How Does A Credit Freeze Compare With A Fraud Alert

If you’ve been a victim of identity theft or suspect your personal information is otherwise being abused by criminals, you can limit most access to your credit reports by requesting security freezes at all three national credit bureaus. Doing so can limit unauthorized credit checks, but can also limit processing of your own legitimate credit applications.

While a to your credit report until you lift it, fraud alerts are temporary. An initial fraud alert remains for one year, while an extended alert remains for seven. And while freezes must be removed before most access is granted, fraud alerts give lenders access to your credit reports and ask that they verify your identity before processing credit applications made under your name.

Compared with the process of lifting and reapplying a credit freeze at all three credit bureaus anytime you need to allow access to your report and scores, a fraud alert offers a more convenient and potentially safer alternative. A fraud alert stays in place while you continue to use your credit as normal, and won’t need to be lifted like a credit freeze would.

Unlike a credit freeze, when you request a fraud alert at any one of the three credit bureaus , alerts are automatically placed at all three bureaus. Removing fraud alerts before they expire will require you to contact each bureau separately.

A Credit Freeze Can Protect You From Identity Theft

Having your identity stolen is no stroll along the beach. Victims of identity theft often suffer for months and even years after it occurs. Clearing your name takes time and effortand sometimes money. It can seem like youre doing time, even though you werent the one who committed the crime.

To prevent your identity from being stolen or further identity theft after your identity has already been stolen, you might consider freezing your credit report, a free service that all three major credit bureaus offer.

Can You Lock Your Credit By Yourself

Yes, you can lock your credit on your own. All three major consumer credit bureaus have credit locking programs available. You must sign up for each program to lock and unlock your files. However, we’d recommend that you allow Aura to do this for you.

Once you sign up, you’ll have access to your credit files via smartphone app or desktop. If you want to lock your credit, toggle the settings to âlockedâ. Then toggle them back when you are ready to unlock. This takes only a few seconds.

With Aura, you can lock your Experian credit with one click. If you need help locking your credit files and setting up credit monitoring, Aura’s team of U.S. based agents are ready to assist.

Related: What Is Credit Monitoring

Don’t Miss: Does Looking At Your Credit Score Lower It

Differences Between Credit Monitoring And Identity Theft Protection

alerts you whenever there is activity that involves or affects your credit report, including:

- Inquiries: Requests from lenders to review your credit report or obtain a credit score in connection to loan applications.

- New accounts: Any time a new loan or credit card account is opened using your name and Social Security number, credit monitoring notifies you via text or email. New accounts can also include collections accounts.

Identity theft protection, including services offered by Experian, typically encompasses alerts covered under credit monitoring, and extends its scope to include combing online exchanges, including those on the dark web, for signs your passwords or other personal data appear on lists of information stolen by data pirates, culled from data breaches or otherwise hijacked by cybercriminals.

What Credit Card Can I Use At Costco

Category: Credit 1. What credit cards does Costco accept? CNBC Since Costco has a contract with Visa, shoppers cant use credit cards backed by the other three main networks, American Express, Mastercard or Discover, at Costco shoppers can only use Visa credit cards in-store. Here are the best credit

Also Check: A Credit Score Is A Number Between

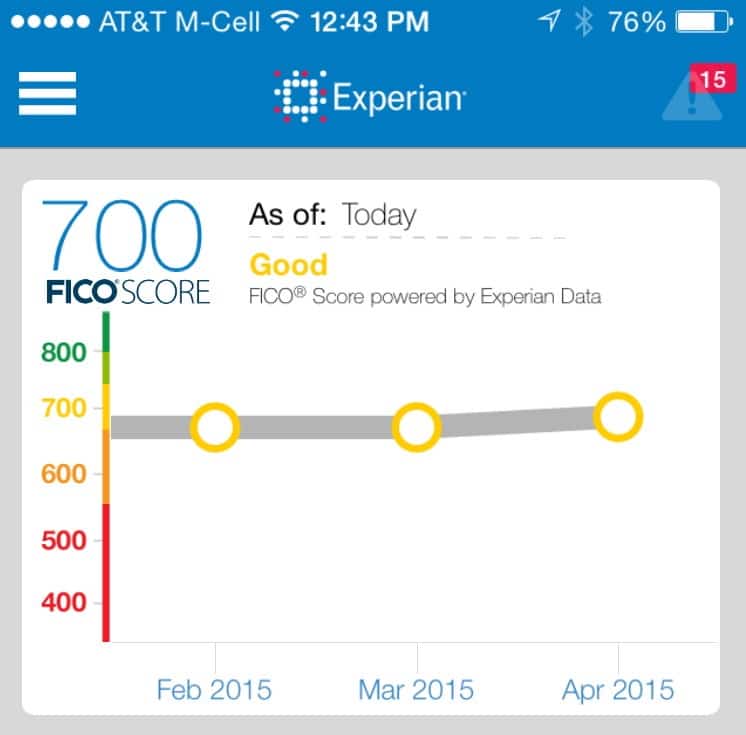

When Does It Make Sense To Use Credit Monitoring

Credit monitoring is something you should already be doing, by way of obtaining and carefully reviewing your credit reports once a year at AnnualCreditReport.com and by tracking your credit score for free to check for significant score changes you can’t explain based on your borrowing and debt payment activities.

If those checks reveal signs of suspicious activity, or if you have reason to be concerned that your personal data has been compromised, stepping up your watchfulness with automated credit monitoring could be a wise decision.

When To Use A Credit Freeze

You should freeze your credit if you believe youve been the victim of identity theft or if your personal or financial information has been exposed in a data breach. Freezing your credit can help keep predators from opening new accounts in your name.

But this isnt the only time you should consider a credit freeze. If you want to help protect yourself from identity theft, you should keep your credit frozen at all times unless you are actively applying for a new credit card or loan. When you are applying for credit or debt, you can unfreeze your credit temporarily.

Make sure, though, that you freeze your credit at all three credit bureaus.

Read Also: Does Walmart Report To Credit Bureaus

Go To Experians Security

The process to freeze your Experian credit report starts at Experians security-freeze website.

If you already have a credit freeze in place, this is also where you can lift your freeze.

Click Add a security freeze, at which point the system asks you to clarify that you want to freeze your credit report . If you do have a child under the age of 16, you can freeze their Experian credit report too. The Federal Trade Commission offers tips for how to do this.

If your kid doesnt have a credit report, Experian can create one for them and then freeze it. This helps ensure that con artists cant use their information to open up fraudulent credit accounts.

How Does Locking Your Credit File Work

Procedures for setting up credit-locking services vary among the three bureaus:

- Experian offers credit locking as part of its CreditWorks Premium subscription service, which also includes:

- Monthly access to updated credit reports from all three bureaus

- Notifications of new credit activity at any of the three bureaus

- Up to $1 million in identity theft insurance

- Phone assistance from Experian credit and fraud resolution experts

Each bureau requires proof of identity as part of its credit lock setup process.

You May Like: Is 580 A Bad Credit Score

Consider Using Experian Creditlock

An alternative to an Experian security freeze is Experian CreditLock, a feature that lets you lock and unlock your Experian credit file on the fly from the Experian app. With CreditLock, you’ll also receive alerts when anyone attempts to access your credit file while it is locked. With an Experian CreditWorksSM or Experian IdentityWorksSM premium membership, consumers can take advantage of CreditLock’s features for no additional charge.

Comparing Credit Freezes And Credit Locks

TransUnion: Free with TransUnions TrueIdentity credit monitoring service. $19.95 a month with the TrueIdentity Premium service. You cant sign up for a credit lock without enrolling in one of the programs.

Equifax: Free

Experian: Free for the first 30 days, then $19.99 a month to keep the credit lock in place, after the free trial ends.

You May Like: What Credit Score Do Apartments Look For

What Are The Costs For Placing A Credit Freeze

The 3 major credit reference agencies previously charged a fee for applying a credit freeze, with the cost varying by state.

On September 21, 2018 the new Economic Growth, Regulatory Relief, and Consumer Protection Act changed the rules on applying a credit freeze.

The three big credit-reporting agencies Equifax, Experian, and TransUnion are now required to offer you a credit freeze, free of charge.

Not only will it be free for consumers to freeze their credit, but those who choose to apply a credit freeze can also lift that freeze and reapply it again, as many times as they want for free.

Should You Lock Your Credit Report

Generally, you should lock your credit report between credit applications to protect yourself from identity theft. This way, your report will block inquiries you didnt approve and fraudsters wont be able to open credit accounts in your name.

Lock your credit immediately if you notice any of the following, which might indicate that an identity thief is using your credit:

- Someone accesses your personal information

- You get bills from collection agencies that youve never heard of

- You find inquiries or accounts on your credit report that you didnt apply for

- Your data is stolen in a breach 5

Be mindful that if you lock your credit, you wont be able to apply for a loan because your prospective creditor wont be able to assess your credit report. If youre planning to open a new credit account soon, there are two ways you can protect your credit that wont affect your applications:

Set up a fraud alert

Unlike a credit lock or credit freeze, a fraud alert allows prospective lenders to access your report. Fraud alerts appear as a warning on your credit report for prospective creditors to see creditors will also need to verify that anyone applying for credit under your name is actually you.

The drawback is that the extra steps your creditor or lender takes to verify your identity might not be sufficient, and a fraudster might get around them.

Set up an extended fraud alert

Monitor your credit reports

Active-duty service members can monitor their credit for free

Article Sources

Don’t Miss: Is 630 A Bad Credit Score

How To Unfreeze Your Credit

If you’ve frozen your Experian credit file, you can visit Experian’s Security Freeze Center to lift your credit freeze.

You also can call 888-EXPERIAN or contact Experian by mail to lift the freeze from your credit report. If you’ve frozen your credit file with other bureaus, you’ll need to contact them directly to complete a similar process.

Can I Freeze My Child’s Report

If your minor children have credit files, it can be a good precaution to freeze those files. Underage children ordinarily have credit files only if you’ve made them an authorized user on a credit card or as a result of identity theft.

To freeze a credit report for someone under 16, you’ll need to prove you have authority to make that request. Proof of this authority can include:

- A lawfully executed and valid power of attorney

- A document issued by a federal, state or local government agency in the United States attesting to your parental relation to the minor

- A birth certificate

You can thaw the files when the children come of age and are ready to begin seeking credit on their own.

You May Like: What Is A Bad Credit Rating

What Is A Credit Lock

Like a credit freeze, a and you can activate it and disable it instantly via an app or secure website.

Service offerings that include credit locks differ among the national credit bureaus. Experian offers Experian as part of its CreditWorksSM Premium subscription service, which also includes:

- Monthly access to credit reports from all three bureaus

- Alerts when there’s new credit activity on your accounts at any of the three bureaus, to help you detect unauthorized action

- Up to $1 million in identity theft insurance

- Phone assistance from Experian experts in credit and fraud resolution

Each credit bureau requires you to provide proof of identity when you set up a credit lock. You can submit the necessary documents electronically or mail in hard copies.

The security benefits of a credit lock are the same as those for a credit freeze, and the limitations on access to your credit are the same as well: Criminal access to your credit file is protected against, but any legitimate access by new lenders to whom you are applying for loans or credit may also be limited.

You may also want to consider a third option: a fraud alert.

Freezing A Minors Experian Credit Report

Parents and legal guardians can also request a credit report freeze for minor children under age 16. Experian provides a form that you must complete and mail providing your personal information. You must also send the following information for the person whose credit you want to protect:

- The protected consumer’s full name, with middle initial, and generation

- Social Security number

- Current and previous mailing addresses for the past two years

- Copies of the protected consumer’s birth certificate and Social Security card

You should also send in your own personal information:

- Your full name, with middle initial and generation

- Your Social Security number

- Your date of birth

- Current and previous mailing addresses for the past two years

- One copy of your government issued identification card, such as a driver’s license, state ID card, etc.

- One copy of a utility bill, bank, or insurance statement, etc.

- If you are the protected consumer’s guardian, submit a copy of the court document naming you as the guardian.

Recommended Reading: How Do You Get Credit Inquiries Off Your Credit Report

How To Prevent Id Theft

In the age of digital commerce and electronic record keeping, cyber criminals are constantly devising new schemes for hijacking personal data and using it to unlock financial holdings. It’s critical for all individuals to watch out for unauthorized credit activity. For many, automated and identity theft protection services provide an extra level of caution and care that can safeguard credit and avoid costly, time-consuming remedies to identity theft.

How Do I Unfreeze My Credit With Experian

If you want to unfreeze your credit report online with Experian, youll be asked to fill out a form and specify the dates that you would like to remove and add back the security freeze. Youll be asked to confirm your information by providing the PIN you were given when you put the original freeze on it. You can also call Experian directly, but youll need the PIN for that, too.

Read Also: What Will My Credit Score Be After Chapter 7

How Do I Unlock My Credit Report

of yourunlock

Ways to Unfreeze

Also Know, how do I unlock my TransUnion credit report? To request a temporary lift or permanently unfreeze your , call TransUnion at -909-8872 or write to TransUnion, P.O. Box 380, Woodlyn, PA, 19094. You may need to provide proof of your identity and provide your PIN when youre making changes to your freeze by phone or mail.

Regarding this, how do I unlock my Equifax credit report?

To lock your Equifax Credit Report:

Why is my credit locked?

A report lock or has the same impact on your reports as a security freeze, but isnt exactly the same. A report lock generally prevents access to your reports to open new accounts. If you want to apply for , you must unlock your report to allow a check.

Recommended Reading: Does Paypal Working Capital Report To Credit Bureaus

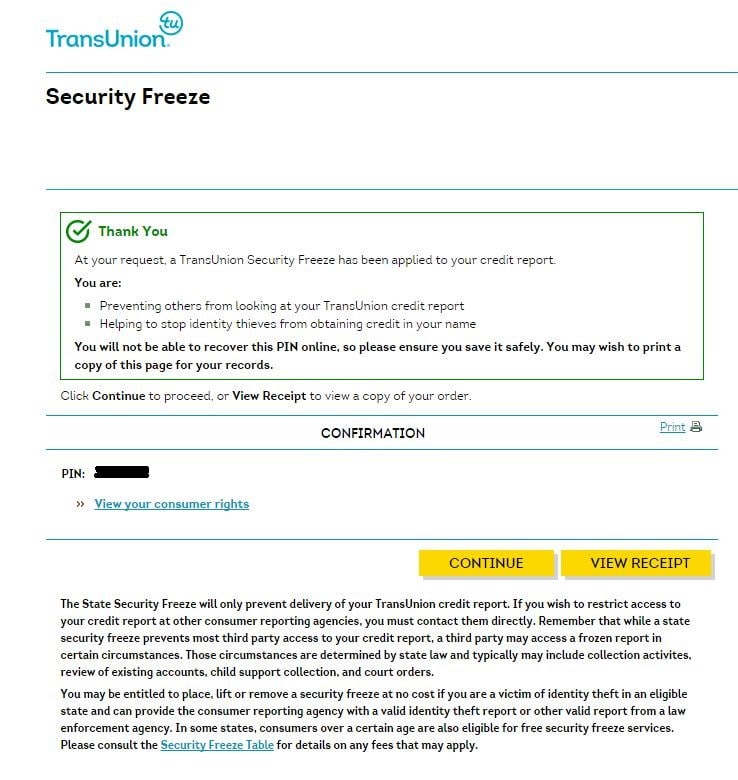

How Do You Request A Freeze

To freeze your credit, youâll need to contact each of the three major consumer credit bureaus â Equifax, Experian, and TransUnion â and request a credit freeze.

Freezes last indefinitely, or until you thaw your file. In a few states, freezes expire after seven years.

When you make the request, youâll need to provide your:

- Address history

- Social security number

When requesting a credit freeze online, you can send these items electronically. Verifying your identity will follow. Upon approval, you’ll receive a Personal Identification Number . To refreeze or unfreeze your file, you will need this PIN.

You can unfreeze your credit report online, by phone, or by mail. Federal law requires credit reporting agencies to lift the freeze within one business day if you call or submit online.

Recommended Reading: When Do Student Loans Show Up On Credit Report

Pros Of Locking Your Credit

- A credit lock can reduce your chances of becoming an identity theft victim, since lenders cant check your credit reports while theyre locked.

- You can lock and unlock your reports yourself at any time, making it faster than a freeze if you need to authorize a legitimate credit check.

- TransUnion and Equifax allow you to lock and unlock your credit for free.

How A Credit Freeze Works

When you freeze your credit with the three major national Equifax, Experian, and TransUnionyou’re essentially telling them that you don’t want just anyone to be able to access your credit file. Again, there are some exceptions to who can and can’t see your credit file while a freeze is in place.

A credit freeze can stay in place for as long as you want it to it’s up to you to decide when to lift it. Freezing your credit is now completely free, thanks to a 2018 change in the law. Previously, there was a fee to freeze and unfreeze your credit.

You May Like: Why Is My Fico Score Lower Than Credit Karma