Dont Hit Your Credit Limit

If you want to get into the 800+ credit score club, be sure that you dont use your credit card up to its full limit. Use no more than one-third of your credit limit if you dont want to hurt your credit score, Nitzsche says.

For example, if your credit card has a limit of $9,000, dont have a balance of more than $3,000.

Ideally, credit card utilization should be 10% or less. Jennifer Martin, a business coach, says she has a credit score of around 825, and that she tries to keep her spending to no more than 10% of a credit cards available credit.

Outstanding debt accounts for 30% of a credit score, Ross says.

If you are overextended and close to your credit limit this indicates overextension and you need to work at getting your credit card balances well below the limits, she says.

A 790 Credit Score Is Often Considered Very Good Or Even Excellent

A very good or excellent credit score can mean youre more likely to be approved for good offers and rates when it comes to mortgages, auto loans and credit cards with rewards and other perks. This is because a high may indicate that youre less risky to lend to.

Lenders use this three-digit indicator, which is calculated from all the information collected in your credit reports, to gauge how likely they think you may be to default on your loans and the higher the score, the better you look to a lender.

But even having an excellent credit score doesnt mean youre a shoo-in there are still no guarantees when it comes to credit approval.

A credit score can be an important factor when you apply for credit, yes. But you actually have multiple credit scores from different sources, each one drawing on data from your various credit reports with the major consumer credit bureaus . A credit score may be considered excellent according to one scoring model but could be calculated differently using another model that weighs certain factors differently, resulting in a different score altogether.

Also, scoring models and lenders can have different interpretations of what qualifies as excellent. And when its time to make a decision about whether to extend credit to you, lenders typically consider other factors not reflected in your scores, such as your income or employment status.

Learn more about keeping up and making the most of an excellent credit score.

What Does A 791 Credit Score Mean

A credit score of 791 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that youre a low-risk borrower. FICO considers 791 to be very good, and VantageScore considers it to be excellent. Its also well above the national average.

Although a 791 credit score is far from the lowest credit score of 300, its still not quite at the highest credit score of 850. However, in practice, your score will be good enough to get the best terms on loans and lines of credit from most lenders.

To put your score of 791 into context, heres how it compares with the average for various generations:

Recommended Reading: What Credit Report Does Apple Pull

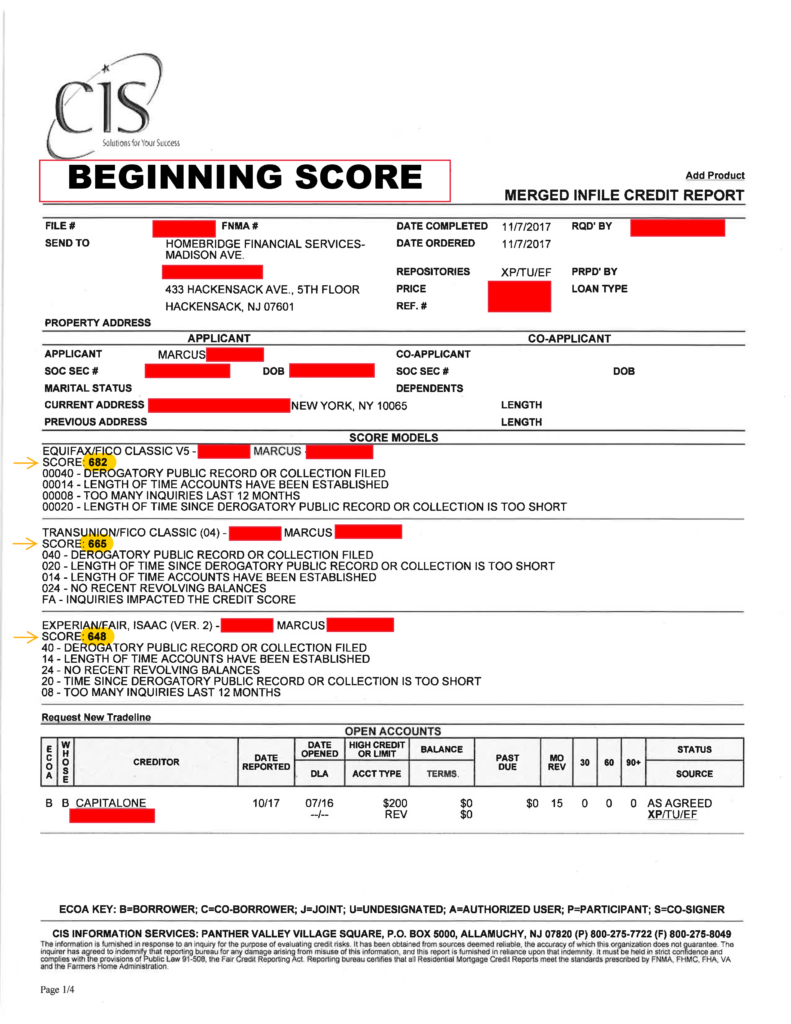

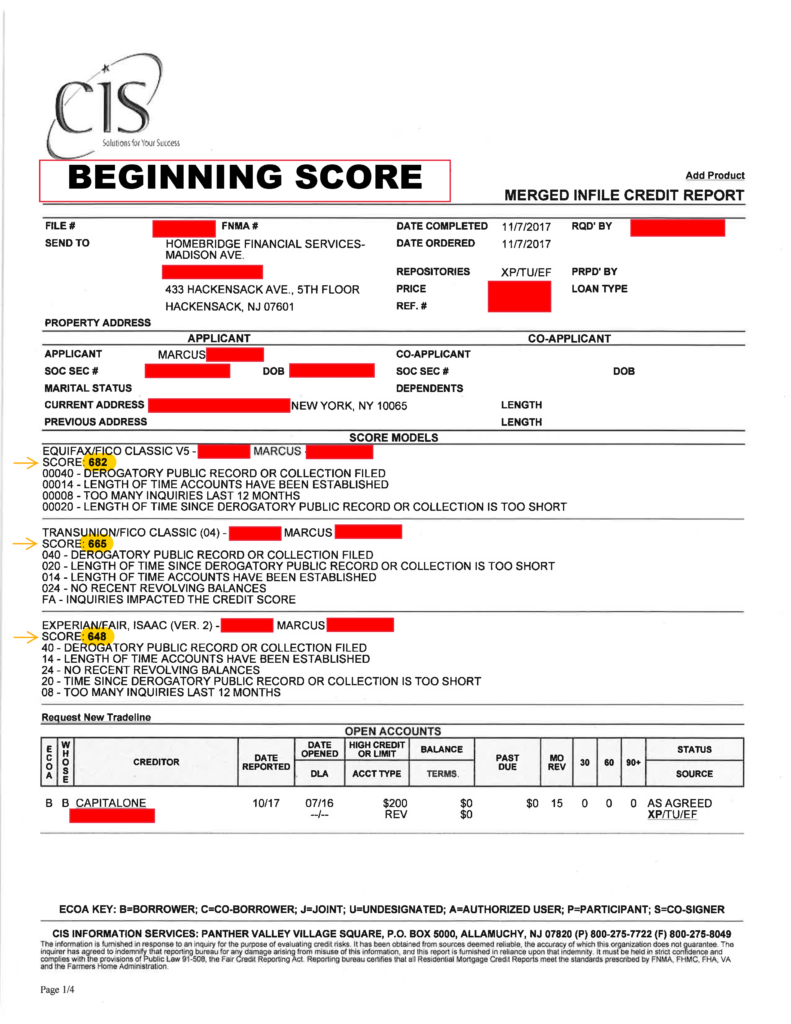

The Three Credit Reporting Agencies And Different Types Of Credit Scores

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 791 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Factors That Can Affect The Calculation Of Your Credit Scores

There are five main factors that can affect the calculation of credit scores. If youre interested in improving your credit, understanding what these factors are can help you create a plan to build healthy credit habits.

1. Payment History

How you manage your payments is one important factor used during the calculation of your credit scores. This includes how many accounts you have open as well as all the positive and negative information about these accounts. For example, if you make payments on time or late, how often you make late payments, how late the payments were, how much you owe, and whether or not any accounts are delinquent.

2. Outstanding Debt

Sometimes referred to as a , many credit scoring models take into account how high your balance is compared to your total available credit limit. Specifically when it comes to revolving credit, for examples credit cards and lines of credit.

3. Length Of Credit History

Your credit file includes how old your credit accounts are and will influence the calculation of your credit scores. The importance of this factor will differ depending on the scoring models, but generally speaking, how long your oldest and newest accounts have been open is important.

4. Public Records

Public records include bankruptcies, collection issues, liens, lawsuits, etc. Having these types of public records on your credit report may have a negative effect on your credit scores.

5. Inquires

Additional Reading

Also Check: How Much Is It To Get A Credit Report

How To Check Business Credit Score For Free

Category: Credit 1. How to Check your Business Credit Score for Free CNBC Select reviews common questions surrounding business credit scores and reports, so you can familiarize yourself with your companys credit standing. Jun 30, 2021 Credit Score Ranges: Personal FICO scores range between 300 to 850 business

Is It Possible To Get A Credit Score Of 850

Its possible to achieve an 850 FICO® Score. However, its very difficult to get your score this high. An 850 credit score means that you have nearly perfect credit management. Very few people actually hold a perfect 850 credit score. Consumers with this score are incredibly unlikely to default on their loan obligations. If you can achieve an 850 credit score, youll have access to nearly any type of loan or card.

No lender will expect you to have an 850 credit score, no matter what youre applying for. Its possible to buy a home, go back to school and get a personal loan even if you have less-than-ideal credit. However, if youre still determined to make it into the perfect credit club, you can use these tips to start your journey toward an 850-point score.

Recommended Reading: How To Report Identity Theft To Credit Agencies

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

Habits To Get 800+ Credit Score

Joining the ranks of the credit elite with an 800+ credit score can do much more than provide bragging rights.

A higher credit score can help you qualify for better interest rates and other terms from lenders, saving you thousands of dollars on an auto loan, home mortgage, credit card interest, or any other type of financing. Investing the savings which can add up to hundreds of thousands of dollars can result in close to $1 million over a lifetime.

FICO scores range from 300 to 850. Getting a perfect credit score may be extremely difficult, but theres really not much of a difference between getting a 780 or 800+ credit score. A score of 780 or more will get you the same interest rates as someone with a perfect score.

To get into the 800+ credit score club, youll have to follow some of the best credit habits for a long time. Here are five ways to get into the elite club:

Read Also: When Do Closed Accounts Come Off Credit Report

Is 791 A Good Cibil Score

Asked by: Patrick Schoen MD

A 791 credit score is Very Good, but it can be even better. If you can elevate your score into the Exceptional range , you could become eligible for the very best lending terms, including the lowest interest rates and fees, and the most enticing credit-card rewards programs.

Can I Get A Car / Auto Loan W/ A 791 Credit Score

Trying to qualify for an auto loan with a 791 credit score is cheap. There is little to no risk for a car lender .

Taking out an auto loan out with a 791 credit score, should be easy.

It gets even better.

You can improve your loan terms with a few simple steps to repair your credit.

An ideal option at this stage is reaching out to a credit repair company to evaluate your score and see how they can increase it.

Don’t Miss: Who Can See My Credit Report

How To Maintain A Good Credit Score

Practicing healthy credit habits can help keep your score in a good range. Its smart to keep your balances as low as possible. Your credit utilization, which is how much of your available credit limit youre using, is a major factor in credit score calculations. Popular advice is to keep your utilization rate below 30%. But the lower the better its smart to leave some breathing room should an unexpected expense come up.

Because your payment history is another important credit score factor, youre likely to achieve and maintain a good credit score by not missing payments. Automate payments when you can because with multiple services, subscriptions and accounts, it can be easy to let one accidentally slip.

Aim to only apply for credit when needed. Of course, theres no need to avoid credit altogether. For many people, lifes major purchases may require loans or other credit, and a good credit score lays the groundwork for your credit goals. But because new credit may result in hard inquiries on your report its smart to limit credit applications.

Some people like to take advantage of rewards credit cards that are geared toward those with good credit scores. Just make sure youre mindful in your approach and not overspending and over-applying for the sake of some cash back or travel points.

Can I Get A Personal Loan Or Credit Card W/ A 790 Credit Score

Like home and car loans, a personal loan and credit card is easy to get with a 790 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 790 score means you likely have few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

You May Like: Is 784 A Good Credit Score

Regularly Read Your Reports

Since your credit score is based off of the information in your credit report, take time to review your reports regularly. You want to be sure everything is an accurate, true reflection of your financial story. As you become more comfortable reading and understanding the data in your report, the easier it is to identify which information is potentially causing changes in your credit score.

To help you understand your credit report, weve created an interactive guide that breaks down each section and explains how the information may impact your credit score.

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located .

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

You May Like: How Do You Get A Perfect Credit Score

S To Improve Your 791 Credit Score

Improving your 791 credit score can take a lot of work, but following these steps can make all the difference. It will take time, but you can see your credit score go up within a year, which could save you countless amounts on interest rates. Dedicating the effort to improving your credit is worth the investment.

The Best Credit Cards For Excellent Credit

With excellent credit, you could be eligible for some of the best credit card offers.

This might include premium rewards cards that come with more-valuable rewards and top-notch perks like travel credits, free hotel nights, airport lounge access, complimentary upgrades and elite status. Keep in mind that these cards also tend to carry expensive annual fees and higher interest rates if you carry a balance. So youll have to weigh the benefits against the costs to see if its worth it for your wallet.

On the other hand, if youre paying down credit card debt, you also might see offers for the best balance transfer cards that come with longer 0% intro APR periods and higher credit limits.

Explore on Credit Karma to see whats available.

Read Also: Does Paying Off Collections Help Credit Score

What Is A Credit Score And Why Is It So Important

A credit score is a decision making tool used by creditors or lenders to determine how likely you will repay your loan on time. Having good credit is important to whether you can get qualified for a loan, and the better your credit rating, the more savings you can reap on interest rates and your down payment.

Shield Your Credit Score From Fraud

For hackers and identity thieves, people with Very Good credit scores are attractive targets. Your score could enable crooks to open and exploit sizable bogus loan or credit-card account in your name, and then disappear, leaving you to sort out the mess with the lender. To help avoid this, consider credit-monitoring and identity theft protection services. These services can alert you when they detect applications for new credit or other unexpected changes in your credit report.

Consumers reported $905 million in total fraud losses in 2017, a 21.6% increase over 2016 with aan avergae of $429 lost.

Read Also: How Long Does Bad Credit Stay On Report Ontario

Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.