How Long Do Derogatory Marks Stay On Your Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Derogatory marks on your credit are negative items such as missed payments, collections, repossession and foreclosure. Most derogatory marks stay on your credit reports for about seven years, and one type may linger for up to 10 years. The damage to your credit score means you may not qualify for new credit or may pay more in interest on loans or credit cards.

If the derogatory mark is in error, you can file a dispute with the credit bureaus to get negative information removed from your credit reports. You can see all three of your credit reports for free on a weekly basis through the end of 2022.

If the derogatory marks are not errors, you’ll need to wait for them to age off your credit reports.

If you are not in a position to pay your bills, learn how to limit the damage to your finances.

Heres how long derogatory marks stay on your credit reports click to learn how to recover:

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

Do I Still Have To Pay A Debt That Fell Off My Credit Report

Your debt isnt simply erased once it falls off your credit reports, but your liability for owing it might vary if the debt is past its statute of limitations.

If you never paid off the debt and the creditor is within the statute of limitations, youre still liable for it and . The creditor can call and send letters, sue you or get a court order to garnish your wages.

If you never paid off the debt, but its past its statute of limitations, the debt is now considered time-barred. How you choose to act on a time-barred debt thats fallen off of your credit report is your choice. According to the FTC, you can do one of the following:

- Pay nothing

- Pay part of the debt

- Pay the total outstanding debt

Regardless of which option youre considering, talk to an attorney about your best path forward before contacting a debt collector.

Depending on the state you live in, debt collectors might be allowed to call you to try to collect on a time-barred debt. However, creditors and debt collectors cant sue you or threaten a lawsuit to collect on a debt thats outside of the statute of limitations.

If youre looking to put your debt behind you and move on with a clean slate, a surefire way is to pay what you owe, or at least an agreed-upon part of what you owe. Before making the phone call, make sure you know:

- That the debt is legally yours

- The date of the last payment on the account

- How much you owe the creditor

- What you can realistically afford to pay per month or in a lump sum

You May Like: Does Paying Off A Credit Card Help Your Credit Score

How Long Does Info Stay On The Record

How long adverse information remains on your credit report depends on what is being reported. Positive information can stay on your report indefinitely. Negative information must be removed in accordance with limits set by the Fair Credit Reporting Act.

According to Experian, adverse information for business credit reports can remain on your report for as little as 36 months, or as long as nine years and nine months. Trade, bank, government and leasing data can remain for up to 36 months. Uniform Commercial Code filings stay for five years. Judgments, tax liens and collections remain for six years and nine months. Bankruptcies remain on your business credit report the longestup to nine years and nine months.

Adverse information generally remains on individual consumer credit reports for seven to 10 years. Bankruptcies remain the longest: up to 10 years from the order date or date of adjudication. If you defaulted on a government-backed student loan, the reporting period can be longer.

Civil suits, civil judgments and records of arrest can remain on your credit report for up to seven years or until the statute of limitations has expired, which ever is longer. Tax liens remain until they are paid, and then remain for seven years thereafter.

How Long Does Debt Stay On Your Credit Report

How long a collection stays on your credit report depends on the type of loan you have. Derogatory items may stay on your credit reports for seven to 10 years or more, according to the Fair Credit Reporting Act.

Heres how long you can expect derogatory marks to stay on your credit reports:

| Hard inquiries | |

| Money owed to or guaranteed by the government | 7 years |

| 7 years or until the state statute of limitations expires, whichever is longer | |

| Unpaid taxes | Indefinitely, or 7 years from the last date paid |

| Unpaid student loans | Indefinitely, or 7 years from the last date paid |

| Chapter 7 bankruptcies | 10 years |

Also Check: What Is Cbna On My Credit Report

How To Remove Negative Information From Your Credit Report

As long as the information is accurate and verifiable, the credit reporting agencies will maintain it for the aforementioned timeframes. If, however, you have information on your report that you believe is incorrect, whether it’s positive or negative, then you have the right to dispute the information and have it corrected or removed from your credit reports.

The most efficient way to file a dispute is to contact the credit reporting agencies directly. And while Equifax and TransUnion have their own processes for consumers to dispute their credit reports, Experian makes available three dispute methods: You can do it over the telephone, via U.S. mail or online.

Why Do I Have A Credit Report

Businesses want to know about you before they lend you money. Would you want to lend money to someone who pays bills on time? Or to someone who always pays late?

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

Recommended Reading: How To Get 850 Credit Score

Student Loan Default: Seven Years

Failure to pay back your student loan remains on your credit report for seven years plus 180 days from the date of the first missed payment for private student loans. Federal student loans are removed seven years from the date of default or the date the loan is transferred to the Department of Education.

Limit the damage: If you have federal student loans, take advantage of Department of Education options including loan rehabilitation, consolidation, or repayment. With private loans, contact the lender and request modification.

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

Read Also: How Long Do Credit Checks Stay On Your Credit Report

Can You Erase Bad Credit Overnight

The short answer is no. Fixing bad credit is a time-consuming process that often takes months. It involves contacting credit agencies and lenders to dispute inaccurate information, and they can take up to 30 days to respond to your request. They may also ask for more documentation to validate your dispute, further prolonging the process. Additionally, note that accurate negative items cannot be deleted from your report and will remain on your record for at least seven years.

How Long Do Negative Items Stay On Your Credit Report

It can take a while for some negative events to fall off your credit report. Heres how long you can expect them to have an impact on your score.

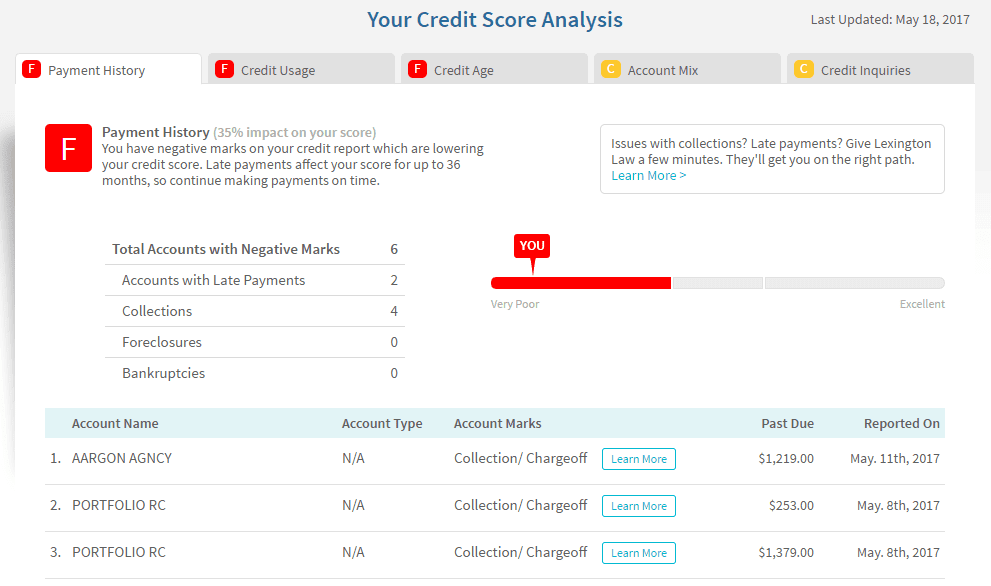

Many Americans are struggling to put their personal finances in order amid the pandemic as they are dealing with debt and other credit issues. If you’re one of them, you’re not alone and there are credit repair steps you can take. Often, the first step is determining where your credit score currently stands by checking credit reports from the three credit bureaus.

Once you’ve had a chance to look at a copy of your credit report, it’s important to check for errors. Assuming the information listed is correct, it may take some time for negative items to fall off your credit report. Read on for a look at four common negative items — foreclosure, bankruptcy, missed payments and collections — and how long they will appear on your credit report.

What are common negative items on a credit report?

1. Negative event: Foreclosure

How long it will stay on your report: 7 years

2. Negative event: Bankruptcy

How long it will stay on your report: 7-10 years, depending on the type of bankruptcy. A Chapter 7 bankruptcy remains on your credit report for 10 years while a Chapter 13 bankruptcy will only be part of your credit history for seven years.

The bottom line

Don’t Miss: What Is The Connection Between Credit Report And Credit Score

Negative Information From Public Records

Tax liens have been removed from all credit reports, as of April 2018. Before that, unpaid tax liens remained on credit reports indefinitely. Paid tax liens remained for 7 years from the date of payment .

Civil judgements no longer appear on credit reports, either. Before the law changed, records of judgements remained on credit reports for 7 years from the date filed in court. This was regardless of whether the amount owed was paid.

Negative Information From Late Payments

- Late Payments: You must be at least 30 days late on a payment for it to show up on your credit report. Information about payments that are late by 30 days or more will remain on your credit file for 7 years from the date creditors report them to the credit bureaus. People often get concerned that a payment thats just a few days late will be noted on their credit reports, but thats not the case.

- Charged-Off Account: When you are 120 days behind on a loan payment or 180 days late on a credit card, your lender will be required to write the debt off its books , and your account will be classified as Not Paid as Agreed on your credit reports. This information will remain on file for 7 years, starting from when the delinquency that led to the charge-off is first reported to the credit bureaus.

For example, if your account was reported as late to the credit bureaus in September 2020 and it charged-off in December 2020, the late payments and charge-off record would stay on your credit report until September 2027.

You can read more in our Q& A about how long late payments stay on your credit report.

Don’t Miss: Is 670 A Good Credit Score

How To Get A Credit Report

The Fair Credit Reporting Act requires Experian, Equifax and TransUnion to provide you a free copy of your credit report once, every 12 months.

There is a charge for credit scores, but the credit report is free.

To get a free credit report, go online to www.annualcreditreport.com or call 1-877-322-8228 and request it. This is the only website authorized to fill orders for free credit reports. Once there, each agency must supply you one credit report every 12 months. You could receive all three reports at once, or spread them out over 12 months depending on the purpose you have.

If you want to examine the three together and compare all the information contained in each report to be sure its accurate , you should request all three at the same time.

Since the information on all three should essentially be the same, you may want to ask for one report every four months and verify each time that the information remains accurate.

If you already received a free report from each of the bureaus and want to check your credit report again, you can contact any of the three reporting agencies and order one for a small charge, usually under $10.

What If I Dont Recognize An Account On My Report

If your there are typically two causes, either the information was reported incorrectly or the discrepancies are due to identity theft. If you notice a mistake or discrepancy, please contact Equifax or TransUnion to resolve the problem. Keep in mind that both bureaus have their own protocol for dealing with incorrect information and you may need to provide specific documentation as proof.

Problems like these are an important reminder of why you should check your credit report at least once a year.

Read Also: What Credit Report Does Comenity Bank Pull

How To Remove Negative Items Related To Identity Theft

If you believe youve been a victim of identity fraud, you should first file a dispute with the Federal Trade Commission online at IdentityTheft.gov or by phone at 1-877-438-4338. You should also file a police report.

After you report the incident, make sure to take the following steps:

- Request a copy of your credit report through AnnualCreditReport.com

- Look out for unauthorized transactions or new accounts that dont belong to you

- Contact the credit bureaus through phone or mail to dispute any credit information that doesnt belong to you

- Place a security freeze and fraud alert on your credit report

- Contact creditors to close compromised accounts

- Consider subscribing to an identity theft protection or credit monitoring service

How Long A Closed Account Stays On Your Credit Report

The length of time a closed credit card stays on your credit report depends on whether the account was closed in good standing. A negative closed account, like a charged-off credit card, will remain on your credit report for seven years. That’s the maximum amount of time most negative information can be included on your credit report.

If your account was closed in good standing, there is no law requiring it to be removed from your credit report in a certain time period. It could stay on your credit report indefinitely, but will likely be removed ten years after it was closed based on the credit bureau’s guidelines for reporting closed accounts.

It’s not a bad thing that a closed account still remains on your credit report, depending on how the balance and status of the account. Closed accounts generally only hurt your credit score when you have a negative account status or a high credit card balance. An account closed in good standing, however, may have a positive impact on your credit score for as long as the account is included on your credit report.

You might want to scrub your credit report of all closed accounts, but you can only have inaccurate or outdated information removed from your credit report. If this is true for any of your closed accounts, submit a dispute with the credit bureaus to have the account removed from your credit report.

Also Check: How Long Do Things Stay On Your Credit Report

Closing A Line Of Credit That Is Already Behind On Payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.