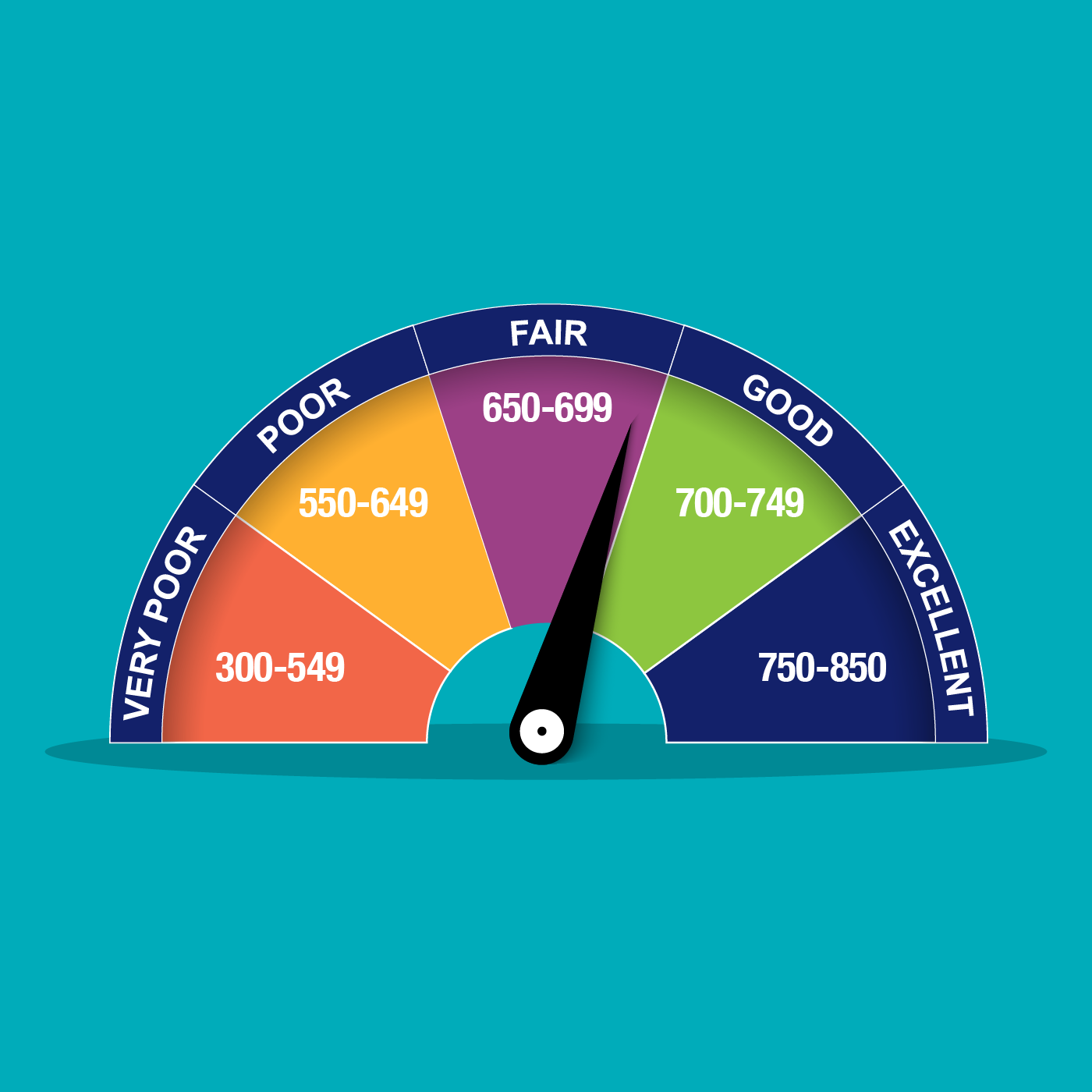

What Category On The Vantagescore Or Fico Credit Score Range Your Credit Score Currently Sits

If your score is very low, even a small sign of improvement in your payment history and reducing card balances might increase your credit relatively fast. But it will take more than paying your credit card bill on time for a month or two to really move your score into a range that’s considered good enough to get unsecured credit cards:

- Developing a solid payment history

- Keeping your card balances at less than 30% of each card’s credit limit

Recommended Reading: Usaa Vantagescore

Checking Your Credit Score

Since you need a good credit report for a good credit score, once youve verified your credit history is in-check you may also want to get your credit score. Knowing what is on your credit report is nice, but without having an estimated score its really hard to know where you fall on the scale of good and bad credit.

A FICO credit score ranges from 300 to 850, where the higher the number, the better. And the higher the score, the more likely you will be approved for a loan and ensured the lowest rates. When you know your score youll have a pretty good idea of where you fit in the spectrum. For example, scores greater than 720 are considered excellent, and would put you in the best position to obtain the best rates and terms. On the other hand, scores less than 620 are considered poor, and that means you may have trouble getting a loan or may have to pay a few percentage points higher interest. Everything in-between is pretty much average and lending requirements will reflect that.

Another often forgot report you should be checking is your CLUE Report learn more about it here.

If you do need to check your credit today I would recommend checking out Credit Karma here www.creditkarma.com

Why Do Fico Scores Fluctuate

There are many reasons why your score may change. The information on your credit report changes each time lenders report new activity to the credit bureau. So, as the information in your credit report at that bureau changes, your FICO® Scores may also change. Keep in mind that certain events such as late payments or bankruptcy can lower your FICO® Scores quickly.

FICO® Scores consider five main categories of information in your credit report.

- Your payment history

- Types of credit in use

Recommended Reading: Speedy Cash Repayment Plan

How Will I Know If My Fico Score Is Available

If your account is eligible, the link to View Your FICO® Credit Score will automatically display on your Account Summary screen. Just select the link to opt in and view your FICO® Score.

Note: You can also access your FICO® Score in Spanish with your smartphone.

- Direct your mobile browser to wellsfargo.com or download the Wells Fargo Mobile® app.

- You can update your setting any time on the Language Preference screen. Just sign on to your account, go to the Profile and Settings menu, and select Language Preference.

Will Checking Your Credit Hurt Credit Scores

Reading time: 2 minutes

Highlights:

-

Checking your credit reports or credit scores will not impact credit scores

-

Regularly checking your credit reports and credit scores is a good way to ensure information is accurate

-

Hard inquiries in response to a credit application do impact credit scores

Many people are afraid to request a copy of their credit reports or check their credit scores out of concern it may negatively impact their credit scores.

Good news: Credit scores aren’t impacted by checking your own credit reports or credit scores. In fact, regularly checking your credit reports and credit scores is an important way to ensure your personal and account information is correct, and may help detect signs of potential identity theft.

Impact of soft and hard inquiries on credit scores

When you request a copy of your credit report or check credit scores, thats known as a soft inquiry. Other types of soft inquiries result from companies that send you promotional credit card offers and existing lending account reviews by companies with whom you have an account. Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay on your credit reports for 12 to 24 months, depending on the type.

The other type of inquiry is a hard inquiry. Those occur after you have applied for a loan or a credit card and the potential lender reviews your credit history.

Getting your credit reports

Don’t Miss: Carmax Income Requirements